David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

5 minutes reading time

Global markets

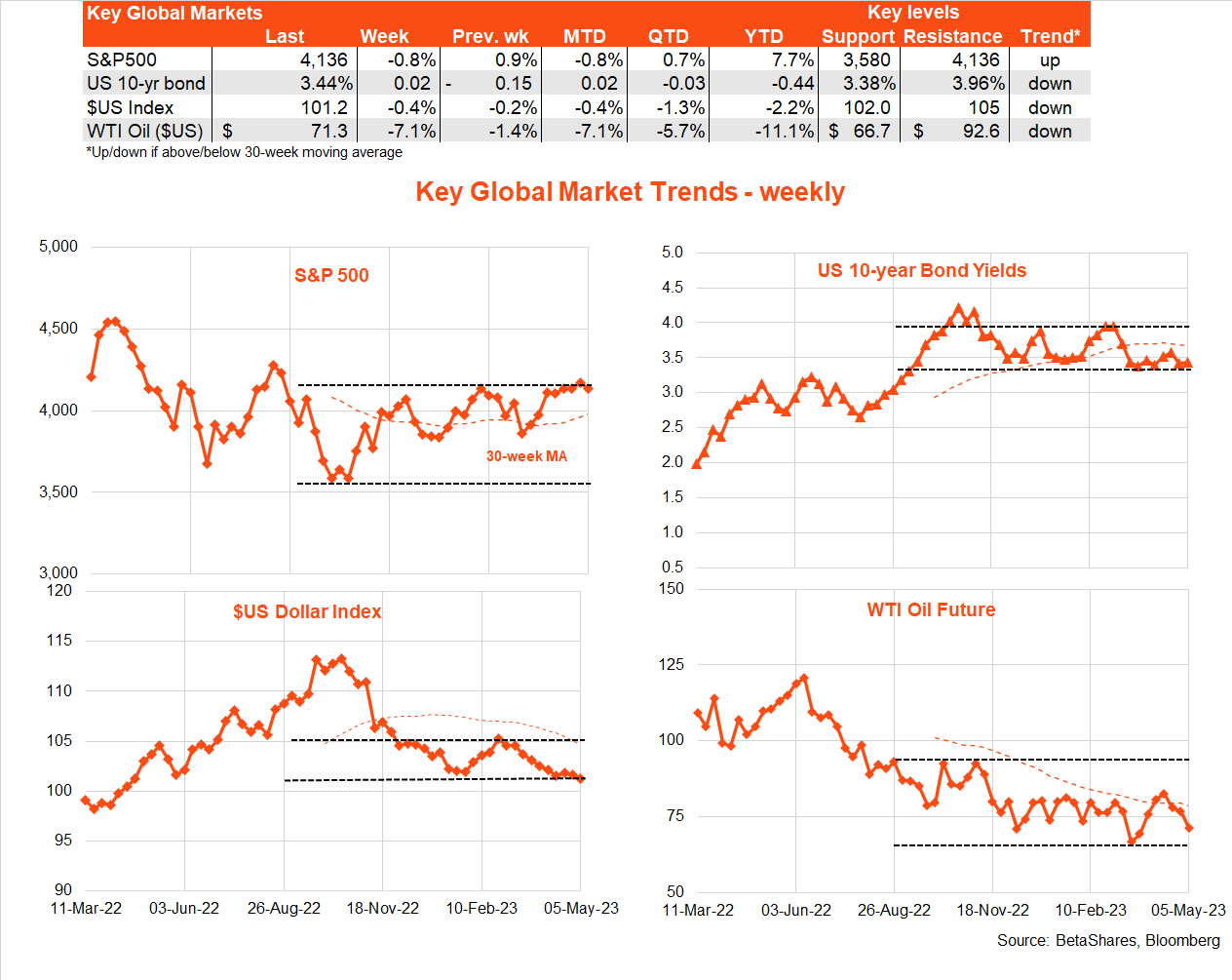

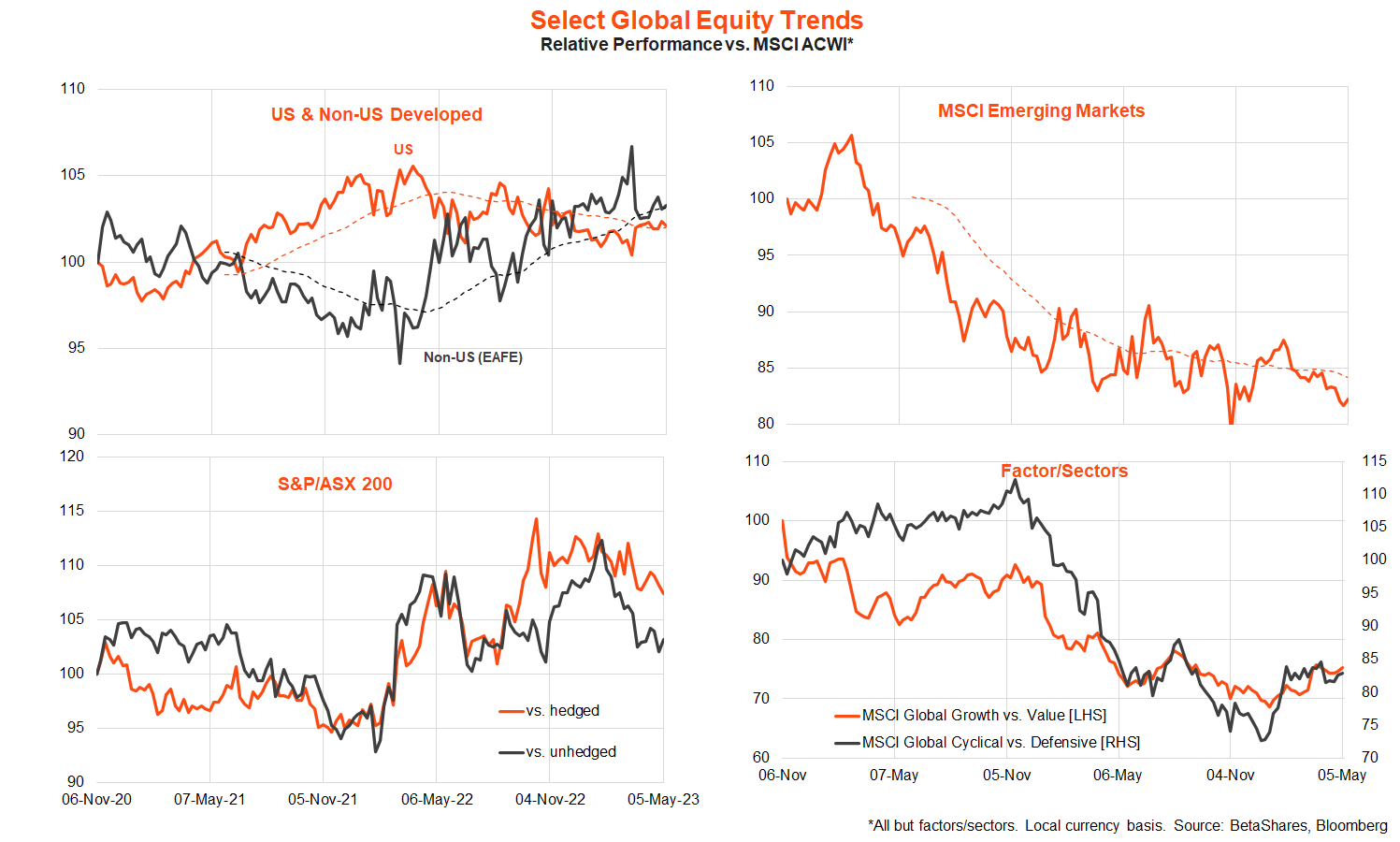

Global equities pulled back a little last week under the weight of ongoing US banking concerns and the failure of the Fed to validate market rate cut expectations. The US S&P 500 is still trying to break above recent range highs, while US 10-year bond yields and the $US are trying to break below recent range lows.

Last week’s highlight globally was the Fed’s widely expected decision to hike rates by 0.25%. As also expected, Fed chair Powell poured cold water on the idea of rate cuts this year, though he did hint he is open-minded about not hiking again in June if we see some further moderation in growth and inflation. At present, markets are attaching only a 10% chance to a June rate hike, which seems a little skinny to me.

Also notable, Powell suggested (genuinely it seems) that he believes a soft landing is possible, even though the Fed’s own staff forecasts predict a mild recession later this year. In this regard, Powell noted that job openings (labour demand) have been falling without as yet any rise in the unemployment rate. This points to the potential for an easing in the excess labour demand (and hence wage pressure) without a material weakening in the economy. Possible? Maybe – but I won’t hold my breath!

Of course, if US banking concerns get worse, the Fed will likely pause in June. Last week we saw the second largest bank failure since the GFC with First Republic overtaken by regulators and sold off to JP Morgan. Surveys suggest US lending conditions are tightening on Main Street as small/medium-sized banks fret over deposit losses to more competitive money market funds. It seems likely a few more vulnerable banks may be picked off in the coming weeks – if only because their share prices become victim to speculative attack.

Meanwhile, however, the dilemma for the Fed is that current economic conditions and inflation pressure remain stubbornly firm. Although job openings eased further last week, they remain very high by historic standards. Similarly, although weekly jobless claims have lifted in recent months, they remain relatively low. The manufacturing PMI survey revealed an uptick in pricing pressure and April’s 230k employment gain remained impressively strong.

Worse, Friday’s payroll report also revealed a tick down in the unemployment rate from 3.6% to 3.4% and a strong 0.5% gain in average hourly earnings. As in Australia, weak US productivity growth is also pushing up unit labour costs.

In Europe, the unemployment rate dropped to a very low (by European standards) 6.5%. The rate in Germany is down to 2.8% which has allowed its strong union movement to win hefty wage gains. It’s perhaps no surprise, therefore, that the European Central Bank lifted rates a further 0.25% last week (albeit a downshift from recent 0.5% increases) and warned of further rate hike ahead.

In terms of the week ahead, the highlight will be Wednesday’s April US CPI report, which is expected to reveal stubbornly firm overall core pricing pressure. The core CPI (i.e. excluding food and energy) is expected to rise by 0.4% – the same as in March – with annual core inflation easing only marginally from 5.6% to 5.5%.

Also worth watching is weekly jobless claims (will they rise a lot further?) and what a range of Fed speakers say about the interest rate outlook.

Australian markets

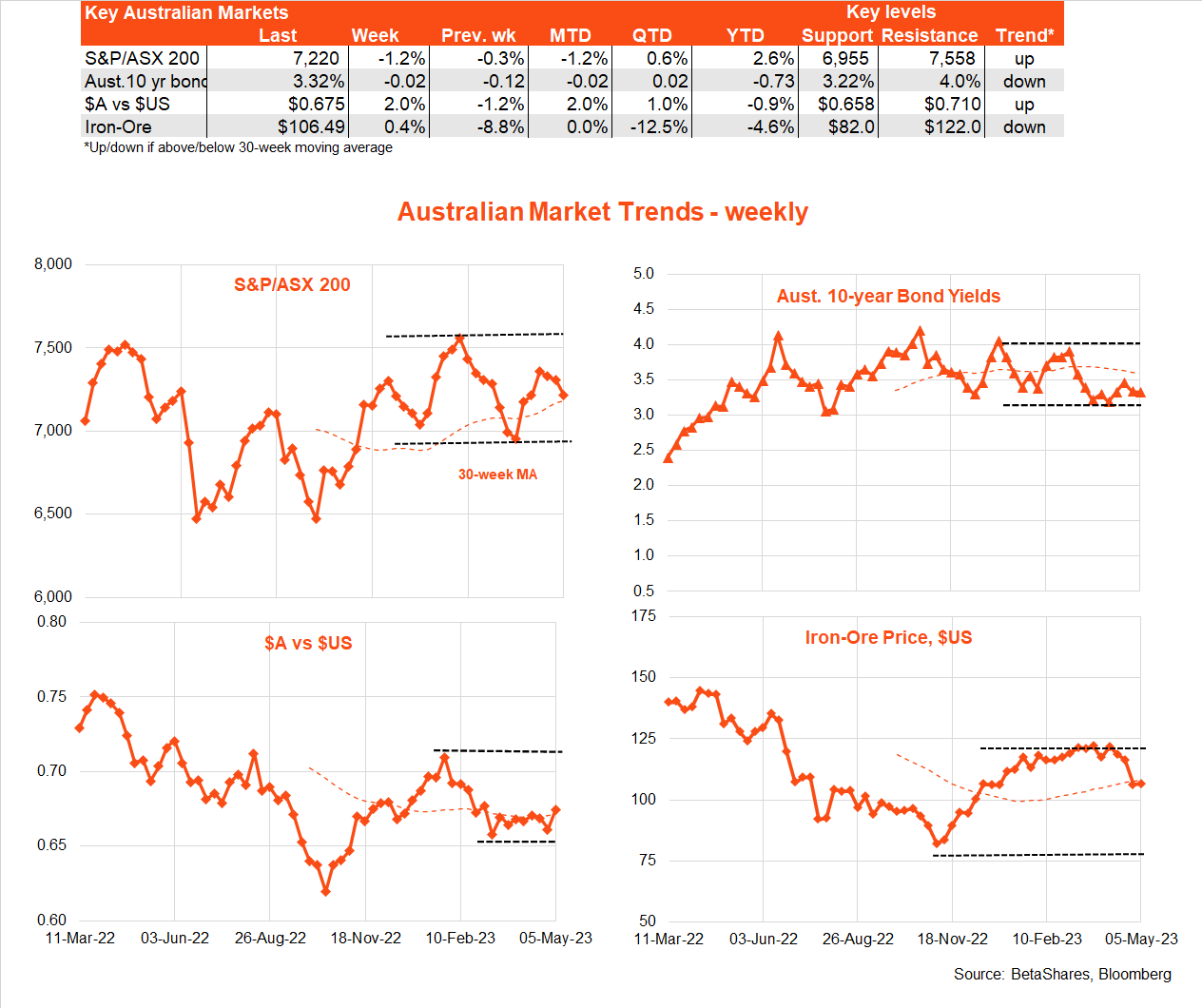

The S&P/ASX 200 also pulled back further last week to be left meandering within its 7,000-7,500 range since late last year. The week’s highlight, of course, was the surprise RBA decision to hike interest rates – despite announcing a pause only one month ago and despite a downgrade to its near-term inflation expectations in Friday’s Statement on Monetary Policy.

Why did the RBA act? It’s hard to know for sure – but what does seem new in recent weeks is the bounce back in house prices and concern that global service sector inflation has remained reasonably sticky.

Where to from here? As with the Fed, the RBA retains a clear tightening bias though is likely open-minded as to whether it feels it needs to hike again. Both central banks are now in wait-and-see ‘data dependent’ mode.

On that score, the near-term policy outlook obviously depends on the resilience of economic growth and inflation to the rate hikes already in place. If both remain resilient in both countries, which is a very real risk, both central banks could easily raise rates once or twice more at least – although this is (not yet!) my base case. That said, the risk of further near-term tightening seems higher than the very low probability currently assigned by the markets.

We’ll get updates on business and consumer sentiment with the NAB and Westpac surveys respectively today and tomorrow. Depending on when these surveys were taken, they may well show optimism following last month’s RBA pause or despair given last week’s surprise rate hike. Notably, housing auction clearance rates remained firm over the weekend despite the rate hikes – which could be a red rag to the newly riled-up RBA.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.