Is your portfolio really diversified?

6 minutes reading time

Whether they know it or not, many Australians are already familiar with the idea of gearing. Generations of Australians have built their family’s wealth in residential property.

If you’ve bought property, either to live in or as an investment, the chances are you funded your purchase partly through a mortgage. Looking at your purchase purely from an investment perspective, if the property increases in value over time by more than the cost of the borrowing, you are better off.

Betashares has just launched two Wealth Builder ETFs to provide an effective way by which investors can seek to build long-term wealth through diversified exposure to Australian and global shares using a moderate level of gearing.

These Funds have a wide range of potential use cases, from accumulators with limited capital trying to reach their financial goals sooner, to asset-rich investors seeking to optimise outcomes across investment vehicles.

About Betashares Wealth Builder ETFs

Betashares Wealth Builder ETFs offer a convenient, cost-effective way to gain moderately leveraged exposure to the Australian and global sharemarkets. They can be used by investors who are comfortable with the risks associated with gearing to seek to accelerate the creation of long-term wealth.

The Funds are internally geared. All gearing obligations are met by the fund – you don’t have to borrow money yourself. This means you avoid the costs and complications of other methods of gearing such as margin loans – there is no loan application process or credit check, and no possibility of margin calls for investors.

Another significant benefit is that Betashares is able to access funding for the Wealth Builder ETFs at institutional interest rates, significantly lower than the interest rates typically available to individual investors seeking to borrow on their own account.

Furthermore, by investing in a Wealth Builder ETF that provides exposure to Australian shares, you may be entitled to more franking credits than if you had invested in an equivalent ungeared portfolio.1

The Betashares Wealth Builder range currently comprises two ETFs.

| Betashares Wealth Builder ETFs | ||

| Exposure | Australian equities | Australian and global equities |

| Fund | G200 Betashares Wealth Builder Australia 200 Geared (30-40% LVR) Complex ETF | GHHF Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF |

| ASX Code | G200 | GHHF |

| Underlying portfolio | 200 largest ASX-listed companies | Diversified basket of Australian and global developed and emerging markets equities |

| Management fee and costs | 0.35% p.a. of Gross Asset Value | 0.35% p.a. of Gross Asset Value |

Fund strategy

Each Fund combines applications received from investors with borrowed funds and invests the proceeds in one or more cost-effective ETFs traded on the ASX and other global exchanges.

G200 Betashares Wealth Builder Australia 200 Geared (30-40% LVR) Complex ETF invests in Betashares Australia 200 ETF (ASX: A200), which aims to track the performance of the largest 200 equity securities on the ASX (before fees and expenses).

GHHF Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF provides diversified exposure to approximately 4,000 shares from Australian, global developed and emerging markets.

Each Fund’s gearing ratio (being the total amount borrowed as a percentage of the Fund’s total assets) will generally vary between 30% and 40% on a given day.

This means that the Fund’s geared exposure is anticipated to vary between ~143% and 167% of the Fund’s Net Asset Value on a given day. In other words, for every $100 you invest in the Fund, you can expect to have between $143 and $167 worth of exposure to the underlying assets on the given day.

The Fund’s portfolio exposure is actively monitored and adjusted to stay within this range. However, it is important to note that the Fund’s exposure to the underlying assets over periods longer than a day will not necessarily be in this range, due to a number of factors, including:

- the impact of funding costs, management fees and transaction costs

- the effects of rebalancing to maintain the Fund’s target geared exposure range, and

- the compounding of investment returns over time.

Investors should monitor their investment regularly to ensure it continues to meet their investment objectives.

It’s important to understand that gearing magnifies both gains and losses, and may not be a suitable strategy for all investors. Geared investments involve significantly higher risk than non-geared investments.

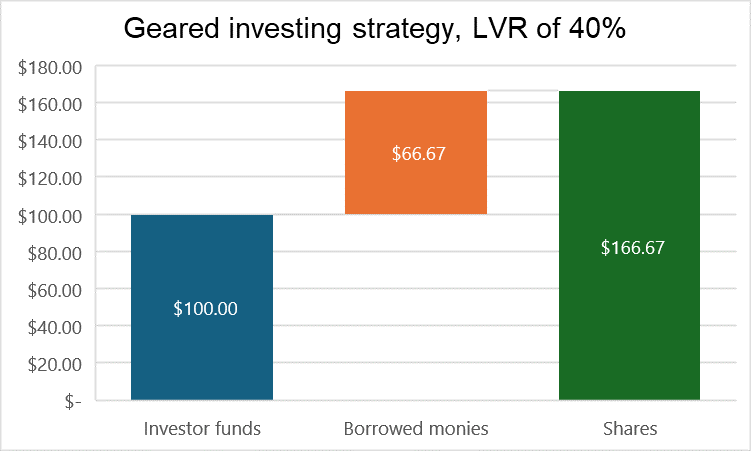

| Gearing 101: How does gearing work?

Gearing is an investment strategy in which borrowed money is used to invest, along with an investor’s own capital. Borrowing to invest increases the total amount available for investing. In the example below, the investor’s $100 cash, combined with borrowed funds of $66.67, creates a total pool of $166.67 that can be invested in the sharemarket. In this case, the loan-to-valuation ratio (LVR) is 40%. In other words, 40% of the total money invested is borrowed funds. The LVR is also known as the ‘gearing ratio’.

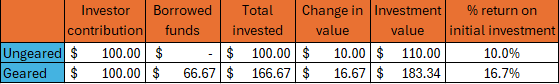

Because gearing increases the total amount you are investing, it increases your potential gains – and losses – compared to an ungeared investment. The example below shows the outcome in two scenarios, assuming an LVR of 40%. In this simple example, neither borrowing costs nor any income from the investments are taken into account. It is provided for illustrative purposes only and does not reflect actual fund performance, and actual results may differ materially. Scenario 1: sharemarket rises by 10%

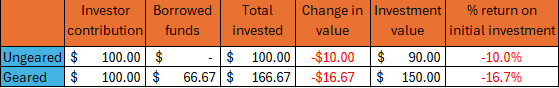

Gearing has resulted in a 16.7% return on the investor’s initial contribution, compared to the 10% return from an ungeared investment. Scenario 2: sharemarket falls by 10%

Gearing has resulted in a loss of 16.7% on the investor’s initial contribution, compared to a fall of 10% on the ungeared investment. These examples illustrate the basic principle of gearing over a one-day period. For a more complete picture over the longer term, we would need to take into account:

|

| In summary, borrowing to invest will be profitable if the geared returns generated on the underlying investment are higher than the costs of investing, including interest on the borrowed funds.

If, however, the underlying investment decreases in value, the losses on a geared strategy will also be magnified compared to an ungeared strategy. |

In the coming weeks, the ‘Insights’ newsletter will feature a number of articles on Betashares Wealth Builder Funds, including how the Funds can be used in combination with a dollar cost averaging (DCA) strategy to potentially accelerate the wealth accumulation process, and case studies on how the Funds could be used by accumulators and SMSF investors.

There are risks associated with an investment in each Fund, including market risk, underlying ETF risk, gearing risk, rebalancing and compounding risk and lender risk, as well as (for GHHF) asset allocation risk and currency risk. Investment value can go up and down. An investment in each Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Fund, please see the applicable Product Disclosure Statement and Target Market Determination at www.betashares.com.au.

1. Not all Australian investors will be able to receive the full value of franking credits.