6 minutes reading time

Market summary

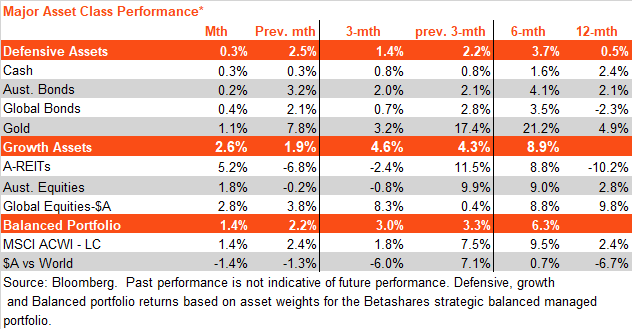

Both growth and defensive assets rose in April, with the latter outperforming the former due to moderate gains in both Australian and global equities.

Defensive assets

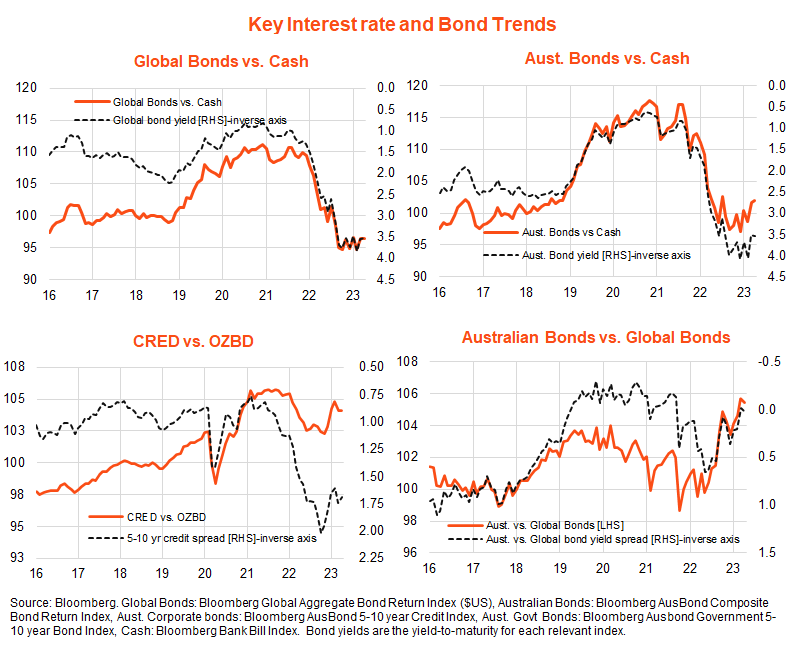

Broadly steady global interest rates – after steep declines in March – led to more muted gains from fixed-rate bonds last month. The yield on US 10-year government bond yields eased by only 0.05% to 3.43% in April, after a large 0.45% decline in March. The US market ended the month expecting one further 0.25% Fed rate hike in May, though two 0.25% rate cuts by year-end. The Bloomberg Global Aggregate Bond Index ($A hedged) returned 0.4% in April after a 2.1% gain in March.

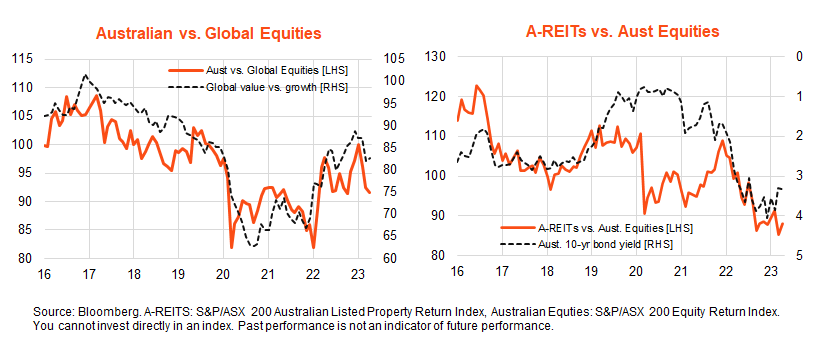

Australian 10-year bond yields rose by 0.04% to 3.34% over the month, with the market pricing in a modest risk of only one further rate hike this year. The Bloomberg AusBond Composite Index returned just 0.2% in the month after a solid 3.2% gain in March.

As evident in the chart set below, long-term bond yields appear to be bottoming out as central bank tightening cycles draw to a close. This has seen the performance of bonds relative to cash improve since late last year. Credit spreads have also narrowed with the recovery in equity prices from late last year. Australian bonds have tended to outperform global bonds, given the relatively less aggressive rate hikes expected from the RBA.

That said, after signalling a pause in rate hikes only last month, the RBA surprised markets with a further 0.25% rate hike in early May. It also retained a tightening policy bias, suggesting rates could rise at least once or twice more in the coming months.

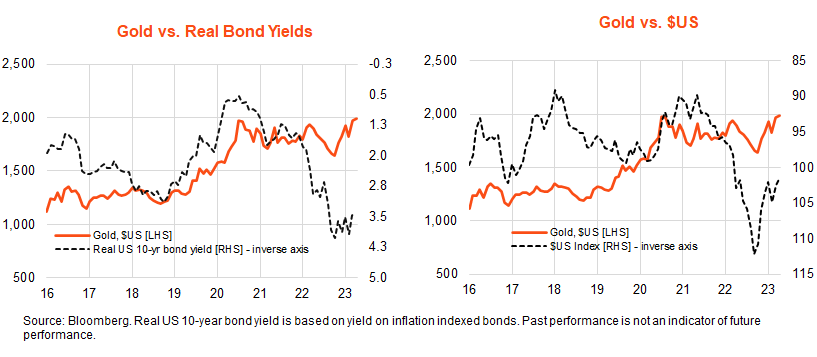

Also included among defensive assets, gold prices rose by a further 1.1% in April, after a strong 7.8% gain in March, supported by steady bond yields and a softer $US.

Growth assets

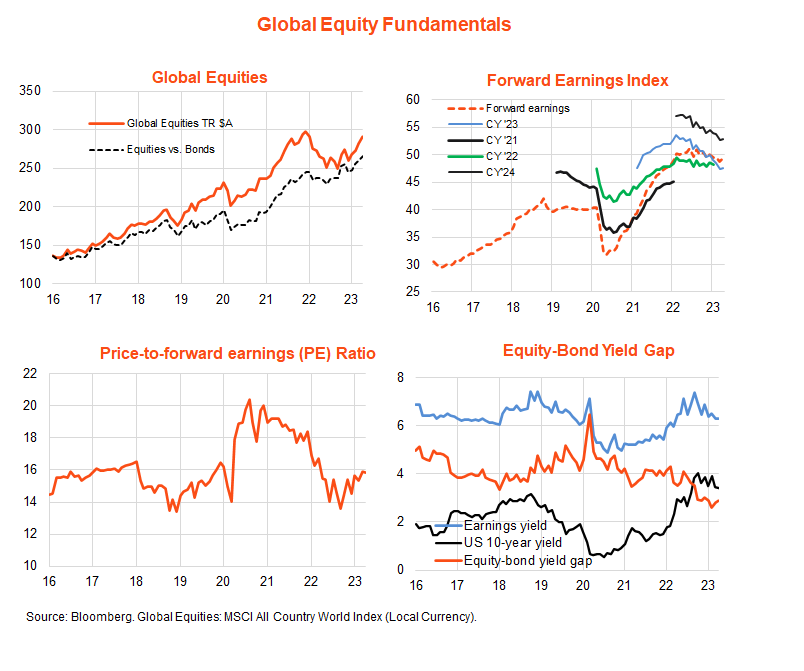

Steady bond yields and easing fears with regard to global banking instability supported equity valuations over April, while forward earnings rose modestly as earnings growth expectations remained relatively stable after recent declines.

In hedged terms, global equities rose by 1.4% after a 2.4% gain in March. Further weakness in the $A saw a stronger 2.8% gain in global equities on an $A or unhedged basis over the month after a 3.8% gain in March.

Despite a decline in forward earnings, global equities have generally performed better than global bonds since around mid-2022. That said, much of this relative performance has reflected a decline in the equity risk premium to below 3% compared with an average of just over 4% since the mid-2000s.

Australian equities returned 1.8% in April, after a 0.2% decline in March, modestly beating global equity returns (in local currency terms) – though, due to $A weakness, underperforming unhedged global equity returns. Australian equities have tended to underperform global equities in recent months due to the easing in bond yields and improved sentiment towards growth over value stocks.

The volatility in listed property returns continued in April, with a solid 5.2% bounce back after a 6.8% decline in March. While the easing in bond yields would ordinarily support property, relative performance is being held back by concerns over rising office vacancy rates and whether valuations have yet to fully reflect the rise in bond yields over the past year.

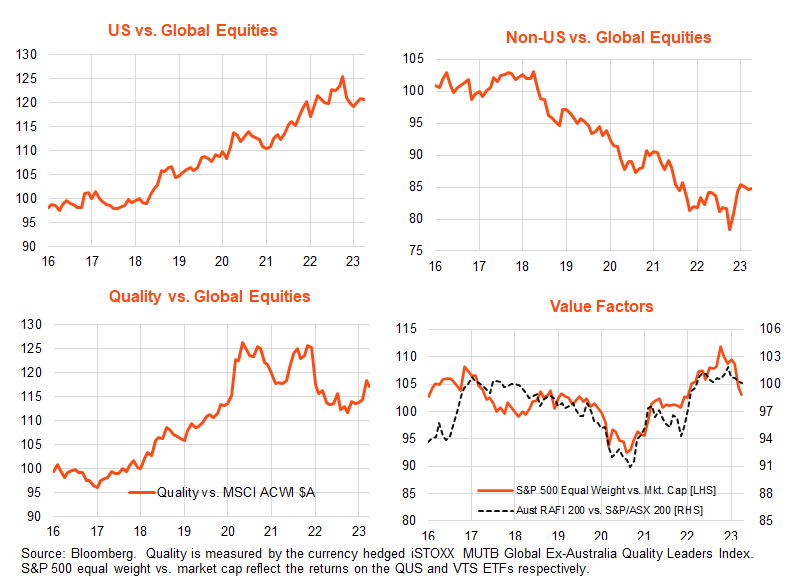

As with Australian equities, ongoing global soft landing hopes and easing bond yields have improved sentiment towards global growth stocks over value in recent months. This has seen relatively improved performance by US equities over non-US equities.

By factor, the relative performance of global quality (as tracked by the HQLT ETF) has also improved since late last year, while that of more value-orientated exposures – such as the S&P 500 equally weighted index (QUS ETF) and the fundamentally weighted Australian equity ETF (QOZ) – has eased.

Outlook

Whether or not the US economy can pull off a soft landing remains the critical driver of global market trends. Prior to the recent increase in global banking instability, renewed fears of an overly strong US economy were beginning to outweigh hopes of a soft landing that had been in place since around October last year.

Banking instability has now revived hopes of a soft landing, if only because it suggests the Fed will hike rates by less. So far, markets have taken the recent failure of First Republic Bank in the US fairly well as depositors at least have been protected due to its ‘shotgun sale’ to JP Morgan. But given the ongoing pressure on the deposit base of US small to medium-sized banks, further consolidation of the banking sector and tightening in credit conditions seems likely.

All up, however, the critical question for equity markets remains whether a soft landing will be enough to tame US inflation- because otherwise, if banking instability and associated credit tightening do not cause a recession, then the Fed surely will.

We remain in a state of flux. While some US indicators – such as weakness in manufacturing and very inverted yield curves – point to impending recession, underlying consumer spending and employment demand remain robust. And while goods and increasing housing-related areas of inflation have eased, non-housing service sector prices along with wages remain fairly robust.

My base case still errs towards stubbornly high US wage and price inflation and so an eventual US recession – caused by a tightening in lending conditions and/or aggressive further Fed rate hikes. Indeed, history suggests it will be hard to get US inflation sustainably lower without a material weakening in the still very tight labour market.

The resilience of the US economy and the degree of monetary tightening required to get this hard landing, however, will determine whether we need to go through a ‘no landing’ scenario before we get there.

Further information on the complete range of Betashares exchange traded products can be found here.