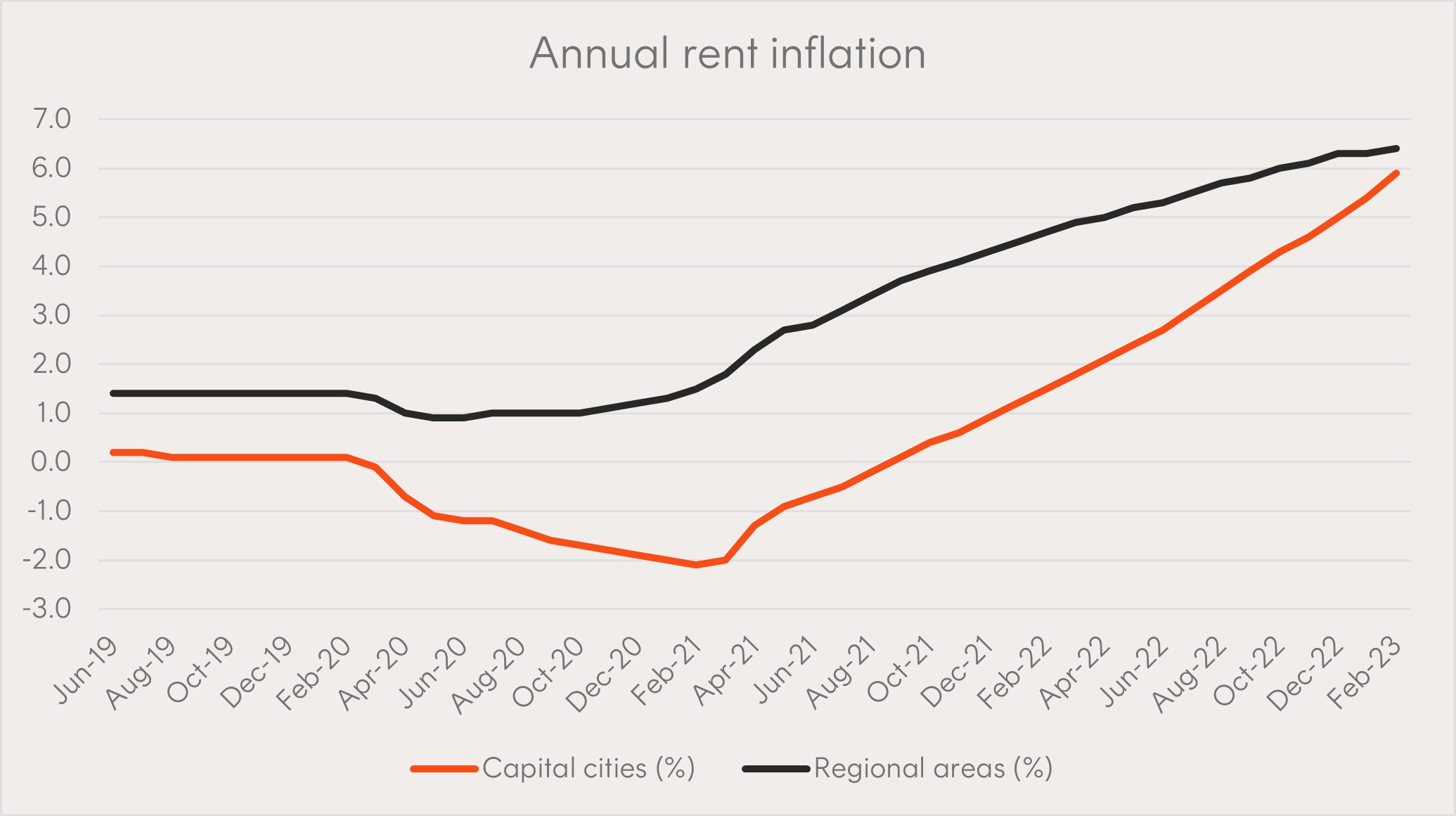

Interest rates are now at their highest level in more than 10 years1, and while house prices have eased from their recent highs, they remain well above pre-Covid levels. With rental vacancies below 2% in most capital cities2, and annual rent inflation tracking around 6% – as shown in the chart below – the situation in Australia’s property market is complicated, for both home buyers and investors.

Source: Australian Bureau of Statistics, Betashares.

Australia has a well-known love affair with property, and many Australians hold a firm belief that its value never goes down. However, not everyone has the minimum amount needed to place a deposit on a property and secure a mortgage.

This has many people wondering if it makes more sense to invest in the sharemarket or dive into property? Despite the modern dynamics, this is an age-old debate.

Let’s explore some of the similarities and differences between asset classes, and some of the pros and cons to help in your research3.

Potential for growth

Both investments offer the potential to grow in value over time.

A 2015 research paper from the Federal Reserve of San Francisco titled The Rate of Return on Everything looked at nearly 150 years of data to uncover very long term returns across a range of asset classes and geographies. Australian housing returned 6.37% p.a. in real terms over the full sample of data, while equities returned 7.81% p.a. Looking at just the data since 1950, housing performed better, returning 8.29% p.a. vs 7.57% p.a. for equities. However, looking at just the more modern series since 1980, the pendulum swung back the other way, with equities returning 8.78% p.a. vs 7.16% p.a. for housing4.

Comparisons have their limitations of course. Returns can vary according to the timeframe selected, and you can break property down into different regions, or equities into various sectors. It’s important to keep in mind there have been periods of boom and bust for both asset classes. Returns change further once gearing and costs are introduced into the equation. Also, it’s important to keep in mind past performance is not indicative of future performance.

Regardless of how you cut the data though, it’s clear that both equities and property have produced attractive long-term returns.

Income

Investing in either property or equities can provide income.

Over the 12 months to 31 May 2023, A200 Australia 200 ETF , which invests in 200 of the largest companies by market capitalisation listed on the ASX, paid out a distribution yield of 6.5% plus franking credits. There are also a range of exchange traded products that aim to enhance the income from shares.

Property can also generate income, assuming it is occupied. In Sydney, houses offer an average gross rental yield of 2.8% p.a., while units offer 4.1% p.a. It’s a similar story in Melbourne, with houses offering an average gross rental yield of 3% p.a., and units offering 4.5% p.a5.

Maintenance and transaction costs

With property you must assume there will be yearly maintenance costs associated with repairs, upkeep, and upgrades. If you use a property manager, there will be costs associated with that too.

Other costs associated with starting your search and the initial purchase include search fees, pest and building reports, legal and conveyancing fees and stamp duty.

The maintenance costs for property can be unpredictable and can end up being quite high if something unexpected occurs.

With equities, depending on how you decide to invest, there may be transaction costs when you buy and sell, such as brokerage. In addition, if you are using an adviser or broker, there may be fees or costs for the advice and to manage the portfolio, which is usually calculated as a percentage of your portfolio value. If you use actively managed funds or exchange traded funds (ETFs) to obtain equities exposure, there will be management costs built into the price of those funds, though ETFs generally provide a cost-effective way to gain exposure to shares.

For example, A200 Australia 200 ETF offers exposure to a diversified portfolio of shares for as little as 0.04% p.a6.

Ability to enter the market quickly

Buying a property takes time.

It’s not easy coming up with the deposit needed to secure a mortgage. Usually, unless you put down at least 20% of the purchase cost, there will be likely be the additional expense of mortgage insurance. It can take years to save up for these costs – and then, of course, you take on the commitment of a mortgage payment that has to be made every month.

By contrast, if you are ready to invest in equities, you can get started with as little as $500, or even less (depending on your broker’s trading limits). All you need to do is open an account with a trading platform.

One of the easiest and most cost-effective ways to access equities is through an ETF. ETFs are funds that can be bought and sold on an exchange such as the ASX. Instead of buying shares in one company, ETFs allow you to get exposure to a basket of shares or other assets with a single trade.

Hands-on involvement

With equities, you can invest in companies run by some of the most influential people of our generation – Warren Buffett, Jeff Bezos and Mark Zuckerberg come to mind when thinking of founders of companies that dominate the globe and continue to grow and improve their business. As a shareholder, you can own part of these businesses without having to be involved in their day-to-day operations.

When investing directly in property there is greater hands-on involvement. You can take on becoming a landlord yourself – or you can hire a property manager, which reduces your workload but comes at a cost.

1. Leverage – This can be a big winner for investing in property. The most important figure for an investor is your return on investment. When you purchase a property, you usually borrow a substantial portion of the cost. Assuming you put down 20% of the value of the property, you are 80% leveraged. Therefore your returns (or losses) are magnified at a ratio of 4:1

Of course, you may be able to leverage your share portfolio to some extent, but far fewer share investors than property investors leverage their investment. This may be due to the potential for margin calls, which you don’t get with property. Share investment loans (known as margin loans) typically charge a higher interest rate than property loans.

2. Add value – You’ve no doubt heard the saying “buy the worst house on the best street” – the reason being that with a bit of TLC and hard work, through renovations, upgrades and additions, you may be able to add value to your property.

Two advantages of investing in equities

1. Diversification – whereas property investors typically invest in a very small number of assets, share investors can easily spread their money across a range of investments. ETFs make this even easier. ETFs enable you to easily diversify your portfolio without having to buy multiple companies across multiple sectors and asset classes. You can invest in many companies across a broad market or gain exposure to specific sectors or ‘themes’. By using ETFs, you can also obtain exposure to other asset classes, such as fixed income, commodities and currencies.

DHHF Diversified All Growth ETF is an all-in-one investment solution that provides low-cost exposure to a diversified portfolio comprising Australian, global developed and emerging markets equities, in a single ASX trade.

BGBL Global Shares ETF offers a convenient, cost-effective way to gain exposure to an index comprising approximately 1,500 companies across global developed markets (ex-Australia) for a management fee of just 0.08% p.a.7

2. Liquidity – ETFs are generally very liquid, meaning they can easily be bought or sold when the need arises. If you sell your units, the proceeds are generally available two business days later. This is a significant benefit if something unexpected comes up and you need to access your funds. Compare this to the time it takes from deciding to sell an investment property, to when you receive the proceeds of the sale. Plus, if you don’t need all your funds, you can’t just sell off a bedroom!

There’s more to investing than just returns

Investing doesn’t just come down to which asset class offers the best returns. You need to consider the risks associated with the asset, and your personal situation such as your goals, financial situation, risk appetite, and age.

Diversification across different asset classes is key. A healthy investment portfolio should contain an exposure to a range of different assets and geographies, which can include shares and property. Luckily, ETFs offer a convenient way for investors to build a diversified share portfolio while limiting transaction and management costs.

There are risks associated with investment in the Betashares Funds, including market risk and index-tracking risk, as well as international investment risk and currency risk (for DHHF and BGBL). Investment value can go up and down. An investment in a Betashares Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1. RBA cash rate target

2. New insights into the rental market

3. Please remember it is important you consider your own circumstances, relevant risks and seek appropriate advice.

4. The Federal Reserve Bank of San Francisco, The Rate Return of Everything. Page 22. Data compiled from multiple sources by paper’s authors. Refer to pages 1-3 of the paper for detail.

5. propertyupdate.com.au, Melbourne’s property market forecast for 2023 and beyond & Sydney property market forecast for 2023. Data current to May 2023.

6. Other costs, such as transaction costs, may apply. Refer to the Product Disclosure Statement, available on this website, for more information.

7. Other costs such as transaction costs may apply. Refer to the Product Disclosure Statement, available on this website, for more information.

This article mentions the following funds

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.

4 comments on this

Do you run a property ETF?

Hi Mike,

Betashares does not offer a dedicated property ETF, though Betashares Martin Currie Real Income Fund (managed fund) (ASX: RINC) does invest in A-REITs, among other real assets. The topic of discussion here though is residential property (vs shares), in particular, direct ownership of residential property for investment purposes.

Cheers,

Patrick

In the section above titled ‘potential for growth’ do the figures include costs? I assume not, because further below you say ‘Returns change further once gearing and costs are introduced into the equation’.

So how are the figures calculated, are they gross yields?

The costs related to property investment are much higher than shares

That’s right John, they are gross yields. And yes, costs can be high for property investment. They’re also highly variable though, so difficult to account for. They’re also not clearly disclosed in documentation like a PDS, making the task even more challenging.

There was some research done on this topic a long while ago, but it’s out of date now, so we chose not to include it.

Cheers,

Patrick