Want to read it later?

Send the lesson to your inbox

Lesson 7 transcript

An important part of investing is tracking the performance of your investments and reviewing how much your portfolio has gained or lost over time.

When it comes to understanding the performance of an ETF, there are a few things to consider.

Expense ratios and costs

An ETF’s management costs indicates how much of your investment in an ETF will be deducted annually as fees. You can think of this as the fee paid to the ETF provider for managing the fund.

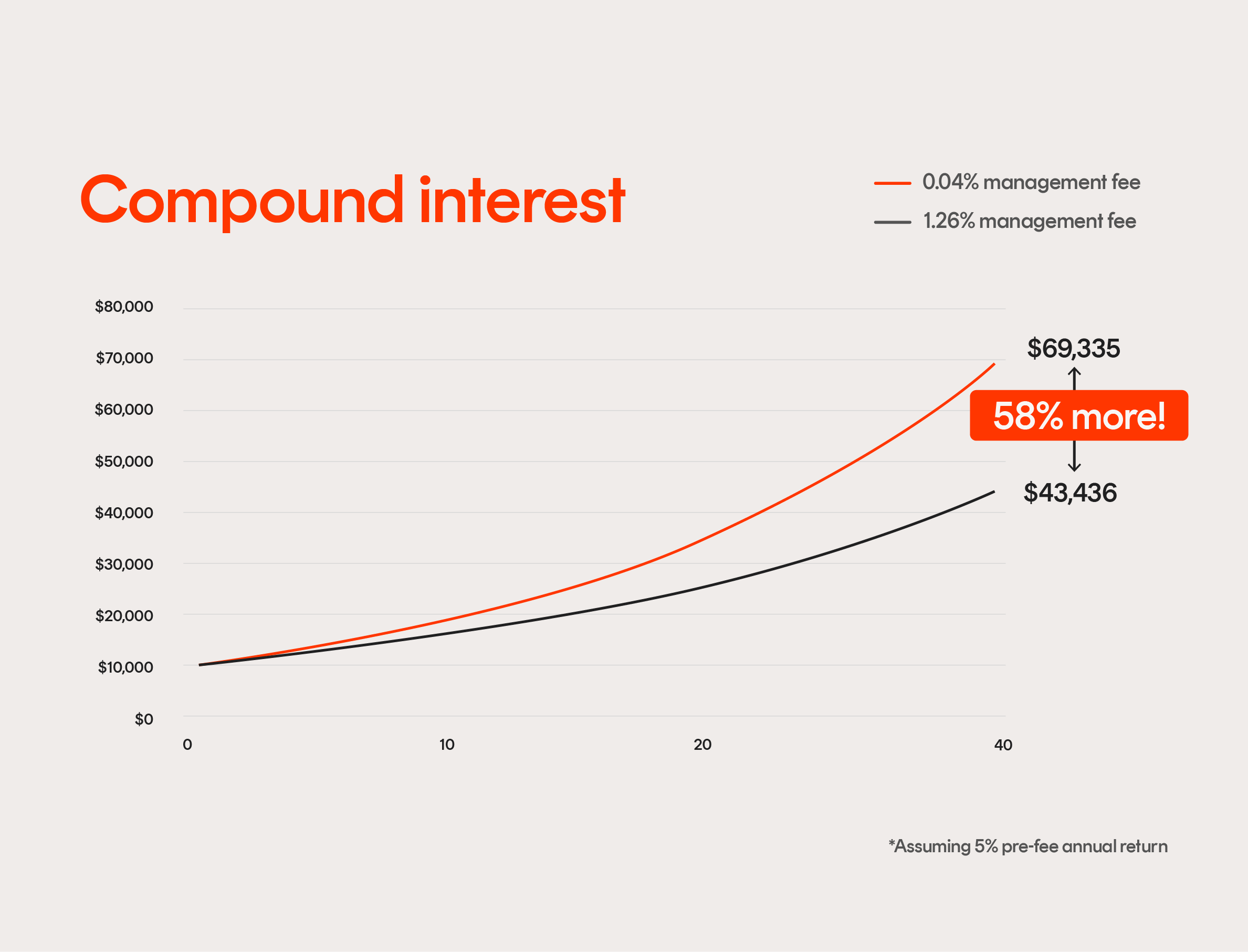

In the case of fees, the lower the better. That’s because management costs are measured as a percentage of your investment in the ETF.

For example, an ETF may charge a fee of 0.04% – meaning, you’ll pay $4 per year for every $10,000 you have invested in the fund.

An annual fee of 1% or less may not seem like much, but, every dollar that comes out of your account in fees is a dollar that is not compounded, and will not grow, in future years.

We cover the importance of paying attention to fees and how they work with ETFs in greater detail in our course, Betashares explains: Investing.

Historical performance

You might have heard the phrase “past performance is no indicator of future performance”. There’s no way to predict the future, which means that the way an ETF has performed in the past can’t tell you how it will perform in future.

But what it can do is give you an idea of how the ETF historically has fared in different conditions – so it is still worth checking past performance on the provider’s website.

Tracking error

Since the main task of most ETFs is to track an index, it makes sense to check on its tracking record.

Two key questions to ask:

- How well did the ETF replicate the performance of its index (keeping fees in mind)?

- When the index increased, did the ETF increase by the same amount?