David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

6 minutes reading time

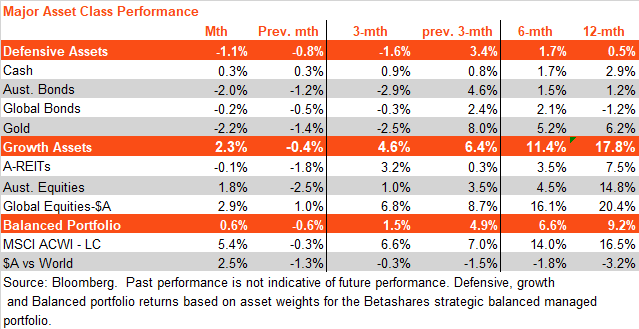

Market summary

Rising bond yields dented returns from defensive assets in June – hurting both fixed-rate bonds and gold. Bond yields rose as resilient global economic growth and sticky core inflation led many central banks to signal likely further policy tightening in coming months, and little prospect of rate cuts this year.

Higher bond yields were not enough to hold back equity markets, however, which are growing in confidence that a global recession is unlikely any time soon – despite the prospect of higher interest rates. With earnings growth expectations no longer falling, equities lifted due to higher PE valuations and a further narrowing in the equity risk premium.

As a result, growth assets outperformed defensive assets in June, with the former showing positive relative performance over recent months.

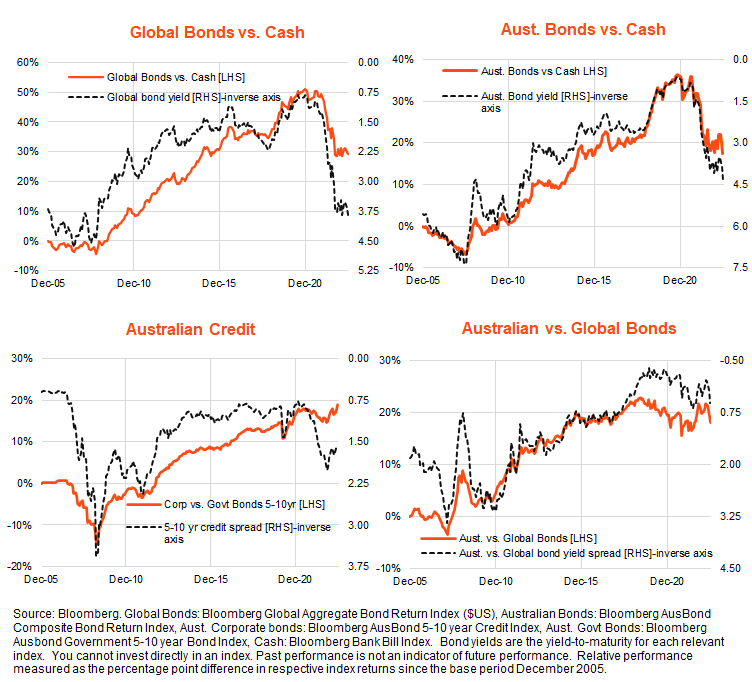

Interest rates and bonds vs cash

Another rise in bond yields hurt fixed-rate bond returns in June. The yield on US 10-year government bonds rose by 0.19% to 3.84%, after rising by 0.22% in May. The US market ended the month expecting one further 0.25% Fed rate rise over the coming months, with 1% worth of rate cuts expected over 2024. The Bloomberg Global Aggregate Bond Index ($A hedged) declined by 0.2% in June after a 0.5% loss in May.

Australian 10-year bond yields rose by 0.42% to 4.02% over the month, reflecting a surprise RBA rate hike and hawkish commentary suggesting further rate rises in coming months. The market fully expects one further rate hike and some risk of a second interest rate hike – followed by only one rate cut in 2024. The Bloomberg AusBond Composite Index declined by 2.0% in the month after a 1.4% loss in May.

As evident in the chart set below, after appearing to top out earlier this year, long-term bond yields rose over the past two months with further monetary tightening priced into markets. This has seen the performance of bonds decline again relative to cash.

Credit spreads, by contrast, continue to narrow with the recovery in equity prices from late last year. The larger increase in Australian bond yields in the past two months has seen Australian bonds underperform global bonds of late, after an earlier period of outperformance.

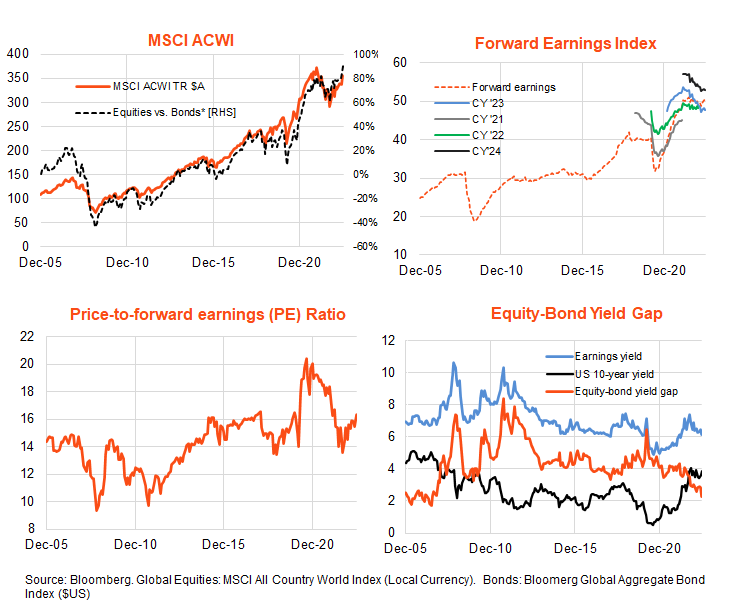

Global equities

Unlike in May, global equities shrugged off the rise in bond yields in June, with the MSCI All-Country World Index returning 5.4%. With forward earnings flat, the gain in equities reflected a rebound in the price-to-earnings (PE) ratio and associated decline in the equity risk premium.

At 16.3, the global PE ratio ended June at the higher end of its range since 2015 (excluding the very high valuations seen during 2020 and 2021 as markets – correctly in hindsight – looked through the COVID crisis). At 2.3%, the equity risk premium is at its lowest level since 2007.

The upbeat market tone appears to reflect growing confidence that marginal further global monetary tightening may not cause a recession. This is reflected in a levelling out in earnings growth expectations after downgrades since mid-2022.

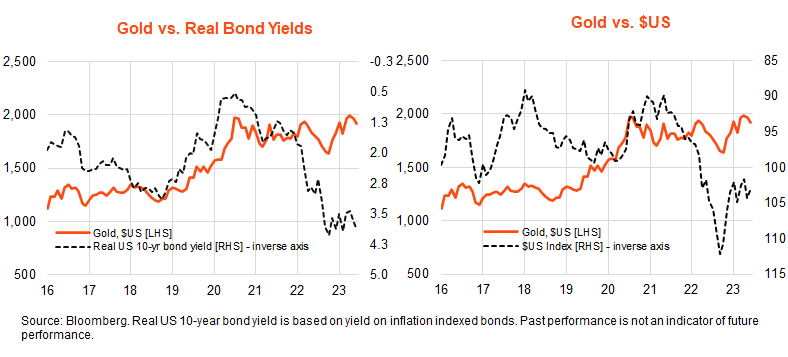

Gold

Despite a softer US dollar in June, gold prices eased back a further 2.2%, after a 1.4% fall in May, likely reflecting the rise in bond yields.

Australian equities and listed property

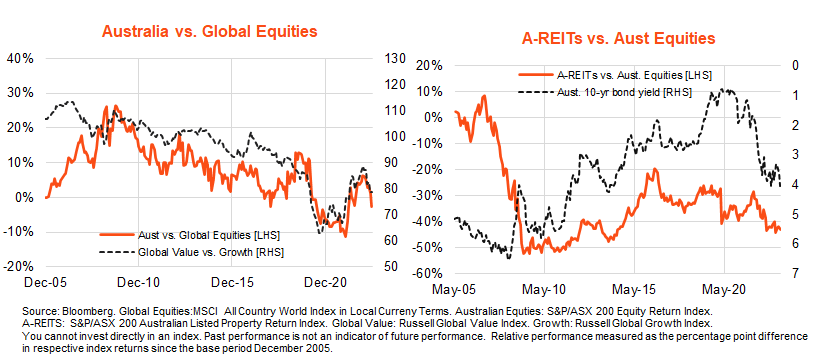

Australian equities rebounded by 1.8% in June, which represented further underperformance relative to global equities. While recent underperformance has broadly reflected relative strength in global technology/growth exposures compared to resources, gains across most local sectors were also likely held back in June due to heightened concerns over further aggressive RBA policy tightening.

Rising bond yields also continue to dampen listed property returns which were down 0.1% in June, after a 1.8% decline in May.

Global equity themes

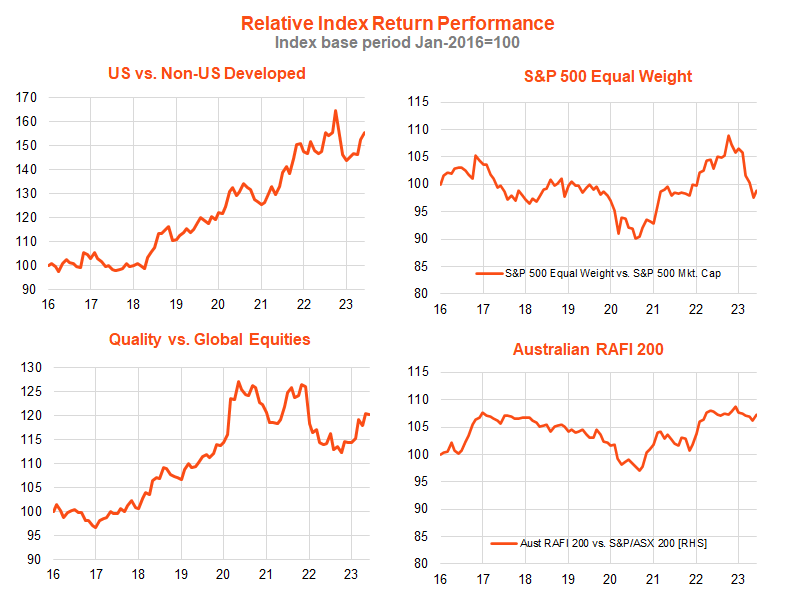

Technology/quality/US market themes have broadly tended to outperform since the global equity recovery from end-October 2022. In June, there was a modest broadening in returns, with the S&P 500 equal weight and Australia RAFI 200 indices modestly outperforming their market-cap counterparts. Global quality also had a small relative performance pullback.

Source: Bloomberg. Indices: US: S&P 500. Non-US Developed: MSCI World, ex-US. Global Equities: MSCI ACWI. Quality: iSTOXX MUTB Global Ex-Australia Quality Leaders Index AUD Hedged. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Outlook

As noted above, June was notable in that global equities withstood a further rise in bond yields.

That said, equity gains are still being driven largely by valuations rather than earnings in the hope of better times ahead. At some point, however, stretched valuations will make the market vulnerable to a correction if the anticipated recovery in earnings fails to appear relatively soon. The market will be even more vulnerable if core inflation/wage growth remains sticky and central banks step up their efforts to ensure a decent slowing in global economic growth.

In some respects, equity markets appear to be enjoying a ‘melt up’ as seen from late 2020 when investors at the time – correctly in hindsight – anticipated only a short COVID-related disruption to corporate earnings. Investors today are also anticipating only a short disruption to earnings and eventually lower bond yields – on the view that global inflation will fall sufficiently quickly that central banks can pivot in time to avoid a global recession. This is the so-called ‘immaculate disinflation’ scenario.

We remain in a state of flux. While some US indicators – such as weakness in manufacturing and very inverted yield curves – point to impending recession, underlying consumer spending and employment demand remain robust. And while underlying price and wage inflation are easing, they remain uncomfortably high.

My base case still errs towards stubbornly high US wage and price inflation and so an eventual US recession – caused by a tightening in lending conditions and/or aggressive further Fed rate hikes. Indeed, history suggests it should be hard to get US inflation sustainably lower without a material weakening in the still very tight labour market.

The resilience of the US economy and the degree of monetary tightening required to get this hard landing, however, will determine whether we need to go through a ‘no landing’ scenario before we get there.

Further information on the complete range of Betashares exchange traded products can be found here.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.