January 2026 inflation analysis: Omens do not bode well for a May rate hike

6 minutes reading time

- Technology

Social media, digital advertising, and e-commerce were three huge trends for tech investors that defined the last decade. The impressive growth in these sectors helped propel Meta (formerly Facebook), Alphabet (formerly Google), and Amazon to among the largest companies in the world.

But a new order is emerging, and while many of the players remain the same, the game has changed.

Let’s explore three important trends for tech investors to watch in the decade ahead.

Artificial intelligence

Artificial intelligence (AI) has received a lot of attention this year, and for good reason. While the release of ChatGPT initially triggered the hype, real-life business applications are driving growth.

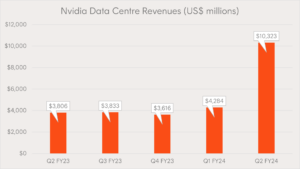

For evidence of this, one needs only look at Nvidia’s stunning 843% year-on-year increase in profits in Q2 was largely driven by increased demand coming from data centres. Management points to Amazon Web Services, Google Cloud, Meta, Microsoft Azure, and Oracle Cloud as drivers of demand. Revenue from data centres grew by 171% year-on-year1.

Source: Nvidia, Betashares.

Microsoft is beginning to roll out Copilot to enterprise users of Office. Copilot is said to cost US$30 per user per month – almost doubling the cost of a Microsoft 365 subscription. Copilot is an AI-powered personal assistant that can assist users with everything from organising their Outlook inbox to improving their Excel formulas. And it’s not just Microsoft, Google, Zoom, and Salesforce have all begun rolling out AI-powered features in recent months2.

How to gain exposure

RBTZ Global Robotics and Artificial Intelligence ETF invests in companies involved in Industrial Robotics and Automation, Non-Industrial Robots, Artificial Intelligence and Unmanned Vehicles and Drones. In one trade, investors can get diversified, cost-effective exposure to the world’s leading robotics and AI companies, a sector that is heavily under-represented on the ASX.

Cybersecurity

Cybercrime has evolved from the days of unsophisticated spam emails riddled with spelling errors.

Today, cybercriminals are capable of generating realistic voices capable of fooling parents into thinking they’re speaking to their own children. Modern cybercrime is both highly sophisticated and highly lucrative. In 2023, the global cost of cybercrime is expected to hit US$8 trillion3.

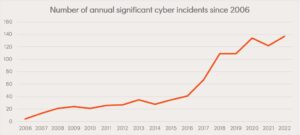

The scope of the issue extends well beyond scamming private individuals. A ransomware group called Clop has reportedly compromised more than 730 organisations to date4, extorting an estimated US$75-$100 million from victims5. And the number of significant cyber incidents has been growing.

Source: Betashares.

Wherever crime proliferates, security is sure to follow. Global cybersecurity revenues grew from US$83 billion in 2016, to US$147 billion in 2022. This year the industry is expected to hit US$162 billion in revenues, and this number is projected to grow to US$256 billion by 20286.

How to gain exposure

HACK Global Cybersecurity ETF invests in leading companies in the global cybersecurity sector. The Fund’s portfolio includes global cybersecurity giants, as well as emerging players, from a range of global locations.

Climate change technology

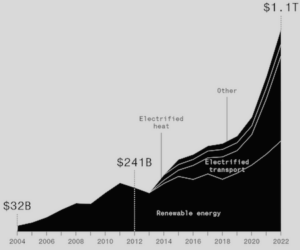

If the world is to meet its climate goals, significant technological development will be needed across the vast range of industries. From energy generation and storage, to mobility, food and agriculture, investment is expected to drive growth.

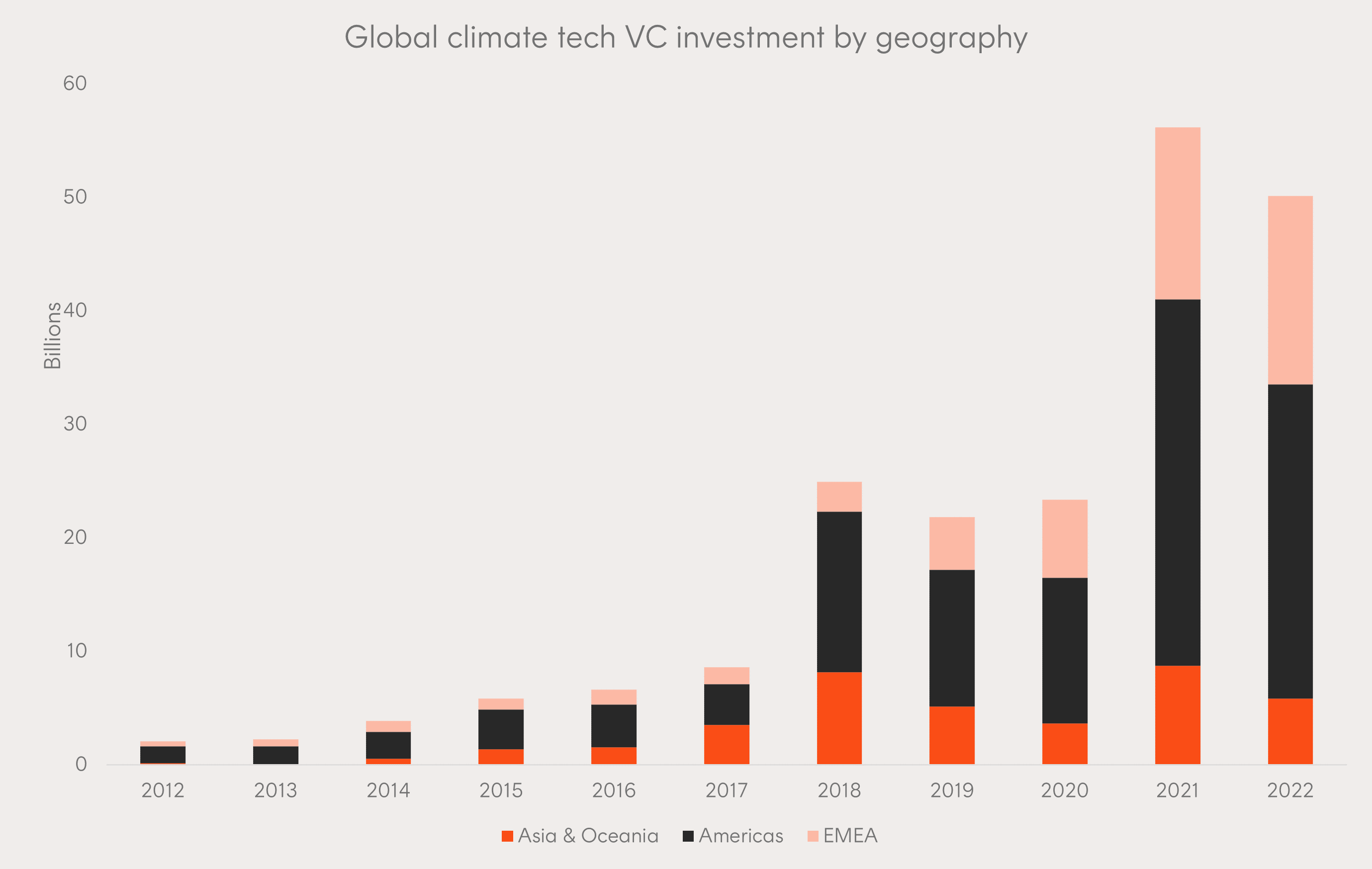

Venture capital investors have clearly already noted this, with a 24x increase in investment for climate tech startups seen over the last decade7.

Source: Dealroom.

It’s not just startups though. Climate and sustainability technology is big business. Climate tech focused companies such as Ecolab, Vestas Wind Systems, and Kingspan are already valued in the 10s or even 100s of billions of dollars.

According to BloombergNEF, global investment in the energy transition topped US$1 trillion in 20228. But this is really just the beginning. The International Renewable Energy Agency suggests that US$5 trillion per year, for a cumulative US$150 trillion of investment will be required by 2050 for the world to achieve the 1.5°C pathway9.

Global investment in the energy transition

Source: BloombergNEF

How to gain exposure

ERTH Climate Change Innovation ETF invests in a portfolio of up to 100 leading global companies that derive at least 50% of their revenues from products and services that help to address climate change and other environmental problems through the reduction or avoidance of CO2 emissions. This covers clean energy providers, along with leading companies tackling green transport, waste management, sustainable product development, and improved energy efficiency and storage.

Looking ahead

While nothing is ever certain in investing, these three trends have the potential for significant growth over the decade ahead. As with any growing industry, competition is likely to be fierce, so taking a diversified approach to gaining exposure can help to reduce stock-specific risk.

ETFs offer a convenient way to gain exposure to a diversified portfolio of shares. Investors may wish to consider one of the thematic ETFs mentioned above, or alternatively, NDQ Nasdaq 100 ETF aims to track the performance of the NASDAQ-100 Index (before fees and expenses).

The NASDAQ-100 comprises 100 of the largest non-financial companies listed on the NASDAQ market. NDQ currently includes companies with exposure to many of the trends discussed in this article, including Nvidia, Microsoft, Palo Alto Networks, CrowdStrike, Tesla, and Zoom.

There are risks associated with an investment in RBTZ, HACK, ERTH and NDQ, including market risk, sector risk and international investment risk for example. Investment value can go up and down. For more information on risks and other features of the funds, please see the respective Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1.Source: Nvidia Q2 FY24 Investor Presentation

2.Source: Microsoft puts a steep price on Copilot, its AI-powered future of Office documents

3.Source: Deepfake Imposter Scams Are Driving a New Wave of Fraud

4.Source: MOVEit attack spree makes Clop this summer’s most-prolific ransomware group

5.Source: Clop gang to earn over $75 million from MOVEit extortion attacks

6.Source: Cybersecurity – Worldwide

7.Source: Dealroom Climate Tech Guide

8.Source: How the world is spending $1.1 trillion on climate technology

9.Source: World Energy Transitions Outlook 2023