Chamath De Silva

Betashares - Head of Fixed Income Chamath is responsible for the portfolio management function and fixed income product development at Betashares. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their international reserves section in Sydney and London, where he managed the RBA’s Japanese and European government bond portfolios. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne, is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

3 minutes reading time

Last year I addressed the concept of portfolio diversification and how we can assess it quantitatively through the use of return correlations. Just to recap:

- Correlation refers to the strength of the co-movement between two assets or portfolios (ranging from -1.0 or perfect negative correlation to +1.0 or perfect positive correlation)

- Diversification benefits – where we can lower the return volatility for a given expected return – exist when the correlation between the return of two assets or portfolios is less than perfectly positive (i.e. less than +1.0) and generally speaking, the lower the better.

- In reality, highly negatively correlated assets are hard to find (and more akin to hedging), so finding assets with low positive correlations is a good practical recommendation.

In my previous post, I looked at diversification largely through international broad equity market exposures and asset allocation (i.e. investing across asset classes). Here, I want to fine-tune this approach by exploring global diversification in the context of sector exposures to help us achieve true benefits and minimise redundancy.

When adding international exposures to your domestic portfolio, it is worth keeping in mind not only your current sector exposure, but also the sector exposure of the funds you want to add and the correlation between the respective domestic and international sectors. If diversification is our aim, we want to minimise redundancy and add truly new exposures. Let’s investigate this using the S&P/ASX 200 as our starting point and compare it with a broad global market index (S&P 1200 Global) and a broad US market index (S&P 500).

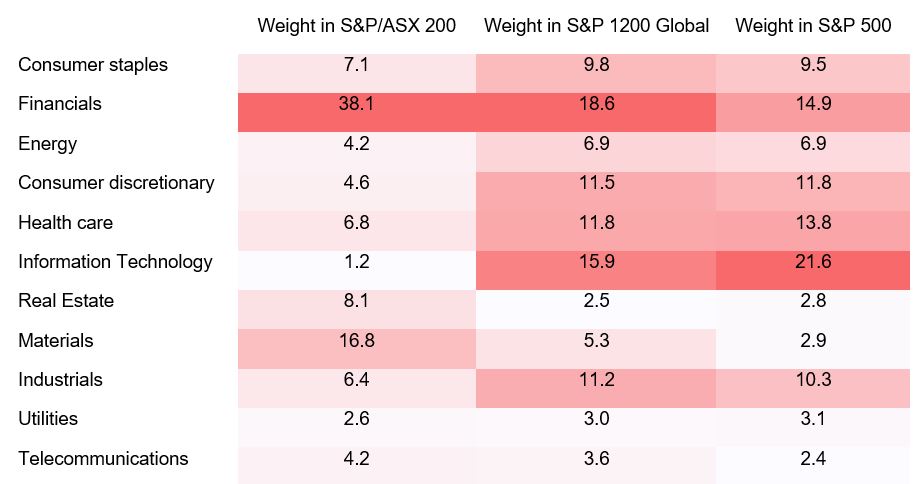

Table 1: Sector exposures by market, as at 22 February 2017

Source: Bloomberg

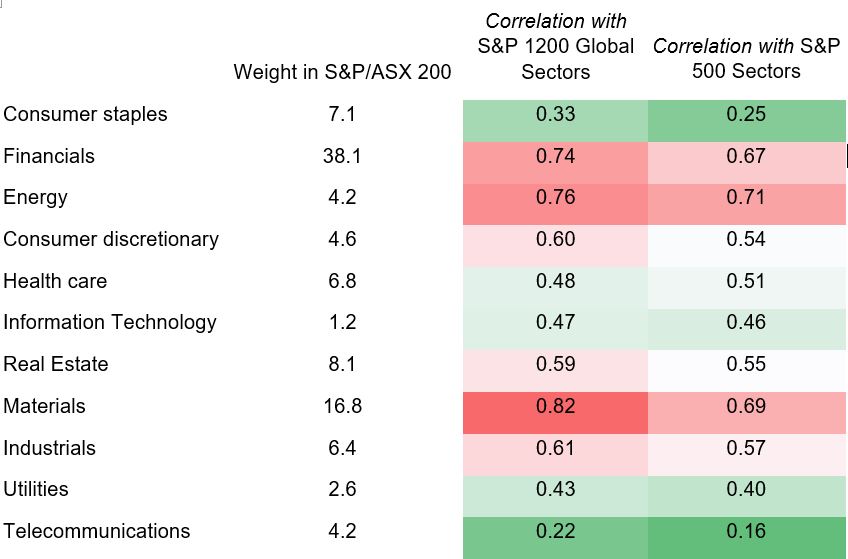

Table 2: Return correlation between Australian sectors and international sectors, monthly local currency returns, Jan-2010 to Jan-2017*

Source: Bloomberg. Historical correlations serve only as a guide and should not be construed as a forecast of future correlations; correlations are between local currency returns and unhedged return correlations may differ significantly.

One insight we can draw from the tables above is the ASX 200 is clearly underweight in some sectors (such as technology, healthcare and consumer discretionary) compared to international markets and is over-represented in other sectors (such as financials, real estate and materials). Another is that some domestic sectors have stronger interrelationships with their international counterparts than others, creating potential redundancy implications. As such, adding foreign energy, financials or materials exposure appears to be more redundant compared to the addition of international consumer staples or telco exposures. This makes sense as the former are very globally connected or heavily dependent on the price of an underlying commodity. In contrast, the latter may have domestic factors driving returns to a much greater degree.

When deciding what type of international exposure you need for your portfolio, it is worth considering which sector exposures you already have, which sector exposures you lack and what diversification benefits exist between those sectors here and abroad. Adding sector exposures that are under-represented in the domestic market in your portfolio is usually a wise move for diversification. In addition, adding international exposure from a sector you’re already overweight in domestically may still have diversification benefits for your portfolio. Conversely, adding a new international broad market or sector exposure may actually contain significant redundancy.

Adding international broad market exposures can be a smart choice for many investors, although at times it can be too much of a blunt instrument. Depending on your circumstances, fine-tuning your global sector allocation may be necessary.

BetaShares has a range of global sector ETFs, a list of which can be found here.

Written by

Chamath De Silva

Head of Fixed Income

Chamath is the Head of Fixed Income at Betashares and is a voting member of the firm’s Investment Committee. He is responsible for managing the fixed income ETFs and leading the fixed income product development. In addition, he shares responsibility for the strategic and dynamic asset allocation decisions for the Betashares model portfolios. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their FX reserves management function in Sydney and London. There, he managed the RBA’s Japanese and European government bond portfolios across a range of market conditions. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne. He is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

Read more from Chamath.