ETF distributions: frequently asked questions

5 minutes reading time

Free cash flow (FCF) is a simple, yet relatively misunderstood concept. While net profit is often looked upon as the main gauge of profitability, a company’s FCF provides a better measure of economic value created. It is simply any cash left over after operating and capital expenditures are paid for.

The idea behind this is that a company pays recurring expenses to keep it running day to day such as rent, payroll, and physical equipment. What’s left over is available or ‘free’ cash that can be used for the following purposes:

Any small business owner will tell you how important FCF is. Generating an accounting profit is nice, cash flow is even more fundamental to remaining in business.

Why focus on Free Cash Flows?

In short having positive FCF gives a company’s management more optionality and more opportunity to deliver for its shareholders.

- Financial Strength

Companies with strong FCF are generally better placed to weather tough times and service debt and are less dependent on capital market funding.

- R&D, innovation and growth

Positive FCF indicates a company is generating more cash than it needs to run the business and can invest in growth opportunities

- Generate shareholder returns

Companies generating strong FCF have the potential to grow dividends over time and produce better earnings.

As earnings drive share price returns over the long run, it is not surprising that companies with high levels of FCF have the potential to generate high returns.

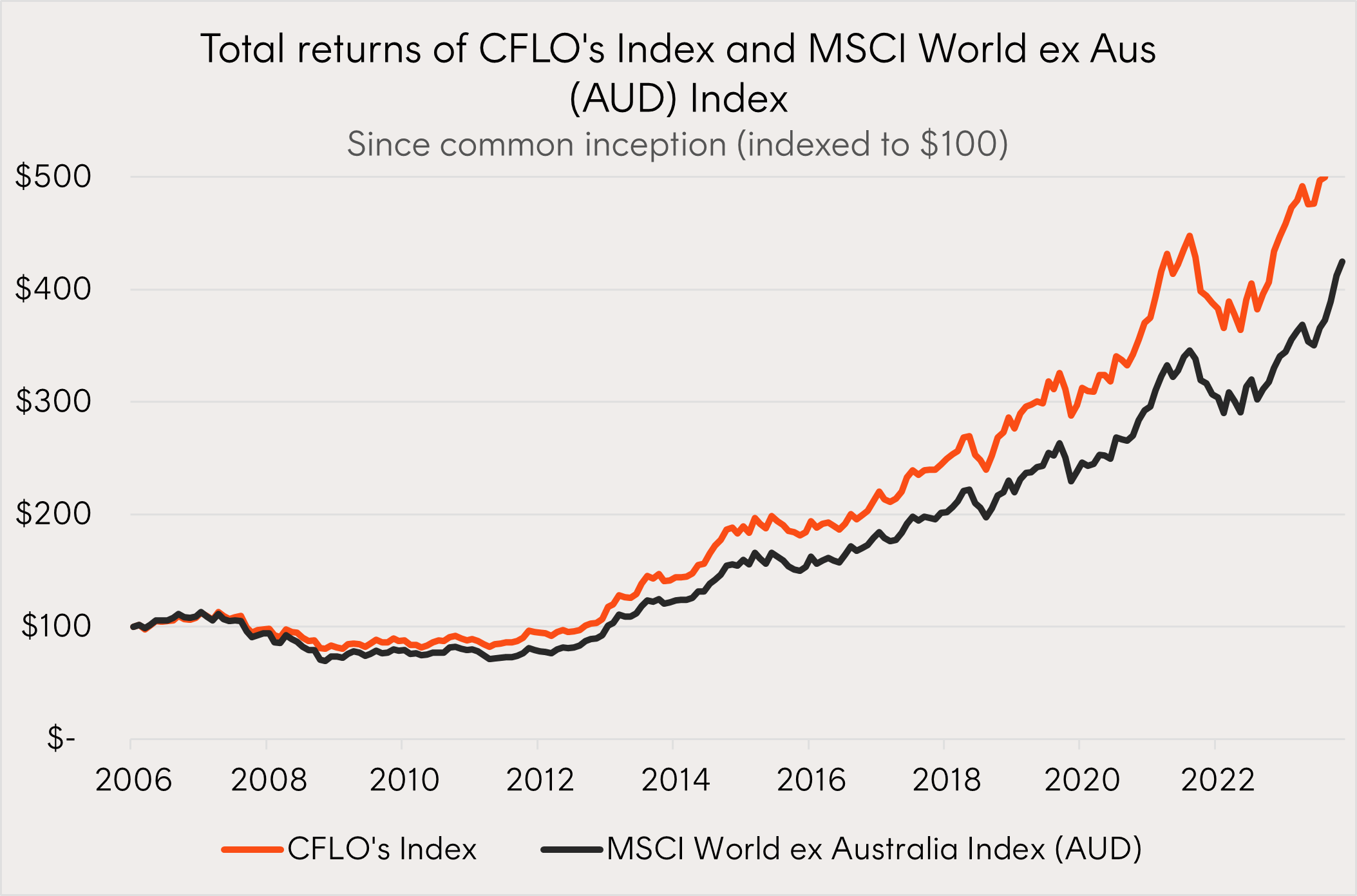

For example, the chart below shows the outperformance of the CFLO Global Cash Flow Kings ETF index since inception, relative to a broad market index for the period ending 29 March 2024.

CFLO’s index targets 200 global companies that generate strong and consistent free cash flows. Since common inception it has returned 10.1% p.a. compared to 8.5% p.a. for the MSCI World Index NR (AUD) – highlighting that an exposure to highly cash generative companies can deliver outperformance in different market environments.

Source: Bloomberg. For the period since common inception on 8 May 2006 until 29 March 2024. Chart shows Index performance (not actual fund performance) to illustrate the longer-term historical performance of global companies that demonstrate strong free cash flow. Doesn’t take into account ETF fees and expenses of 0.40% p.a. You cannot invest directly in an Index. Past performance is not an indicator of future performance.

What do weight loss drugs, renewable energy and factory automation equipment have in common?

Below we look into some of the key holdings in CFLO and how each company has used their FCF in different ways.1

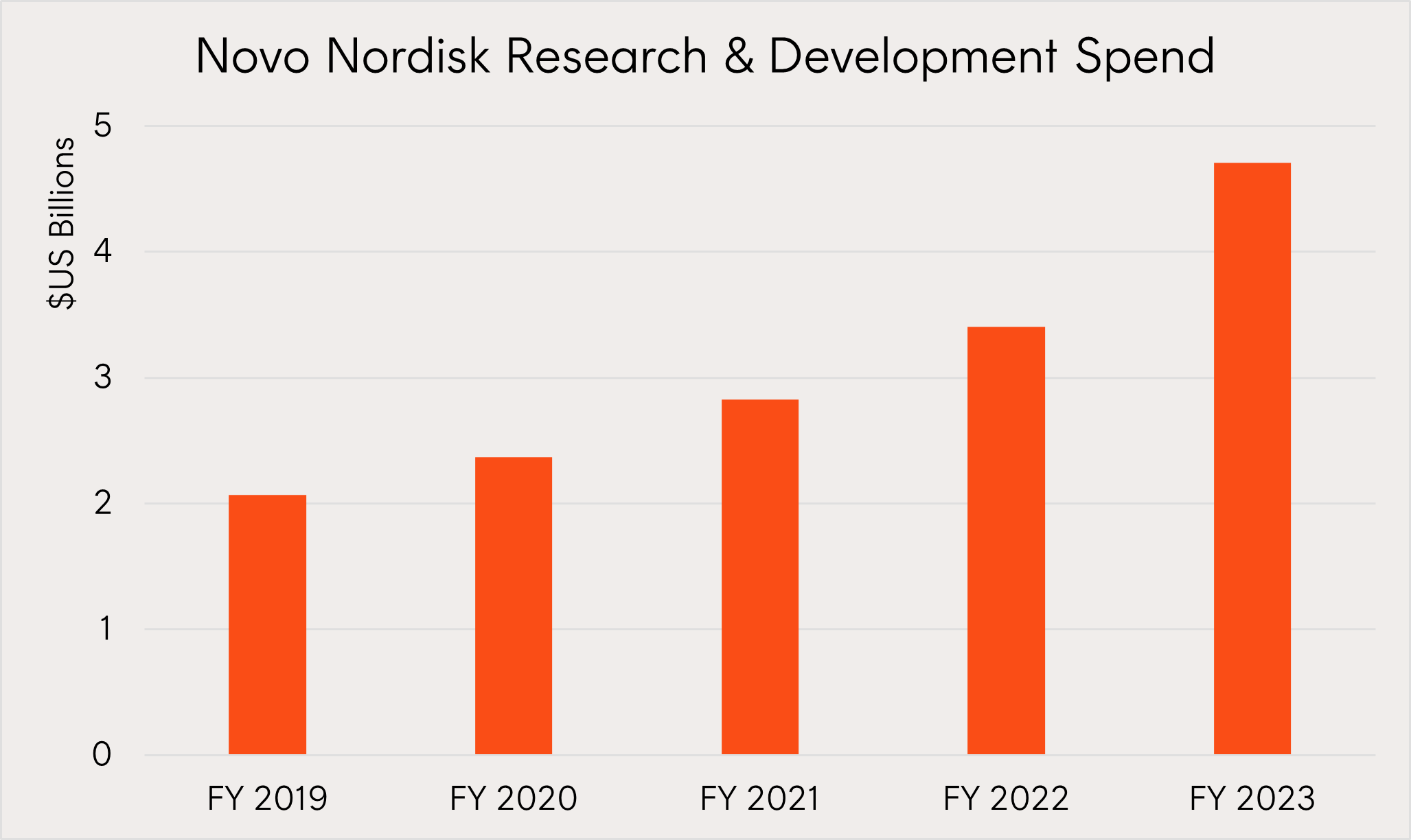

Novo Nordisk is a global healthcare company which generated a record $12b of free cash flow in 2023 as their weight loss drugs saw widespread adoption in the US. Their ability to consistently generate and grow FCF allowed Novo Nordisk to double the amount spent on research and development (R&D) over the last 5 years. Free cash flow is particularly critical for healthcare companies to develop new drugs as competition within the industry intensifies. Novo Nordisk’s share price was up over 20% for the first quarter of 2024.

Source: Bloomberg. Research and development spend for each financial year ending 31 December.

Iberdrola is a Spanish multinational electric utility company which generated over $5 billion of FCF in 2023. Whilst Novo Nordisk used their FCF to reinvest into R&D for development of new drugs, Iberdrola instead returns value to shareholders through dividends. The company has a set dividend payout ratio between 65% – 75%2 which is significantly higher than the median of 33%3 for US listed companies. Over the last 7 years, their dividend yield has also averaged 4.0% per annum.

Keyence is another cash generative company headquartered in Japan which manufactures automation products like sensors and barcode readers. The company consistently generates close to $2b in FCF every year which has helped keep their balance sheet very capital efficient with zero debts outstanding whilst generating high returns on capital.

The importance of free cash flow cannot be understated. Regardless of what market cycle we find ourselves in, having the ability to generate positive FCF over time is an attribute that most investors look for when evaluating high quality, self-sustaining companies to invest in.

Portfolio Implementation

Investors may consider CFLO:

- as a core exposure to global (developed market) equities,

- to use alongside an existing low-cost, passive global equity exposure to improve the overall fundamentals of a portfolio while retaining a strong cost focus, and

- to replace or blend with existing active global equity funds to lower overall management costs.

CFLO is designed to provide a convenient, transparent and cost-effective way for Australian investors to gain a diversified exposure to 200 global companies delivering strong FCF with relatively low levels of financial leverage – and hence potential to outperform broad global equity benchmarks over the medium to long term.

You can find more information on CFLO at its fund page here.

Sources:

1. No assurance is given that these companies will remain in the portfolio or will be profitable investments.

2. https://www.iberdrola.com/press-room/news/detail/iberdrola-launches-billion-investment-plan-2025-firm-commitment-economic-recovery

3. NYU Stern School of Business