This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

Investors are generally familiar with the benefits that broad market passive ETFs offer; low cost, improved diversification, ease of access to buy and sell, transparency of the strategy and holdings, and tax efficiencies due to lower turnover and from the streaming of capital gains to authorised participants to name a few. These attributes make ETFs particularly suitable for the core of investors’ portfolios where the bulk of assets sit acting as an anchor to the whole portfolio.

However, the pursuit of alpha, the excess returns earned on an investment above the benchmark when adjusted for risk, often leads investors to look beyond broad market indices. Traditionally, strategies seeking to provide investment alpha have been accessed through active managers. Unfortunately, using active managers can mean forgoing some of the advantages of an index or rules-based approach which are also the key principles for an investment core. Active managers typically charge higher fees eating away at invested capital, tend to generate outperformance that is transient making it hard to pick a successful manager over the long-term1, and often have higher levels of stock concentration.

Betashares Global Quality Leaders ETF (ASX: QLTY) offers investors the opportunity to access an ‘active like’ alpha generating strategy with the added benefits of being a low-cost passive ETF. By only holding companies that display “quality” characteristics that have historically generated outperformance over long-term and through the cycle, and employing a weighting strategy that seeks to enhance diversification and mitigate stock-specific risks, QLTY can be suitable as the core of investors global equities portfolio.

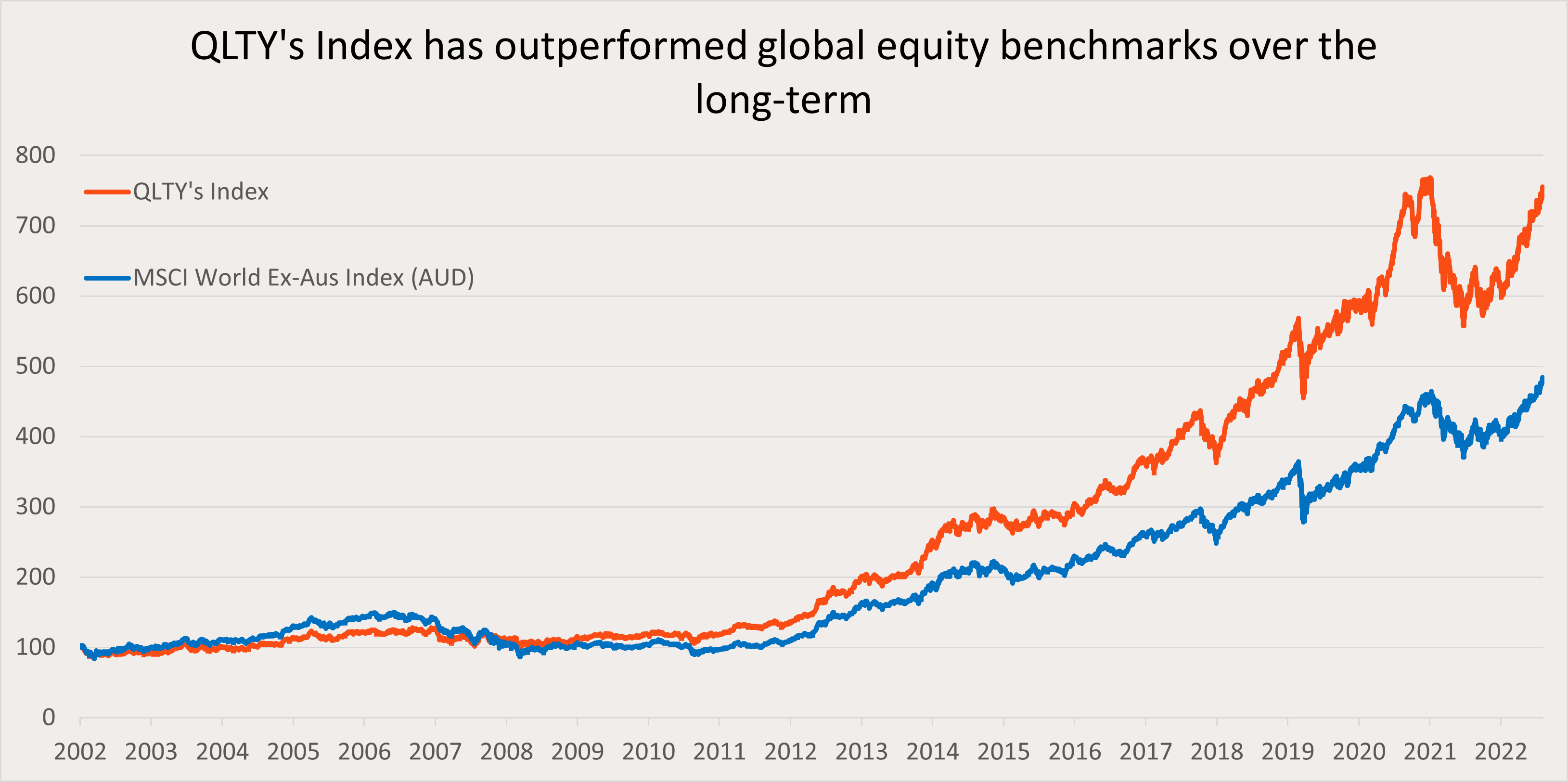

The Index QLTY aims to track (before fees and costs) has outperformed the benchmark MSCI World ex AU Index by 2.4% p.a. from Dec 2002 to July 2023.

Source: Bloomberg and Morningstar Direct. As at 31/07/2023 since common inception 27/12/2002. Currency: Australian Dollar. Past performance is not an indicator of future performance. You cannot invest directly in an index. Index performance does not include any ETF fees or costs (0.35%pa). QLTY’s inception date was 5 November 2018.

Defining Quality

For much of the past year, market commentators have worried about the outlook for equities as the potential for a slowdown and even a recession looms. Although this has not yet eventuated the reasons for these concerns seem clear:

- Profit margins coming under pressure due to companies not being able to continue to pass on higher underlying prices,

- higher financing costs as interest rates reach levels not seen in over a decade, and

- as a result, a more conservative consumer.

Under these circumstances, like businesses and consumers, investors can be expected to be more wary of the outlook and adjust their strategies accordingly. Historically, investors have turned to high quality companies during times of heightened economic stress.

Quality, like value, size, and momentum, is an investing factor; a characteristic that helps to explain the long-term risk and return performance of an asset. Factor investing is quantitative and based on observable data, such as stock prices and financial information, rather than on opinion or speculation. Academic papers and investors have a range of criteria that they believe defines a company as high quality. Chief among these are:

- High profitability and capital efficiency,

- low financial leverage, and

- high likelihood of earnings stability in the future.

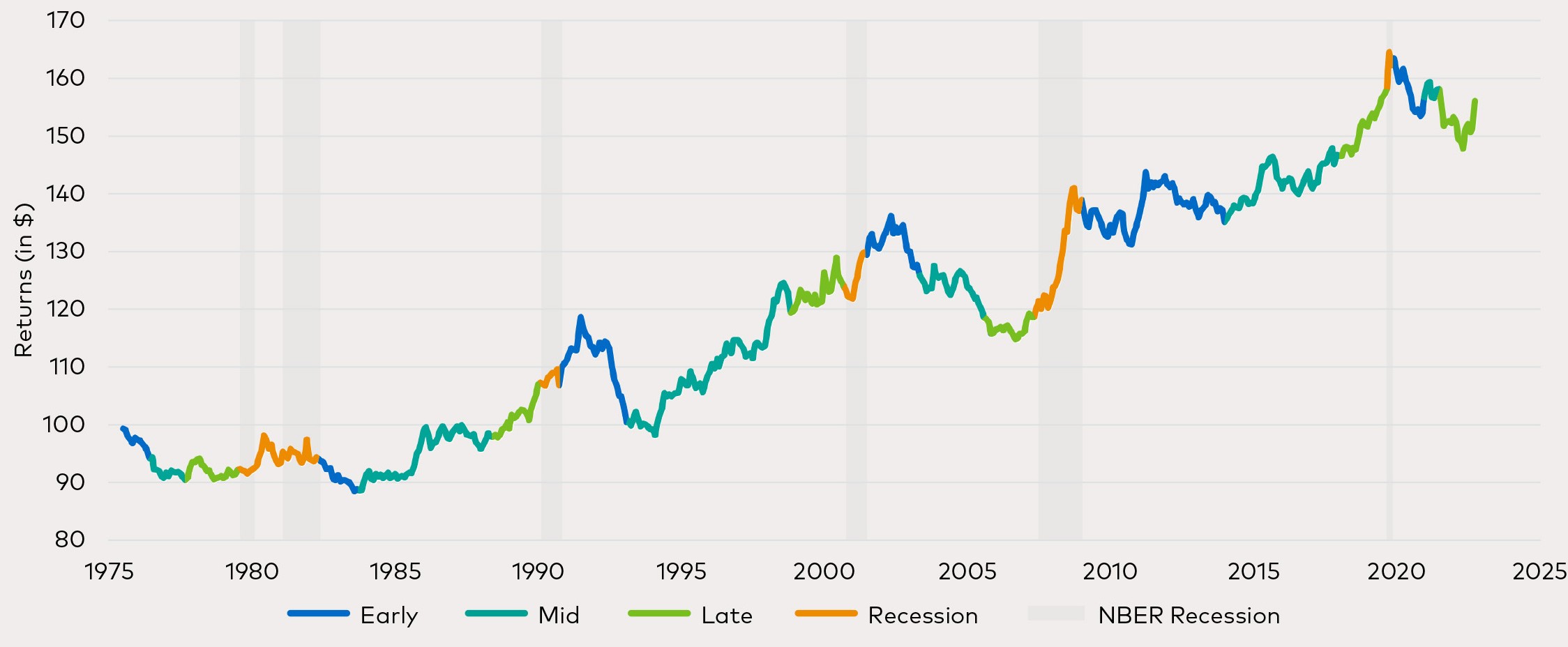

For these reasons “quality” is classified as a defensive factor with associated companies historically experiencing their strongest periods of outperformance during economic downturns. The graph below depicts this through the relative performance of a US quality index against the broader market, with the phase of the business cycle defined. The greatest relative outperformance has typically occurred during the orange recessionary periods.

Quality’s Relative Performance over the Business Cycle

Source: Polen Capital, FRED, NBER, FactSet, as of March 31, 2023. Relative performance of the MSCI USA Quality Index against the MSCI USA index. Stages of the business cycle represented by the “Output Gap”, a measure of the difference between the actual output of an economy and its potential output. Past performance is not indicative of future performance. you cannot invest directly in an index.

Active v Passive – The best of both worlds

QLTY uses an intelligent indexing solution. An intelligent index combines the benefits of active and passive investing. The strategy is more ‘active’ than a broad market benchmark as it screens a universe of companies only selecting those that meet defined criteria. However, it does so using a rules based approach, as defined by its index methodology. This allows QLTY to maintain the benefits of a low-cost passive ETF.

More specifically QLTY’s index selects companies based on four key characteristics: high return on equity, low leverage, cash flow generation ability, and earnings stability. This approach aligns with quality investing principles, with the aim of capturing enduring, highly profitable businesses and attaining superior long-term performance compared to benchmark global equity indices. Additionally, the index employs a weighting strategy that seeks to enhance diversification and mitigate stock-specific risks, applying a 2% cap on individual stock weightings.

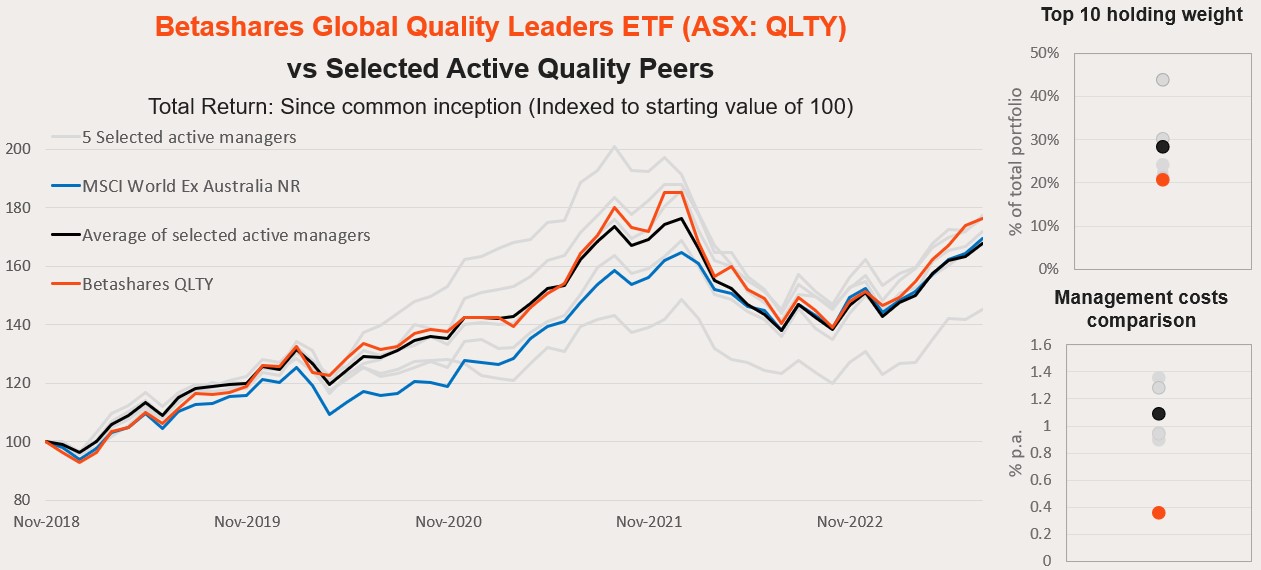

QLTY’s strategy has seen it perform in the top quartile amongst active manager peers over the long term.2

Source: Morningstar. As at 30 June 2023. Common inception date is 5 November 2018. Active Quality peers selected as funds in the top quartile for Quality factor with 5 years track record from Morningstar Australian domiciled global equity active funds in the Large Blend, Large Value, and Large Growth categories. You cannot invest directly in an index. Past performance is not indicative of future performance of any index or fund.

You can find more information on QLTY at its fund page here.

QLTY is rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.

2. Morningstar. As at 31 July 2023 QLTY has performed in the top quartile of active peers over 5yr, 10yr, and 15yr time periods. Peer group includes all active funds in Morningstar categories ‘Australia Fund Equity World Large Growth’, ‘Australia Fund Equity World Large Value’ and ‘Australia Fund Equity World Large Blend’. QLTY’s performance is a blend of live and historical index performance less QLTYs MER (0.35%pa). You cannot invest directly in an index. Past performance is not indicative of future performance.

This article mentions the following funds

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from .