ETF distributions: frequently asked questions

6 minutes reading time

Humans have been using gold for thousands of years, but even in the 21st century, the precious metal retains its relevance.

Demand for gold today comes from technology, bars and coins, central banks, and exchange traded products. But the biggest source of demand is jewellery.

Even the James Webb Space telescope famously coated its mirrors in gold – though it used just 48 grams to cover its 18 massive primary mirror sections.

Sources of gold demand

Sources: Metals Focus, World Gold Council. Data to 31 March 2023

Gold as an investment

Gold has a reputation as a hedge against inflation, but the data doesn’t necessarily back this up over timeframes that would be relevant to most investors. Some studies have found that gold only appears to be effective as an inflation hedge over very long timeframes – i.e. hundreds of years.1

One thing gold historically has shown though is a low correlation with other asset classes. Since 2000, US dollar gold has exhibited a correlation of just 0.045 with US equities, and 0.139 with global equities. A correlation of 1 means that the assets move in perfect unison, 0 means that they have no correlation at all, and -1 means that their movements are perfectly inverse.

A low correlation between assets can help to improve portfolio diversification, as it means that everything should not rise or fall at the same time, smoothing out the ride for the investor. This is one of the reasons that many investors include both shares and bonds in their portfolio, as they typically have a low correlation with each other.

The chart below shows the correlation between gold (priced in US dollars) and several major asset classes and indices.

Gold correlations

Sources: World Gold Council, Bloomberg, COMEX. Correlation based on weekly data from 31 December 1999 to 19 May 2023.

Gold has also produced respectable longer-term returns for investors, producing an average annual return of 9.3% since 2000.2

Importantly, these returns have often come during periods of share market upheaval. In 2002 and 2003, when the dotcom bubble was bursting, gold returned 24.8% and 19.4% respectively. In 2007, 2008, and 2009, during the global financial crisis, gold returned 31%, 5.8%, and 24.4% respectively. And in 2020, when the world was in lockdown, it returned 25.1%.3

But past performance is not an indicator of future performance. So what might drive demand for gold from here?

1) Economic uncertainty

Gold is commonly seen as a ‘safe-haven’ asset during times of economic instability or market volatility. In a recent survey conducted by Bloomberg4, 52% of professional investors selected gold as their number one investment choice should the US government hit the debt ceiling. Unlike US treasuries, gold is a tangible asset that does not rely on the stability of the US government.

Whether or not the current debt ceiling issues are resolved, the impacts of the US Federal Reserve’s rate hiking cycle are starting to weigh on the US economy. This may be creating a supportive environment for investor demand for gold.

2) Strength (or weakness) in the US dollar

Gold historically has been used to hedge against a weakening US dollar. As mentioned above, gold’s value does not rely on the performance or stability of the US government, hence it arguably can be seen as the ‘currency of last resort’.

The sell-off in the US dollar between September 2022 and January 2023 created an attractive environment for gold. If the US Federal Reserve were to pause or start cutting interest rates prior to other major central banks, we might see further US dollar weakness in the second half of 2023.

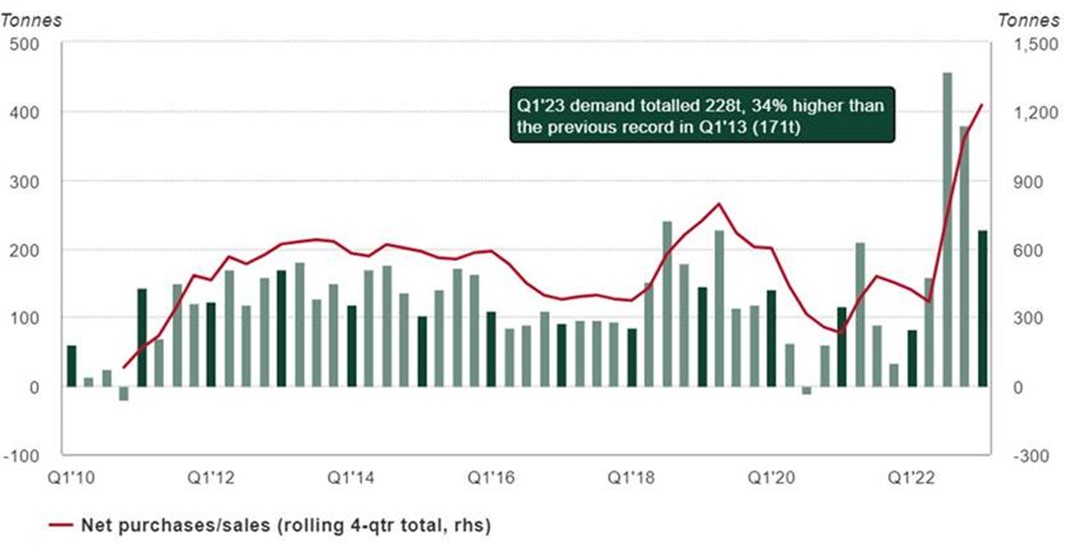

3) Central bank demand for gold

In the wake of Russia’s invasion of Ukraine, the US imposed crippling financial sanctions on Russia. As the world’s reserve currency, the US dollar gives the US enormous leverage on the global stage.

Global central banks, particularly those in emerging market countries such as China, India and Turkey, have been buying record amounts of gold. For countries that export more than they import, gold is an asset that allows them to diversify their reserves away from US dollars and treasuries, which may reduce the US government’s ability to exert political or financial pressure on them. If this is a government’s objective, there seem to be few (if any) practical alternatives to increasing their investment in gold.

According to the World Gold Council, aggregate central bank purchases reached a new Q1 record this year, following a record-breaking year in 2022. This central bank buying may continue to drive overall demand for gold throughout 2023.

Quarterly Aggregate Central bank gold buying: 1 Jan 2010 – 31 Mar 2023

Sources: Metals Focus, Refinitiv GFMS, World Gold Council, as at 31 March 2023.

How to gain exposure to US dollar gold

QAU Gold Bullion Currency Hedged ETF is physically backed by gold bullion held in a segregated account with a third party custodian.

It is the only currency-hedged gold ETF currently available in the Australian market, meaning it offers exposure to the US dollar gold price rather than the Australian dollar gold price. If the US dollar gold price rallies at a time of US dollar weakness, Australian investors with unhedged gold exposure may find their investment returns partially or entirely eroded in Australian dollar terms.

References:

1. Forbes, Is Gold An Inflation Hedge?

2. Bloomberg, Betashares. Average annual gold price returns for 2000-2022.

3. Bloomberg, Betashares.

4. Bloomberg Markets Live Pulse Survey, Bloomberg Markets Live Pulse Survey, based on survey with 637 respondents carried out 8-12 May 2023.Debt-Limit Default Risk Is Higher Than Ever. How Can You Safeguard Your Wealth?