September 2023 Review: Industry declines in value as markets fall, while flows remain strong

The second highest net flows of the calendar year were not enough to combat a decline in asset values, as global sharemarket falls caused the industry to decline in September

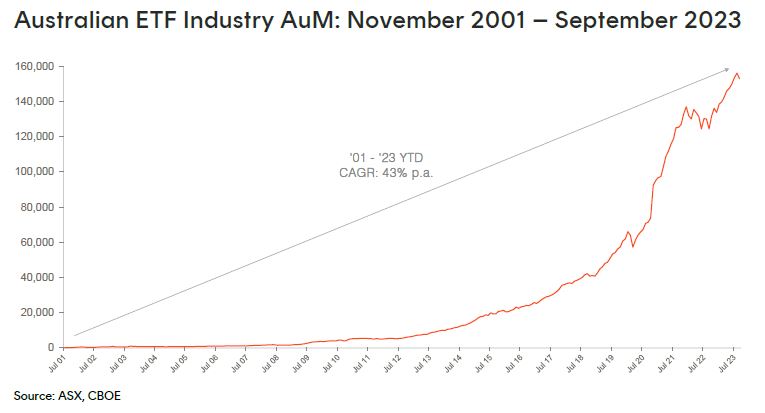

Exchanged Traded Funds Market Cap

• Australian Exchange Traded Funds Market Cap (ASX + CBOE): $152.9B

• ASX CHESS Market Cap: $137.9B1

• Market Cap increase for month: -2.0%, -$3.1B

• Market Cap growth for last 12 months: 22.9%, $28.5B

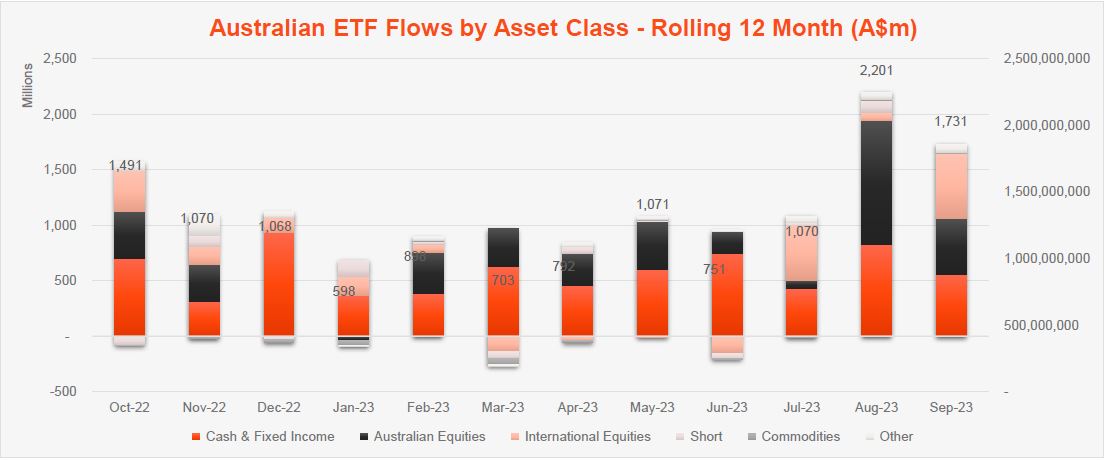

New Money

• Net inflows for month: $1.7B – 2nd highest inflows for 2023 to date

Products

• 350 Exchange Traded Products trading on the ASX & CBOE

• Nine new ETFs launched: Betashares launched two US Treasury Bond ETFs including the first

UTIP

Inflation-Protected U.S. Treasury Bond Currency Hedged ETF

and a

US10

U.S. Treasury Bond 7-10 Year Currency Hedged ETF

; the ASX had a further 5 ETF launches in the Government Bond & thematic space by VanEck, Global X and iShares. 2 new funds were launched on CBOE – Active ETFs from Coolabah Capital (Active short term bonds) and JPMorgan (Active Emerging Markets equity)

• 1 XTB single bond exposure was closed

Trading Value

• After very high levels of trading value last month, trading value dropped back by ~20% in September, with ASX trading value of $9B for the month

Performance

•

URNM

Global Uranium ETF

was the best performing product for the second month in a row, rising an additional 24% (after the ~15% rise last month). With sharp falls in the US sharemarket in September, geared short US equities exposures such as

BBUS

U.S. Equities Strong Bear Hedge Fund – Currency Hedged

performed strongly (~13% for the month)

Source: ASX, CBOE

Top 5 category inflows (by $) – September 2023

| Broad Category | Inflow Value |

| International Equities | $582,641,062 |

| Australian Equities | $508,148,070 |

| Fixed Income | $475,245,385 |

| Cash | $78,162,605 |

| Multi-Asset | $43,254,425 |

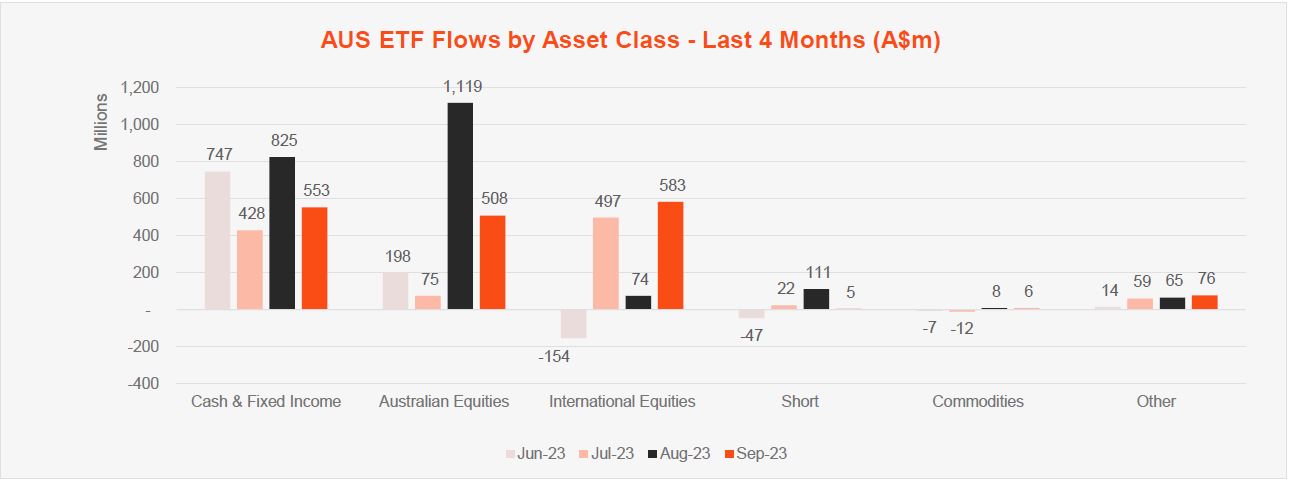

Comment: For only the second time in the last 12 months, we saw a return to meaningful inflows in the International equities ETF segment, which was the highest category for new money ($583m). Australian equities also had strong inflows ($508m), and it appears as though ETF investors are making a return to equity investing after focusing heavily on Fixed Income exposures for the majority of the year to date.

Source: ASX, CBOE

Top sub-category inflows (by $) – September 2023

| Sub-category | Inflow Value |

| Australian Equities – Broad | $408,422,025 |

| Australian Bonds | $289,369,893 |

| International Equities – Developed World | $253,281,657 |

| International Equities – US | $213,222,231 |

| Global Bonds | $175,619,140 |

Top sub-category outflows (by $) – September 2023

| Sub-Category | Inflow Value |

| Australian Equities – Large Cap | ($43,527,379) |

| Australian Equities – Short | ($19,421,259) |

| Oil | ($15,717,460) |

| International Equities – E&R – ESG Lite | ($8,595,741) |

| Other | ($6,285,448) |

Comment: Like last month, there were very little outflows at a category or sub-category level this month, with ETF investors largely choosing to hold or add to their positions, in aggregate.

*Past performance is not an indicator of future performance.

1. Since February 2023, the ASX started reporting additional data on a CHESS-only basis. The primary use of such data is that it excludes, amongst other things, the FuM and Flows in ‘dual class’ Active ETFs and potentially provide a more accurate picture of exchange traded activity.

-

UTIP

Inflation-Protected U.S. Treasury Bond Currency Hedged ETF

-

US10

U.S. Treasury Bond 7-10 Year Currency Hedged ETF

-

URNM

Global Uranium ETF

-

BBUS

U.S. Equities Strong Bear Hedge Fund – Currency Hedged

Investor & founder with a Financial Services & Fintech focus. Co-founder of Betashares. Passionate about entrepreneurship and startups.

Read more from Ilan.