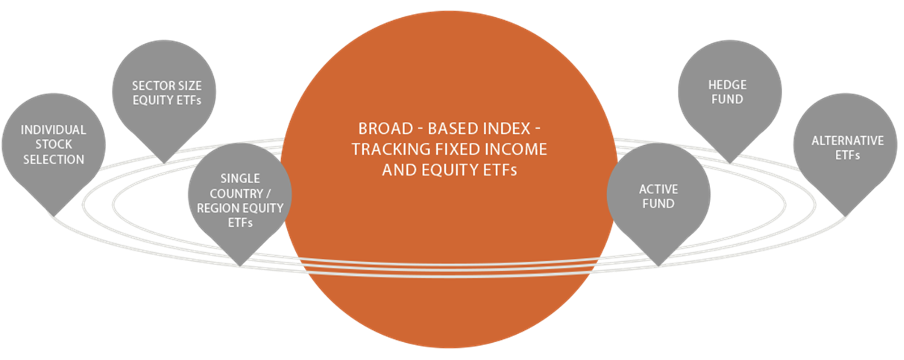

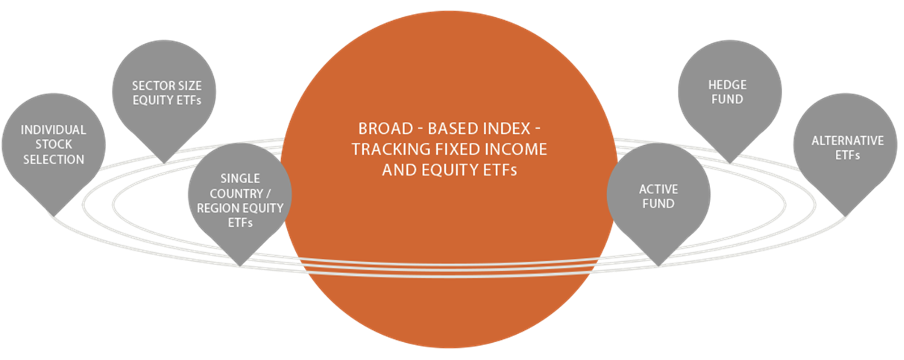

One popular approach to portfolio construction for the accumulation phase is the core-satellite strategy.

The core-satellite investing strategy is an approach that seeks to achieve capital appreciation, limited volatility, and cost control for your investment portfolio.

It’s a strategy that can be designed specifically to cater to your needs, and can be achieved through a selection of just a few ETFs.

The core, or foundation, of your portfolio typically consists of a number of investments that give you broad exposure to a range of asset classes.

The satellite component of your portfolio comprises investments you might make to try and generate extra returns.

This could include investments to take advantage of short-term opportunities, or more focused exposures than the broad exposures that make up the core of your portfolio.

Learn more about the core-satellite strategy.

Once you’ve set up your investment portfolio, it’s wise to consider when you may need to rebalance your portfolio as your circumstances change over time and as you move into retirement.

Learn more about portfolio rebalancing.