David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

6 minutes reading time

- Digital assets

Bitcoin and the rest of the crypto market lost over three weeks of gains as prices dropped, and bitcoin hit its lowest price since July 27th. Contributing to the downside, the Federal Reserve released minutes from its July meeting in which it said it would continue to hike interest rates in order to tame inflation. Both BTC and ETH fell after the announcement and failed to recover back to those levels for the rest of the week.

At the time of writing, bitcoin is trading at US$21,362. Ethereum performed worse for the week, down -19.97% vs bitcoin’s -13.66% loss.

Bitcoin’s market cap is down to US$409.8B, with the total crypto market falling to $1.02T. Bitcoin’s market dominance is up slightly to 40.11%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $21,426 | $25,135 | $20.856 | -13.66% |

| ETH (in US$) | $1,608 | $2.007 | $1,534 | -19.97% |

Source: CoinMarketCap. As at 21 August 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Five crypto companies sent cease and desist letters

The Federal Deposit Insurance Corporation (FDIC) sent five crypto companies cease and desist letters for allegedly making false or misleading statements regarding their relationship with the FDIC. The five companies involved are FTX US, Cryptonews.com, Cryptosec.info, Smartasset.com, and FDICCrypto.com. The companies which received letters had said that certain cryptocurrency related products or services they offered were FDIC-insured, according to the FDIC.1 The agency is responsible for insuring deposits for FDIC-insured banks and savings associations across the US.

Crypto second most popular investment among Australians

A recent survey by SEC Newgate Research (in close consultation with ASIC) revealed that about 44 percent of retail investors hold crypto and this has ASIC concerned. Crypto was second only to shares which were held by 73 percent of respondents. The concern stems from fears that Australian investors may not understand the high levels of risk when investing in cryptocurrencies. Only 20 percent of crypto investors viewed it as risky. The survey of 1,053 retail investors was conducted last November.

ASIC chair Joe Longo said “We are concerned about the number of people surveyed who reported investing in unregulated, volatile crypto-asset products. This research does highlight during this particular point in time, the appeal of crypto-assets to the market.”

After Australian shares and crypto, the next most popular investments were international shares (31 percent), ETFs (28 percent), gold or silver (21 percent), residential investment properties (20 percent) and term deposits (17 percent).2

Altcoin buys limited to CA$30,000

Two Canada-based crypto exchanges in Ontario; Bitbuy and Newton, have imposed a new rule implementing a CA$30,000 annual limit on altcoin purchases. Traders based in Ontario (and possibly other provinces) on these exchanges will be limited to CA$30,000 net buys on all coins excluding Bitcoin (BTC), Bitcoin Cash (BCH), Ether (ETH), and Litecoin (LTC). The limit will then reset every 12 months from the initial purchase of restricted coins.

Newton explained in a post that “These changes are to protect crypto investors, like yourself, and to make sure investors are aware of the risks associated with investing in crypto assets.” Being a “restricted dealer” in the province meant they are subject to the regulations set out by the Ontario Securities Commission (OSC).3

On-chain metrics

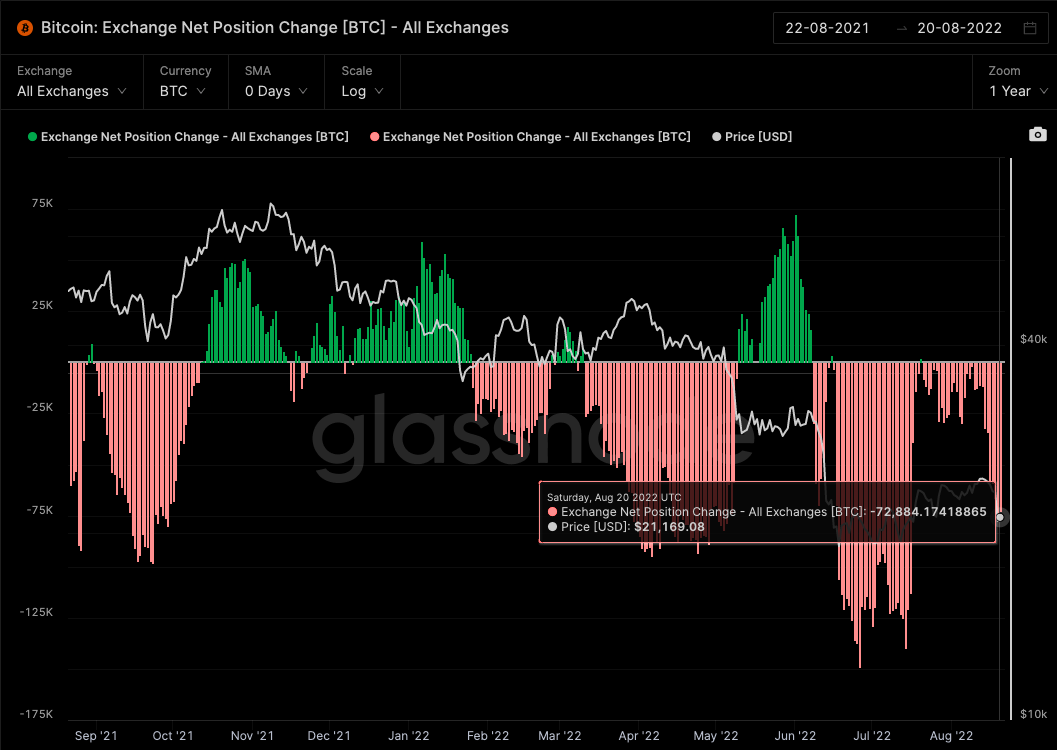

Bitcoin (BTC): Exchange Net Position Change – All Exchanges

Exchange Net Position Change shows the 30 day change held in all exchange wallets. Historically, exchange outflows may be considered bullish as investors take coins off the exchange with the intention of “HODLing”, while inflows on to exchange may be seen as bearish as investors may be preparing to sell their coins.

Looking at data from on-chain analytics company Glassnode, BTC exchange balances have been in continuous net outflow position (other than two very small blips), since June 8th. BTC rebounded 40% since the lows of the year before pulling back, and according to the data, investors appear happy to continue to accumulate and hold.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Liveliness

As per Glassnode: “Liveliness is defined as the ratio of the sum of Coin Days destroyed and the sum of all Coin Days ever created. Liveliness increases as long term holders liquidate positions and decreases while they accumulate to HODL.” According to the creator of this metric, Tama Blummer, “Liveliness can give insight to shifts in HODLing behaviour.” Liveliness is measured between a score of 0 and 1. Liveliness increases and decreases with the amount of selling with 1 representing all coins moving within a single block and 0 for a blockchain that has not had a transaction other than issuance.

Looking at the data on Glassnode, BTC “liveliness” is at 0.61 which is the lowest since 2021, hitting 19 month lows. Coupled with exchanges being in net outflows, it appears from the data that there is a strong desire to hold amongst investors.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, the value of sports tokens which cater to sports fans surged this past week. Sports tokens or fan tokens enable sports teams, clubs, organisations and players to strengthen fan engagement. Driving prices higher was regulatory approval for Socios.com to operate in Italy. The fan tokens market cap which sits at approximately $440 million, is up almost 100% from last month according to FanMarketCap data. The regulatory approval allows Socios to offer virtual currencies and digital wallets for its fan engagement and rewards platform.4

There are fan tokens for a number of football clubs across Europe such as Juventus and Paris Saint-Germain. A token called Chiliz is the fansite platform’s main currency. All were higher follow the news of the Socios.com approval.

According to the Socios website, “fan tokens are finite digital assets built on the Chiliz Chain. Holding fan tokens gives you the right to vote on official team polls that help your team make fan-related decisions. Token holders also benefit from a host of amazing perks, exclusive promotions, rewards, VIP experiences and engage with a community of like-minded super fans.”5

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

Off the Chain will be published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.