This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

Betashares FTSE RAFI Australia 200 ETF (ASX: QOZ) challenges the traditional approach of market capitalisation-weighted indices by employing a “fundamental indexing” strategy. Unlike market-cap weighted indices, which link stock prices to weight, fundamental indexing aims to overcome drawbacks like potential overvaluation and mispricing.

QOZ’s index (being the FTSE RAFI Australia 200 Index) uses metrics that are independent of stock price fluctuations while maintaining the benefits of passive investing, such as diversification and a low cost. The approach selects and weights securities based on fundamentals such as sales, cash flow, dividends and book value, reflecting each company’s overall economic importance rather than market sentiment.

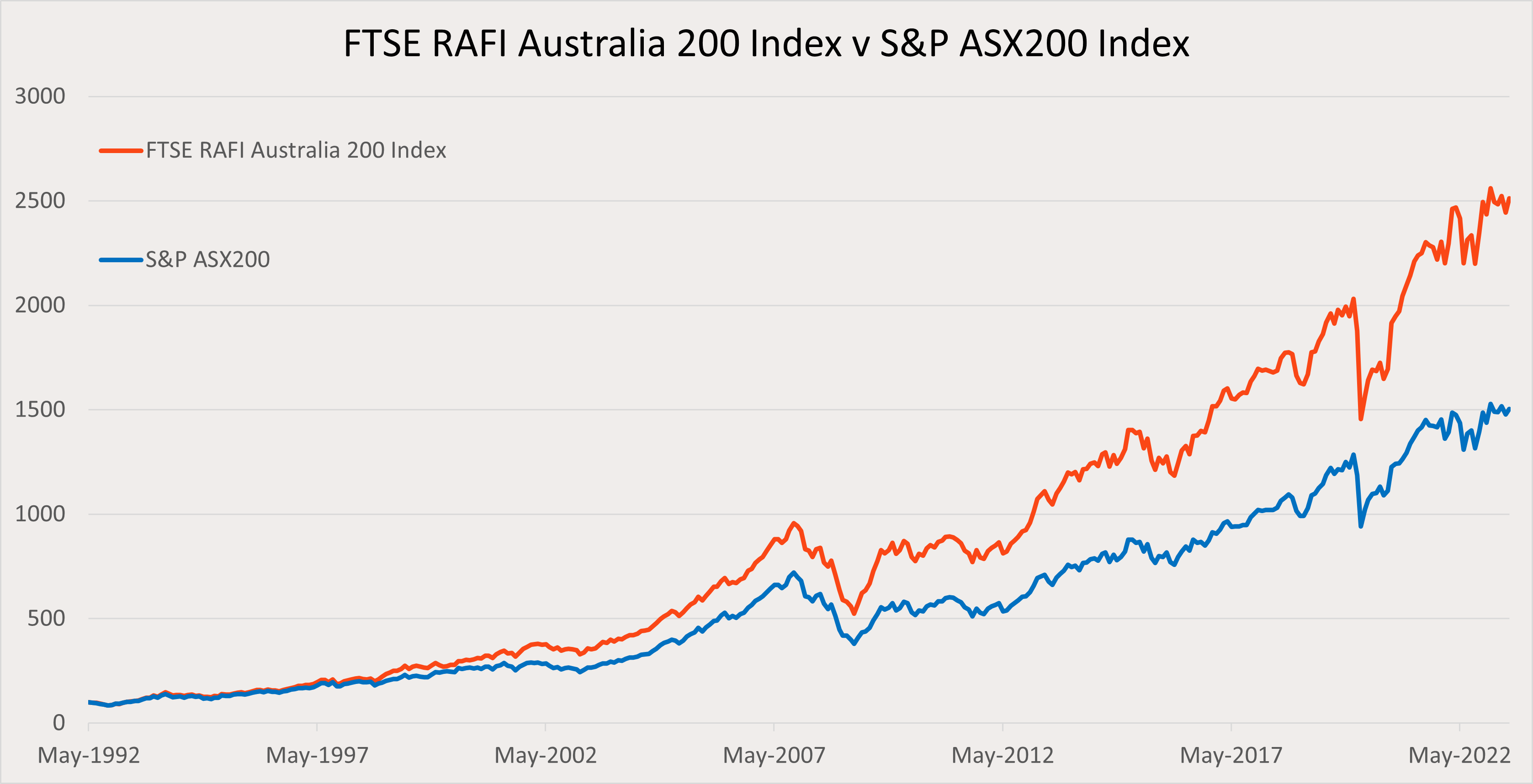

QOZ’s index has delivered excess returns over the benchmark S&P/ASX 200 Index over the long term (as shown in the graph below), by combining a targeted investing strategy and disciplined rebalancing to offer an effective ‘active-like’ alternative to traditional passive benchmarks, which may be suitable for the core of investors’ portfolios.

Source: Morningstar and Bloomberg. As at 30 June 2023. Common inception date is 29 May 1992. Shows performance of the index that Betashares FTSE RAFI Australia 200 ETF (ASX: QOZ) seeks to track, and not the ETF itself. Does not take into account QOZ’s management fee and cost (0.40% p.a.). Index returns prior to QOZ launch date are simulated based on Research Affiliates’ patented non-capitalisation weighted indexing system, method and computer program product. You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

Systematically buying low and selling high

Investors are generally familiar with the advantages of rebalancing portfolios. By re-aligning portfolios to asset allocation weights, investors may be able to better maintain diversification benefits. Further, rebalancing provides investors the opportunity to take profits on their winners, the stocks that have had the greatest price increase, and buy more of their losers, those stocks whose prices have dropped off. Traditional market capitalisation-weighted indexes tend to take the opposite approach, buying more of the best performing stocks and selling the underperformers.

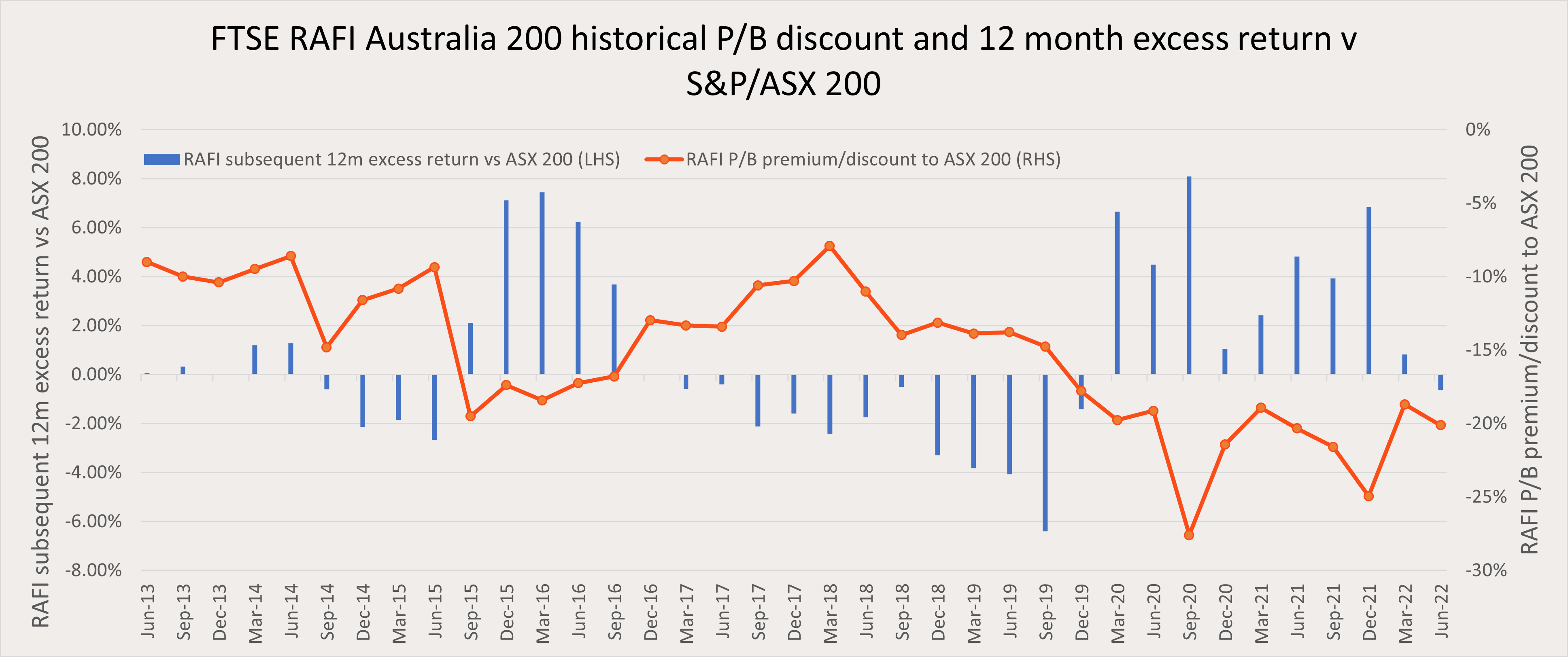

On the other hand, QOZ’s fundamentally-weighted approach aims to provide systematic benefits from a “buy low sell high” rebalancing philosophy. When stock prices move in a manner that is more volatile than underlying fundamentals, QOZ’s index will generally rebalance on a periodic basis by selling the stocks that have had the greatest price performance and have become “expensive”, aiming to taking profits, and reinvest into securities whose prices have fallen and become “undervalued”. In doing so, QOZ’s index historically has tended to hold and rebalance into less expensive stocks when compared to the S&P/ASX 200.

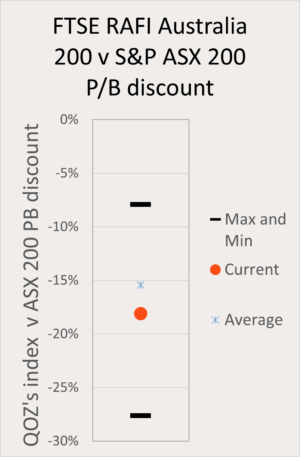

Source: Bloomberg. As at 30 June 2023. Quarterly data used is oldest available starting 28 June 2013. Shows performance of the index that Betashares FTSE RAFI Australia 200 ETF (ASX: QOZ) seeks to track, and not the ETF itself. Does not take into account QOZ’s management fee and cost (0.40% p.a.). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

Source: Bloomberg. As at 30 June 2023. Quarterly data used is oldest available starting 28 June 2013. Shows performance of the index that Betashares FTSE RAFI Australia 200 ETF (ASX: QOZ) seeks to track, and not the ETF itself. Does not take into account QOZ’s management fee and cost (0.40% p.a.). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

As indicated in the above dot plot, QOZ’s index’ price to book (P/B) discount to the S&P/ASX 200 Index as of 30 June 2023, at -18%, was below its long-term average, being -15%. Historically, this has provided an opportune entry point into the strategy as it has corresponded with the greatest forward 12-month and 3-year periods of outperformance for QOZ’s index relative to the S&P/ASX 200 .

Source: Bloomberg. As at 30 June 2023. Quarterly data used is oldest available starting 28 June 2013. Shows performance of the index that Betashares FTSE RAFI Australia 200 ETF (ASX: QOZ) seeks to track, and not the ETF itself. Does not take into account QOZ’s management fee and cost (0.40% p.a.). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

QOZ’s approach may appeal to investors who are seeking the benefits of a more ‘thoughtful’ approach to index weighting and taking advantage of potential market mispricing.

You can find more information on QOZ at its fund page here.

QOZ is rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.

-

QOZ

FTSE RAFI Australia 200 ETF

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from .