David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

5 minutes reading time

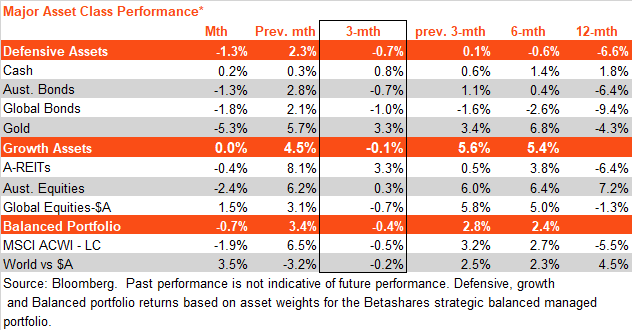

Major asset class performance

Hopes of a soft landing for the global economy – with inflation falling without the need for a recession – have supported both bond and equity markets in recent months, along with gold.

Soft landing hopes gave way to ‘no landing’ fears in February, however, with renewed signs of resilient global economic growth and persistent inflation, which saw markets price in additional central bank rate hikes in coming months. In turn, this pushed up bond yields and the $US, while pushing down returns from bonds, equities and gold.

In hedged terms, global equities declined by 1.9%, while global bonds fell by 1.8%. Weakness in the $A, however, saw a modest 1.5% gain in global equities on an $A or unhedged basis over the month.

Australian equities declined by 2.4% over the month, while Australian bonds fell by 1.3%. The usually interest rate-sensitive local listed property sector, however, held up reasonably well, down by only 0.4%.

Higher global interest rates and a stronger $US likely helped undermine $US gold prices, which declined 5.3% in February.

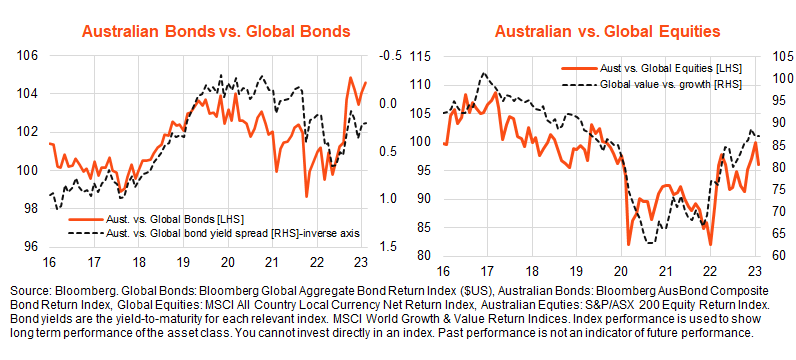

Australia vs. world: outperformance down under

The broad trend in the past year has been Australian bond and equity outperformance relative to global peers.

For bonds, this has reflected less aggressive local interest rate hikes due to relatively more benign demand/wage pressure on inflation and greater assumed sensitivity of the economy to interest rates. For equities, it has reflected the outperformance of value exposures (such as financials and energy) over growth exposures (such as technology) across global markets.

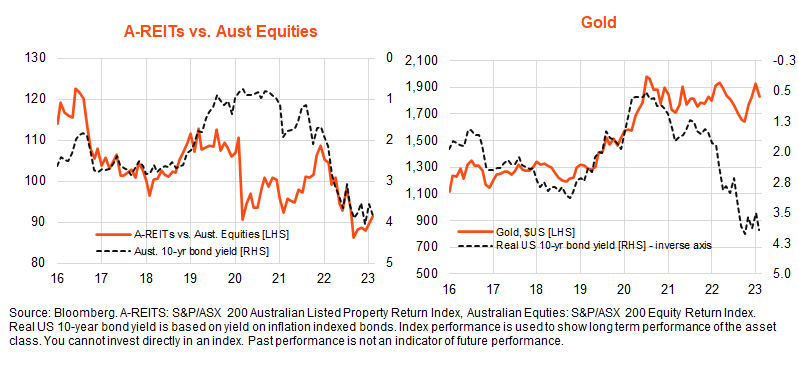

Listed property and gold: benefiting from ‘soft landing’ hopes

The relative performance of property within the Australian equity market has broadly tracked the trend in bond yields in recent times. After significant underperformance through much of last year, there have been signs of a bottoming out in the underperformance of property in recent months along with the easing in bond yields on ‘soft landing’ hopes.

Similarly, prior to February’s fall, gold had bounced back since late last year as soft landing hopes lowered both global bond yields and the $US.

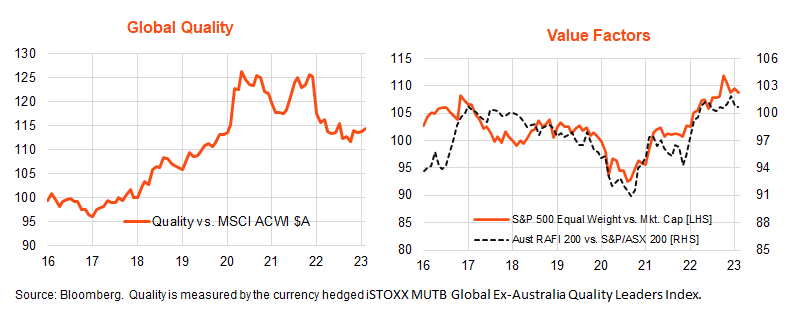

Global factors: value, growth and quality

After underperforming through much of last year, the interest-rate sensitive growth/technology areas of the global equity market have also staged a modest rebound in recent months on US soft landing hopes. This has also helped the quality factor, which currently has a significant technology exposure. By contrast, value exposures – such as resources and financials – have pulled back in terms of relative performance over this period.

The rebound in performance of growth over value in recent months has supported improved relative performance of quality, such as through the QLTY ETF. It has, however, also led to some pullback in the earlier outperformance of value exposures such as the S&P 500 equally weighted index (QUS ETF) and the fundamentally weighted Australian equity ETF (QOZ) versus their market-cap weighted counterparts.

Despite February’s ‘no landing’ fears, however, global technology held up relatively well last month, which supported performance of the QLTY ETF but less so the QUS and QOZ ETFs.

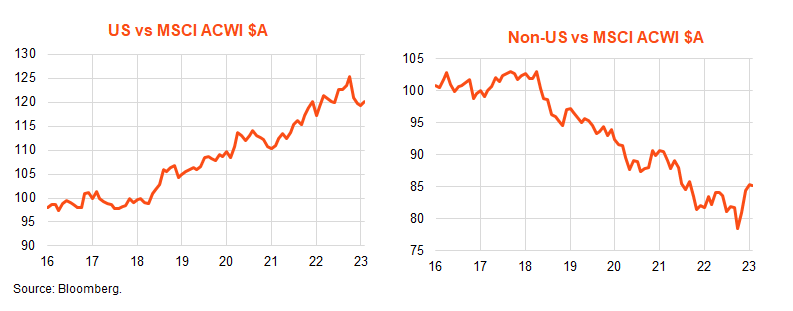

US vs. non-US

A notable feature of the recent rebound in global markets on the back of soft landing hopes has been the underperformance of the US market versus non-US markets.

In part, this has reflected a strong bounce back in European equities amid signs that it is dealing with the Russian-induced energy crisis better than feared.

Outlook

Whether or not the US economy can pull off a soft landing remains the critical driver of global market trends.

As previously outlined, a soft landing would favour both equities and bonds over cash, as well as a likely shift back in relative performance to growth/global over value/Australian equities. It would also likely be positive for the relative performance of gold, listed property and quality.

Should the US quickly succumb to recession (without a lot more policy tightening beyond that already priced into the market) it would be negative for equities but more positive for bonds. This would also, however, likely not favour continued value/Australian equity outperformance over growth/global, though potentially favour quality as a factor and be reasonably neutral for gold and property in terms of relative performance.

Over the past month, however, we’ve been reminded of a final scenario – that of a ‘no landing’ for the US economy – where growth fails to slow or even re-accelerates and inflation/wages remains stubbornly firm. This would likely imply much more significant monetary tightening than currently priced into bond markets, which would likely be a negative for both bonds and equities. As evident over 2022, it would also likely not favour gold or property, though favour value/Australia over growth/global equity exposures.

As recently outlined, my base case errs towards an eventual US recession, as history suggests it will be hard to get US inflation sustainably lower without a material weakening in the still very tight labour market. The resilience of the US economy and degree of monetary tightening required to get this hard landing, however, will determine whether we need to go through a ‘no landing’ scenario again before we get there.

Further information on the complete range of Betashares exchange traded products can be found here.

*Returns are based on the QUS and VTS ETFs respectively. Past performance is not an indicator of future performance.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.