Australian investors have long understood the many benefits of investing in ETFs. Research commissioned by Betashares in 20221 showed that the top four reasons investors chose ETFs were:

- Diversification,

- Saves time from choosing individual stocks,

- Providing a good portfolio core,

- Getting exposure to specific overseas markets.

This week, Betashares launched the BGBL Global Shares ETF . BGBL offers investors access to a broadly diversified global portfolio with management costs of just 0.08% p.a.2, all available via a single trade on the ASX.

BGBL aims to track the Solactive GBS Developed Markets ex Australia Large & Mid Cap Index (before fees and expenses). This index includes approximately 1,500 shares from 23 countries globally (ex-Australia), encompassing the majority of the developed world’s investible equity universe. This makes it a compelling candidate for a core portfolio allocation to global equities.

Active or passive management for global shares?

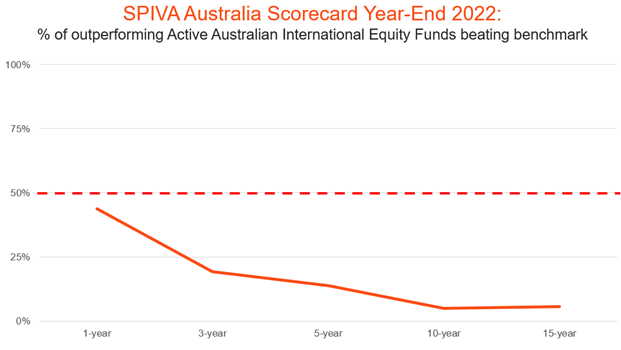

For 20 years S&P Dow Jones Indices have been reporting on the performance of active managers (those who attempt to use stock picking or market timing to exceed the performance of a benchmark) against passive benchmarks. The data allows us to evaluate active manager outperformance over the benchmark each year, as well as how many managers have generated persistent outperformance over longer timeframes.

Claims that increasing interest rates and heightened economic uncertainty would lead to active manager outperformance in 2022 appear to have been misplaced. Last year only 44% of Australian active managers in the international equities category outperformed the benchmark. The proportion of active funds outperforming over 5- and 10-year periods shrank to 14% and 5%, respectively.

Source: S&P Dow Jones Indicies SPIVA Australia Scorecard Year-End 2022. Past performance is not an indicator of future performance.

Over the past decade we have seen a significant flow in funds under management (FUM) from Australian actively managed global equity funds to passive alternatives. In 2013, 75% of FUM was held by active managers with just 25% in passive funds. By the end of 2022 this had shifted to 56% and 44% respectively3. This is likely attributable, at least in part, to performance and fees.

Why fees matter

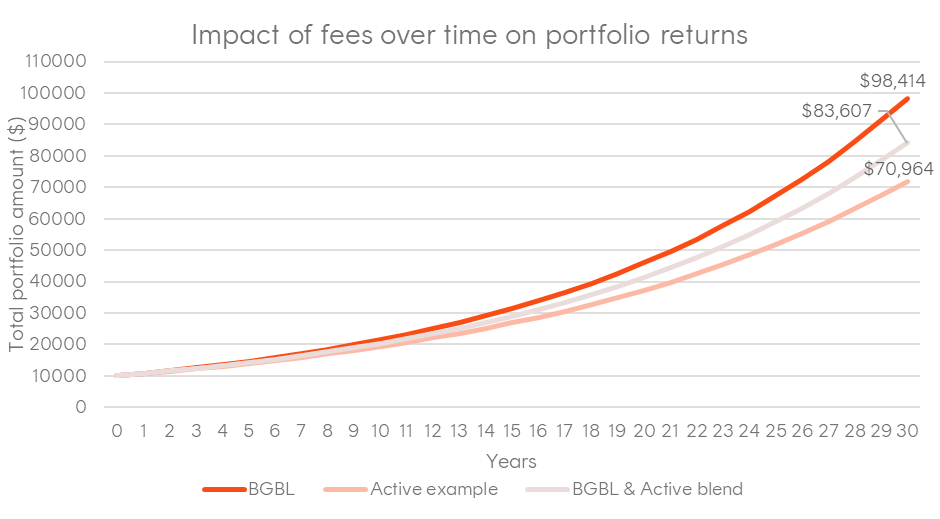

Fees like returns, compound over time and can meaningfully impact portfolio returns. Larger fees, including performance fees, can make it difficult for active managers to outperform the index (after fees) over time.

A simple example shows just how significant this impact can be.

Source: Betashares. Illustrative only, using certain assumptions. Actual results may differ.

Assume an initial investment of $10,000 returning 8% p.a. pre-fee over a 30-year time horizon, a passive fund fee of 0.08% p.a., and an active fund fee of 1.20% p.a. (based on the average Australian broad market international active manager ). Over a 30-year period the passive fund would grow to $98,414 compared to just $70,964 for the active fund; a 39% difference.

Alternatively, blending the passive fund into an existing portfolio of active funds, with the same average management fee of 1.20% p.a., could also have a material impact. A 50/50 blend would result in an end portfolio value of $83,607, 18% above the active only portfolio, and an all-in fee reduction from 1.20% to 0.64% p.a.

Given the difficulty in choosing active managers who outperform passive benchmarks, and the impact of fees, we believe low-cost ETFs like BGBL are worth consideration for long-term portfolio allocations.

Where can BGBL fit in a portfolio?

BGBL is designed to be a cost-effective core allocation for the international equities portion of a portfolio. Its benefits may include:

- Lowering all-in fees: Implementing with BGBL can reduce ongoing fees in a portfolio.

- International exposure: BGBL’s Index invests in around 1,500 companies from 23 developed markets (ex-Australia), making it suitable as a core international equities building block.

- Diversification: BGBL’s Index is broadly diversified across global developed market stocks and sectors. BGBL’s Index sector profile can benefit Australian portfolios that are tend to be concentrated in financials and resources sectors.

Buy ETFs effortlessly with Betashares Direct

Betashares Direct is the new investing platform designed to help you build wealth, your way. Access BGBL Global Shares ETF through Betashares Direct, along with the 340+ other ETFs that trade on the ASX. Register for early access to Betashares Direct here:

-

BGBL

Global Shares ETF

There are risks associated with BGBL, including market risk, international investment risk, and country risk. Investment value can go up and down. An investment in the funds should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks please see the Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

References:

1. 2022 Betashares/Investment Trends ETF Investor and Adviser Report. Research conducted June to August 2022.

2. Other costs, such as transaction costs, may apply. Refer to the PDS for more information.

3. Source: Morningstar Direct. Universe includes Morningstar Categories: Australia Fund Equity World Large Blend, Large Growth, Large Value, Long Short, Mid/Small and Other. Data point used is “Net Assets – Share Class (monthly)” for December of each year.

4. Source Morningstar Direct. Includes Morningstar Cateogry: Australian Fund Equity Large Blend, Large Growth, Large Value. As at 4th May 2023.

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from .