The benefits of a Dividend/Distribution Reinvestment Plan (DRP) cannot be overstated. For investors, particularly those with a long-term investment horizon, it could mean the difference between working until you’re 70 or retiring earlier in a strong financial position.

A DRP is a great tool to help investors achieve a range of investment outcomes, including:

- earning compounding returns

- accumulating ETF units, typically for no commission, and

- smoothing out cost price.

What is a DRP?

A DRP is a plan offered by a company or ETF manager that allows you to automatically reinvest your cash dividends/distributions in additional shares of the company or units in an ETF. DRPs are typically commission-free – generally there is no brokerage or other transaction costs payable to acquire additional shares or units.

Of course, participating in a DRP means you do not receive a cash distribution; however, DRP can truly be seen as a case of short-term pain for long-term gain, as I will illustrate below.

You may have the option of participating fully in a DRP, where 100% of your distributions are reinvested, or partially, where a portion is reinvested, and the remainder is paid in cash.

The difference of DRP - DRP in action

“Compound interest is the eighth wonder of the world,” Einstein reportedly said. “He who understands it, earns it. He who doesn’t, pays it.”

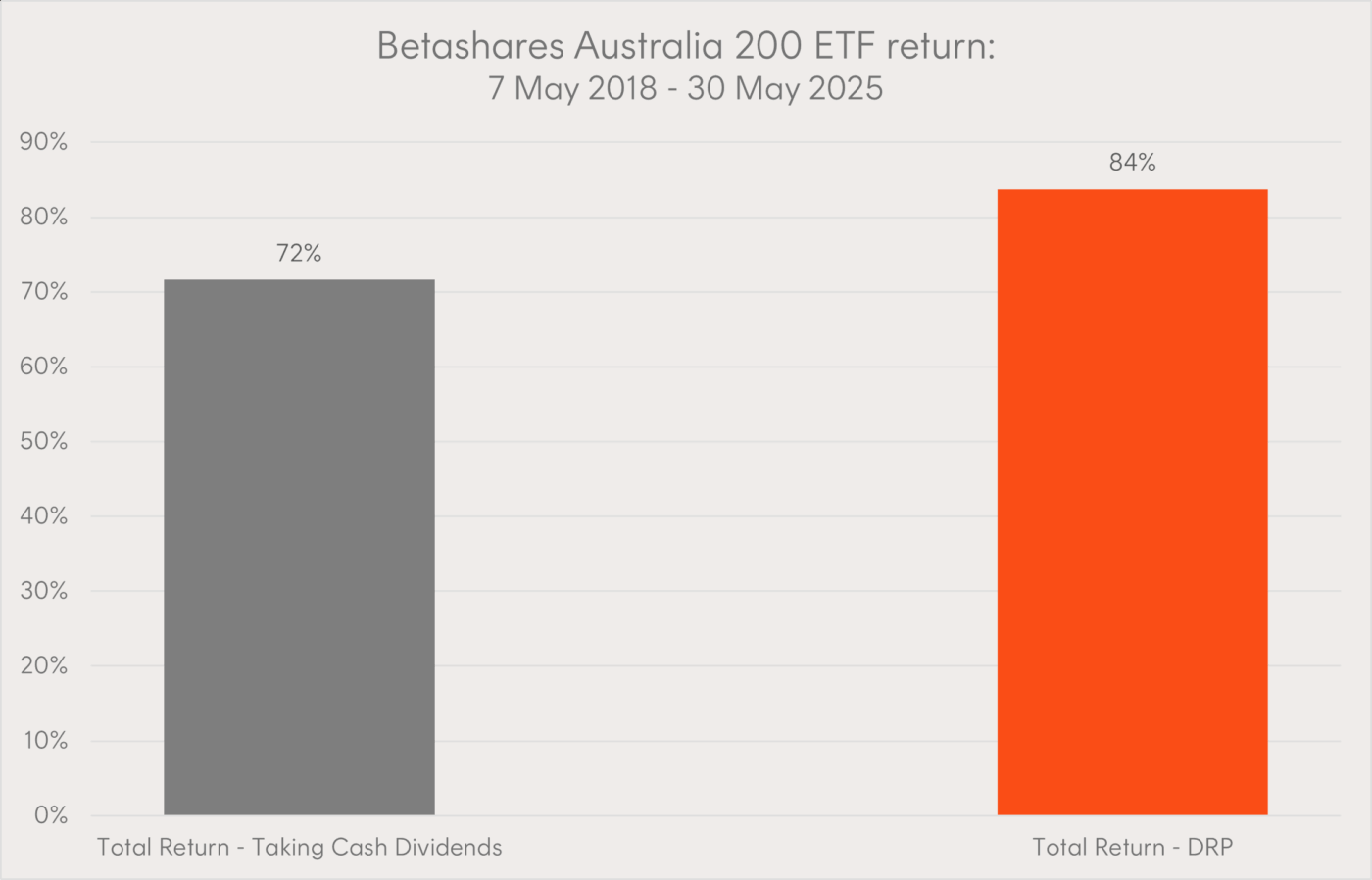

In the below chart, which is a hypothetical example provided for illustrative purposes only, you can see the powerful compounding effect that reinvesting dividends can achieve. It shows the returns of the Betashares Australia 200 ETF (ASX: A200) since its inception on 7 May 2018 (net of A200 fees and costs), for:

- an investor who participates fully in a DRP, and

- an investor who takes their dividends in cash.

Source: Bloomberg. Hypothetical example provided for illustrative purposes only. Past performance is not indicative of future performance any index or ETF. Not a recommendation to make any investment or adopt any investment strategy. Inception date of A200 is 7 May 2018.

The investor who participated fully in the DRP would have achieved a return of ~84% over the 7 year period on their investment, compared to a ~72% return for the investor who took their dividends in cash.

To put it in dollar terms, a $10,000 investment made at the start of the relevant period would have been worth $18,375 as at 30 May 2025 with DRP, compared to $17,161 with cash dividends. This compounding effect becomes exponential as market’s generally appreciate, meaning the difference generally becomes greater over time.

For simplicity, this hypothetical example assumes the cash dividends that were not reinvested in A200 were not deposited in a savings account (that may have paid interest) or invested in other asset(s) that may have generated a positive return over the relevant period.

Achieving compounding returns

The process of reinvesting distributions generates additional returns over time. These returns occur because your investment will generate returns from both the initial principal and the additional units you receive at each subsequent distribution payment date.

Compounding, therefore, differs from linear growth, where only the principal earns distributions each period. Put in simpler terms, the additional units in the ETFs you accrue on each payment date will in turn earn more units in the ETF at the next distribution payment date.

Accumulating commission-free ETF units

Smoothing out cost price

Things to remember

Tax implications

It is important to understand that electing to participate in a DRP or taking a cash distribution will generally not affect your tax outcome. In both instances, the amount of the distribution will generally form part of your taxable income.

If you participate in a DRP, be sure to keep a record of the acquisition price and date of the units you receive. You will need these details to calculate your capital gain or loss, should you ultimately dispose of these units.

Managing your DRP participation

All Betashares ETFs have a DRP available. Please see below to learn how you can switch it on and reap the potential benefits if you are investing outside of Betashares Direct.

You are able to opt into or out of a DRP via MUFG Corporate Markets once you are a registered unitholder (three days after you purchase the units).

Please see below for the step-by-step process to register your holdings and manage your DRP participation.

1. How to access the Investor Centre online

Please have the following information before accessing the website:

- HIN/SRN – This can be found through your investment portal or by contacting MUFG Corporate Markets on 1300 554 474.

- Bank Account Details (BSB and account number)

- Tax File Number or Australian Business Number (TFN/ABN)

2. How to log in

- Visit au.investorcentre.mpms.mufg.com/ and click on “Investor Login”

- Go to “Single Holding” and in the Issuer Name field, enter “BETA” or “Betashares”

- Enter your Securityholder Reference Number (SRN) or Holder Identification Number (HIN). Please note, if not already displayed as such, the HIN should start with an ‘X’ before the numerals.

- Enter your postcode (or, if your registered address is overseas, select Outside Australia)

- Type in the “Security Code” displayed on the screen

- Click on the box to accept the terms and conditions and then click “Login”

Note you may also log in using your “portfolio login”, if you have previously established one with MUFG Corporate Markets.

3. How to participate in the DRP

Go to Payments & Tax in the menu

- Select “Reinvestment Plan” (or “DRP” if accessing via mobile) to manage your participation in the Distribution Reinvestment Plan. Joint holders will need to print, complete and return the form available online.

DRP with Betashares Direct

Alternatively, if you invest through Betashares Direct you can simply opt into distribution reinvestment within the app. This will automatically reinvest distributions paid into your wallet from your ETF holdings.