Back to the Fed as banking stress fades

The risk of a full-blown banking crisis looks to have abated for now. As conditions stabilise the market’s focus has returned to Fed monetary policy with stubborn wage pressures and OPEC’s surprise cut reminding investors that the fight against inflation is not over yet.

Despite the sell-off of US financials in March, the broader S&P500 index was buoyed by falling rate hike expectations to finish up 3.67% for the month. But at this point in the cycle the S&P500 index looks expensive, trading off a forward PE of 18.7x (as at 19 April 2023). That is nearly as high as when hopes of a soft landing peaked in January. And while nominal bond yields have indeed fallen, the real yields (the component of nominal yields, after removing inflation expectations) remain elevated – compounding equity valuation worries.

To top that off, forward earnings have clear negative momentum, with downward revisions across most sectors and the S&P500 predicted to enter a ‘earnings recession’ this quarter1.

US investment flows: From TINA to TARA

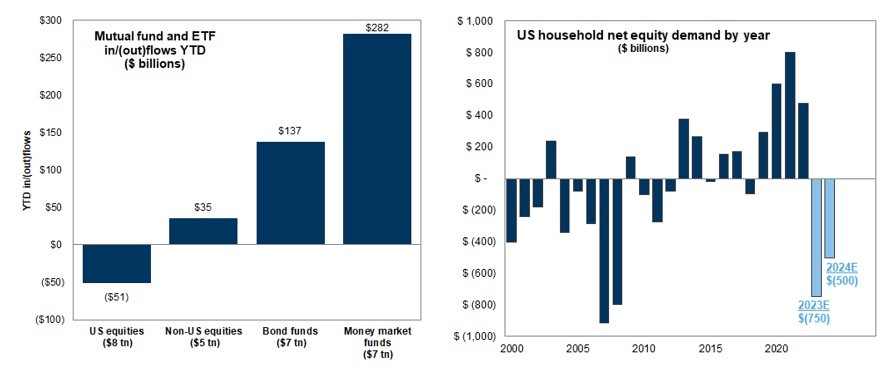

For the last few years US households have ploughed excess savings into the stock market, but that net buying has reversed in 2023 with $51B year-to-date net outflows from US equity mutual funds and ETFs2. This is due in part to a collapse in the US personal savings rate, but also the attractive yields now on offer in fixed and floating rate bonds relative to equities. It appears the TINA trade (there is no alternative to equities) is over and the TARA era (there are reasonable alternatives to equities) is upon us – with very strong flows into bond and money market funds in particular. Goldman Sachs Investment Research forecast US households will be net sellers of US$750 billion in equities in 2023. This amount of net selling would reverse the previous six quarters of household equity demand, a significant headwind facing equities this year.

Source: Goldman Sachs, as of March 2023

Source: Goldman Sachs, as of March 2023

Portfolio Implementation in Australia

If the outlook for equities is challenging, where can investors look?

Getting paid for patience:

Many investors are seeking liquid “TARA” investment options that offer the ability to take advantage of any buying opportunities that may materialise in equities. Below are four options where investors can look to “park” capital with the potential for attractive levels of income relative to platform cash solutions or term deposits, with the benefit of T+2 liquidity.

Option 1 & 2 – Cash is king

AAA Australian High Interest Cash ETFAAA’s assets are simply invested in cash deposit accounts held with select banks in Australia. As at 18 April 2023, the interest rate earned on AAA’s deposits sat at 3.69% p.a.*, net of fund management fees and costs. AAA’s interest rate has been above the RBA Cash Rate since the Fund’s inception in 2012. AAA has a management fee of 0.18% p.a.**

AAA pays monthly distributions and has the added benefit of being exchange-traded.

USD U.S. Dollar ETFLike AAA, USD’s assets are simply invested in a bank account, however it is a U.S. dollar bank account. This Fund allows Australians who are comfortable with foreign exchange rate fluctuations to take advantage of the current higher rate environment in the U.S. As at 18 April 2023, the interest rate earned by USD is 4.38% p.a.*, net of fund management fees and costs. USD has a management fee of 0.45% p.a.**

Beyond this interest rate, USD also provides two very attractive use cases:

1. Historically, the U.S. dollar has tended to behave like a “risk off” or “safe haven” currency relative to the Australian dollar. It has demonstrated a negative correlation to equities, meaning that USD has typically appreciated in value when equity markets have sold off, so can be used for equity diversification purposes3.

2. If an Australian investor is waiting for an attractive entry point to deploy Australian dollar cash into the US equity market they face currency risk. Often the US dollar has tended to rally at a time when US equities have become cheap, as was the case in the COVID lows of March 2020. Rather than risking the erosion of a US asset buying opportunity by adverse currency movements, an investor can park their capital in USD while they wait for that opportunity to emerge.

Option 3 – Floating above cash rates

QPON Australian Bank Senior Floating Rate Bond ETFQPON’s assets are invested in a quality portfolio of capital stable senior floating rate notes issued by Australian banks, which are among the most liquid and highest credit-rated corporate bonds issued in Australia.

In a chaotic 2022 when both government yields and credit spreads blew out, and where many bond funds were down -12% or more, QPON had a maximum drawdown of -1.0%, from which it fully recovered within 4 months. QPON has a current All-in Yield of 4.62% p.a.*, estimated Yield to Maturity of 4.49% and a management fee of 0.22%p.a.** (as at 18 April 2023).

Option 4 – Higher income and diversification away from Australian banks and residential property

HCRD Interest Rate Hedged Australian Investment Grade Corporate Bond ETFHCRD generates an attractive All-in-Yield of 5.93%* and estimated Yield to Maturity of 5.52%*** (as at 18 April 2023) through a portfolio of investment grade corporate bonds, while hedging out the interest rate duration risk. Most floating or variable rate credit available in Australia is issued to fund banks, residential mortgages and/or property developers. HCRD’s issuer profile is somewhat unique in that it has very little banking exposure (~6%), and is instead diversified across defensive sectors like infrastructure (eg Brisbane Airport, Ausnet) and consumer staples (eg Woolworths, Coles). HCRD has a management fee of 0.29% p.a.**

Defending against a US recession:

In March, fixed-rate high grade bonds again showed their defensive attributes against equities when fears of a recession are heightened. In a US recession these bonds have tended to benefit from both a flight to quality from earnings downgrades and a pivot in central bank policy. In addition to equity diversification benefits, the equity risk premium (the amount you get paid for taking equity volatility excess of bonds) does not look attractive – explaining some of the switching from equities to bonds.

Option 1 – Government bonds may provide a “safe-haven”

AGVT Australian Government Bond ETFAGVT invests in a portfolio of relatively long duration Australian government and government-related bonds. AGVT targets bonds with a maturity of 7-12 years seeking to enhance defensive characteristics particularly when compared to the AusBond Govt 0+ Yr Index which has a significant weighting to shorter dated Australian Commonwealth Government bonds (20.4% to 0-3yr bonds as at 31 March 2023). This longer duration profile and high credit quality (average rating of AAA) makes this Fund well positioned to benefit from a recessionary environment. Indeed in March, when recessionary fears heightened around banking stresses, AGVT returned 4.56%. (returns for periods longer than one month are available at www.betashares.com.au) AGVT has a current Yield to Worst of 3.76% p.a.* (as at 18 April 2023) and management costs of 0.22% p.a**.

OZBD Australian Composite Bond ETFOZBD is designed to be a core portfolio allocation for fixed income. It aims to track the performance of an index that provides exposure to a diversified portfolio of high-quality Australian government and corporate bonds selected on the basis of risk-adjusted income potential, while controlling for overall interest rate and credit risk. OZBD’s portfolio has provided defensive properties, returning 3.42% during the recessionary fears in March (returns for periods longer than one month are available at www.betashares.com.au), and has appealing income potential with a current Yield-to-Worst of 4.20% p.a.* (as at 18 April 2023) and a management fee of 0.19% p.a**.

-

AAA

Australian High Interest Cash ETF

-

USD

U.S. Dollar ETF

-

QPON

Australian Bank Senior Floating Rate Bond ETF

-

HCRD

Interest Rate Hedged Australian Investment Grade Corporate Bond ETF

-

AGVT

Australian Government Bond ETF

-

OZBD

Australian Composite Bond ETF

There are risks associated with an investment in the Funds and the value of units may go up and down. An investment in the Funds should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the Target Market Determination (TMD) and Product Disclosure Statement (PDS) for the relevant Funds, available at www.betashares.com.au.

This is not a recommendation to buy units or adopt any particular strategy. You should make your own assessment of the suitability of this information. Past performance is not an indication of future performance. No assurance is given regarding the future performance of the Funds or the payment of any distributions. Betashares Capital Ltd (ACN 139 566 868 AFS Licence 341181) (“Betashares”) is the issuer of the Funds. This is general information only and does not take into account any person’s particular circumstances. Investors should read the relevant PDS (at www.betashares.com.au) before deciding to buy or hold units. Investors may buy units on ASX through a broker or financial adviser. To the extent permitted by law Betashares accepts no liability for any loss from reliance on this information.

Future outcomes are inherently uncertain. Actual outcomes may differ materially from those contemplated in any opinions, estimates or other forward-looking statements given in this information.

1. https://www.reuters.com/markets/us/q1-earnings-sp-500-seen-falling-48-vs-yr-ago-refinitiv-2023-04-14/

2. Goldman Sachs, From TINA to TARA Exploring the drivers of household equity demand

3. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/fed-rules-currency-market-as-dollar-moves-align-more-closely-with-stocks-59185505

*Yield figures are calculating by summing the prior 12 month fund per unit distributions divided by the fund closing NAV per unit as at 18 April 2023. Past performance is not an indicator of future performance. Yields will vary and may be lower at the time of investment.

**Additional costs, such as transaction costs, may apply.

***The estimated annualised total expected return of a bond if it is held to maturity, and the coupons and reinvested at the Yield to Maturity (YTM). For floating rate securities, the estimated YTM is calculated assuming forward BBSW projections based on market pricing of the swap curve, these projections are expected to change constantly along with market pricing. The YTW for the relevant fund is the weighted average of its underlying bonds’ YTMs.

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from Tom.