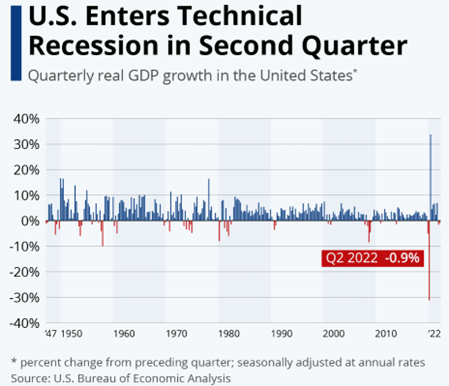

With the number of active online investors in Australia having almost doubled from around 750,000 since the beginning of COVID1, I thought it’d be useful to provide newer investors an overview on a topic that is getting a bit of airtime recently – recessions. In fact, the US entered a technical recession only last month, despite the Fed Chairman Jerome Powell recently stating that “I do not think the US is currently in a recession.”2 David Bassanese forecast this recession back in June for those who missed it. 3

Source: https://www.statista.com/chart/22426/long-term-gdp-growth-in-the-united-states/

What is a recession and why does GDP (gross domestic product) matter?

The RBA defines a recession as “a sustained period of weak or negative growth in real GDP (output) that is accompanied by a significant rise in the unemployment rate.”4 Recessions are a common feature of the economic landscape and have generally occurred every 7-10 years, usually due to the economic imbalances of the preceding expansionary cycle.

GDP is widely used to measure the health of an economy and essentially measures the total volume of all the finished goods and services produced within a country’s borders in a specific period. When GDP is growing, workers and businesses are generally better off than when it is not.

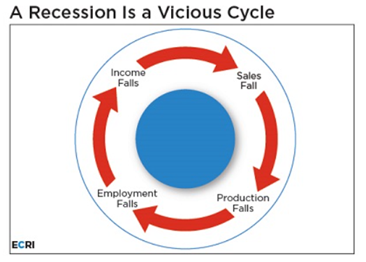

Therefore, when GDP is falling, as it has now been for two consecutive quarters in the US, consumer confidence tends to be lower, resulting in lower household spending and in turn, lower hiring and investment intentions from businesses. Why would a business look to expand into new geographic regions, new product lines, and ramp up marketing and other expansionary activities when their customers are looking to spend less due to concerns about their levels of wealth and employment?

As a result, company profits tend to decline, which can result in lower share prices and investors feeling less ‘wealthy’. This ‘wealth effect’ further dampens consumer sentiment and spending, deepening the slow-down in the economy.

Technical recessions

The most widely used definition of a recession in the media is a ‘technical recession’, which is when a country records two quarters of negative GDP growth.5

Going by this definition, Australia holds the record in the developed world for the longest uninterrupted growth (recession-free) streak of 29 years, which ended in June 2020.6

Recessions as defined by the NBER

The National Bureau of Economic Research (NBER) in the US takes a different approach to defining recessions. Officially, the NBER defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”7

While the NBER agrees that most recessions will have two consecutive quarters of negative growth in real GDP, this will not always be so. NBER also considers indicators including unemployment figures, industrial production and retail sales, due to what can sometimes be conflicting signals that can arise from the different approaches to measuring GDP.8

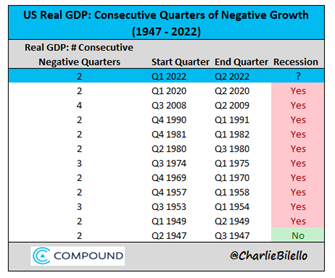

However, judgements made by NBER about whether the US has recorded a recession are not usually arrived at quickly, so it may still be some time before we learn whether the US is ‘officially’ in recession according to their measure. Despite the two quarters of negative GDP growth, the US unemployment rate is at record lows9 (though initial jobless claims are at their highest this year10), and consumer spending while slowing, was still growing11. In saying that, the last 10 times the US had two or more consecutive quarters of negative GDP growth, the economy was in a recession. You have to go back to 1947 to find an exception:

Source: https://compoundadvisors.com/2022/9-chart-friday-7-29-22

Are we in recession? (And what to look for)

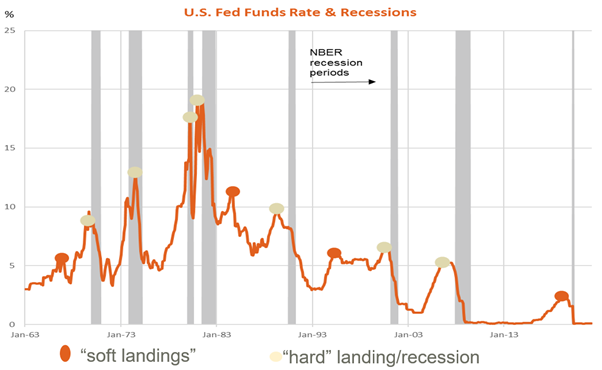

We’re currently seeing high levels of inflation globally, and central banks are trying to combat this fast economic growth with higher interest rates to slow the economy down. Central banks will be trying their best to do this without causing a recession. Higher interest rates mean borrowing costs rise, causing more indebted consumers and businesses to slow their spending.

As discussed earlier in the year, the Betashares Global Quality ETF (QLTY) may be well positioned for such environments. QLTY’s portfolio currently boasts a net-debt-to-equity ratio of 14.58%, compared with the MSCI All Countries World Index with 124.44%.12

Historically, most interest rate hiking cycles have led to recession, as we can see from the example in the US below.

Source: Refinitiv Datastream, BetaShares

The US recently slipped into a ‘technical recession’ after recording GDP growth of -0.9% in the June quarter, and -1.6% in the March quarter.

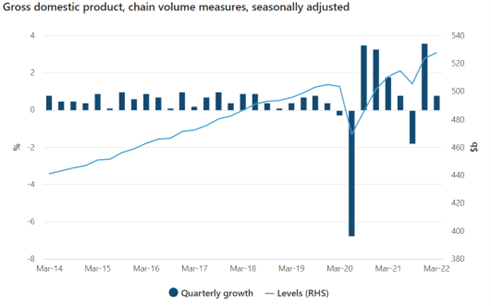

Australia on the other hand, has had two strong quarters or growth as seen below and is not currently in a ‘technical recession’:

The impact on markets

The average bear market decline during a US recession historically has been around 35%, with the declines during the Global Financial Crisis and Dotcom Crash closer to 50%. The S&P 500 price-to-forward earnings ratio is currently 17.5 times13, which is still above its long-run average of around 15 to 16 times. A decline closer to previous recession lows of 10 to 14 seems likely, according to our Chief Economist, David Bassanese.14

“Wall Street does not yet seem priced for recession, and there seems scope for equity markets to fall further,” Bassanese says. His base case is that “the ultimate peak-to-trough decline in the S&P 500 will be 35%, implying a decline to 3,100 from its closing peak of 4,796 on 3 January” – this implies a further 25% decline.15

This might sound scary, and certainly nobody likes to see red in their investment portfolio on a regular basis. However, we have compiled plenty of valuable resources for investors to help navigate these tricky times and hopefully help to grow their wealth when we make it to the other side:

| There are risks associated with investing in QLTY, including market risk, index methodology rishttps://www.betashares.com.au/education/long-term-investing-market-volatility/k, international investment risk, concentration risk and currency risk. For more information on the risks and other features of QLTY, please see the Product Disclosure Statement available at www.betashares.com.au. A Target Market Determination is also available at www.betashares.com.au/target-market-determinations. |

1. “Highlights from the 2021 First Half Australia Trading Behaviour Survey.” Investment Trends, Investment Trends Pty Limited, https://investmenttrends.com/wp-content/uploads/2021/08/2021-1H-Australia-Online-Investing-Respondent-Pack-2.pdf. Accessed 7 Aug. 2022.

2. https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220727.pdf

3. Bassanese, David. “US Recession Now Likely within next 12 Months.” BetaShares, 16 June 2022, https://www.betashares.com.au/insights/us-recession-now-likely-within-next-12-months.

4. “Recession | Explainer | Education.” Reserve Bank of Australia, https://www.rba.gov.au/education/resources/explainers/recession.html. Accessed 7 Aug. 2022.

5. https://www.rba.gov.au/education/resources/explainers/recession.html

6. https://www.bloomberg.com/news/articles/2020-06-03/australia-economy-contracts-as-end-to-recession-free-run-looms#xj4y7vzkg

7. https://www.nber.org/business-cycle-dating-procedure-frequently-asked-questions

8. https://www.nber.org/business-cycle-dating-procedure-frequently-asked-questions

9. https://tradingeconomics.com/united-states/unemployment-rate

10. https://tradingeconomics.com/united-states/jobless-claims

11. https://tradingeconomics.com/united-states/consumer-spending

12. Source: Bloomberg, BetaShares. As at 8 August 2022.

13. Source: Bloomberg, BetaShares. As at 8 August 2022.

14. https://www.betashares.com.au/insights/us-recession-now-likely-within-next-12-months/

15. Based on 5 August 2022 closing price of 4,145.19. Source: Bloomberg.

Written by

Jeremy Benson

1 comment on this

Insightful analysis! Your examination of whether we’re in a recession is thorough and enlightening. Thanks for providing clarity on such a complex topic. Keep up the great work!