David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

Global markets

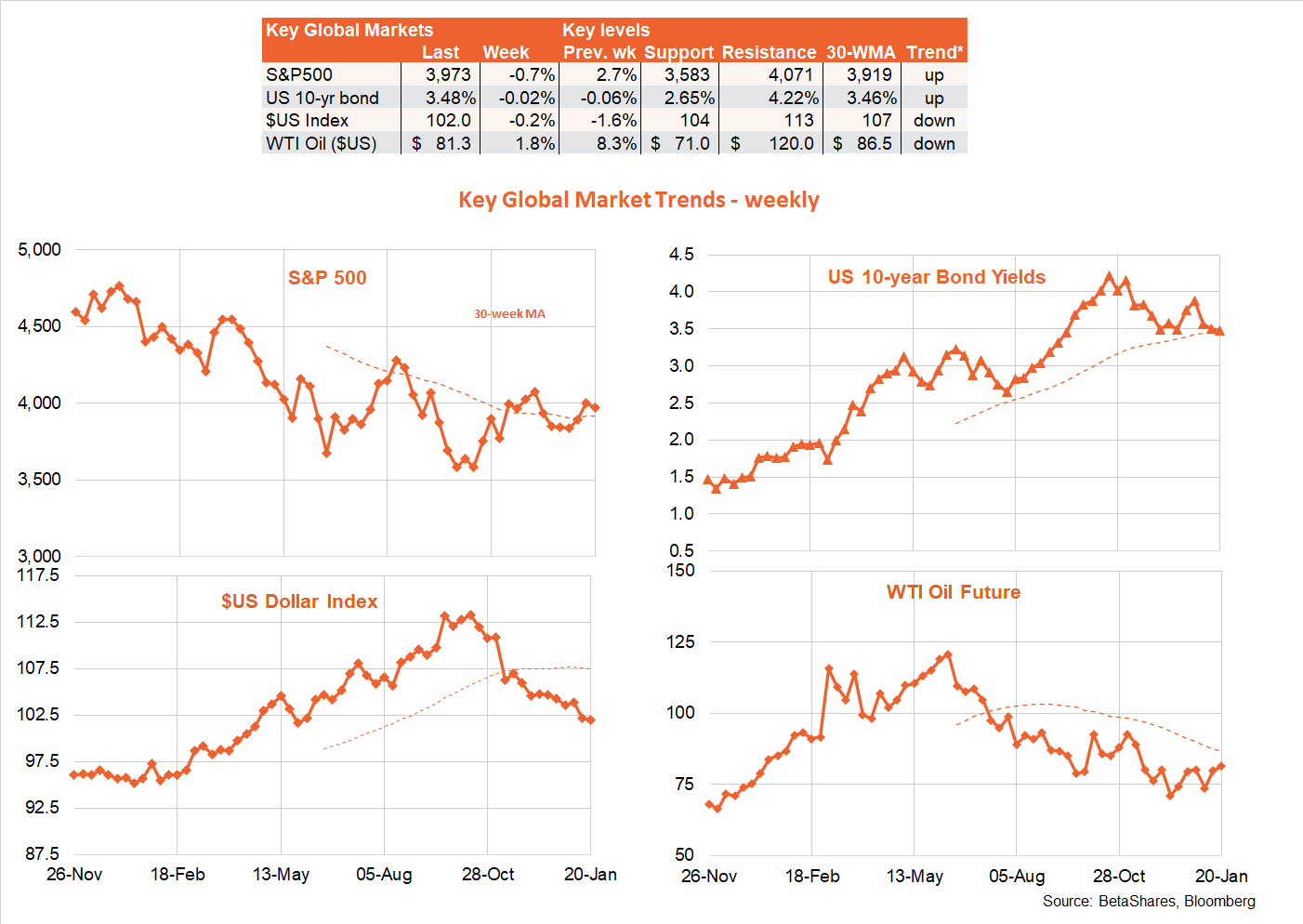

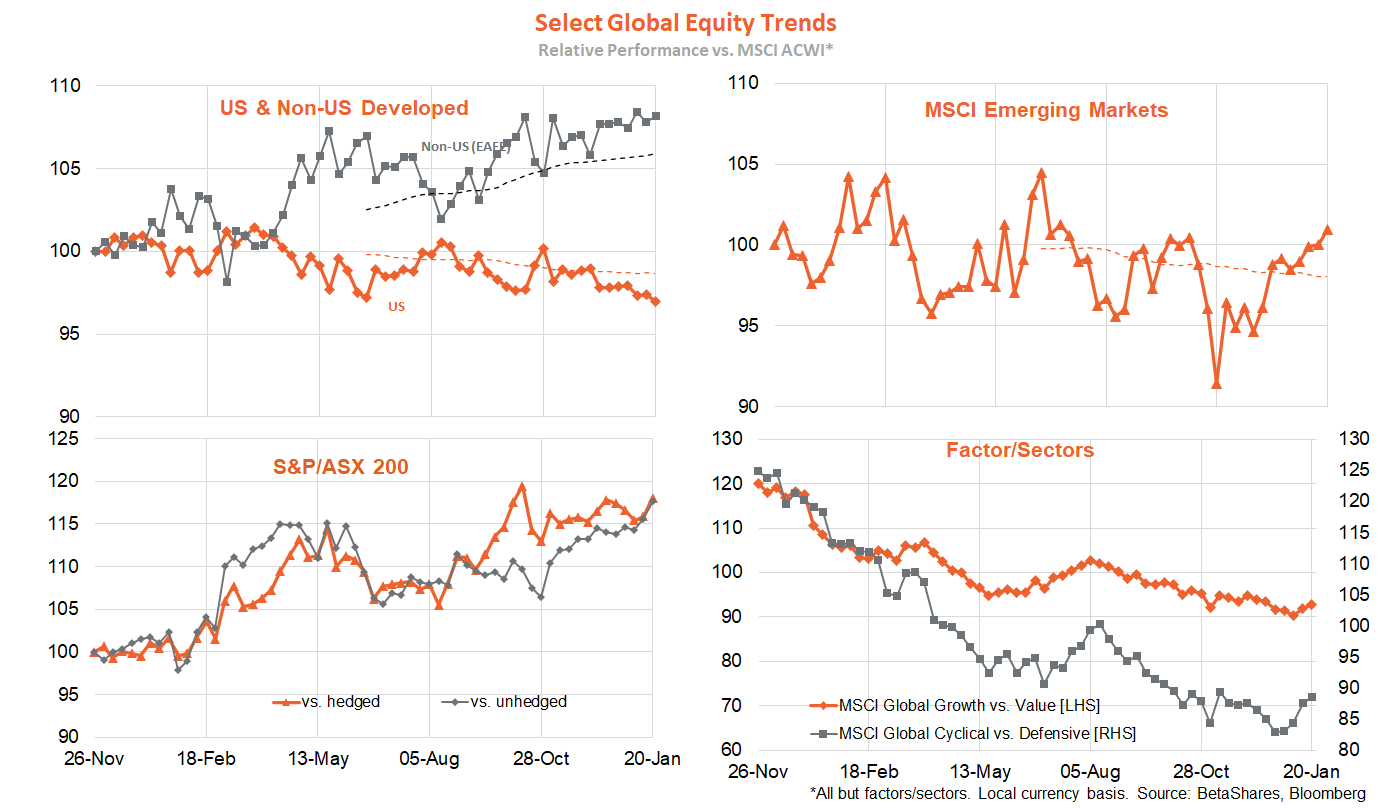

It was a relatively subdued week in global markets, with the main focus remaining on how quickly the US economy is slowing – and whether the Fed will relent and become less hawkish before it triggers a recession.

Equities weakened and bond yields eased, reflecting softer US economic data – particularly a decline in retail sales in December. Markets were buffeted by a range of Fed comments, the bottom line of which is that the Fed will likely only raises rates by 0.25% next month, but does not want to encourage market speculation about rates cuts in the second half of the year.

All up, however, bonds and equities have started the year somewhat better than last year – with ‘immaculate disinflation’ (i.e. US inflation will slow quickly enough to have the Fed pivot and avoid recession) the overriding hope. This remains negative for the $US dollar and positive for the $A.

That said, as I’ve previously outlined, what’s critical is whether there’s immaculate US wage disinflation (slowing wage growth without a big move higher in the unemployment rate). What’s more, even if the US avoids recession, the economy should still slow and earnings remains under downward pressure – while the S&P 500 is also trading at a relatively lofty 17 times forward earnings. This is a recipe for at best a potentially rangebound market this year unless low inflation really does allow the Fed to slash rates in H2.

For those that missed it, I outlined a few possible scenarios for 2023, with US recession still my most likely (though not 100%) outcome assuming there is not immaculate US wage disinflation.

Turning to the week ahead, markets will remain focused on US economic data – such as weekly jobless claims and durable goods orders. The Q4 earnings reporting season is also underway, with generally weaker than expected results at this early stage. Key tech companies such as Microsoft and Tesla report this week. Friday’s private consumption expenditure deflator should further support the narrative of cresting inflation.

Australian Market

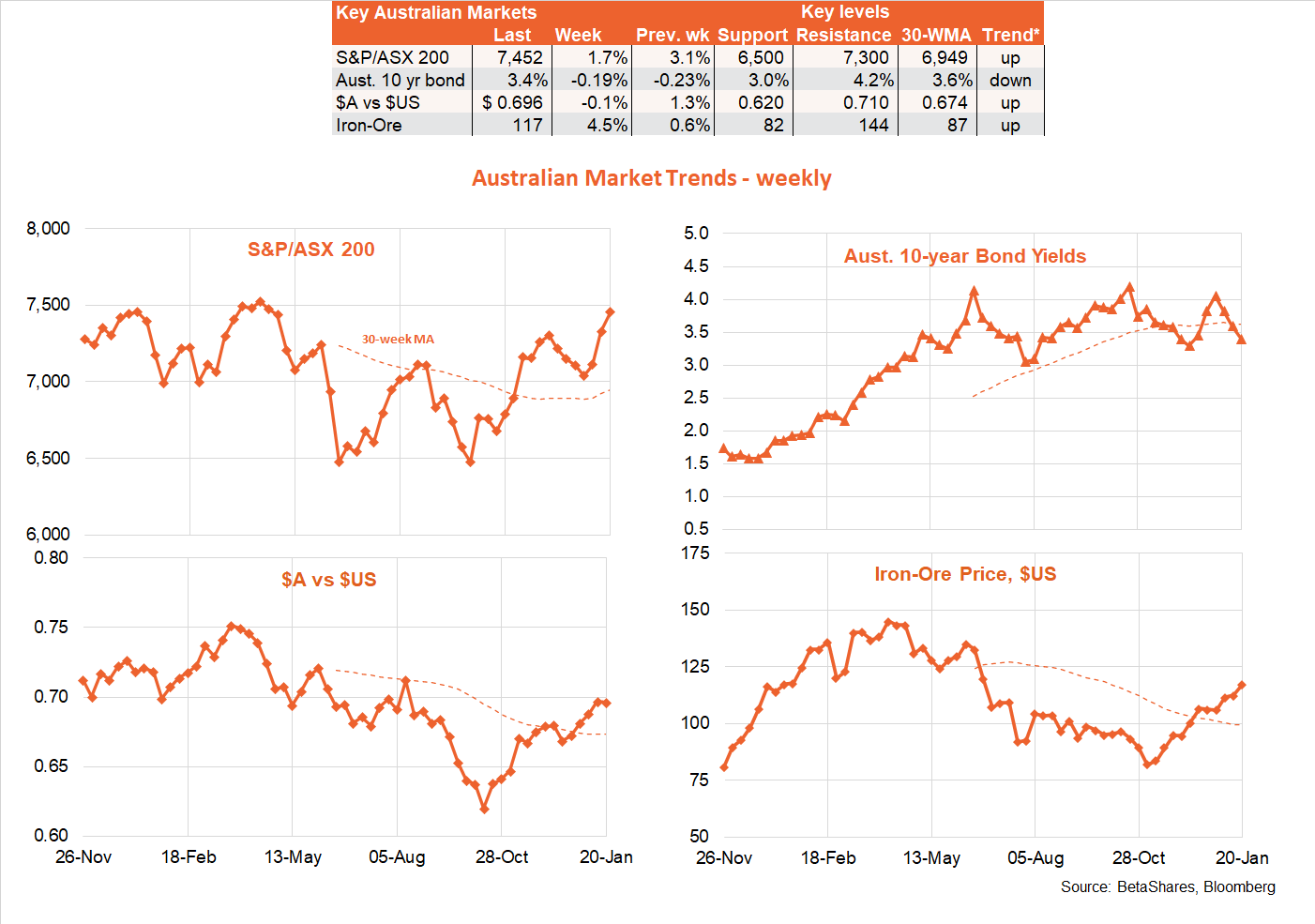

Local markets have started the year strongly, buoyed by the ‘immaculate disinflation’ hope floating across global markets. Equities and the $A are up, while bond yields are down – what’s not to like!

There was mixed local economic data last week with a bounce in (still depressed) consumer sentiment and a 14k decline in December employment – albeit the latter followed very strong employment growth in the previous few months. All up, the data is still supportive of the RBA hiking rates a further 0.25% next month, even though the market now reckons it’s only a 60% chance.

Indeed, the Q4 CPI on Wednesday should remind us that the local inflation genie is not yet back in its bottle – as it will include more of the troublesome strength in electricity prices than covered in reasonably benign monthly reports of late. Trimmed mean inflation is likely to show another large increase, reflecting broad-based strength in food, energy and housing costs. While this could represent the peak in local inflation, it’s hardly a good backdrop for the RBA to leave rates on hold next month.

It’s great to be back for what should be another action-packed year!

Have a great week!

*Trend is up (down) if end-weekly price is above (below) 30-week moving average.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.