6 minutes reading time

- Commodities

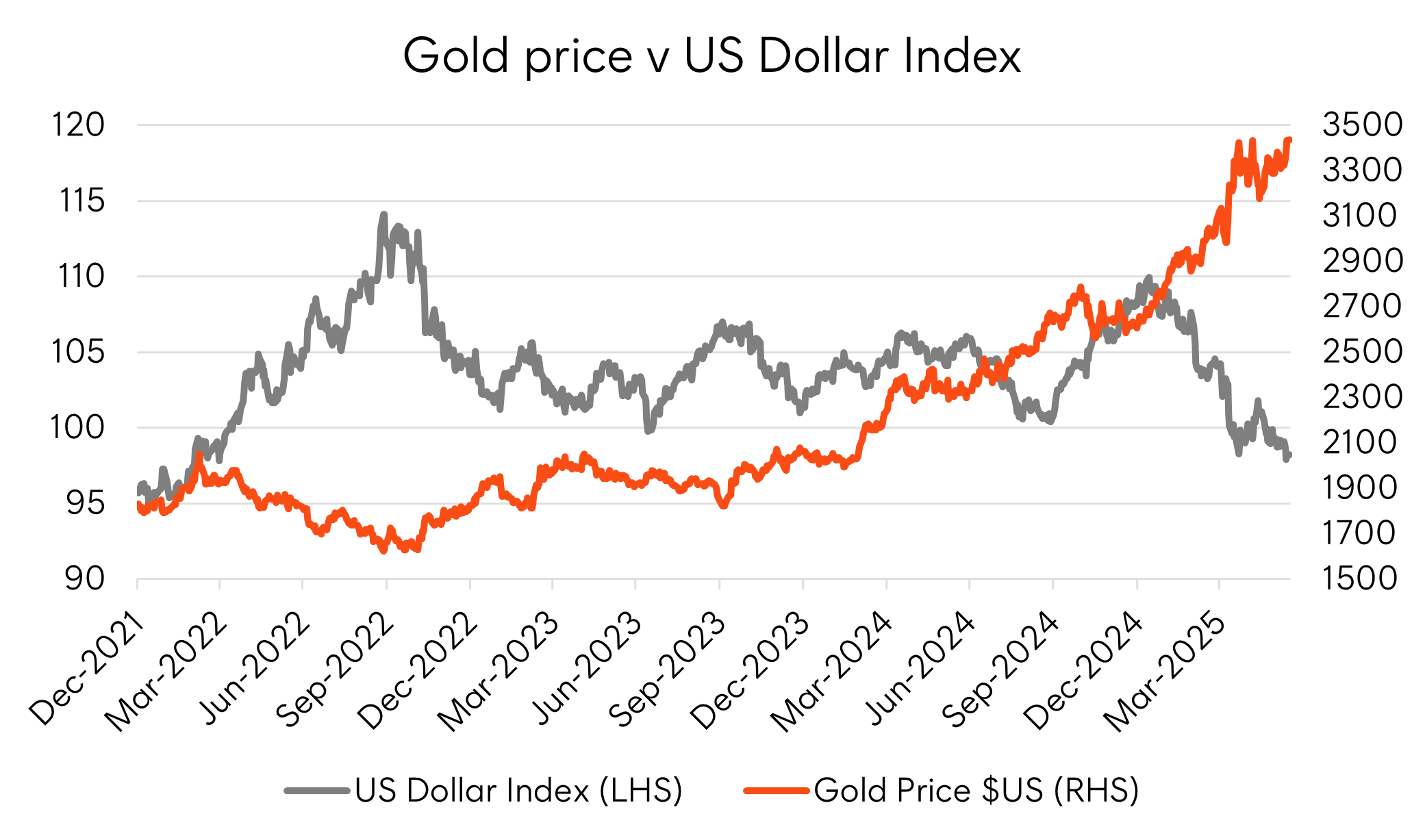

On Monday, gold rose to an all-time high, as the escalating conflict between Israel and Iran drove investors toward ‘safe haven’ assets. The upsurge in geopolitical risk on top of fears around the impact of tariffs and US policy uncertainty has driven investor demand for gold. Gold has typically performed well in slowing economic environments and can provide a hedge against higher inflation. Yet gold’s glittering run commenced well before Trump came to office, and in my opinion has further to go as investors continue to shun other ‘safe havens’ such as US Treasuries and the US Dollar.

Source: Betashares, Bloomberg. As at 16 June 2025. Past performance is not indicative of future returns future returns of any index or ETF. Gold price does not take into account any fund management fees and costs.

Understanding the role gold can play in portfolios requires an understanding of the key market drivers – who buys gold and why? While jewellery fabrication and industrial consumption account for approximately 40% of total gold demand1, the main catalyst behind major price movements is gold’s use as a financial asset. Investor and central bank flows – together making up around 60% of demand – have historically had a far greater influence on gold prices than consumer or industrial usage.

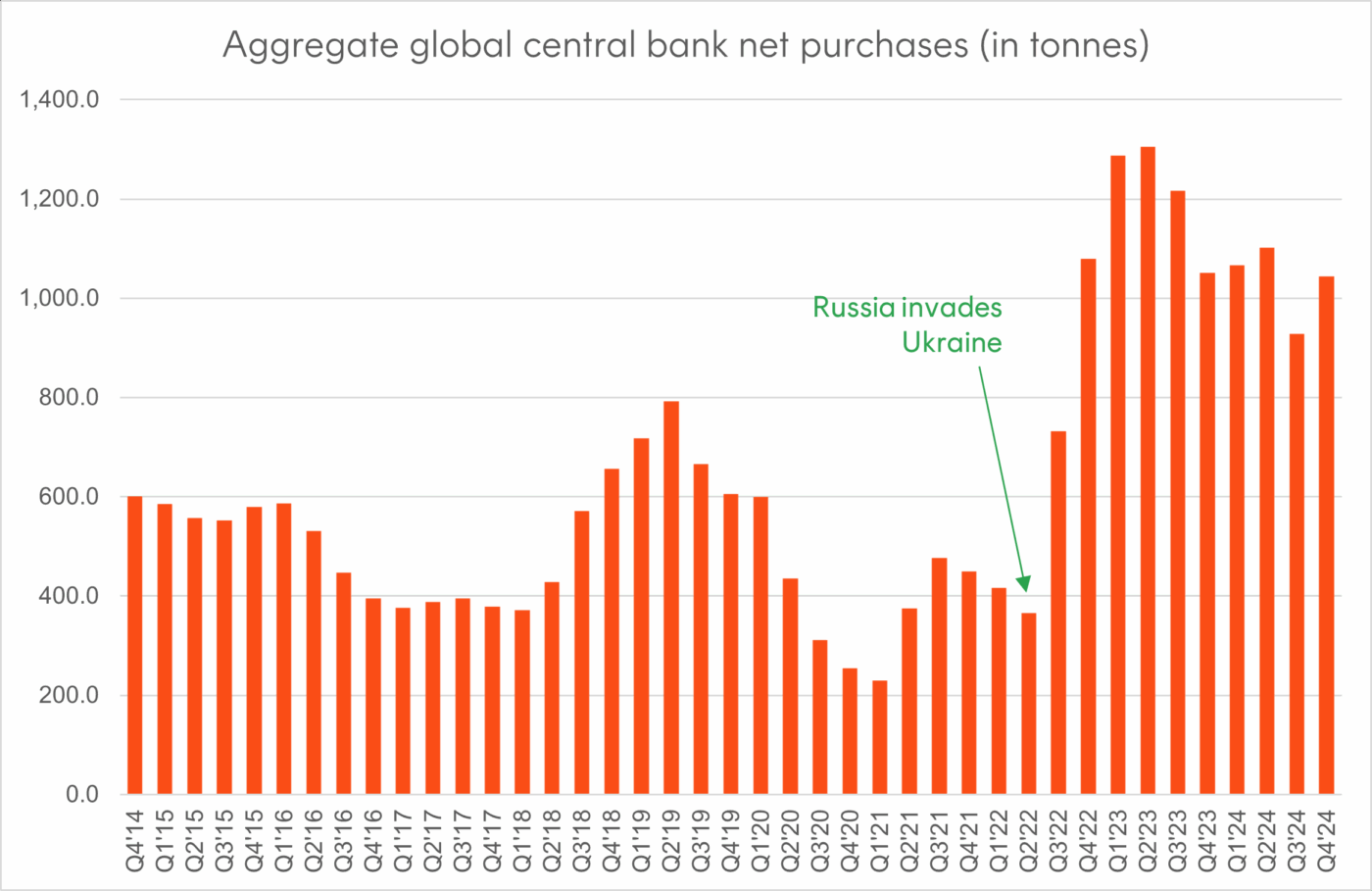

Central banks providing structural support

The escalation in geopolitical tensions in recent years has caused central banks to buy a lot of gold. Central banks generally see gold as a stable way to diversify their reserves beyond foreign currencies like the USD and US Treasuries. In the wake of Russia’s invasion of Ukraine, the US showed they were not afraid to ‘weaponise’ the dollar-centric global financial system by imposing crippling sanctions on other nation states. In response, some non-US aligned central banks have turned to gold. Since February 2022, total reported central bank buying has jumped significantly. Demand has been driven by such countries as China, India, Poland, Turkey and Egypt.

Source: World Gold Council, Betashares, as at January 2025, rolling four-quarter figures shown

China still holds a significant portion of its reserves in US Treasuries and only ~7% in gold – well below the average of the rest of world2. This underscores substantial room for China, in particular given its rivalry with the US, to diversify further into gold over the coming years. Importantly, given that central banks tend not to be price sensitive buyers, they are unlikely be dissuaded by the gold price being above US$3,300 an ounce.

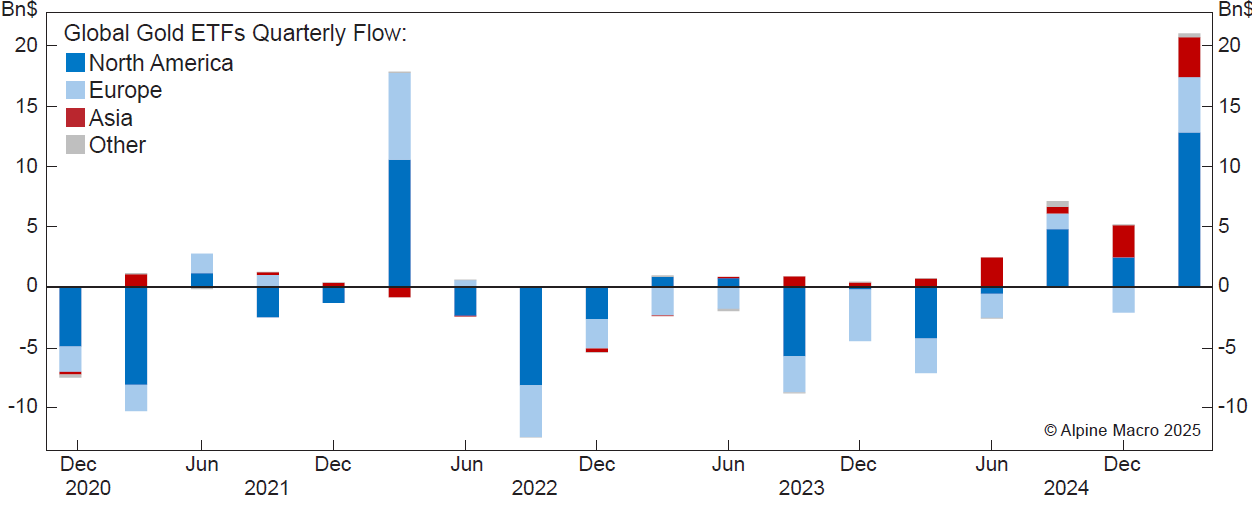

Investor demand has returned in 2025

Global gold ETFs experienced strong inflows in Q1 this year, with positive demand observed across all major regions, including North America, Europe, and Asia. This marks a noted shift after ETF investors remained largely on the sidelines for much of the past four years. US investors bought US$5 billion in gold-backed ETFs in one week. In the first five months of 2025, our QAU Gold Bullion Currency Hedged ETF saw over $160 million in net inflows.

Robust Gold ETF inflows in Q1 2025

Source: Alpine Macro, World Gold Council, May 2025. Series shown as a 3-month moving sum.

Furthermore, retail gold buying in Asia has surged over the past 12 months, coinciding with a significant increase in gold stockpiles at the Shanghai Futures Exchange3. These trends are expected to persist as long as Chinese households continue to view gold as a ‘safe’ store of value in comparison to the volatility of property and shares.

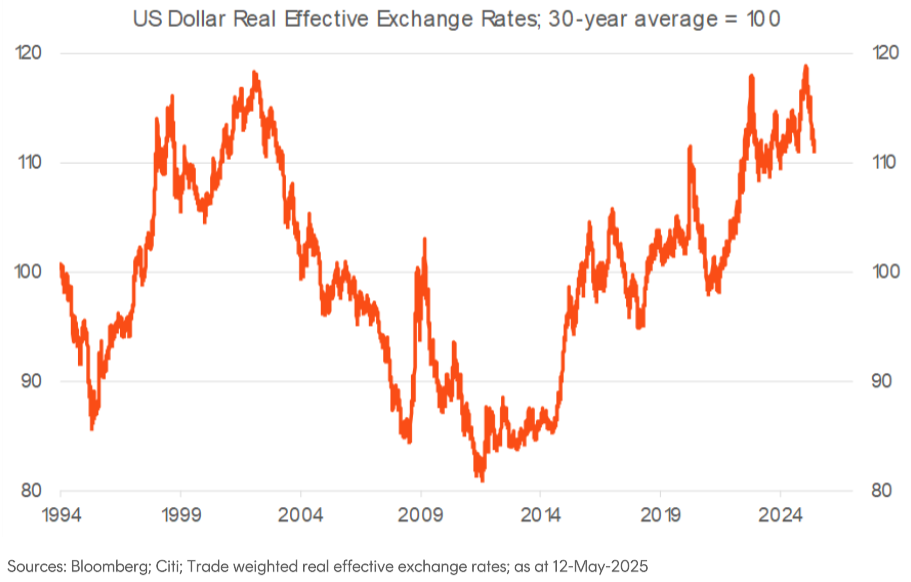

Gold’s main rival as a ‘safe haven’ is expensive

The US dollar surged following Trump’s election victory in late 2024. But 2025 has seen a complete reversal as markets weighted the potential implications of the administration’s tariff policy on inflation and growth. When investors are questioning whether inflation or growth is the bigger problem, it brings into doubt the US exceptionalism thesis. This concern is starting to weigh on the US dollar and conversely increase gold’s attractiveness as a ‘safe haven’ asset. In fact, the muted US dollar reaction to the outbreak of Israel and Iranian hostilities shows that that investors are looking elsewhere for ‘safe havens’.

The US dollar remains almost as expensive as it has ever been over the last 30 years, on a purchasing power parity basis (see chart below). Given this, the US dollar could decline significantly from its current level. Add in the heightened volatility seen in currency markets, and it may not take much for gold to rally even further in US dollar terms.

Sources: Bloomberg, Citi. Trade weighted real effective exchange rates as at 12 May 2025.

With the apparent winding down of Department of Government Efficiency and the One Big Beautiful Bill’s large tax cuts outweighing the modest spending cuts, it seems Trump has abandoned efforts to reign in the budget deficit. Concerns around the serviceability of US government debt have started to dampen investor appetite for US Treasury bonds as well as the USD. Historically, there has been a strong correlation between rising US budget deficits and gold prices.

Currency hedging your gold exposure may therefore be an important consideration.

Investment implementation

In a period of escalating geopolitical tension and policy uncertainty, gold provides unique characteristics that can help to diversify risk embedded in other asset classes. As such, adding some exposure to the USD gold price may improve diversification for traditional multi asset portfolios. QAU Gold Bullion Currency Hedged ETF has been the point product for Australian ETF investors seeking gold exposure in 2025, and recently reached $1 billion of assets under management.

QAU is fully backed by physical gold bullion, providing transparency, security, and peace of mind for investors. QAU offers a ‘purer’ exposure to the USD gold price rather than the AUD price of gold and has seen the largest year-to-date on market inflows out of any ASX-traded gold bullion ETF.

This information is general only, is not personal financial advice, and is not a recommendation to invest in any financial product or to adopt any particular investment strategy. You should make your own assessment of the suitability of this information. It does not take into account any person’s financial objectives, situation or needs. Past performance is not indicative of future performance.

There are risks associated with an investment in QAU, including market risk, gold price risk and currency hedging risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Sources:

1. World Gold Council, Gold Demand Trends Data, as at Q1 2025 ↑

2. AlpineMacro, 19 May 2025 ↑

3. AlpineMacro, 19 May 2025 ↑