In 2022 the world passed a significant milestone, with investment in clean energy passing US$1 trillion for the first time.1

With significant investment in wind and solar, the question arises: What are the next big themes in sustainable investing?

This paper looks at five themes that will play out over coming years:

• energy storage

• electric vehicles

• critical minerals

• the future of food, and

• recycling and the circular economy.

Energy storage

Wind and solar can decarbonise electricity production, but come with the problem of intermittency. Intermittency refers to the fact that the output of wind and solar varies with weather conditions and time of day. There are limits to the percentage of energy in a grid that can be generated from variable renewables if the grid is to remain stable.

The solution to intermittency is storage. Energy storage fills the gaps when the sun doesn’t shine or the wind doesn’t blow. As we shut down coal-fired power stations and the build-out of wind and solar accelerates, the need for storage for grid stability and energy security will rapidly increase. There are a range of energy storage technologies, each with different characteristics and costs.

Pumped-hydro – pumped hydro is the dominant form of energy storage currently in operation. It involves pumping water uphill from one reservoir to another at a higher elevation for storage when power is cheap and in surplus, then, when power is needed, releasing the water to flow downhill through turbines, generating electricity on its way to the lower reservoir.

Lithium-ion batteries – because of its high energy density, the lithium-ion battery has become the dominant battery type used in electric vehicles (EVs)2, as well as being used for residential and commercial storage applications.

Redox flow batteries – while being less energy dense, a reduction-oxidisation (redox) flow battery has several advantages over a lithium-ion battery: safety (they don’t catch fire), greater capacity, lower cost and longer lifespan.

Synchronous condensers and flywheels – electrical grids need to operate at a predictable frequency. The inertia provided by rotating coal or gas turbines acts as a buffer against rapid changes in frequency. With the demise of coal and gas, frequency stability is provided by synchronous condensers (SC) and flywheels. Working together, SCs and flywheels provide short term storage and the immediate demand response required for frequency stability in renewables heavy grids.

Figure 1: Synchronous Condenser and Flywheel

Source: Andritz AG

Green hydrogen – hydrogen is the simplest of elements, and one of the most reactive. Green hydrogen can be produced from water using renewable energy and then used to power a fuel cell – which operates like a battery. While there is a lot of hype around green hydrogen, it has disadvantages for energy storage. Hydrogen has low energy density, and the round-trip efficiency of hydrogen storage is low, relative to alternative technologies.

Figure 2: Projected Cost of Energy Storage.

Source: Projecting the Future Levilized Cost of Electricity Storage Technologies, Joule Vol 3 Issue 1

As the percentage of wind and solar in our electricity grids increases, demand for energy storage and grid firming technologies will increase substantially, creating opportunities for thematic investors. ERTH Climate Change Innovation ETF invests in a range of companies providing energy storage solutions.

Electric vehicles

Predicting the future is not an easy task. In 2014 Forbes magazine published an article by the editor of AccurateAutoAdvice.com stating that electric vehicles (EVs) in general, and Tesla in particular, were not the future of autos3. Batteries were too expensive and hydrogen fuel cells were the more promising technology. He could not have been more wrong. In 2022 EV sales topped 7 million vehicles. Of those, 1.3 million were Teslas. An investment of $1,000 in Tesla shares at the beginning of 2014 was worth almost $45,000 at the end of January 20234.

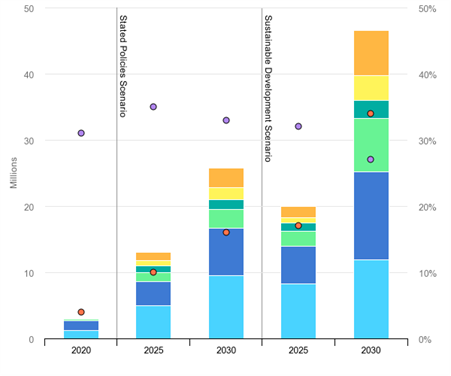

One in seven vehicles sold is now electric. Under its Sustainable Development Scenario, the IEA projects the global stock of EVs will reach 230 million vehicles by 2030, with annual sales of 46.8 million vehicles.5 Even this estimate could be conservative. Anecdotal evidence suggests the global waiting list for EV’s is more than 3.5 million vehicles with over 1.6 million pre-orders for the Tesla Cybertruck alone6.

Figure 3: EV Sales by Scenario

Source: IEA

The projected boom in EV sales will undoubtedly create opportunities for investors. Additionally, advances in vehicle autonomy and self-driving technologies will disrupt transportation and logistics, creating entirely new business models7. DRIV Electric Vehicles and Future Mobility ETF provides investors with exposure to companies producing EVs, charging infrastructure and self-drive technologies.

Critical minerals

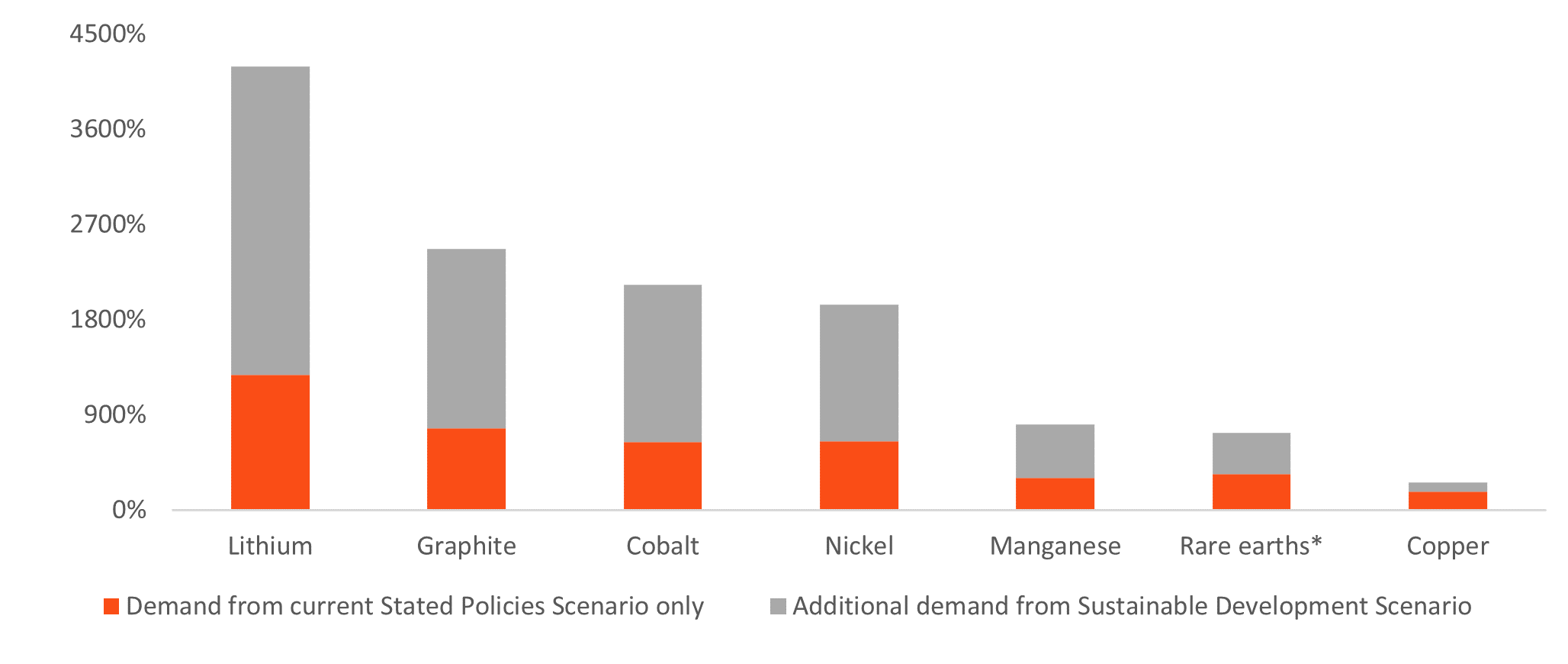

There is a familiar saying, “In a goldrush, sell shovels”. In any trend or upheaval, identifying the basic thing that everyone needs is the surest way to profit. In the transition to net-zero, those basic things are critical minerals such as lithium, cobalt, and graphite, and conductive metals such as copper, nickel and zinc.

Modelling by the International Energy Agency (IEA) based on its Paris Agreement-aligned Sustainable Development Scenario (SDS), indicates demand for lithium could increase by around 42 times by 20408.

Figure 4: IEA Estimates of demand for selected minerals

Source: Betashares, The Critical Minerals ‘Arms’ Race9

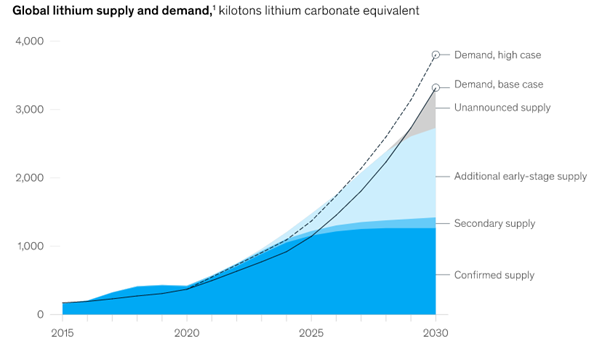

Much of the demand for lithium and critical minerals will come from rapidly increasing EV production. According to research by McKinsey & Co, demand for lithium-ion batteries could increase from approximately 600 gigawatt-hours in 2022 to 4,500 gigawatt-hours by 203010. There are currently plans to build 300 battery ‘gigafactories’11, which means demand for lithium and other critical minerals is likely to outstrip supply for many years.

Figure 5: Global lithium supply and demand

Source: McKinsey & Co: McKinsey lithium demand model12

XMET Energy Transition Metals ETF provides investors with exposure to a diversified portfolio of critical and conductive metals producers and refiners.

The future of food

Food systems account for around one-third of anthropogenic GHG emissions13. With the world’s population expected to increase to 9.7 billion people by 205014 we need to rethink our entire food system.

In 2013, the world’s first hamburger patty was created from cultured meat, but it cost over $300,000 to produce15. Today a cultured hamburger patty costs US$12 to produce and the cultured meat market has grown at over 48% p.a.16

Cultured meat uses a fraction of the resources of conventional meat, does not require the raising or slaughtering of animals, reduces land use by 99%, uses around 90% less water and produces 96% less GHG emissions17. According to US market research firm Grand View Research, the size of the cultured meat market is expected to grow from US$373 million in 2022, to US$6.9 billion in 203018.

The future of food is about more than just cultured meat. A revolution is occurring in farming technology including vertical farming, hydroponics and aquaponics, robotic tractors, drones, and the use of satellites. There are exciting advances in animal and plant nutrition which reduce the need for environmentally damaging chemicals and fertilisers, and developments in how we harvest, package and transport our food to be more sustainable and to reduce waste19.

Figure 6: Vertical Farming

Source: Agritech Tomorrow

IEAT Future of Food ETF provides investors with a diversified exposure to some of the most exciting names in emerging food technology.

Recycling and the circular economy

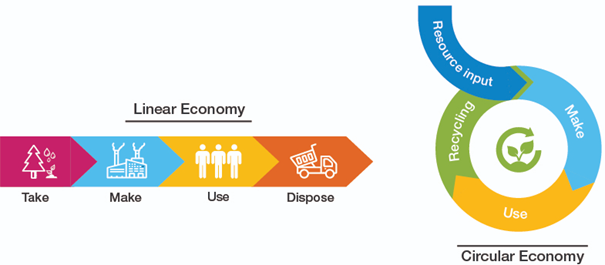

The world is realising that our current linear economy has a use by date. Our linear economy is one where resources are mined, transformed into products, used, and then discarded. Currently the world generates over two billion tonnes of municipal solid waste a year20.

Figure 7: Linear versus Circular Economy

Source: Locus Research

A circular economy is one that follows the principles of reduce, reuse, and recycle. Not only must our economy operate with limits in relation to available resources and how much pollution the planet can absorb, it should also provide minimum standards in education, healthcare and justice and equality.

The transition to net-zero may be the catalyst that pushes us towards a circular economy. Many of the technologies employed in clean energy are dependent on rare and expensive minerals. As demand for these materials increases (and depending on supply constraints), the cost of materials from recycling becomes relatively cheaper.

Recycling materials also has environmental benefits. A recycled aluminium can uses 95% less energy than one made from virgin materials21, while recycling of organic waste can prevent methane emissions, produce biofuels and divert waste from landfills22.

Conclusion

In 2022 wind and solar accounted for around 12% of total electricity production23. They have moved from an emerging to mainstream sector. As the focus shifts to other areas of sustainability, new technologies will emerge and new themes will arise, providing investors with opportunities to benefit from the shift to a more sustainable economy. Betashares provides investors with a range of impact and sustainability-themed investments which give investors diversified and cost-effective exposure to emerging themes in sustainable investing.

-

ERTH

Climate Change Innovation ETF

-

DRIV

Electric Vehicles and Future Mobility ETF

-

XMET

Energy Transition Metals ETF

-

IEAT

Future of Food ETF

Depending on the fund, risks may include market risk, international investment risk, sector risk, non-traditional index methodology risk and concentration risk. The funds mentioned should only be considered as a component of a diversified portfolio. For more information on risks and other features of the respective fund, please see the Product Disclosure Statement.

Betashares Capital Ltd (ABN 78 139 566 868 AFS Licence 341181) is the issuer of the Betashares funds. Read the Target Market Determination and PDS at www. betashares.com.au and consider with your financial adviser whether the product is appropriate for your circumstances. The value of the units may go down as well as up. The Fund should only be considered as a component of a diversified portfolio.

1. https://time.com/6250469/clean-energy-investment-sets-1-1-trillion-record-matching-fossil-fuels-for-the-first-time/

2. https://www.betashares.com.au/insights/spotlight-on-lithium/

3. https://www.forbes.com/sites/quora/2014/07/29/is-teslas-ev-the-future-of-autos-probably-not/

4. Source: NASDAQ and Betashares.

5. Source: https://www.iea.org/data-and-statistics/charts/global-ev-sales-by-scenario-2020-2030

6. Source: https://www.drive.com.au/news/tesla-cybertruck-orders-pass-1-6-million-report/

7. Source: RethinkX, Disruption, Implications, and Choices, August 2021

8. https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary

9. https://www.betashares.com.au/insights/critical-minerals/

10. https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-mining-how-new-production-technologies-could-fuel-the-global-ev-revolution

11. Source: https://chargedevs.com/newswire/over-300-battery-gigafactories-in-the-global-pipeline/

12. https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-mining-how-new-production-technologies-could-fuel-the-global-ev-revolution

13. https://ecbpi.eu/wp-content/uploads/2021/03/Nature-food-systems-GHG-emissions-march-2021.pdf

14. https://www.un.org/en/global-issues/population

15. https://www.labiotech.eu/interview/interview-mark-post-cultured-meat/

16. https://www.statista.com/chart/29615/global-revenue-of-meat-and-meat-substitutes/2

17. https://impakter.com/our-sustainable-future-lab-grown-meat/.

18. https://www.grandviewresearch.com/industry-analysis/cultured-meat-market-report

19. https://www.betashares.com.au/insights/sustainability-and-the-future-of-food/

20. https://datatopics.worldbank.org/what-a-waste/trends_in_solid_waste_management.html

21. https://recycling.world-aluminium.org/review/sustainability/

22. https://www.startus-insights.com/innovators-guide/recycling-technology-trends-innovation/

23. https://ember-climate.org/insights/research/global-electricity-review-2023/

Ex Suncorp, Russell Investments, QIC and Mercer. Past Director of the Investment Management Consultants Institute (IMCA) and Management Committee of the Investor Group on Climate Change (IGCC)

Read more from Greg.