9 minutes reading time

At a glance

- Asia is home to key manufacturers crucial to the global AI supply chain.

- Nvidia pays ~US$10 billion for TSMC to manufacture their AI accelerator chips.

- Chinese consumer technology companies are integrating their own AI models within core business segments.

Many investors would be familiar with the Magnificent 7 megacap tech stocks given they have collectively been the largest driver of US equity returns in recent years, for good reason.

These companies are pioneering the AI race with billions of dollars being spent on data centres to provide the infrastructure required to train the latest foundational LLMs (large-language models) such as OpenAI’s ChatGPT and Google’s Gemini.

But the AI ecosystem is much broader than just these seven companies.

“If Nvidia’s chips are being bought by the hyperscalers including the likes of Microsoft, Meta, and Amazon, then who are manufacturing Nvidia’s chips and where are they located?”

In this note, we take a ‘trip’ around Asia to put a spotlight on some of these companies and highlight their importance within the semiconductor supply chain, and how they are building the next generation of LLMs, electric vehicles and robots.

Made in Taiwan

Company spotlight: Taiwan Semiconductor Manufacturing (TSMC)

TSMC is a leading contract chip manufacturer based in Taiwan that fabricates (or builds) semiconductor chips based on designs provided by other companies such as Nvidia. This model has allowed TSMC to refine its manufacturing capabilities over time and become the world’s leading foundry for AI accelerator chips, such as Nvidia’s Blackwell B200.

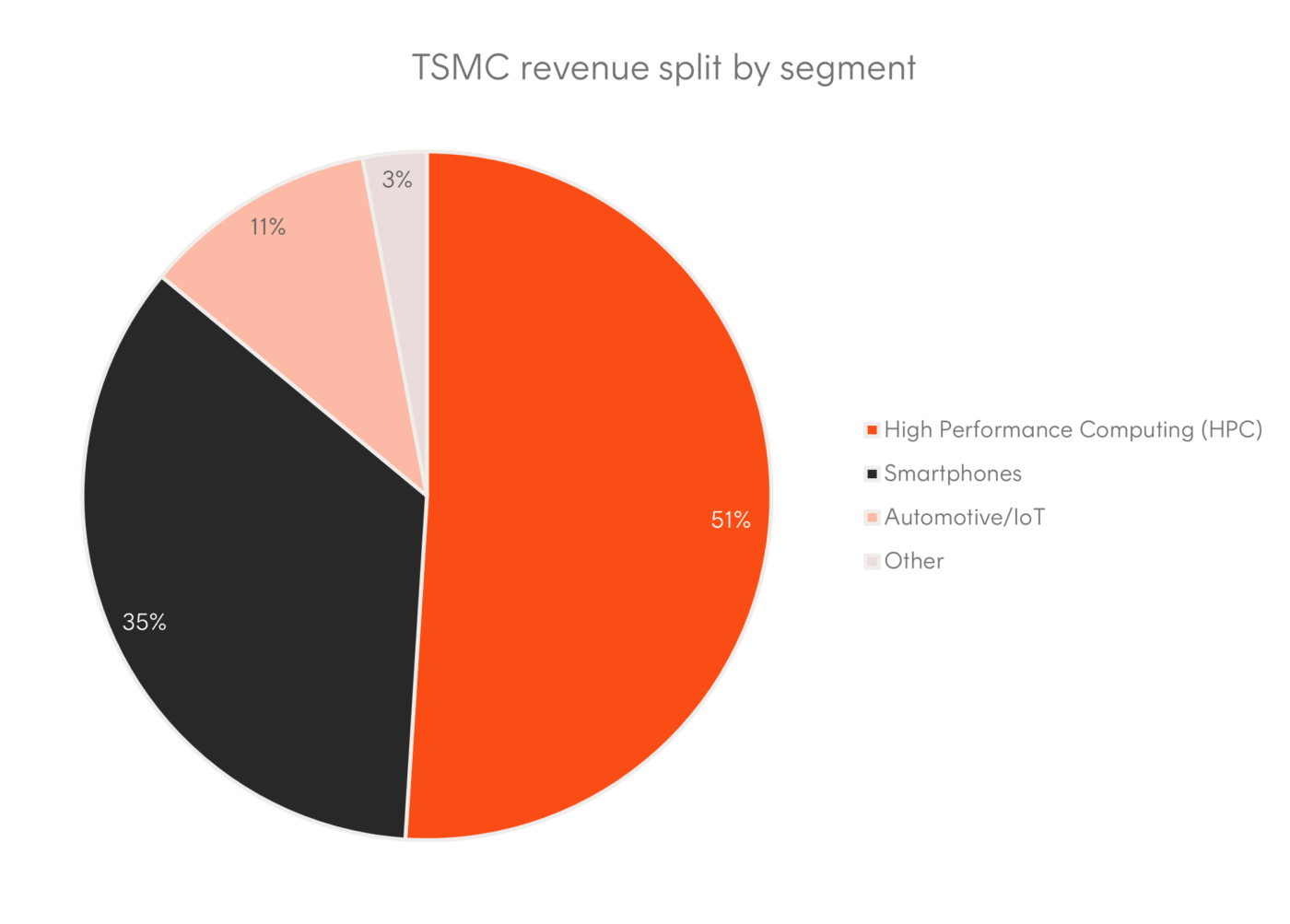

That’s helped TSMC generate more than half of its net revenue (51%) from high-performance computing (HPC) whilst smartphones’ share of net revenue has declined gradually over recent years to 35%[1] (as at the end of 2024).

That is not to say smartphone sales have shrunk but rather the immense demand for HPC has significantly outstripped growth in TSMC’s smartphone segment.

Source: TSMC Annual Report 2024.

As the AI infrastructure build out continues, TSMC will likely remain a key beneficiary.

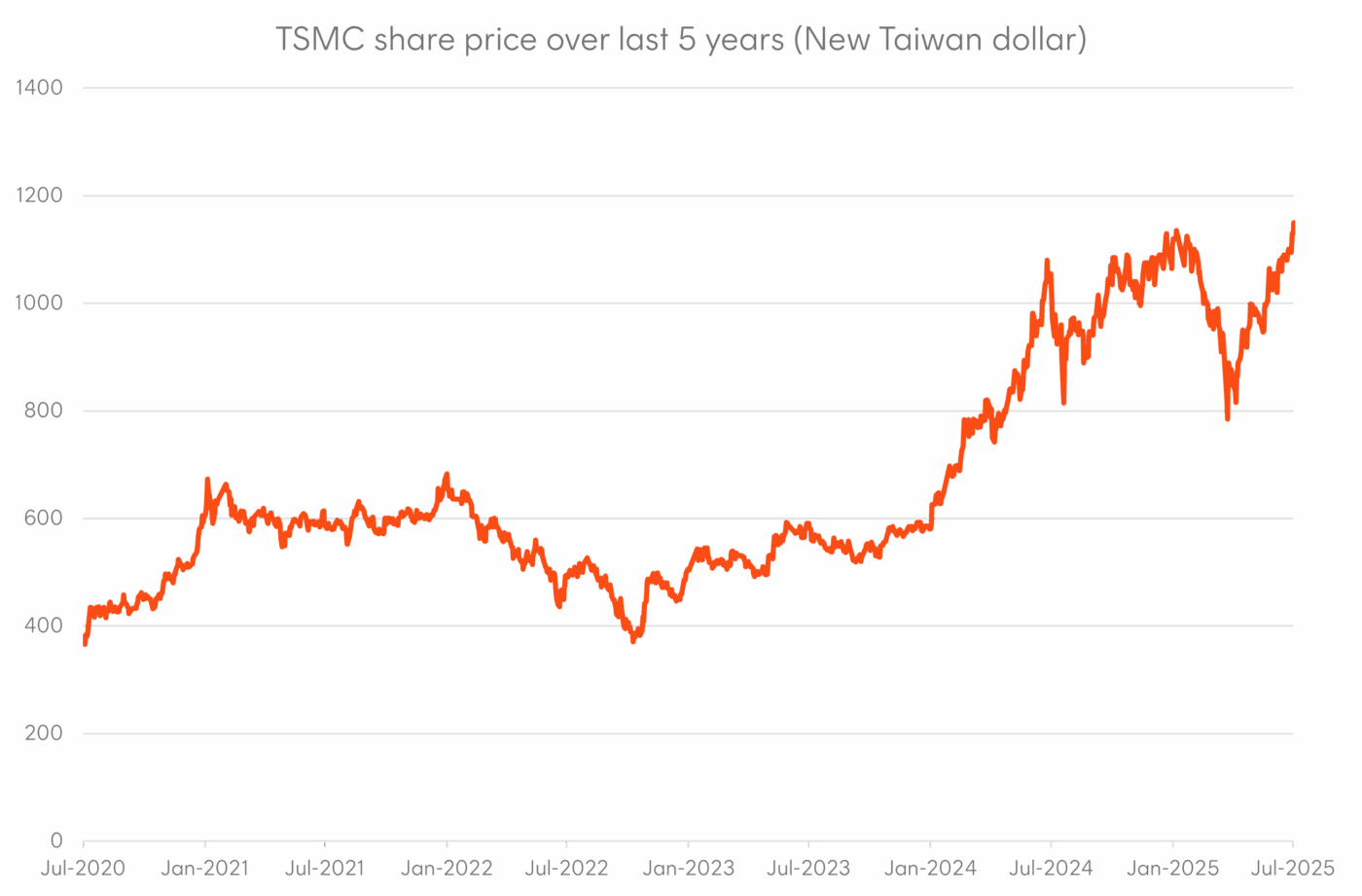

In the most recent June quarter, TSMC reported better than expected revenue growth of 39% thanks to the resiliency in AI-driven demand from advanced chip designers including Nvidia. Close to a third of Nvidia’s cost of goods sold (around US$10 billion) goes to TSMC as revenue.

TSMC also raised its outlook for revenue growth this year with sales forecasted to grow by around 30% in US dollar terms, up from mid-20% previously.

Source: Bloomberg. As at 17 July 2025. Past performance is not an indicator of future performance.

Hard to Forget: South Korea’s dominance in memory chips

Company spotlight: SK Hynix

Memory is another critical component that sits within a graphics processing unit (GPU) to ensure that the huge amounts of data that AI applications work through can be processed in a seamless manner.

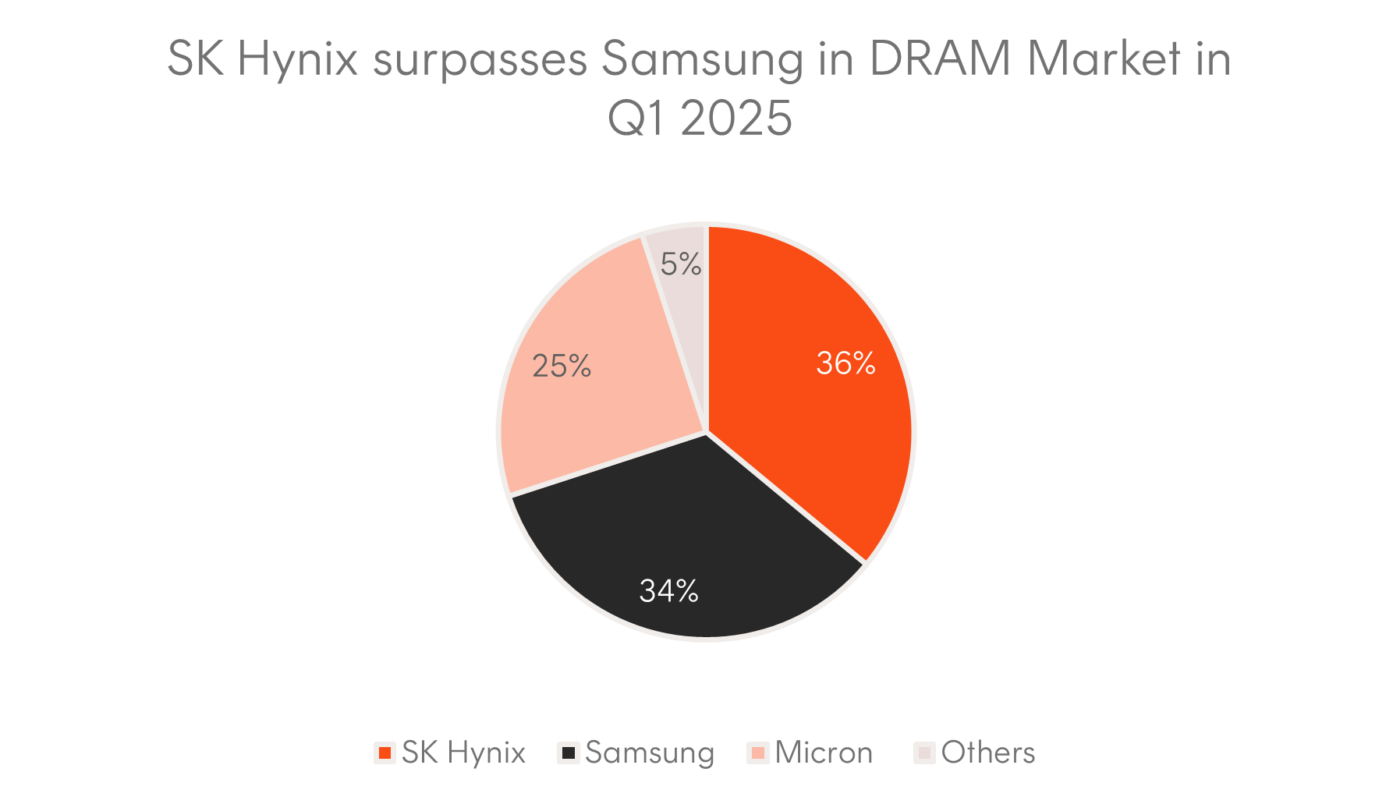

Leading this space is SK Hynix – the world’s leading supplier of dynamic random-access memory (DRAM) chips2 which was, up until recently, a position held by Samsung for over 30 years. Together, the two South Korean memory chip providers account for approximately 70% of the global DRAM market.

Source: Counterpoint, Bloomberg. As at March 2025.

Source: Counterpoint, Bloomberg. As at March 2025.

The evolution of high bandwidth memory (HBM) has been instrumental in increasing the capacity of AI accelerator chips to process larger and more complex datasets in both the training and inference phases.

A memory vendor like SK Hynix will firstly build and then ship these HBM chips3 over to TSMC who then integrates these onto those accelerator chips using their proprietary CoWoS (Chip-on-Wafer-on-Substrate) packaging technology.

Similarly to TSMC, SK Hynix has benefited materially from the large investments made in AI infrastructure even as DeepSeek’s low-cost models called into question whether the huge amounts of capex spending by the large cloud service providers would continue.

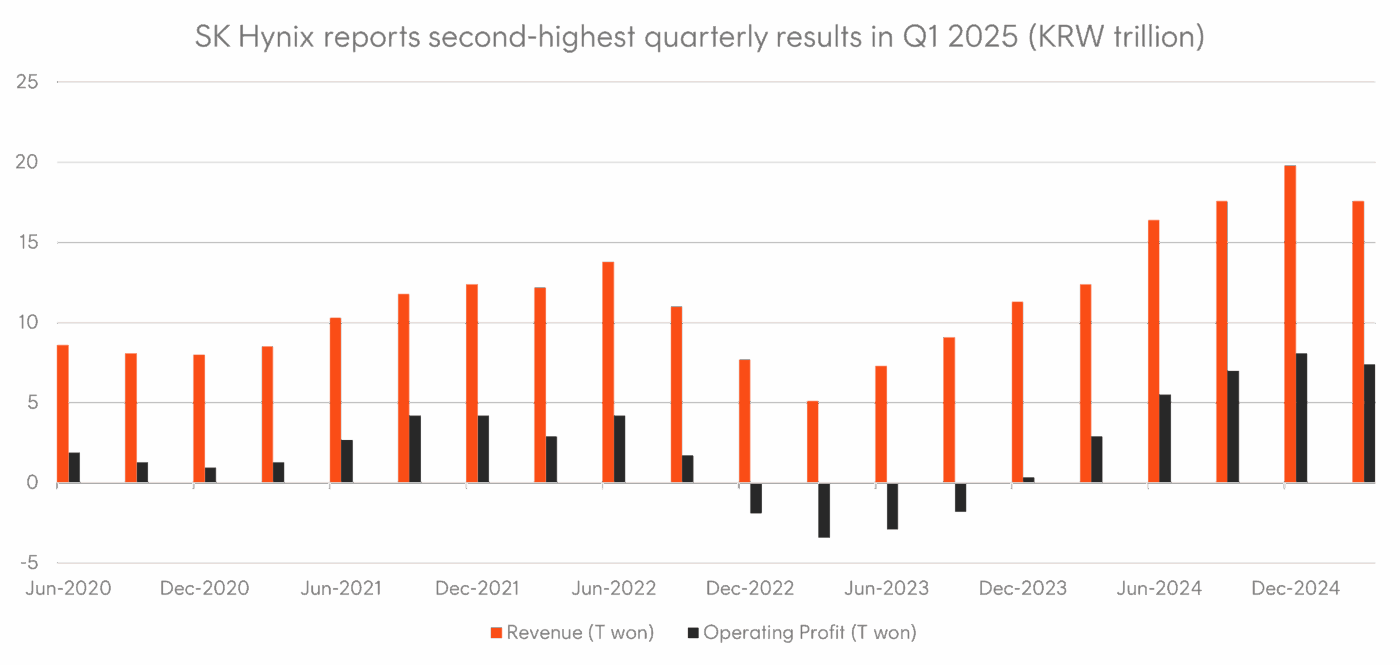

The fundamentals of SK Hynix are also strong with the company reporting KRW 7.4 trillion (~US$5.3 billion) in operating income for the first quarter of 2025 – its second highest quarterly result. This comes following a more challenging period throughout 2023 where the company had operating losses due to a combination of declining memory chip prices and softer demand.

Source: SK Hynix, Bloomberg. Past performance is not an indicator of future performance.

Source: SK Hynix, Bloomberg. Past performance is not an indicator of future performance.

Chinese consumer technology giants shaping the future of AI

Company spotlight: Alibaba

Beyond the infrastructure layer, large consumer platform companies in China are actively integrating their own AI models within their core business models.

For example, Alibaba – an e-commerce giant with over a billion active users globally – is using generative AI to improve the customer experience through personalised product recommendations and AI-driven search functions to assist with product discovery.

Sellers also benefit through the offering of AI agents which simulate the tasks an employee would usually perform. By reducing the barriers to establishing a store, merchants may feel more incentivised to sell their products on Alibaba’s platform.

Company spotlight: Tencent

Tencent is another multinational consumer technology company that has been leveraging AI to grow its core video games and social media business. Its foundational model, Hunyuan, is being used by video game developers to produce high-resolution, textured 3D assets more efficiently to provide an enhanced user experience for the gamer.

It is this advanced technology that democratises the ability for gamers, developers and creators to all create 3D content in the same way that Alibaba’s AI model lowered the barriers to entry for prospective merchants.

Source: South China Morning Post, Tencent

The AI capex race heats up in China

The Mag 7 companies are not the only ones spending billions of dollars on data centres.

Alibaba announced it would spend more than US$53 billion4 over the next three years on AI and cloud infrastructure, which has become a rapidly growing business segment for the company. AI-related products achieved triple-digit growth for the sixth consecutive quarter5 as the company continues to accelerate its global cloud network across Southeast Asia.

Tencent President Martin Lau also announced that would rise to the “low teens” as a percentage of revenue – or roughly US$10.7 billion in 2024.

This trend is expected to continue as the launch of DeepSeek in January will likely drive an influx of demand for cloud computing services over the years from China’s private sector. Additionally, the Chinese government has made a direct push for the buildout of new AI data centres including in the desert Xinjiang region.

A new frontier: From phones to electric vehicles and robots

Company spotlight: Xiaomi

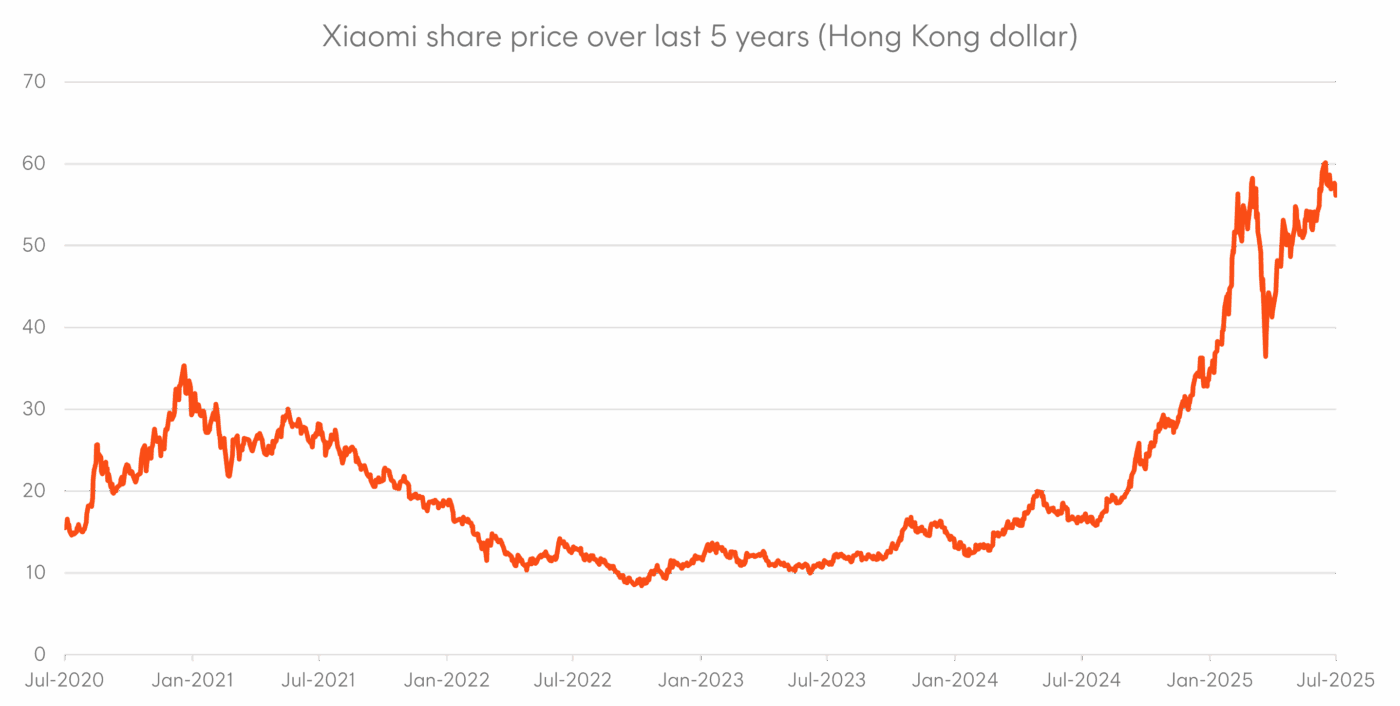

Xiaomi has become one of the fastest growing companies in China over recent years, having only launched in 2010. The company has transitioned rapidly from manufacturing smartphones throughout the 2010s to now establishing itself as a leader in electric vehicles (EVs) and robots.

In fact, the company only launched its first EV (the SU7) in March 2024 last year and has received over 289,000 orders for its second EV (YU7) which is anticipated to turn Xiaomi’s EV unit profitable.

As the business enters new segments, it is aiming to build a self-reliant model with the release of its 3nm (nanometre) chip which it has partnered with TSMC for production. These chips will eventually be used within their current smartphone offerings with the potential for future applications in their EVs and robots.

Year to date, Xiaomi’s share price has rocketed 66% and has grown to become a US$200 billion company in the space of just 15 years6.

Source: Bloomberg. As at 17 July 2025. Past performance is not an indicator of future performance.

Investment opportunities

The AI ecosystem has expanded well beyond the Magnificent 7 companies in the US. The global build out of computing infrastructure may continue to benefit companies further up the supply chain including Taiwanese and South Korean chip manufacturers in TSMC, SK Hynix, and Samsung.

And with data centres projected to require in capital expenditures worldwide by 20307, a significant boost in private capital investment is expected over the next few years. This will present strong tailwinds for medium-term global economic growth.

Investors seeking exposure to the companies mentioned throughout this article8 may consider the Betashares Asia Technology Tigers ETF (ASX: ASIA). Since its inception in September 2018, ASIA has returned 11.9% p.a.* (as at 30 June 2025).

References:

1. TSMC 2019 and 2024 company filings ↑

2. DRAM is a common type of memory used to process data in computers and servers. ↑

3. A collection of individual DRAM chips stacked together in a vertical 3D structure ↑

4. Alibaba to Invest RMB380 billion in AI and Cloud Infrastructure Over Next Three Years ↑

5. https://www.alibabacloud.com/blog/alibabas-core-businesses-reignite-growth-as-ai-strategy-delivers-strong-results_602006 ↑

6. Bloomberg

7. https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/the-cost-of-compute-a-7-trillion-dollar-race-to-scale-data-centers ↑

8. No assurance is given that these companies will remain in ASIA’s portfolio or will be profitable investments.