10 minutes reading time

This information is for wholesale client use only.

- A shift from inflation to growth concerns as bonds set to become true portfolio diversifiers again

- What everyone missed when the RBA surprised the market and hiked again

- Rolling US regional banking troubles appear increasingly systematic

Given we’re now at the tail end of an extremely busy week for central bank policy, with the RBA, Fed and ECB all raising their policy rates by 25 basis points – it’s now a good time to take stock. Before diving into the central bank decisions one by one, it’s worth taking a high-level view, given we’ve seen a bit of a change in the macro narrative in recent weeks.

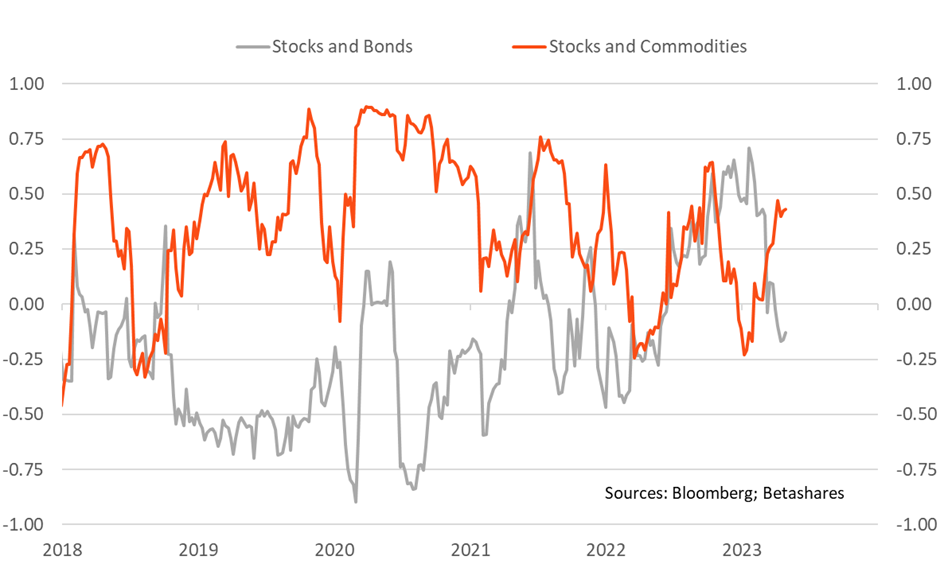

Ultimately, I’d argue that we’re now in a transition phase from inflation being the dominant concern for asset prices to growth. We can see this not only from the outright performance of government bonds (which have been rallying despite the rate hikes continuing), but also the relative performance of cyclicals vs defensives in the equity market and the changing correlations between major asset classes. Although a temporary boost to global liquidity has created some noise (and “soft landing” optics in some parts of the market), the 3-month rolling correlation between US Treasuries and the S&P 500 has turned negative, while the correlation between stocks and commodities is now well into positive territory, which suggests that recession fears are growing in prominence, which should intensify once the global liquidity impulse goes into reverse.

A big story of 2022 was how bonds no longer worked as a portfolio diversifier, but as we stare down the barrel of a major growth slowdown and likely US recession, recent price action suggests that high-grade bonds should once again work as a portfolio ballast. It’s also notable that despite three rate hikes this week – one hawkish surprise (RBA), one in line with expectations (Fed) and one marginally dovish (ECB) – bond yields for Australia, the US and the Euro area all ended the week lower, with the market of the view that central banks will be forced into a cutting cycle sooner than they think.

A busy week for central banks

Heading into the RBA decision, market pricing only indicated a 10% chance of a hike and the RBA not only defied cash rate futures but the consensus from economists by hiking 25 basis points, sending traders scrambling to cover positions, which were suddenly offside. Given the April pause, there had been a belief that the next move would be a cut and market pricing had shifted accordingly. However, had we ignored market pricing and focused on the hard data coming in (both the too-high inflation and “too strong” employment numbers) and the minutes from the April meeting, then a May hike wouldn’t have been a huge surprise. In addition, had we considered that one of the recommendations from the RBA review was to shift the inflation target from the 2-3 per cent “band” to a 2.5% “point” target, then the market should’ve expected the RBA wouldn’t tolerate waiting until 2025 to get inflation back below 3 per cent (implied by their own forecasts). Hindsight…

The Fed’s 25 basis point hike at the FOMC was much less of a surprise for the market, but it still resulted in a large market move, with US Treasuries and rate futures effectively pricing in the end of the hiking cycle, despite Powell not actually committing to a pause in the press conference. Guidance from Fed officials remains far more hawkish than market pricing, especially in relation to H2 2023 and 2024, and the outcome really hinges on whether the growing regional bank stress induces a broader credit crunch. The meeting came on the back of JPM acquiring First Republic’s assets and deposits from the FDIC and coincided with escalating fears relating to PacWest and Western Alliance, sending government bond yields (and regional bank share prices) sharply lower. Despite the hawkish RBA surprise, Australian bond yields were ultimately still more heavily influenced by US developments, with the sympathy rally with US Treasuries sending local yields to lower levels than prior to the RBA meeting (at the time of writing).

In arguably the most dovish of the three meetings, the ECB also raised its key rates (deposit and MRO) by 25 basis points, largely in line with expectations. The market had assigned a 20 per cent probability of a 50 basis point hike on the back of the hawks in the Governing Council getting more vocal, but it’s clear that despite the official view that “inflation is too high for too long”, financial stability concerns are becoming more of an issue, with the ECB appearing to want to preserve optionality. The one bone thrown to the hawks was the announcement that the proceeds from the Asset Purchase Programme (APP) maturities will no longer be reinvested after July, meaning the ECB will finally move to “true QT”. We also now have the strange situation of the market pricing in the ECB hiking during a period of Fed cuts (in Q3).

The RBA surprise notwithstanding, it does increasingly appear major central banks are more open to a true near-term pause, with the bond market taking it as a green light to rally. In addition, the decision from the BoJ last week (Ueda’s first meeting as Governor) to make no change to policy (and likely defer any major shift until its 12–18-month policy review has been completed) will also remove the tail risk of a near-term hawkish surprise out of Japan. However, with market pricing already implying 80 basis points of Fed cuts by the end of the year and the end of the US debt ceiling standoff (assuming a deal is reached) likely to spur a flurry of new Treasury issuance, there is the question whether investors would be best served waiting for the next dip (spike in yields) before going max long duration to play the recession trade.

US regional bank woes continue

Following the failures of SVB and Signature Bank and the introduction of the Fed’s Bank Term Funding Program (BTFP), there had been a growing view (that the Fed itself had endorsed) that the banking stress had been cauterised, giving the Fed runway to keep hiking and maintain their singular focus on inflation fighting. This had been reinforced by some data suggesting the pace of regional deposit outflows had slowed. However, slowing isn’t the same as ending, and outflows from regional bank deposits continue, with First Republic forced into FDIC receivership (and a subsequent sale of selected assets to JPM) and PacWest (like SVB and First Republic, another California-based lender) and Western Alliance (focused on Arizona, Nevada, and California) both teetering on the brink at the time of writing, with fears now emerging around First Horizon Bank. The situation appears less idiosyncratic and more systematic each week, largely on the back of the following structural issues:

- Deposit rates that regional banks can offer are simply uncompetitive compared to less risky, zero or low duration alternatives like Treasury Bills and Money Market Funds, with the latter making increasing use of the Fed’s own reverse repo facility, which is now paying 5% for true risk-free cash. Regional banks aren’t able to materially raise deposit rates without crushing NIMs, given the low investment rates locked on the asset side of their balance sheets.

- Regional banks, in many cases, simply don’t have large portfolios of eligible government securities that can be pledged as collateral at the BTFP (which would offset deposit flight), given their assets are dominated by traditional loans, with a relatively large share tied to commercial real estate (CRE).

- As CRE values look increasingly shaky, so does the collateral backing many of the loans which comprise a large share of regional bank assets, making it likely that any meaningful deposit flight to force a regional lender into FDIC receivership (as loans would need to be offloaded at a large discount, crystallising such a loss as to make the bank effectively insolvent from a capital adequacy perceptive). One notable feature of First Republic’s balance sheet was the large number of highly tailored “jumbo” and “interest only” mortgages made at very low rates (to wealthy individuals) that couldn’t be packaged into government-guaranteed MBS pools or be easily sold.

Share prices in the US regional bank sector have been decimated, with the S&P Regional Bank index down -47% since 31-Dec-2021, with two of the largest weights as at 31-Dec-2022 (SVB and First Republic) completely wiped out. There’s also the risk of further forced selling of regional bank shares (from long only managers now worried about career risk) creating a vicious circle of share price declines -> deposit outflows -> further share price declines, with the eventual destination being FDIC receivership. Such an outcome means shareholders – both ordinary and preferred – and bondholders are most likely zeroed, making it that much harder to buy the dip.

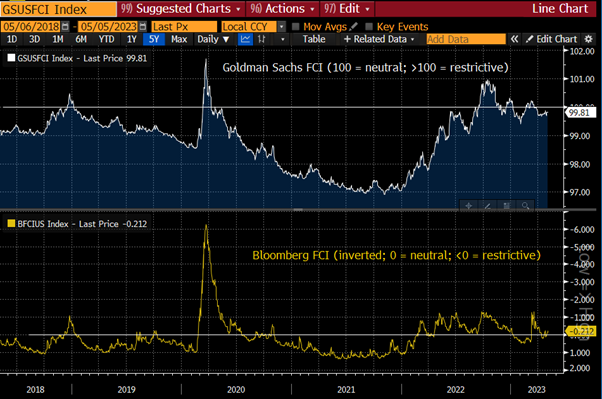

Given the challenges US regional banks will have in just holding on to their main source of funding (deposits), it’s likely to drive increasingly conservative behaviour going forward as they attempt to fortify balance sheets, resulting in much slower loan origination to small and medium-sized businesses more generally – still the main employer in the US economy. If the end-game of this current episode of stress is greater consolidation under the G-SIBs, then credit conditions for the SME sector will tighten materially, not only over the coming months, but also over the longer term. Finally, it’s worth flagging that despite growing risks that the US credit cycle finally turns, financial conditions indices aren’t at truly “restrictive” levels yet, while spreads on the most cyclical part of the US credit market – traditional junk bonds and traded leveraged loans – don’t appear to be indicating much fear of an impending default cycle. What’s “priced in” is largely in the eye of the beholder, with rates and credit telling different stories.

Chart 1: 3-month rolling (weekly return) correlations; S&P 500, Blomberg US Treasury TR Index; Bloomberg Commodity Index

Sources: Bloomberg; Betashares

Chart 2: Policy rates, forward rates, and yields

Chart 3: US deposit rates and t-bill yields

Sources Bloomberg; Bankrate.Com

Chart 4: Credit spreads

Source: Bloomberg

Chart 5: US financial conditions indices

Sources: Bloomberg; Goldman Sachs

Important:

This information is for wholesale client use only. It is not intended for retail clients.

BetaShares Capital Ltd (ACN 139 566 868 AFS Licence 341181) (“BetaShares”) is the issuer.

This is general information only and does not take into account any person’s particular circumstances. It is not a recommendation to make any investment or adopt any particular investment strategy. You should make your own assessment of the suitability of this information.

Future outcomes are inherently uncertain. Actual outcomes may differ materially, positively or negatively, from those contemplated in any views, opinions, estimates, projections or other forward-looking statements given in this document. Readers must not place undue reliance on such statements. BetaShares does not undertake any obligation to update forward looking statements to reflect events or circumstances after the date such statements are made or to reflect the occurrence of unanticipated events.

The author’s views do not necessarily reflect those of BetaShares and are subject to change without notice.

Any past performance information shown is not indicative of future results.

To the extent permitted by law BetaShares accepts no liability for any loss from reliance on this information.