For income-focused investors, yield has been elusive in recent years. Low interest rates globally meant that fixed income yields were reduced, which flowed on to other asset classes, creating the phenomenon that came to be known as the ‘search for yield’.

But this dynamic has changed over the last year as higher rates improved yields across many asset classes. Much of the attention has been on fixed income, but income-focused equity strategies can offer high yields, diversification benefits, and in some cases, franking credits.

A brief primer on covered calls

Betashares’ range of Yield Maximiser funds use a ‘covered call’ strategy to offer additional income over and above dividends generated by the portfolio. Understanding why these strategies may be well placed in the current market first requires an understanding of how they work. This video explains the concept:

The key points are:

- A covered call strategy ‘caps’ the upside potential of an equity investment.

- In exchange for this, you receive additional income through selling options (on top of the dividends paid by the underlying portfolio).

- The strategy is best suited to neutral (or sideways trading) markets to gradually rising markets. However, it would usually be expected to underperform an equivalent portfolio without the covered call strategy during a strongly rising market.

- A covered call strategy may also help reduce portfolio volatility.

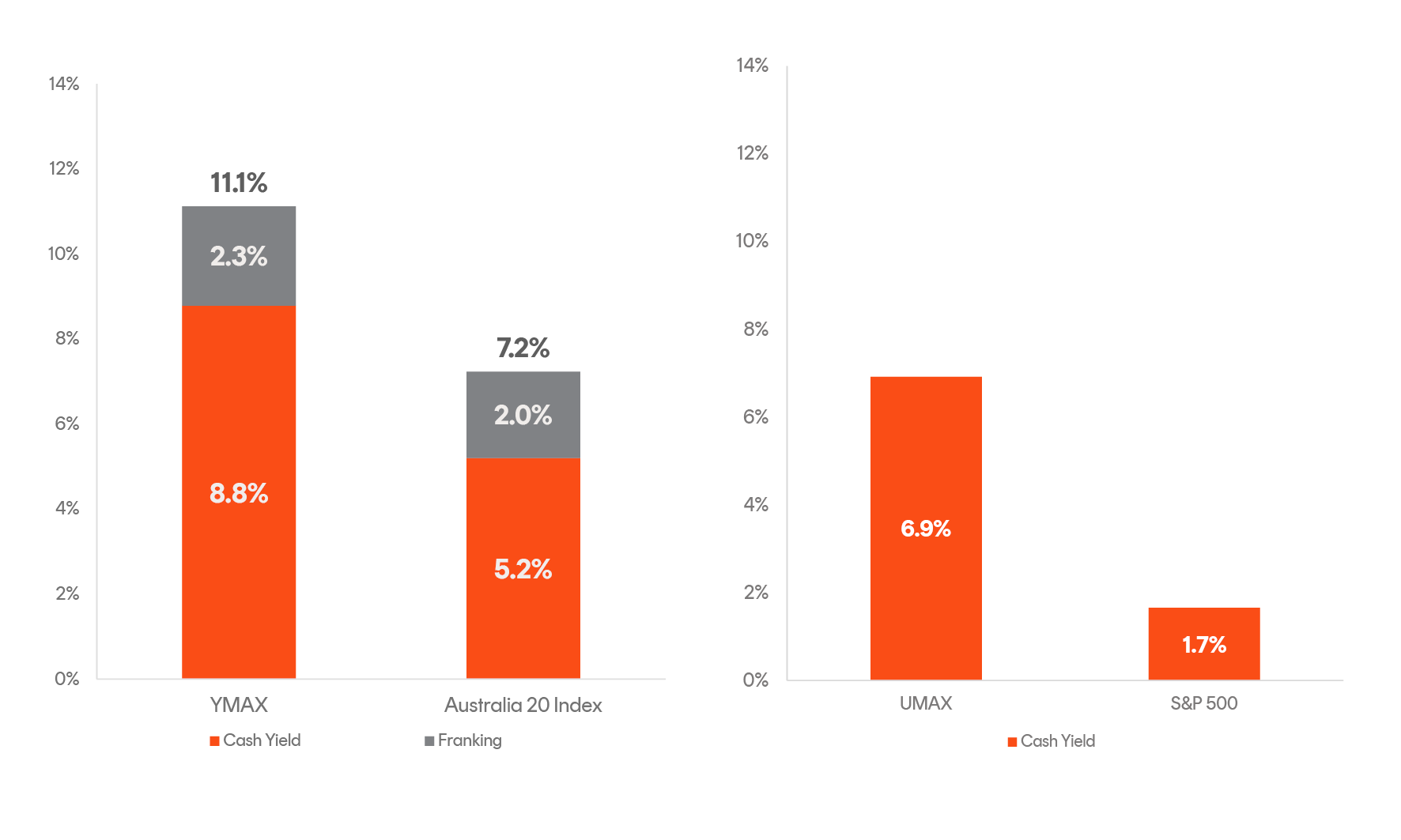

The charts below show the additional income that YMAX and UMAX have produced compared to their respective benchmarks for the 12 months ending 30 April 2023. Source: Bloomberg, Betashares. As at 30 April 2023. Fund yield figures are calculated by summing the prior 12-month per unit distributions divided by the closing NAV per unit at the end of the relevant period. Franking level is total franking level over the last 12 months. Not all Australian investors will be able to receive the full value of franking credits. Yield may be lower at time of investment. Past performance is not an indicator of future performance of any index or fund.

Source: Bloomberg, Betashares. As at 30 April 2023. Fund yield figures are calculated by summing the prior 12-month per unit distributions divided by the closing NAV per unit at the end of the relevant period. Franking level is total franking level over the last 12 months. Not all Australian investors will be able to receive the full value of franking credits. Yield may be lower at time of investment. Past performance is not an indicator of future performance of any index or fund.

There’s one other detail to understand that isn’t covered in the video. All else being equal, option prices increases when the expected volatility of the underlying shares increases. As a covered call strategy produces income by selling options, higher expected volatility in equity markets can mean higher income from selling options.

Options pricing can be difficult to understand – for more detailed coverage, please refer to our Betashares Yield Maximiser Funds brochure.

Why current market conditions are relevant

If you’ve been watching financial markets over the last year or so, you might’ve noticed a couple of relevant points in the section above. Firstly, that neutral or gradually rising markets are usually best for the performance of this strategy. Secondly, that higher expected volatility increases the income from writing (selling) call options. These have been two of the defining features of equity markets since the beginning of last year.

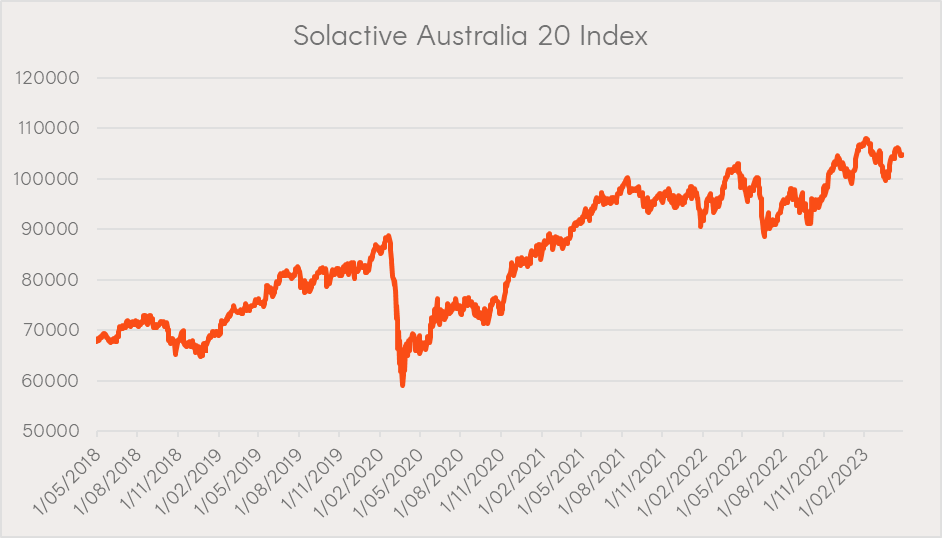

The chart below shows the 5-year performance (to 30 April 2023) of the Solactive Australia 20 Index, which tracks the 20 largest companies listed on the ASX – the same companies held in Betashares Equity Yield Maximiser Fund (managed fund) (YMAX) and in respect of which it writes call options over (noting, however, that YMAX does not aim to track an index).

Prior to late-2021, the market generally moved higher, with the exception of early 2020, which saw a sharp fall. These conditions tended not to be conducive for a covered call strategy as the cap on returns was frequently reached (due to share prices moving above the strike prices for the call options), while conversely the sharp fall in share prices was not sufficiently offset by the income earned by selling the options.

Source: Bloomberg, Betashares. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

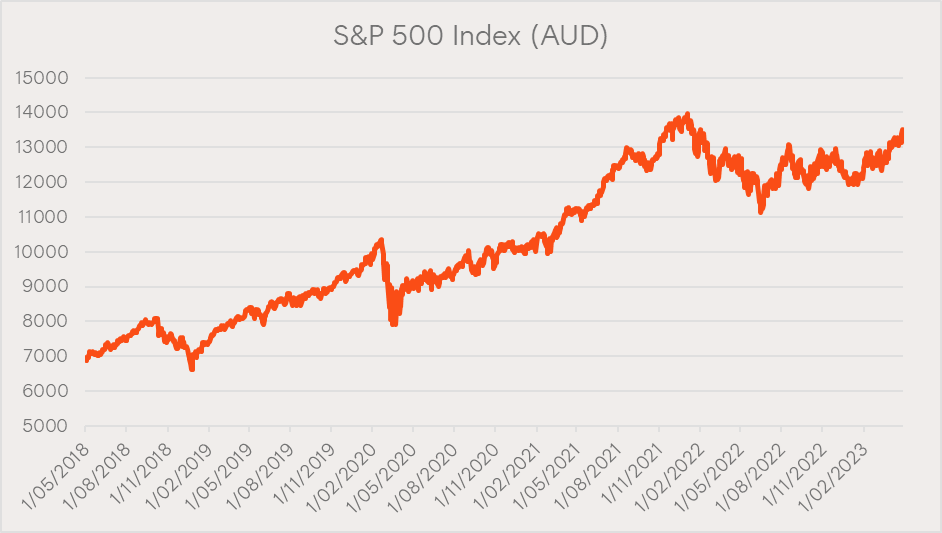

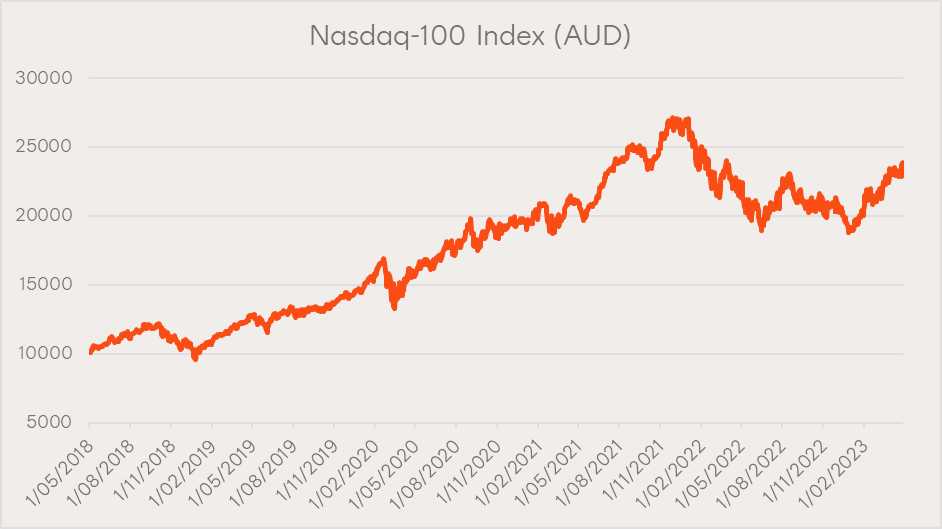

Similar stories can be seen in the below charts showing the 5- year performance (to 30 April 2023) of the S&P 500 Index, which represents the portfolio of stocks held by Betashares S&P 500 Yield Maximiser Fund (managed fund) (UMAX) (and which it writes options over), and the Nasdaq-100, which represents the portfolio of stocks held by Betashares NASDAQ 100 Yield Maximiser Fund (managed fund) (QMAX) (and which it writes options over). Neither UMAX nor QMAX aims to track any index.

Source: Bloomberg, Betashares. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.</small?

Source: Bloomberg, Betashares. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

Since late 2021 though, the sideways-trading and volatility shown above has created better conditions for covered call strategies.

What the future might hold

During the 2010-2021 market rally, the Reserve Bank of Australia and US Federal Reserve regularly lowered interest rates and purchased government bonds when faced with market volatility. This helped to support asset prices, meaning any increase in volatility was generally short-lived. It also created a mentality of ‘buy the dip’.

By contrast, central banks since then have had a clear bias towards tightening financial conditions. This means that as long as inflation remains elevated, they could be expected to increase rates and reduce their bond holdings as long as markets and the economy remain relatively benign. This appears to be creating a mentality of ‘sell the rally’.

This dynamic could mean heightened volatility and a sideways-trading market is here to stay , at least as long as global central banks maintain a tightening bias. Such conditions could be beneficial for the performance of covered call strategies, like those employed by the Betashares Yield Maximiser Funds.

QMAX Nasdaq 100 Yield Maximiser Fund (managed fund) aims to provide regular income along with exposure to a portfolio of the top 100 companies listed on the Nasdaq stock market. In addition, the Fund aims to provide lower overall volatility than the underlying Nasdaq-100 Index.

YMAX Australian Top 20 Equity Yield Maximiser Fund (managed fund) aims to generate attractive quarterly income and reduce the volatility of portfolio returns by implementing an equity income investment strategy over a portfolio of the 20 largest blue-chip shares listed on the ASX.

UMAX S&P 500 Yield Maximiser Fund (managed fund) aims to generate attractive quarterly income and reduce the volatility of portfolio returns by implementing an equity income investment strategy over a portfolio of stocks comprising the S&P 500 Index.

-

YMAX

Australian Top 20 Equity Yield Maximiser Fund (managed fund)

-

QMAX

Nasdaq 100 Yield Maximiser Fund (managed fund)

-

UMAX

S&P 500 Yield Maximiser Fund (managed fund)

There are risks associated with an investment in the Funds, including market risk, use of options risk, sector concentration risk and in the case of UMAX and QMAX, currency risk. Investment value can go up and down and returns are not guaranteed. An investment in the Funds should only be considered as part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the Product Disclosure Statement (PDS) and the Target Market Determination (TMD), available at www.betashares.com.au.

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.