7 minutes reading time

Global leadership in the race to combat climate change is undergoing a quiet but profound reordering.

Asia, led by China and India, is fast emerging as the global leader in climate action, far ahead of the West. This is particularly the case when evaluating key measures of clean energy progress. While Western economies initially set the trend for clean energy investment and improving climate-related disclosures, recent developments suggest a shift is well underway.

Until recently, western economies were seen as the champions of green energy technologies. Today, eastern economies are driving the bulk of new green investment and technology deployment.1 From electric vehicle (EV) adoption to renewable energy capacity and strategies to curb emissions growth, the momentum is decisively shifting eastward.

Furthermore, several western economies are now dismantling or scaling back key regulatory initiatives relating to climate action and climate risk disclosures.2,3 At the same time, major economies in the Asia-Pacific are moving to formalise and strengthen their climate governance frameworks.

This east-west divergence carries significant implications for investors. As the quality and comparability of ESG data increasingly depends on jurisdictional mandates, capital flows may begin to favour those markets offering greater regulatory certainty and climate transparency. For investors, recognising where disclosure standards are strengthening – and where they are being diluted – is now essential to managing long-term risk and opportunity.

From follower to frontrunner: Asia’s EV revolution

Nowhere is the east’s ascendancy more evident than in the EV market.

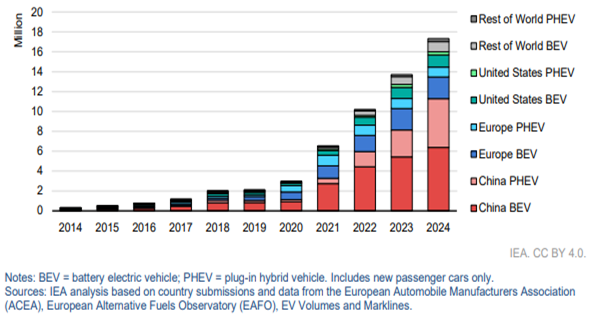

China is now a global leader in electric mobility, on the adoption and manufacturing fronts. In 2024, nearly 65% of all new EVs sold globally were made in China. Chinese manufacturers produced 12.4 million EVs in 2024, representing over 70% of global EV production.4

Source: IEA Global EV Outlook 2025

Emerging markets across Asia and Latin America are rapidly becoming new centres of growth for EVs. In 2024, EV sales in these regions jumped by more than 60% to nearly 600,000 – matching Europe’s total from five years earlier. In Southeast Asia, EVs accounted for 9% of new car sales, with Thailand and Vietnam leading the charge. Brazil more than doubled its EV sales to 125,000, reaching a 6% market share.5

Growth in EV sales has been fuelled by robust policy support and the availability of affordable Chinese imports, which made up 85% of EV sales in both Brazil and Thailand. Overall, Chinese EVs accounted for 75% of the sales growth across emerging markets outside China.6

Europe, the second-largest market for EVs after China, experienced stagnant sales in 2024 as subsidies and other supportive policies were wound back. Despite this, EVs accounted for roughly 20% of new car sales across the continent.7

EV sales in the US reached a record 1.6 million in 2024, lifting EVs to over 10% of new car sales. However, the pace of growth has slowed markedly from 40% in 2023 to just 10%, even as the broader automotive market remained largely flat.8 A repeal of Biden-era EV incentives is expected to further reduce the growth in US EV sales.9

The sun rises in the east – Asia’s renewable energy surge

China has eclipsed its clean energy targets six years ahead of schedule, installing more than 1,200 GW of solar and wind capacity by the end of 2024—well above the target it had set for 2030. This milestone was driven by sustained capital investment, robust government policy and an acceleration in project rollouts across the country.10

China remains the dominant destination for low-carbon energy investment globally, drawing in US$818 billion in clean energy funding last year. That is more than the combined total investment of the US, the EU and the UK.11

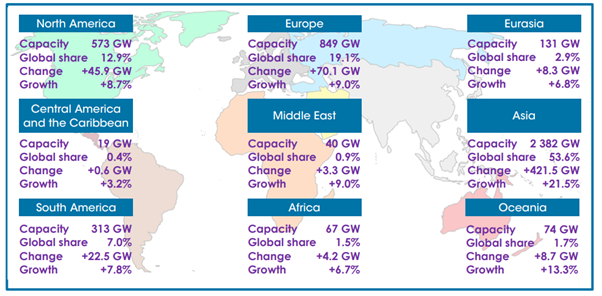

Asia now accounts for nearly 54% of global renewable power capacity, with China contributing the lion’s share. Of the 585 GW of renewable capacity added globally in 2024, nearly 64% was installed in Asia – equating to roughly two-thirds of all solar panels and wind turbines deployed worldwide last year.12

Wind energy capacity has more than doubled to 51 GW from the 21 GW levels seen a decade ago. Including large hydroelectricity initiatives, India’s total renewable capacity has reached 203 GW, ranking it fourth globally behind China, the US and the EU.13

Source: IRENA Renewable Capacity Statistics 2025

In 2024, solar and battery storage led new energy capacity additions in the US, with 50 GW of solar capacity installed. Renewable energy accounted for 84% of all new electricity generation capacity added during the year. This growth was primarily driven by policy incentives introduced under the Inflation Reduction Act.14

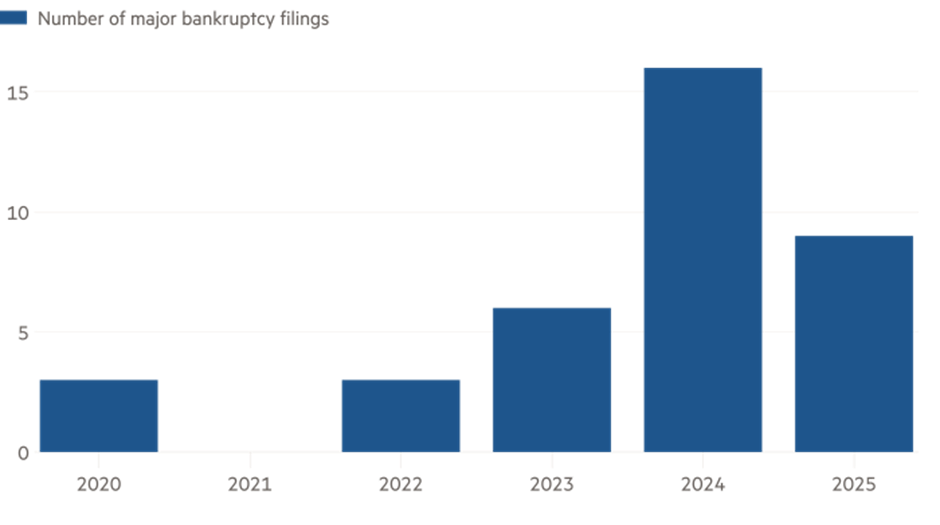

Despite record growth, the US residential solar industry is under pressure. At least 16 major companies, including Sunnova, SunPower, SunWorks and Titan Solar, have collapsed since . The newly introduced “One Big Beautiful Bill” adds to uncertainty. Proposed cuts to clean energy tax credits are threatening to stall further investment.15

Clean energy company failures in the US

Source: FT

Climate-related disclosures and regulatory frameworks

In recent years, a striking divergence has emerged between western and eastern economies in their approach to climate-related and sustainability disclosures. In the west, particularly in the US and parts of Europe, there has been a notable slowing (and in some cases, rollback) of climate-related regulatory momentum.

For instance, the US Securities and Exchange Commission effectively withdrew its proposed climate disclosure rule in early 2025.16 Meanwhile, the European Commission has proposed a significant rollback of its Corporate Sustainability Reporting Directive (CSRD), exempting thousands of mid-sized companies from ESG disclosure obligations that were originally intended to improve transparency and reduce greenwashing.17

In contrast, several Asian economies are accelerating efforts to standardise and enforce sustainability-related disclosures. Although China is the world’s largest emitter, officials have mandated ESG reporting for listed companies by 2026.18 Singapore has already adopted ISSB-aligned reporting for large companies beginning in 2025 and is positioning itself as a regional ESG disclosure hub.19 Even India, long regarded a laggard with respect to climate policy, has released a draft framework for central bank regulated entities to disclose climate-related financial risks.20

Where Australia fits in the climate leadership landscape

Australia occupies a unique position in the global climate leadership landscape, sharing the governance ambition of eastern economies while retaining western institutional frameworks. As of early 2025, renewables supplied roughly 43% of electricity across the eastern states of Australia, up from 39% the year prior. EV uptake is also accelerating.21

Australia is advancing on climate-related disclosures. From FY25, listed companies and reporting entities will be required to report under ISSB-aligned climate standards. This places Australia alongside Hong Kong, Japan, Malaysia, Singapore, South Korea and Taiwan. The Australian Sustainable Finance Initiative (ASFI) released a taxonomy in June 2025 that is intended to encourage green investment and harmonise definitions across the economy.22

This confluence of policy clarity, regulatory alignment and decarbonisation momentum positions Australia as a compelling destination for sustainable investment. For global and domestic investors alike, Australia offers a stable, rules-based environment with credible climate targets and increasingly robust ESG reporting standards—providing a bridge between western capital markets and the fast-evolving sustainability frameworks of the Asia-Pacific.

The dawn of a green Asian century?

The evidence is compelling: climate leadership is decisively shifting eastward. China and India, alongside other dynamic Asian nations, are demonstrating an unparalleled commitment to the green transition. They are doing this not only via ambitious targets, but also through tangible, large-scale investments in renewable energy infrastructure, as well as the widespread adoption and manufacturing of EVs plus the development of innovative sustainability and financial disclosure frameworks.

This pivot has profound implications for investors, international trade and the pace of climate action globally. The future trajectory of our planet’s climate will increasingly be shaped by the policies, technological innovations and collaborative pathways emerging from Asia.

Betashares Capital Ltd (ABN 78 139 566 868 AFS Licence 341181) is the issuer of the Betashares funds. Read the Target Market Determination and PDS at www. betashares.com.au and consider with your financial adviser whether the product is appropriate for your circumstances. The value of the units may go down as well as up. The Fund should only be considered as a component of a diversified portfolio.

Sources:

1. https://www.theguardian.com/environment/2024/oct/09/china-to-head-green-energy-boom-with-60-of-new-projects-in-next-six-years2. https://www.dlapiper.com/en-us/insights/publications/horizon/2025/horizon-esg-regulatory-news-and-trends-may-20253. https://www.wsj.com/articles/europe-waters-down-flagship-climate-accounting-policy-a1c4934f4. https://iea.blob.core.windows.net/assets/0aa4762f-c1cb-4495-987a-25945d6de5e8/GlobalEVOutlook2025.pdf5. https://iea.blob.core.windows.net/assets/0aa4762f-c1cb-4495-987a-25945d6de5e8/GlobalEVOutlook2025.pdf6. https://iea.blob.core.windows.net/assets/0aa4762f-c1cb-4495-987a-25945d6de5e8/GlobalEVOutlook2025.pdf7. https://www.iea.org/reports/global-ev-outlook-2025/executive-summary8. https://www.iea.org/reports/global-ev-outlook-20259. https://apnews.com/article/climate-trump-electric-vehicles-pollution-standards-ae3a35faa376630e494765175aee2c2810. https://carboncredits.com/chinas-renewable-energy-boom-a-record-breaking-shift-or-still-chained-to-coal/11. https://about.bnef.com/insights/finance/global-investment-in-the-energy-transition-exceeded-2-trillion-for-the-first-time-in-2024-according-to-bloombergnef-report/12. https://www.weforum.org/stories/2025/04/renewable-energy-transition-wind-solar-power-2024/13. https://www.ibef.org/news/india-s-renewable-energy-capacity-grows-three-fold-to-232gw-in-last-decade14. https://reneweconomy.com.au/solar-smashes-us-records-with-50-gw-added-in-one-year-as-trumps-energy-secretary-gushes-about-gas/15. https://www.ft.com/content/5587b800-37d6-47fd-b8e3-70eab9ed6ceb16. https://www.sec.gov/newsroom/press-releases/2025-5817. https://www.reuters.com/sustainability/climate-energy/lead-eu-lawmaker-sustainability-laws-proposes-more-cuts-2025-06-12/18. https://www.sec.gov/newsroom/press-releases/2025-5819. https://greenfi.ai/how-to-prepare-for-singapores-mandatory-climate-reporting-in-2025/20. https://www.lexology.com/library/detail.aspx?g=cbf3a9c3-5853-4527-8c82-d4d612edca85#:~:text=On%2028%20February%2C%202024%2C%20the,Banks%20and%20Regional%20Rural%20Banks)21. https://www.climatecouncil.org.au/resources/power-surge-renewable-energy-hits-record-high-as-coal-splutters/22. https://www.asfi.org.au/publications/australian-sustainable-finance-taxonomy-3lwP4