Chamath De Silva

Betashares - Head of Fixed Income Chamath is responsible for the portfolio management function and fixed income product development at Betashares. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their international reserves section in Sydney and London, where he managed the RBA’s Japanese and European government bond portfolios. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne, is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

3 minutes reading time

As investors, we’ve often heard about the ‘benefits of diversification’ for investment portfolios and frequently been told ‘not to put all our eggs into one basket’, but have we really thought about what these ideas mean? In this short post, I’ll try to shed some light on this.

Technically speaking, diversification benefits arise from the volatility of the portfolio being lower than the weighted average volatility of the individual holdings, allowing us to reduce risk while maintaining a given level of expected return. However, what determines the degree of improvement to the risk-return profile? The answer: return correlation, and, in general, the lower the return correlation, the better.

About correlation

Correlation can be defined as the strength of the co-movement between the returns of two assets, ranging from +1 or perfect positive correlation (where the instruments move in lock-step in the same direction, providing no diversification benefits) to -1 or perfect negative correlation (moving in inverse lock-step, allowing us to potentially create a zero volatility portfolio). A correlation around zero describes a situation where two assets tend to move independently of one another. Something to keep in mind is when assets are highly negatively correlated, we move into the realm of hedging (i.e. where we are actively trying to minimise volatility, usually at the expense of expected return) rather than simply optimising our risk-return trade-off. If diversification is our aim, we want to spread and reduce our risk, not necessarily eliminate it altogether.

Diversification as a mindset

When making an investment decision, it is important to assess your existing portfolio and how the potential new investment will affect it from a diversification point of view. With this type of mindset, what might initially appear to be a fantastic standalone investment, may actually be redundant when viewed in the context of diversifying your existing portfolio. Conversely, an investment you may feel indifferent about on its own might actually help to fortify your portfolio from a diversification perspective. Diversification effects should also be assessed on assets you sell, as removing a holding from a portfolio can also alter a portfolio’s risk-return profile even more than a purchase.

Putting it into practice

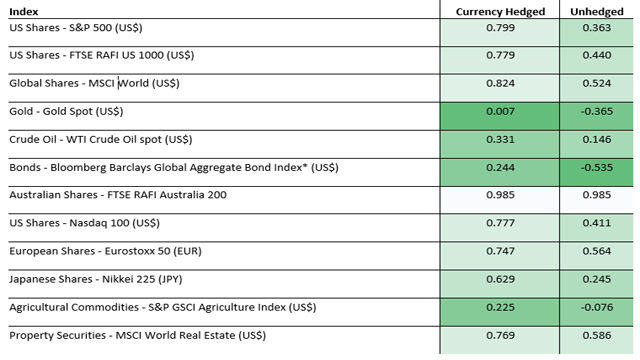

The growth in cost-effective ETF offerings has made it easier than ever to cheaply set up a well-diversified core portfolio. However, even the broadest of index-tracking ETFs can themselves be improved upon as the universe of assets and possible exposures is constantly expanding. To apply return correlations to your decision-making toolset, first assess your current portfolio’s risk-return profile and use a table such as the one below to see how potential diversification benefits stack up for you.

Correlation with S&P/ASX 200 (Broad Australian Sharemarket), August 2006 to August 2016, monthly returns

*Investment grade bonds including treasury, government-related, corporate and securitised debt.

Things to keep in mind:

- Like many metrics based on the past, historical correlations should serve as a guide and not a high precision forecast of future return co-movements. In addition, correlations are dynamic and evolve over time and tables such as the one above should be periodically updated.

- During periods of market stress, such as the global financial crisis, correlations between securities and asset classes can increase, undermining diversification benefits in so-called ‘risk-off’ periods.

- Correlations can differ greatly by the currency of denomination and unhedged returns may provide very different diversification effects to currency hedged returns. Moreover, the choice between hedged and unhedged can significantly impact the expected return profile due to exchange rate fluctuations and the pick-up or costs from maintaining currency hedges.

Use correlations as a tool to aid portfolio construction, but don’t be afraid to back your view!

Written by

Chamath De Silva

Head of Fixed Income

Chamath is the Head of Fixed Income at Betashares and is a voting member of the firm’s Investment Committee. He is responsible for managing the fixed income ETFs and leading the fixed income product development. In addition, he shares responsibility for the strategic and dynamic asset allocation decisions for the Betashares model portfolios. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their FX reserves management function in Sydney and London. There, he managed the RBA’s Japanese and European government bond portfolios across a range of market conditions. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne. He is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

Read more from Chamath.