David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

5 minutes reading time

- Global

Global markets

Just as Glenn Close shockingly sprang back to life in the climatic final scene of the movie Fatal Attraction, so it seems that US inflation could be rearing back into view. That’s the ghastly fear that’s now stalking Wall Street.

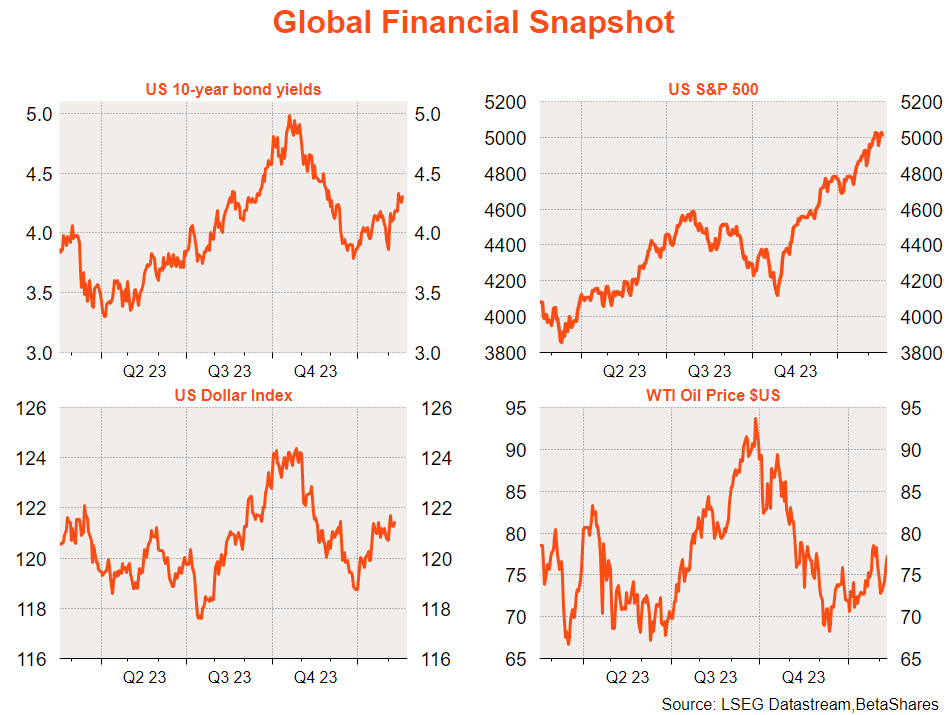

Wall Street’s 5-week winning streak came to an end last week with the US S&P 500 slipping 0.4% following a hotter-than-expected January CPI inflation result. US bond yields also lurched higher, with traders all but giving up on the hope of US rate cuts at either the March or May Fed meetings.

As warned last week, Wall Street is placing a lot of faith in the ‘soft landing’ narrative and reacted notably to only a slight upward miss on inflation – with the core CPI rising 0.4% in the month instead of the 0.3% market expectation. The shock was made worse by the fact that much of it came from sticky services.

At 0.3%, headline monthly inflation was also a touch stronger than expected, though this was partly offset by a downward revision to the December price gain. Adding insult to injury, however, Friday’s January producer price index (PPI) was also stronger than expected – due to strength in a range of services such as medical costs – raising the risk that the trend decline in US inflation may be stalling.

The upshot of the CPI and PPI results is that the January reading of the Fed’s preferred measure of inflation, the core personal consumption expenditure (PCE) deflator, is now also likely to come in hot on February 28 – a gain of potentially 0.4% of 0.5% in the month, after gains of 0.1% to 0.2% in the final months of last year.

Thankfully, given core PCE inflation also rose 0.5% in January 2023, even a similarly large monthly gain this time around would keep annual inflation at least steady at 2.9%. What’s more, markets now at least seem ready for the inflation bounce back.

So far at least, markets seem willing to forgive one monthly upside miss on inflation – though next month’s readings now take on added significance.

What we do know is that US goods inflation is still broadly trending down, as is housing inflation (apart from the odd bump in the road), but the lift in wages last year appears to be still flowing through into a range of service sector prices – which will leave markets nervous for a time. We also can’t discount seasonal year-end distortions.

In other key global news last week, Q4 GDP growth in both Japan and the UK were weaker than expected – with both countries in fact slipping into a technical recession in H2’23 with two back-to-back small negative GDP results. Of course, due to weak population growth, Japan is rarely far from negative growth in any case while the UK is suffering due to both high inflation and Brexit-related woes.

There’s little major global data this week, with highlights being the minutes to the Fed’s January meeting and musings from a range of Fed speakers in the wake of last week’s inflation results. Given concerns over an overly strong US economy, markets will also pay attention to the S&P US services sector February PMI survey.

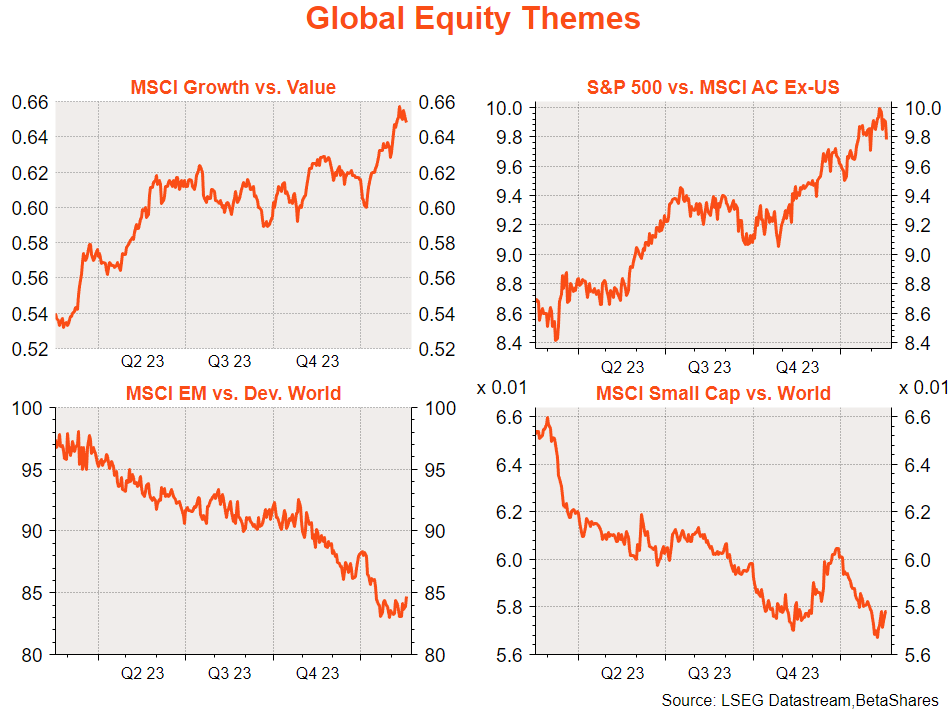

In terms of global equity themes, the return of inflation concerns has seen a small correction in the trends that have been favouring growth/technology/large-cap/US themes over everything else.

Australian markets

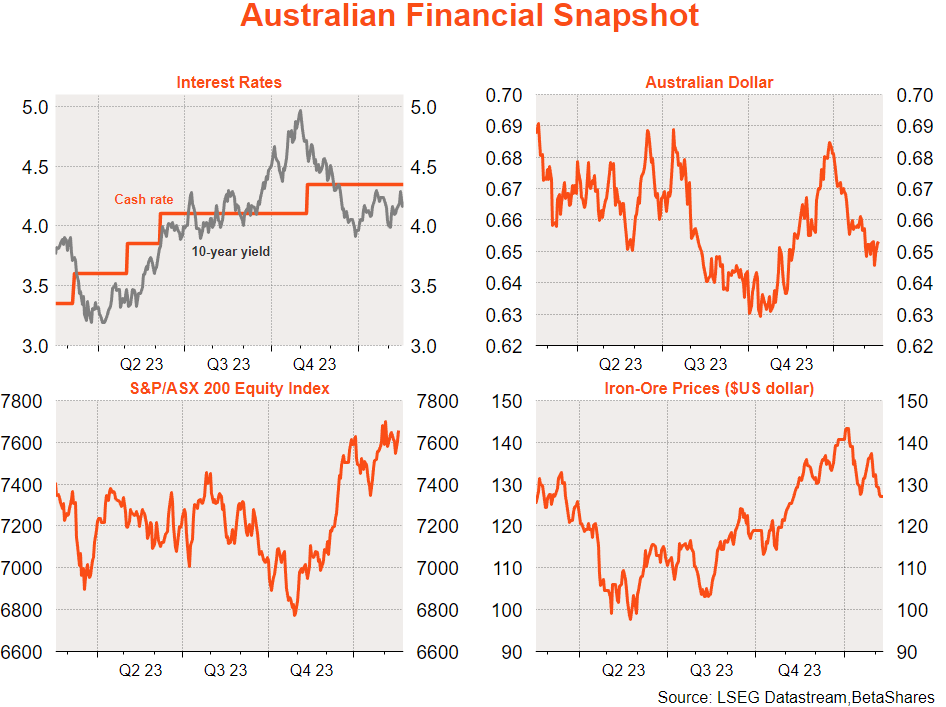

The S&P/ASX 200 was fairly steady over the past week, gaining a mere 0.2% – with futures suggesting an impressively flat open despite Wall Street’s post-PPI drop on Friday. Apart from local rate cut speculation, the other major local theme is the earnings reporting season – which so far seem seems modestly better than feared.

Local data last week was mixed, with a nice bounce in consumer confidence (on rate cut speculation), offset by a small further decline in the NAB index of business conditions. Also on the negative side, employment was flat in January, with the unemployment rate lurching up to 4.1% – though there are question marks around seasonal adjustment given the shift in year-end consumer spending patterns.

Just in case the RBA circus two weeks ago was not enough, minutes to the February RBA meeting are released tomorrow. Of likely more importance this week will be the Q4 wage price index report, which is expected to show a modest acceleration in annual wage growth from 4.0% to 4.1%. Wage growth has firmed up to be sure, but is not bad enough to yet rule out rate cuts later this year – especially given signs of softening in labour market tightness.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.

2 comments on this

Hi David, please bring back your 30 week moving average charts 🙂

Hi Nathan,

We’re glad to hear that you’ve enjoyed those and We’ll pass your interest on to David and the team.

Cheers,

Dina