This information is for wholesale client use only.

We often look to ETF flows as a gauge on how investors are positioning portfolios. The US ETF market, which is larger and has higher portion of institutional investors, can be particularly insightful for Australian investors. At the moment there are 2 trends we wanted to share:

1. US investors increasing allocations to fixed income, and seeking efficient exposure to the asset class

Over the past 12 months there has been a significant increase in net flows to fixed income ETFs. In previous years ‘core’ fixed income ETFs, those that typically invest across a broad range segments, issuers and maturities, have seen the greatest share of flows in the fixed income category. However, this year we have seen investors using more focussed fixed income ETFs seemingly with the aim of gaining more targeted outcomes.

iShares TLT, a 20+ year US Treasury Bond ETF, has seen US$20b net inflows over the past 12 months in the US, US$5b greater than the next closest fund. Sophisticated investors, like institutions, use TLT to add efficient exposure to duration in portfolios. In layman’s terms, an ETF’s duration is the price sensitivity of the portfolio to expected interest rate movements. TLT’s underlying portfolio of fixed rate and long-dated bonds has 17.17yrs of duration (as at 25 May 2023) which is much higher than typical bond funds. For example, iShares IEF (ranked 4th for inflows below) holds US treasuries with a maturity of 7 to 10 years and has a portfolio duration of 7.5yrs (As at 25 May 2023), meaning investors would have to buy more than twice as much IEF compared to TLT to add an equivalent amount of duration to their portfolio. This means investors are to allocate a smaller amount of capital to TLT to achieve similar defensive outcomes to portfolios.

Investors have been re-adding duration to portfolios in anticipation of the ending of the US rate hiking cycle and to seek defensive properties in the event of an economic slowdown or recession, which would likely lead to a repricing lower of expected interest rates. Historically, under this scenario long duration fixed income exposures have tended to provide the best diversification for equities.

In Australia GGOV U.S. Treasury Bond 20+ Year ETF – Currency Hedged provides exposure to 20+ year US treasuries with portfolio duration of 16.26yr (As at 25 May 2023), a similar exposure to TLT.

Australian investors may also look to AGVT Australian Government Bond ETF . AGVT targets Australian government bonds with a maturity of 7 to 12 years and has a portfolio duration of 7.86yrs (As at 25 May 2023). This compares favourably to the broader Bloomberg AusBond Composite 0+yr Index, which stands at 5.26yr portfolio duration, for investors looking to efficiently add duration to portfolios.

Chart 1: US Fixed Income ETF Flows (US$m)

Source: EFTDB as at 25 May 2023

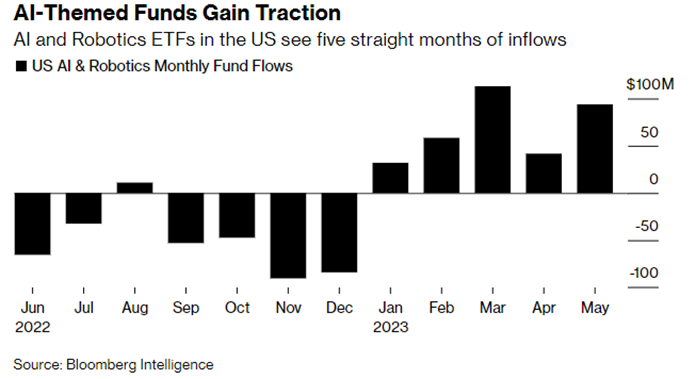

2. AI-Themed ETFs picking up traction

Whilst flows into thematic ETFs have been relatively mute this year, especially compared to 2020 and 2021, investors looking to capitalise on the emergence of artificial intelligence (AI) have started flocking to the related ETFs. The 14 US listed ETFs with ‘Artificial Intelligence’ in their description have taken in US$338m this year so far. Almost half of these flows went to Global X’s US-listed BOTZ ETF.

The public launch of ChatGPT last year gave investors a firsthand insight into the capabilities of language-based models which represent just a fraction of AI’s use cases. Since then, investors have looked to gain exposure through the companies they believe are set to enable and benefit from the structural shift to a more AI facilitated future. Nvidia, who are a leader in the manufacturing process for chips that underpin most AI applications, last week forecast it’s Q2 2023 sales will hit US$11bn on the back of AI driven demand. This was 50% higher than the analyst consensus estimated, and Nvidia’s share price soared on the news.

RBTZ Global Robotics and Artificial Intelligence ETF provides exposure to the leading companies in Artificial intelligence globally and tracks the same index as the US-listed BOTZ. RBTZ’s top holding is in NVIDIA (as at 26 May 2023).

-

GGOV

U.S. Treasury Bond 20+ Year ETF – Currency Hedged

-

AGVT

Australian Government Bond ETF

-

RBTZ

Global Robotics and Artificial Intelligence ETF

There are risks associated with an investment in the funds mentioned in this article, including :

- For GGOV and AGVT: market risk, index tracking risk, interest rate sensitivity risk, credit risk, country risk, and currency hedging risk.

- For RBTZ: concentration risk, robotics & artificial intelligence companies risk, smaller companies risk, and currency risk.

An investment in the funds in this article should only be considered as a part of a broader portfolio, taking into account the investor’s particular circumstances, including their tolerance for risk. For more information on risks and other features of these funds, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

This information is for wholesale client use only. It is not intended for retail clients. Betashares Capital Ltd (ACN 139 566 868 AFS Licence 341181) (“Betashares”) is the issuer.

This is general information only and does not take into account any person’s particular circumstances. It is not a recommendation to make any investment or adopt any particular investment strategy. You should make your own assessment of the suitability of this information.

Future outcomes are inherently uncertain. Actual outcomes may differ materially, positively or negatively, from those contemplated in any views, opinions, estimates, projections or other forward-looking statements given in this document. Readers must not place undue reliance on such statements. Betashares does not undertake any obligation to update forward looking statements to reflect events or circumstances after the date such statements are made or to reflect the occurrence of unanticipated events.

The author’s views do not necessarily reflect those of Betashares and are subject to change without notice.

Any past performance information shown is not indicative of future results.

To the extent permitted by law Betashares accepts no liability for any loss from reliance on this information.

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from .