Cameron Gleeson

Betashares Senior Investment Strategist. Supporting all Betashares distribution channels, assisting clients with portfolio construction across all asset classes, and working alongside the portfolio management team. Prior to joining Betashares, Cameron was a portfolio manager at Macquarie Asset Management, Head of Product at Bell Potter Capital, working on JP Morgan’s Equity Derivatives desk and at Deloitte Consulting.

11 minutes reading time

For financial adviser use only. Not for distribution to retail clients.

Whether they know it or not, many Australians are already familiar with the idea of gearing. Generations of Australians have built their family’s wealth in residential property.

If you’ve bought property, either to live in or as an investment, the chances are you funded your purchase partly through a mortgage. Looking at your purchase purely from an investment perspective, if the property increases in value over time by more than the cost of the borrowing, you are better off.

Betashares has just launched two Wealth Builder Funds to provide an effective way by which investors can seek to build long term wealth through diversified exposure to Australian and global shares using gearing.

- These innovative new funds utilise a moderate level of gearing (30-40% LVR) and a cost-effective structure. They can be used by investors who are comfortable with the risks associated with gearing to seek to accelerate the creation of long-term wealth.

- The Funds are internally geared and all gearing obligations are met by the Fund. You don’t have the costs and complications of having to borrow money yourself – there is no loan application process, and no possibility of margin calls for investors.

- Betashares is able to access funding for the Wealth Builder ETFs at institutional interest rates, significantly lower than the interest rates typically available to individual investors seeking to borrow on their own account.

- By investing in a Wealth Builder ETF that provides exposure to Australian shares, you may be entitled to more franking credits than if you had invested in an equivalent ungeared portfolio.1

These Funds have a wide range of potential use cases, from accumulators with limited capital trying to reach their financial goals sooner, to asset rich investors seeking to optimise outcomes across investment vehicles.

Illustration of performance characteristics of a moderately geared strategy

Using a moderate level of gearing to invest in a diversified equity portfolio can make a meaningful difference to investor outcomes over the long term.

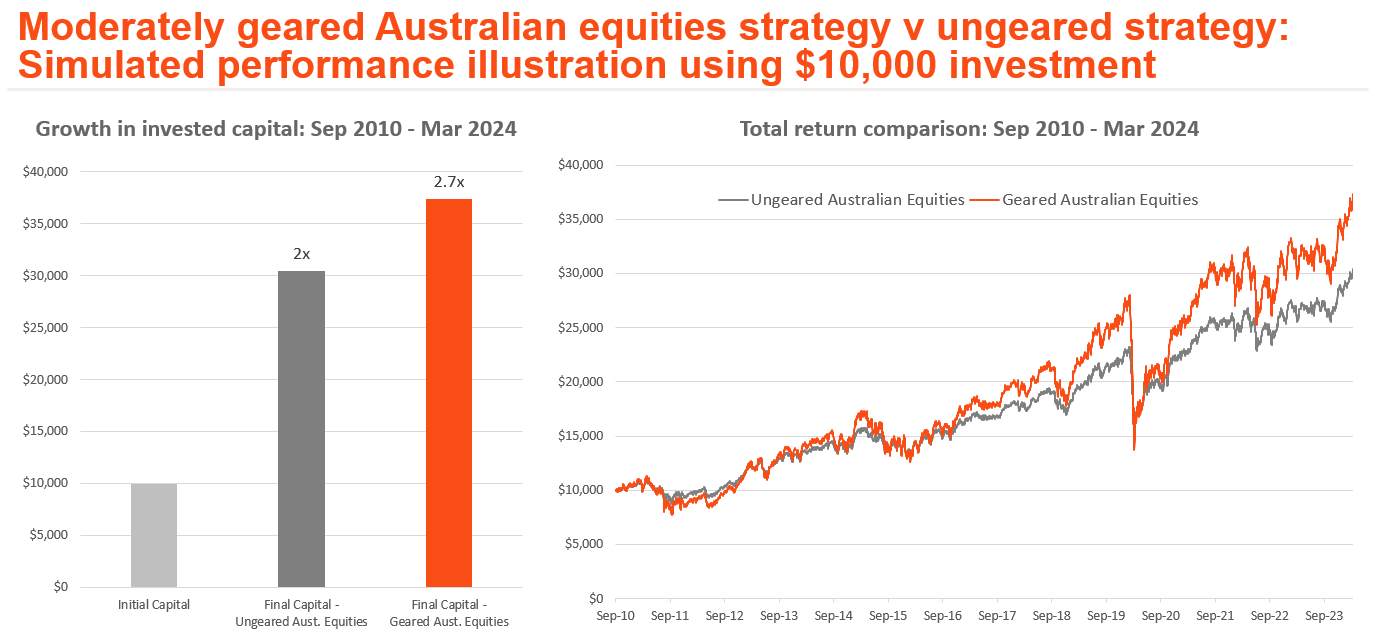

Below we illustrate the performance characteristics of a moderately geared strategy, using simulated historical performance of a moderately geared portfolio of Australian equities (with the gearing ratio actively monitored and adjusted to stay between 30-40% on any given day) compared to a corresponding ungeared strategy over the period from September 2010 to March 2024. It is based on certain assumptions, set out in the ‘Important information’ section at the end of this article. It is provided for illustrative purposes only and is not representative of actual fund performance. Actual outcomes may differ materially. It is not a recommendation to make any investment or adopt any investment strategy.

Simulated past performance is not indicative of future performance of any fund or strategy.

Source: Bloomberg, Betashares. Refer to the “Important Information” section at the end of this article for further information and key assumptions used. This information is provided for illustrative purposes only and is not representative of actual fund performance. Actual outcomes may differ materially. The information is not a recommendation or offer to make any investment or to adopt any particular investment strategy. Simulated past performance is not indicative of future performance of any fund or strategy.

In this illustration, investing in the geared strategy grew the initial invested capital amount from $10,000 to just over $37,000 over the relevant comparison period, compared to the final capital amount of just over $30,000 for the ungeared strategy.

Where a geared strategy has an LVR between 30-40% on a given day you would expect it to provide between ~143% and ~167% exposure to the daily movements of the underlying investment. However, over periods longer than one day the relationship between geared and ungeared returns can be different due to factors such as rebalancing (to maintain a 30-40% LVR target range), compounding of returns, and the impact of interest and other costs. In this illustration, the total return for the entire investment period for the geared strategy was around 135% of the total return of the ungeared strategy (i.e. 2.7x versus 2x, respectively), which is less than the expected ~143% to ~167% exposure range to the daily movements. In summary, the geared strategy outperformed the corresponding ungeared strategy over the relevant comparison period in a market that was generally rising. However, this outperformance generally relies on the underlying investment generating total returns in excess of funding costs (which has been assumed for the purpose of this illustration).

In a declining market, the geared strategy would be expected to underperform, with magnified losses, compared to an ungeared strategy. Geared investing also comes with greater volatility than an equivalent ungeared strategy.

This illustration does not take into account the impact of franking credits, which, if they had been included (subject to an investor’s eligibility), would have further favoured the geared strategy over the ungeared strategy.2

About Betashares Wealth Builder Funds

The Betashares Wealth Builder range currently comprises two ETFs.

| Betashares Wealth Builder Funds | ||

| Exposure | Australian equities | Australian and global equities |

| Fund | Betashares Wealth Builder Australia 200 Geared (30-40% LVR) Complex ETF | Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF |

| ASX Code | G200 | GHHF |

| Underlying portfolio | 200 largest ASX-listed companies | Diversified basket of Australian and global developed and emerging markets equities |

| Management fee and costs | 0.35% p.a. of Gross Asset Value | 0.35% p.a. of Gross Asset Value |

The Funds are internally geared. Each Fund combines applications received from investors with borrowed funds and invests the proceeds in one or more cost-effective ETFs traded on the ASX and other global exchanges.

G200 Betashares Wealth Builder Australia 200 Geared (30-40% LVR) Complex ETF invests in Betashares Australia 200 ETF (ASX: A200), which aims to track the performance of the largest 200 equity securities on the ASX (before fees and expenses).

GHHF Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF provides diversified exposure to approximately 4,000 shares from Australian, global developed and emerging markets.

For further details about each Fund’s investment strategy and an explanation of the mechanics of gearing, please refer to the Wealth Builder Brochure.

It’s important to understand that gearing magnifies both gains and losses, and may not be a suitable strategy for all investors. Geared investments involve significantly higher risk than non-geared investments.

How to use Betashares Wealth Builder Funds

Betashares Wealth Builder Funds may be suitable for a range of investors, with the caveat that they should be comfortable with the higher risk associated with gearing and have the view that equity markets will generally appreciate over time.

Wealth accumulation through Dollar Cost Averaging (DCA)

When starting with little investable capital, achieving your financial goals can seem a long way off. Betashares Wealth Builder Funds can potentially accelerate the accumulation process. However, the use of gearing can result in significant capital erosion should you encounter a market correction. One way to mitigate this risk is to invest in a Wealth Builder ETF using a DCA approach. Provided you invest consistently and the market generally appreciates by more than your cost of borrowing over the long run, investing in a Wealth Builder ETF using a DCA approach could allow you to take greater advantage of the market’s compounding power.

Potential for enhanced franking credits

By investing in a Wealth Builder ETF that provides exposure to Australian shares, you may receive more dividend income and be entitled to more franking credits than if you had invested in an equivalent ungeared portfolio.3

Optimising outcomes inside super:

Building wealth and generating income inside super can be very advantageous from a tax perspective. Wealth Builder ETFs can be used in a number of ways inside a SMSF, where consistent with the SMSF’s investment strategy and risk tolerance, for example:

- Helping to make your concessionally capped super contributions work harder.

- For super fund balances at or near the proposed $3 million threshold, Wealth Builder ETFs can provide scope for a SMSF to enhance franking credits and the ability to buy or sell units on the ASX for more flexible cash flow management.

- Individuals in pension phase who wish to retain a specific level of investment exposure to the equity market can potentially boost their pension income payments by investing in a Wealth Builder ETF in combination with a lifetime annuity.

Please note this is not a recommendation to invest or adopt any investment strategy. Financial advisers should make their own professional assessment of the suitability of such information, relying on their own inquiries.

In summary

Not only do Betashares Wealth Builder Funds provide cost-effective diversified exposure to Australian and global shares, they provide:

- The potential for accelerated wealth creation, even for those with modest investable capital

- Access to gearing at institutional interest rates

- Convenience, with no loan applications, no credit checks and no possibility of margin calls for the investor

- A solution for a range of investor types (including SMSF trustees seeking a gearing solution) where the investor is comfortable with the risks associated with gearing.

Each Fund’s returns will not necessarily be in this range over periods longer than a day, primarily due to the effects of rebalancing to maintain the Fund’s daily target geared exposure range and the compounding of investment returns over time, and the impact of fees and costs.

Each Fund’s returns over periods longer than one day may differ in amount and possibly direction from the daily target geared return range. This effect on returns over time can be expected to be more pronounced the more volatile the relevant sharemarket or portfolio and the longer an investor’s holding period.

Due to the effects of rebalancing and compounding of investment returns over time, investors should not expect each Fund’s Net Asset Value to be at a particular level for a given value of the relevant sharemarket or portfolio at any point in time.

Investors should monitor their investment regularly to ensure it continues to meet their investment objectives.

Gearing magnifies gains and losses and may not be a suitable strategy for all investors. Investors in geared strategies should be willing to accept higher levels of investment volatility and potentially large moves (both up and down) in the value of their investment. Geared investments involve significantly higher risk than non-geared investments. An investment in each Fund is high risk in nature.

Important information – simulated historical strategy performance illustration

The simulated historical strategy performance illustration included in this article shows simulated historical performance of a geared strategy for a broad market Australian equities exposure (as measured by the Solactive Australia 200 Index) compared to an ungeared strategy over the same exposure for the period from September 2010 to March 2024.

All simulated performance information is provided for illustrative purposes only and is not representative of actual fund performance. Actual outcomes may differ materially. You cannot invest directly in an index. The information provided is not a recommendation or offer to make any investment or to adopt any particular investment strategy.

Simulated past performance is not indicative of future performance of any fund or strategy.

Key assumptions

- Simulated strategy performance is shown net of management fee and costs, being 0.04% p.a. of net asset value (for ungeared strategy, being the management cost for Betashares Australia 200 ETF (ASX: A200), being the fund into which G200 invests) and 0.35% p.a. of gross asset value (for geared strategy).

- For the geared strategy, a gearing ratio of 30-40% is applied, with the ratio brought back to the midpoint (35%) at end of day if the ratio moves outside of this range.

- Borrowing costs are based on the rates/margins agreed with the prime broker for G200.

- All returns assume reinvestment of distributions. Does not take into account transaction costs.

There are risks associated with an investment in each Fund, including market risk, underlying ETF risk, gearing risk, rebalancing and compounding risk and lender risk, as well as (for GHHF) asset allocation risk and currency risk. Investment value can go up and down. An investment in each Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Fund, please see the applicable Product Disclosure Statement and Target Market Determination at www.betashares.com.au.

This information has been prepared by Betashares Capital Ltd (ABN 78 139 566 868 AFSL 341181) (Betashares), the issuer of the Funds. It does not take into account any person’s objectives, financial situation or needs. Investors should consider the appropriateness of the information taking into account such factors and seek financial advice. Before making an investment decision, investors should read the Product Disclosure Statement (PDS), available at www.betashares. com.au, and consider whether the relevant Fund is appropriate for their circumstances. A Target Market Determination (TMD), which sets out the class of consumers in the target market for each Fund, is also available at www.betashares.com.au/target-market-determinations. An investment in any Fund is subject to investment risk and the value of units may go down as well as up. Betashares does not guarantee the performance of the Funds, the repayment of capital or any rate of return.

Future outcomes are inherently uncertain. Actual outcomes may differ materially, positively or negatively, from those contemplated in any opinions, estimates, indications, assumptions or other forward-looking statements. You should therefore not place undue reliance on such statements. Any information regarding taxation in this document should not be construed as tax advice and you should obtain professional, independent tax advice before making any investment decision.

1.Not all Australian investors will be able to receive the full value of franking credits. ↑

2.Not all Australian investors will be able to receive the full value of franking credits. ↑

3.Not all Australian investors will be able to receive the full value of franking credits. ↑

Supporting all Betashares distribution channels, assisting clients with portfolio construction across all asset classes, and working alongside the portfolio management team. Prior to joining Betashares, Cameron was a portfolio manager at Macquarie Asset Management, Head of Product at Bell Potter Capital, working on JP Morgan’s Equity Derivatives desk and at Deloitte Consulting.

Read more from Cameron.