Japanese equities kicked off the new year by continuing their run, with the Nikkei closing above 35,000 for the first time since 1990. The AFR recently wrote an article1 on the Japanese market, highlighting:

- Nikkei 225 closed above 35,000 for the first time since 1990,

- The weaker Yen continues to boost export-related Japanese shares, and

- Goldman’s chief Japan equity strategist sees 2024 as “a transformative year” for Japanese equities.

The Japanese share market has been long suffering, still trading below its peak from 34 years ago. But under the surface, reforms have been restructuring the region’s corporations to foster a new era of growth.

Acknowledging historical weakness in corporate governance and a lack of shareholder value creation, the Japanese government has been mandating improvements from corporations for over a decade.

Companies have been expected to strengthen board independence, enhance shareholder rights, and encourage greater disclosure and transparency, among other initiatives to encourage domestic and foreign investors.

Most recently, the Tokyo Stock Exchange weighed in on these reforms and gave companies an ultimatum – enhance corporate value over the medium-to-long term, specifically by bringing P/B ratios above 1x, or risk delisting.

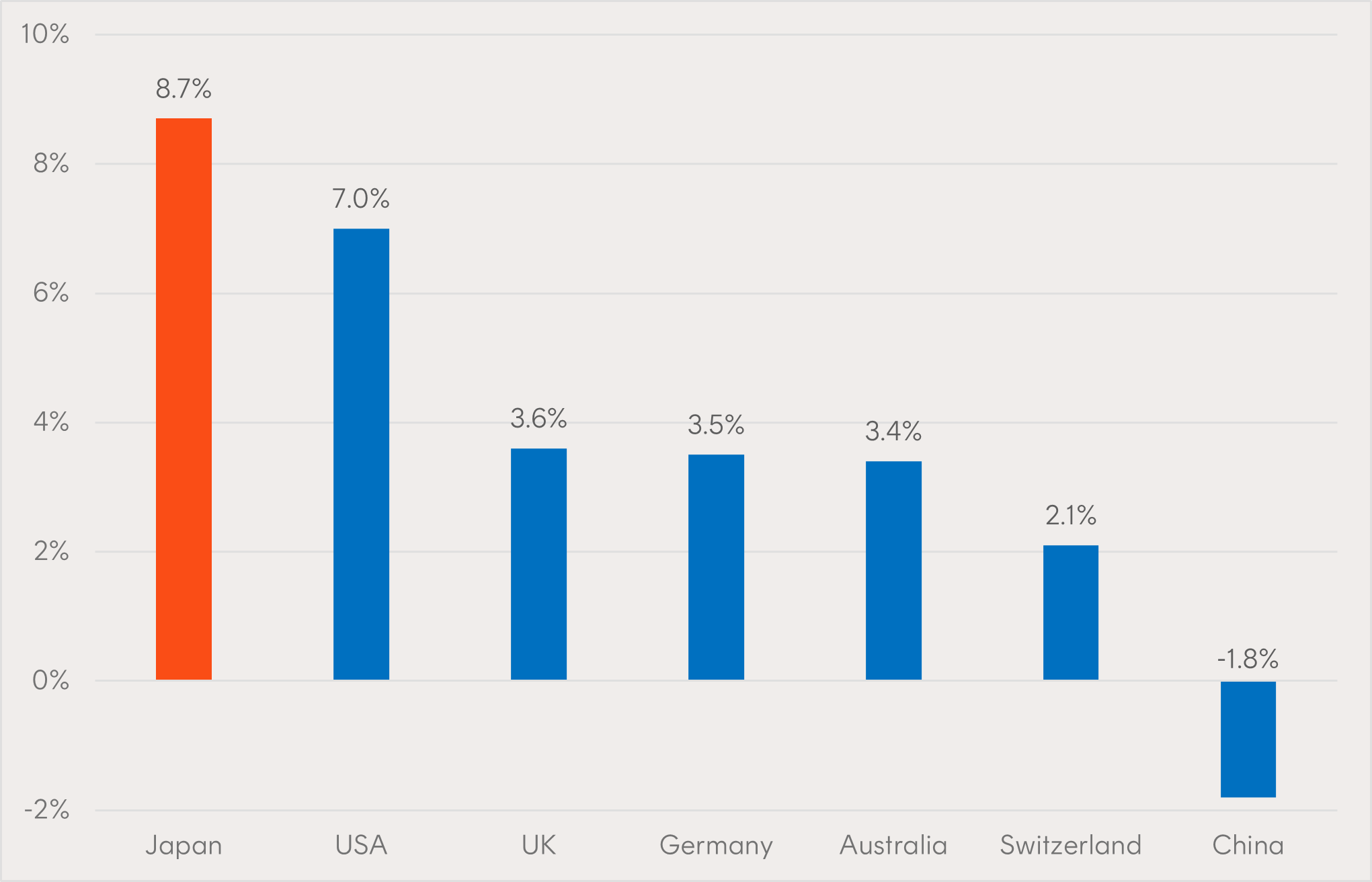

The response has been swift – record levels of share buybacks and dividends, with dividend growth of 10% p.a. over the past decade. The highest level of EPS CAGR over the past 10-years (in local currency). And the second best performing broad market developed world index in 2023.

With the Japanese market still trading at a P/E ratio of 15.2x, compared to 18.6x for the MSCI World, and earnings expected to grow at 14.8% p.a. over the next two years, compared to 11.8% p.a. for the MSCI World, Japanese equities are arguably well positioned coming into 2024.

Chart 1: Select developed country trailing EPS 10-year CAGR (local currency)

Source: Morgan Stanley Research, Datastream, MSCI. Note EPS calculated in local currency. Based on MSCI indices.

About HJPN

HJPN Japan ETF – Currency Hedged has been the best performing Japanese equities ETF in Australia over the past 1-, 3-, and 5-year periods, and has also outperformed the Topix index by 4% p.a. over the 5-year period2. With an investment approach favouring Japanese exporters and currency hedging its exposure, HJPN seeks to benefit from the relatively weak Japanese Yen and structurally lower interest rates in the Japanese economy – currently generating an additional 5.53% p.a. from currency hedging carry.

Quick facts:

- Top 5 holdings: Toyota, Sony, Mitsubishi, Keyence, Tokyo Electron

- FUM: $91m

- Index: S&P Japan Exporters Hedged AUD Index

- Inception date: 10 May 2016

- Currency hedged: Yes

-

HJPN

Japan ETF – Currency Hedged

There are risks associated with an investment in HJPN, including market risk and country risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

1. AFR: Nikkei closes above 35,000 for first time since 1990

2. Past performance is not an indicator of future performance.

This article mentions the following funds

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from .