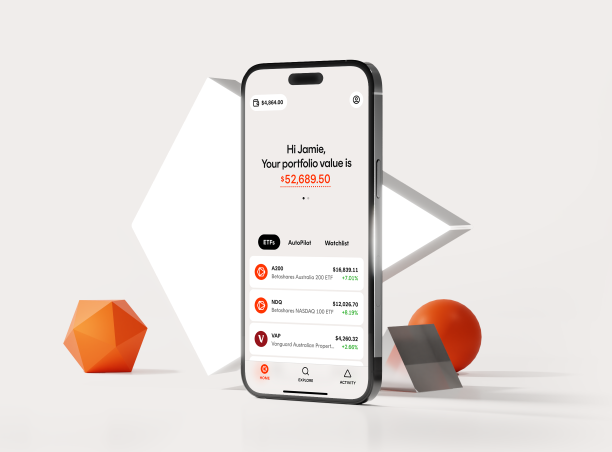

For over a decade, Betashares has been helping Australians to financially progress. As the next step in our journey, we’re launching Betashares Direct, the new investing platform designed to help you build wealth, your way.

Betashares Direct allows self-directed retail investors to invest in any ETF traded on the ASX – whether from Betashares or other ETF managers – with zero brokerage and no account fees on ETF holdings.

The platform also gives investors the ability to automate their investing with AutoPilot, by setting up recurring investments, investing in professionally constructed diversified portfolios or building DIY ETF portfolios, for low portfolio fees.

In light of this announcement, we thought we would explore how we got here and what you can expect from Betashares Direct.

Refer to the PDS for information on interest retained by Betashares on cash balances and AutoPilot portfolio fee.

A decade of innovation

Betashares was established in 2009 with the goal of making investing accessible and affordable for all investors in Australia.

Back then, the Australian ETF industry had around $5 billion in funds under management invested in 45 ETFs from a handful of issuers.

Over a decade later, the ETF industry has grown exponentially to over $150 billion in funds under management across more than 300 products from over 40 providers. More investors are choosing to use ETFs than ever before.

In fact, according to the latest ASX Investor Study, around 20% of Australian investors hold ETFs, up 5% from 20201.

Throughout this industry growth, we have been focused on helping democratise investing for Australians by expanding choice, reducing costs, and improving investor education.

And we’re just getting started…

As our client base has continued to grow to more than one million investors, we have had regular and consistent requests from our self-directed clients to invest in our ETFs directly through us.

We listened to these requests and as the next step in our journey, we are excited to introduce our innovative investment platform, Betashares Direct.

Betashares Direct has been built in-house based on our experience and understanding of Australian investors, and we believe it will play a meaningful role in enabling Australian investors to progress their financial goals.

Our focus is on effortless ETF investing, with features designed to help simplify every stage of the investment process. This includes streamlined, personalised performance and tax reporting to make investments simple to administer and manage.

The initial features of Betashares Direct include:

- Invest in any ETF traded on the ASX with zero brokerage and no account fees on ETF holdings

- Automate your investing with AutoPilot, with access to professionally constructed pre-built portfolios or custom portfolios, for low monthly fees

- Set up recurring investments from your bank account into an AutoPilot portfolio

Refer to the PDS for information on interest retained by Betashares on cash balances and AutoPilot portfolio fees.

Betashares Capital Limited (ABN 78 139 566 868, AFSL 341181) is the issuer of Betashares Invest, being the IDPS-like scheme available through the Betashares Direct platform. Before opening an account or making an investment decision, read the Product Disclosure Statement and the Target Market Determination for Betashares Invest, available by emailing Customer Support at support@betashares.com.au or by phone on 1300 487 577, to consider whether the product is right for you. You should also consider the applicable disclosure document for any underlying investment available through Betashares Invest before making an investment decision. This information is general in nature and doesn’t take into account your financial objectives, situation or needs. You should consider its appropriateness taking into account such factors and seek professional financial advice. Investing involves risk.

References

Annabelle Dickson was previously a journalist at Financial Standard and prior to that at The Inside Investor and The Inside Adviser. She holds a Bachelor of Arts in Communication (Journalism) from The University of Technology Sydney.

Read more from Annabelle.