7 minutes reading time

Bitcoin has come a long way since its 2009 debut. Once a niche idea debated by tech enthusiasts, it’s evolved into a trillion-dollar asset class, drawing interest from both everyday investors and major institutions.

Bitcoin investing is not for everyone, as it comes with extreme levels of volatility. For many of those investors who can tolerate the risk, the growth potential of investing in Bitcoin is appealing, but the process can be overwhelming. Managing digital wallets, securing private keys and navigating cryptocurrency exchanges can leave even experienced investors feeling uncertain.

But what if there was a simpler, more convenient way to access Bitcoin’s potential?

Bitcoin ETFs offer an investment vehicle that strips away much of the complexity, while opening the door to a regulated and transparent way of gaining exposure to the performance of Bitcoin. Let’s explore why ETFs might just be the better way to invest in Bitcoin.

What is Bitcoin and why does it matter?

At its core, Bitcoin is a decentralised digital currency that allows peer-to-peer transactions without the need for intermediaries like banks. Built on blockchain technology, it’s powered by a distributed network of computers, ensuring transactions are recorded transparently.

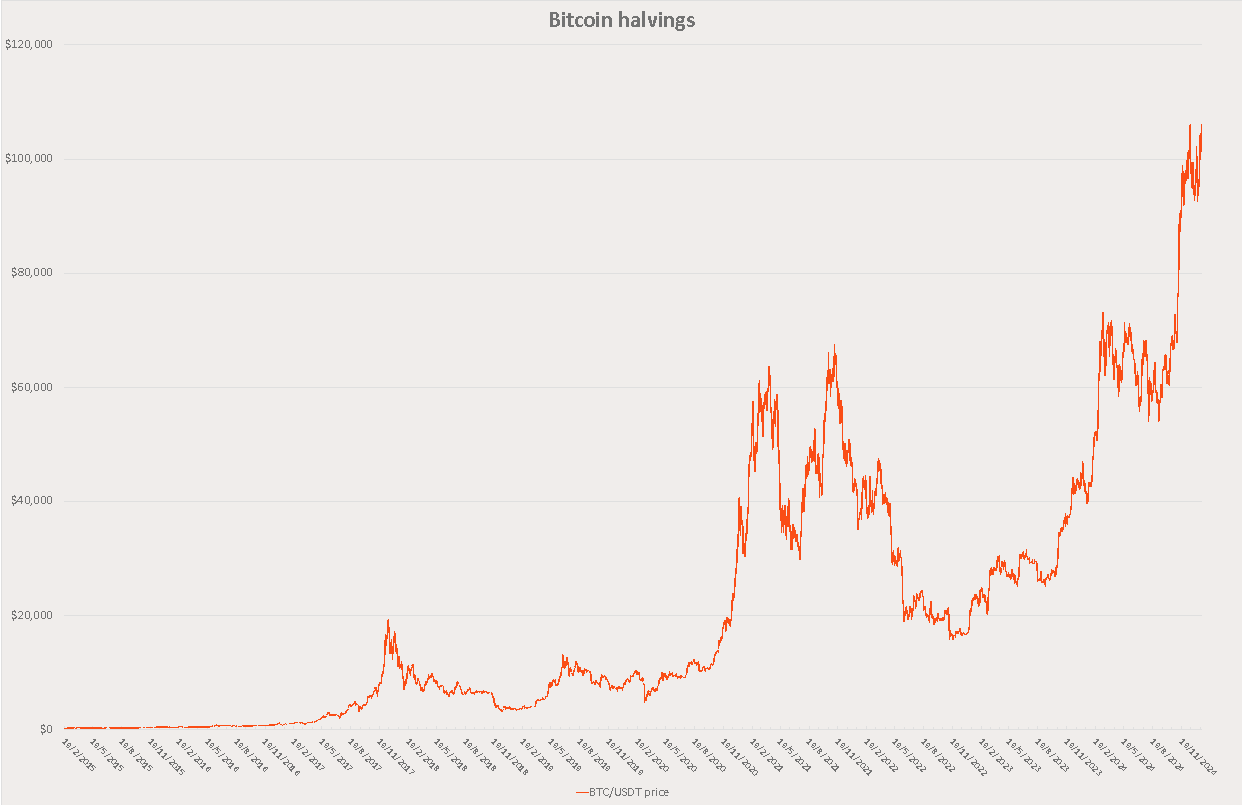

Bitcoin has seen dizzying highs and gut-wrenching lows – reaching an all-time high in 2024 but experiencing extreme volatility along the way. Between 2012 and 2023, Bitcoin was the top performer among major asset classes in seven out of 10 years. But in the three other years, it was the worst performer, with drawdowns of 57.5%, 73.8% and 64.3% in 2014, 2018 and 2022 respectively1.

Source: Bloomberg, Betashares. As of 3 March 2025. Past performance is not an indicator of future performance.

Bitcoin’s capped supply of 21 million coins is one of its standout features, sometimes drawing comparisons to precious metals as a store of value2.

Additionally, its periodic ‘halvings’ – events that halve the number of new coins introduced into circulation for each ‘block’ that’s mined – have historically influenced its price, often triggering significant upward momentum.

![]()

![]()

![]()

Halving – 11/5/2020. Price: USDT 8560

Halving – 19/4/2024. Price: USDT 63,816

Halving – 9/6/2016. Price: USDT 652

Source: Poloniex Exchange Data via cryptodatadownload.com (data), Betashares (chart). As at 22 January 2025. USDT used as proxy for US Dollar. Past performance is not an indicator of future performance.

Why consider an ETF for Bitcoin?

Investing in Bitcoin directly can be complex and challenging, often requiring navigation through unfamiliar platforms for buying and selling – many of which have emerged in recent years, with some, like Sam Bankman-Fried’s FTX, collapsing just as quickly.

However, a Bitcoin ETF, traded on a traditional exchange like any other ETF, offers a more convenient alternative. Here are three key reasons to consider investing in a Bitcoin ETF:

- Ease of access: Investing in a Bitcoin ETF is as straightforward as buying shares on the ASX. You don’t need to worry about setting up a digital wallet, remembering private keys or navigating cryptocurrency exchanges. It’s Bitcoin investing made simple.

- Regulation: Unlike cryptocurrency trading platforms, which can be subject to varying levels of regulation, Bitcoin ETFs are regulated like any other ETF..

- Transparency: With a Bitcoin ETF, you benefit from transparent valuation. The net asset value (NAV) of any ETF, including one tracking the price of Bitcoin, is published daily on the product issuer’s website, along with the amount of Bitcoin held per unit.

Introducing the Betashares Bitcoin ETF (ASX: QBTC)

QBTC Bitcoin ETF provides Australian investors with a simple way to access Bitcoin’s potential. Here’s how it works:

- Exposure to the price of Bitcoin: QBTC aims to track the price of Bitcoin (before fees and costs) in Australian dollars by investing in the NYSE-listed Bitwise Bitcoin ETF (NYSE: BITB). Bitwise is the largest crypto index fund manager in the US.

- Professional custody and cold storage: The underlying Bitcoin is held by an institutional-grade digital asset custodian primarily in ‘cold storage’, meaning it’s stored offline.

- Key benefits: With QBTC, you enjoy all the convenience of ETF investing, along with the benefit of transparent valuation and holdings.

How Bitcoin ETFs can fit into an investment strategy

Bitcoin ETFs can offer a number of advantages as part of a diversified portfolio:

- Diversification: Bitcoin has historically had relatively low correlation to traditional asset classes such as shares and bonds1.

- Inflation hedge: With its fixed supply and growing institutional adoption, Bitcoin has been viewed as a hedge against inflation and fiat currency debasement2.

- Potential satellite allocation: Investors with an extremely high tolerance for risk who are seeking capital growth from Bitcoin could consider a very small portfolio allocation (5% or less) via a cryptocurrency ETF.

Bitcoin represents an exciting opportunity for investors comfortable with the risk, but navigating the complexities of direct investment can be challenging. A Bitcoin ETF like QBTC removes many of these hurdles, offering a regulated and transparent way to access Bitcoin’s potential.

If you’re considering adding Bitcoin exposure to your portfolio, QBTC provides a smart way of gaining exposure to the world of digital assets.

Bitcoin is an extremely high volatility investment. QBTC is suitable only for investors who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment, as a very small portfolio allocation.

Important Information

An investment in QBTC should be considered extremely high risk and should only be considered by informed investors seeking a very small allocation (5% or less) to an extremely high volatility investment.

Bitcoin is subject to certain risks not associated with traditional asset classes such as equities. It is supported by new technologies and traded and valued in largely unregulated markets. Bitcoin is not backed by any government or central bank and could have little or no value in the future. There are risks associated with an investment in QBTC including volatility risk, digital asset price risk, currency risk, political, legal and regulatory risk, immutability risk and digital asset custody risk. An investment in the QBTC is not suitable for all investors and should only be made by investors who fully understand the features and risks of Bitcoin or after consulting a professional financial adviser, and who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

For more information on risks and other features of the Funds, please see the relevant Target Market Determination (TMD) and Product Disclosure Statement, available at www.betashares.com.au.

Footnotes:

1. Bloomberg ↑

2. https://www.forbes.com/sites/digital-assets/article/how-does-crypto-help-hedge-against-inflation/ ↑

Sources:

1. Christopher Gannati CFA, WisdomTree Research, Dynamic Correlations: Bitcoin vs. Other Asset Classes

2. Marion Laboure, Deutsche Bank, https://www.db.com/what-next/digital-disruption/dossier-payments/i-could-potentially-see-bitcoin-to-become-the-21st-century-gold

3. Bloomberg

4. Dave Birnbaum, Forbes, 15 Feb 2025, https://www.forbes.com/sites/digital-assets/article/how-does-crypto-help-hedge-against-inflation/

5. Bloomberg