David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

5 minutes reading time

- Global

Global markets

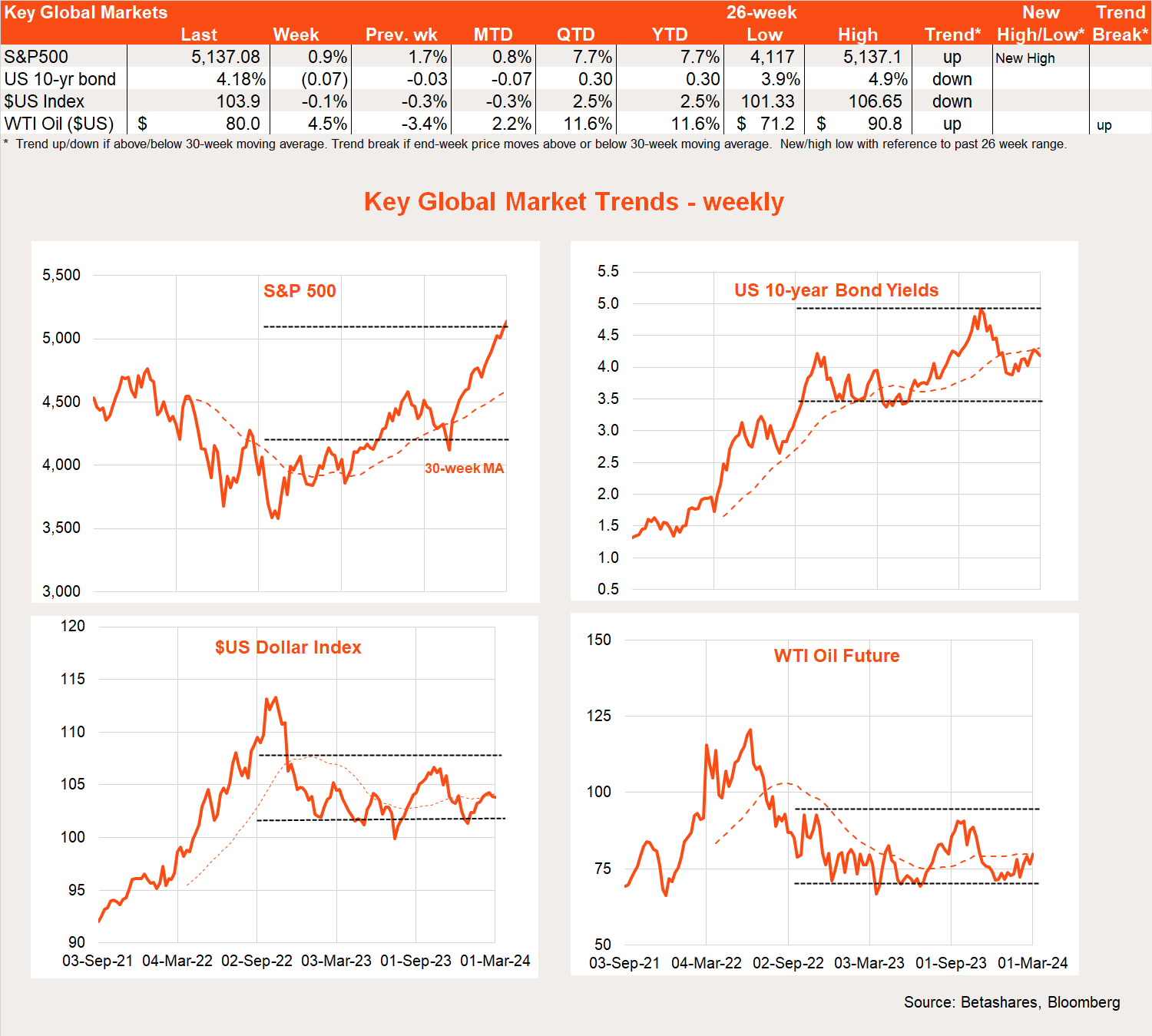

US stocks continued to grind higher last week following a key inflation report that was no worse than expectations. Optimism around the Q4 earnings reporting season also helped as did ongoing euphoria around AI. Bond yields eased a touch and the $US remained steady.

The big news last week was the January private consumption expenditure (PCE) price deflator. The headline and core measures rose 0.3% and 0.4% respectively – higher than we’ve been in recent months, but no worse than expectations, given we already knew larger price increases were likely given the already released January CPI and PPI results. These results were still consistent, however, with a further modest easing in annual headline and core PCE inflation to 2.4% (from 2.6%) and 2.8% (from 2.9%) respectively.

At this stage economists are prepared to dismiss the high January results as seasonal distortions – markets will worry more if these results are repeated in the February reports. To that end, Tuesday March 12 looms large – as it’s when the February US CPI result is released.

Last week also saw the Q4 earnings reporting season wind down. According to FactSet, of the 97% of companies that have reported so far, 73% beat earnings estimates – which is a touch below the 5-year and 10-year averages of 77% and 74% respectively. That said, estimated earnings growth over 2023 now sits at 4% – which is higher than the 1.5% expected at the end of 2023. Technology, consumer and health care stocks tended to have the most impressive earnings beats, while financials were generally underwhelming.

Global highlights this week include Fed chair Powell’s semi-annual testimony to Congress over Tuesday and Wednesday. We should not expect any major surprises, with Powell likely to repeat his cautiously optimistic outlook from late last year based on likely further declines in inflation, resilient economic growth and possible rate cuts later this year.

The other highlight will be Friday’s February payrolls report – which is likely to remain firm, with a 188k gain in employment expected and a steady unemployment rate of 3.7%. One potential market concern will be average hourly earnings growth, which had a high 0.6% monthly gain in January but is expected to tick back down to 0.2%. Following firm January inflation reports, another high wage outcome could see markets fret that even a June Fed rate cut might not be likely.

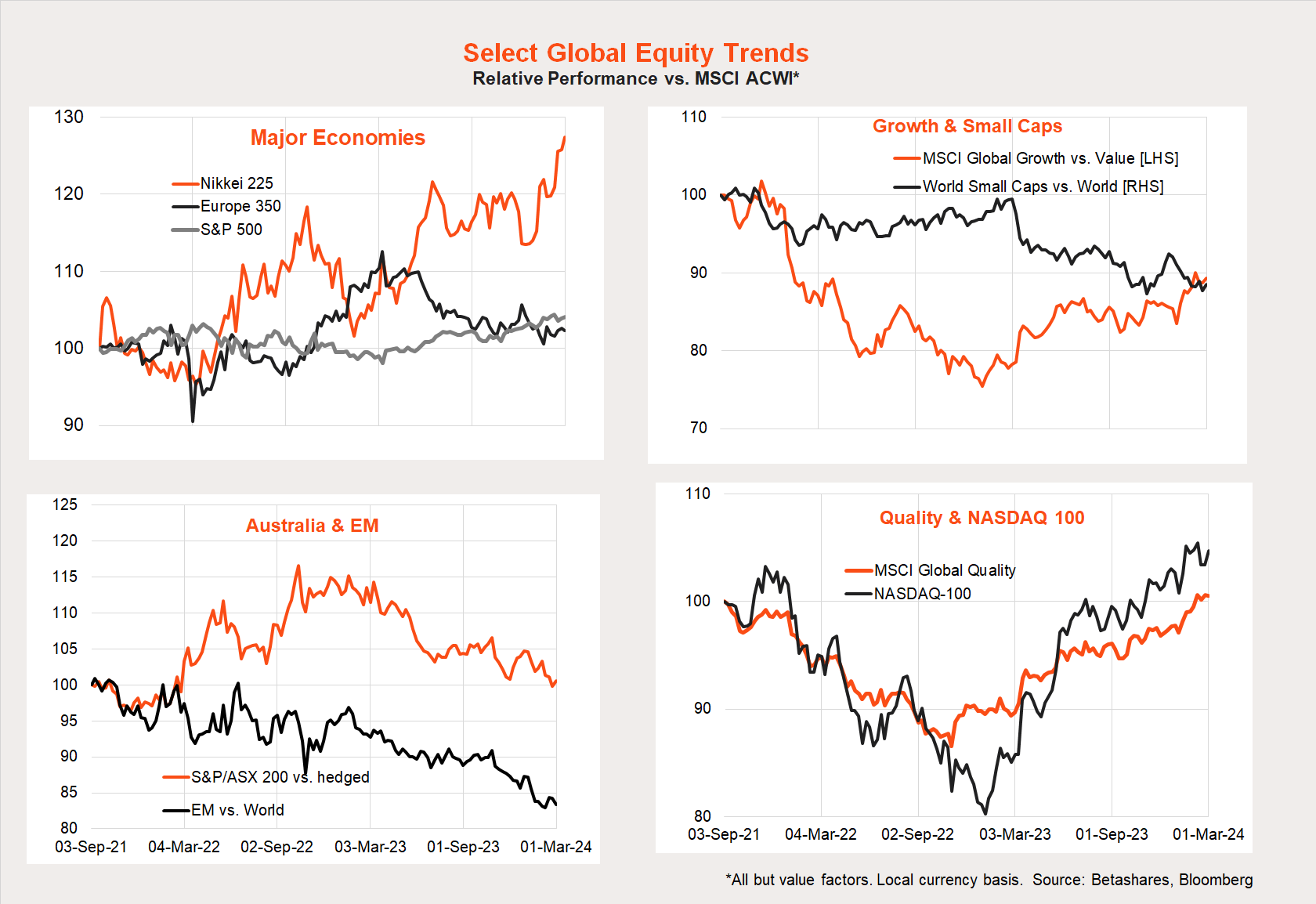

Apart from US tech stocks, Japanese stocks again had another good week. Cheap valuations and solid corporate earnings – due to an improved focus on shareholder returns – is helping Japanese stocks rise again. Small caps and emerging markets in general remain on the nose.

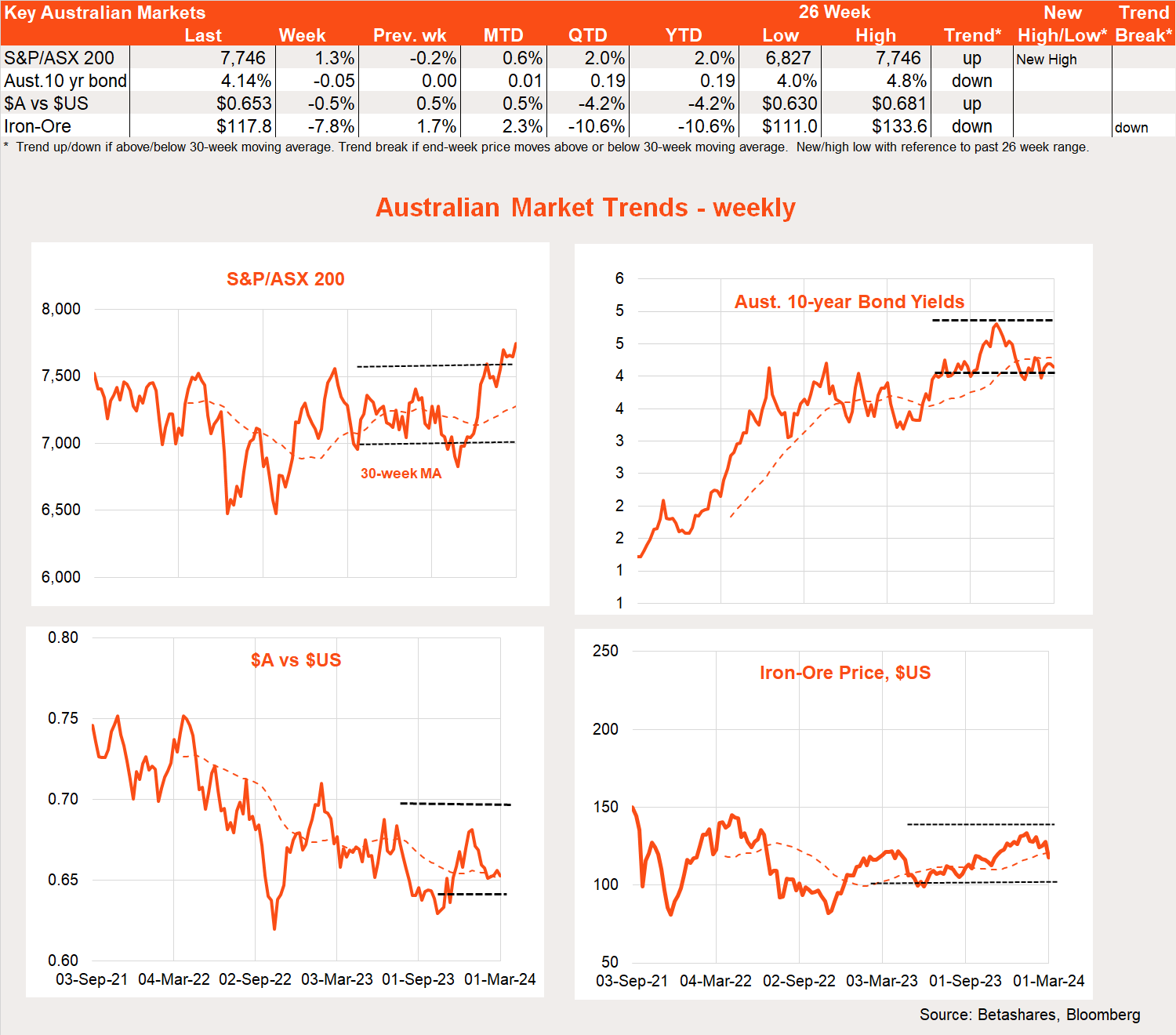

Australian markets

After a few weeks consolidating – after breaking out of a choppy 2.5 year sideways trend – the S&P/ASX 200 pushed on last week to new record highs with a feisty 1.3% gain, helped by a benign inflation report.

It’s hard to believe, but the market touched 7,628 in August 2021 – a level not seen again until end-January. The breakout bodes well for future returns, with my year-end call of 8,000 now seemingly likely to be achieved well ahead of schedule.

Local economic data were mixed. As noted, of most importance was the January monthly CPI report. This was a bit better than expected, with a decline in annual inflation to 3.4% (market expectations 3.6%). The CPI excluding volatile items and travel has grown at a steady annualised pace of around 2.4% over the past five months.

We also learnt private capital spending lifted by a stronger-than-expected 0.8% in Q4, though the 1.1% January bounce back in retail spending was a little less than expected after the dismal 2.1% slump in December.

As befitting an innovative economy, the lift in business investment is being driven by construction of new data centres and renewable energy projects. Investment intentions also remained firm, with near double-digit nominal spending growth expected in the current and following financial year.

The major local highlight this week will be the Q4 GDP result on Wednesday. Held back by weak consumer spending and home building (despite firm business investment and higher immigration), at this stage the economy looks to have eked out another quarter of snail pace growth, with a gain of only 0.3% after a gain of 0.2% in Q3.

Depending on this week’s profit and trade results, there’s a very real risk of negative GDP growth – which could see talk of a potential ‘technical recession’ bandied about in the media with potential knock-on effects to consumer sentiment. If so, this will keep H2’24 RBA rate cut hopes alive and well.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.