Betashares Australian Bank Senior Floating Rate Bond ETF (ASX: QPON) is offering an all-in-yield of 4.88% p.a. (as of 18 May 2023). QPON invests in some of the largest and most liquid senior floating rate bonds issued by Australian banks, providing a high-quality exposure at the top of the Australian bank capital structure. Floating rate notes have historically been difficult for investors to access directly. The ETF structure enables investors to gain exposure via the ASX with T+2 liquidity.

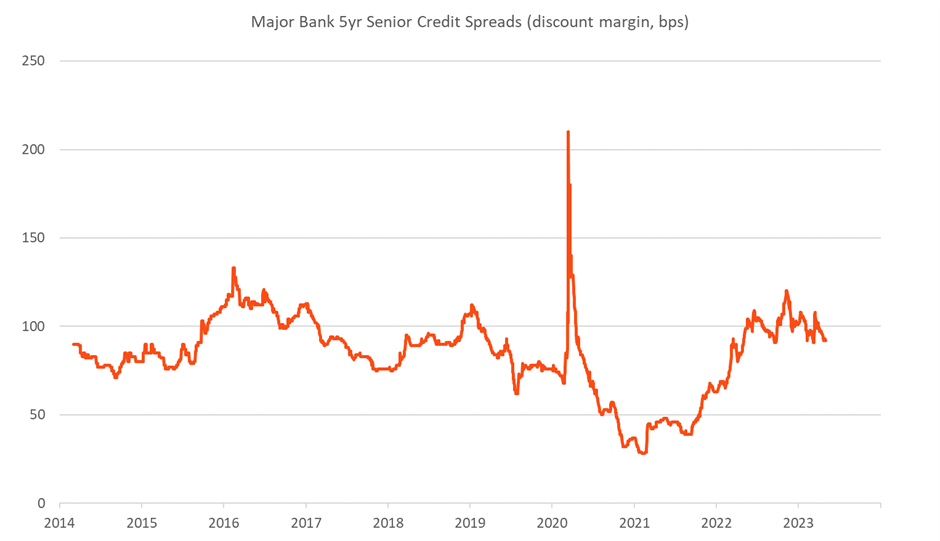

Senior bank FRN spreads are currently trading at the wider end of their historical range, on top of elevated base rates (BBSW), meaning QPON is currently offering an attractive yield. Additionally, the RBA’s surprise hike in May reminded many of the risk that the hiking cycle might not be done. With such uncertainty present, QPON represents a compelling option for income that has tended to be more insulated from rate hikes (or expectations of rate hikes) than fixed rate bonds, without stepping further out on the risk curve.

Source: Westpac, Betashares. Data as at 1 May 2023. Past performance Is not indicative of future performance.

Since its inception in June 2017, QPON has offered attractive returns over cash with significantly less volatility and lower drawdowns than fixed rate bonds, making it an attractive option for both conservative investors and those looking to enhance returns over cash from their defensive assets.

Chart 1: QPON vs Bloomberg AusBond Bank Bill Index and Bloomberg AusBond Composite 0+ Year Index performance since QPON inception (1 June 2017)

Source: Bloomberg. Past performance is not indicative of future performance of any index or ETF. You cannot invest directly in an index. QPON performance is shown after fees and costs.

For more details on QPON, visit the fund page here.

-

QPON

Australian Bank Senior Floating Rate Bond ETF

There are risks associated with an investment in QPON, including interest rate risk, credit risk, bank sector risk and market risk. An investment in QPON should only be considered as a part of a broader portfolio, taking into account the investor’s particular circumstances, including their tolerance for risk. For more information on risks and other features of QPON, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from Tom.