4 ETFs to anchor your income in a declining yield environment

6 minutes reading time

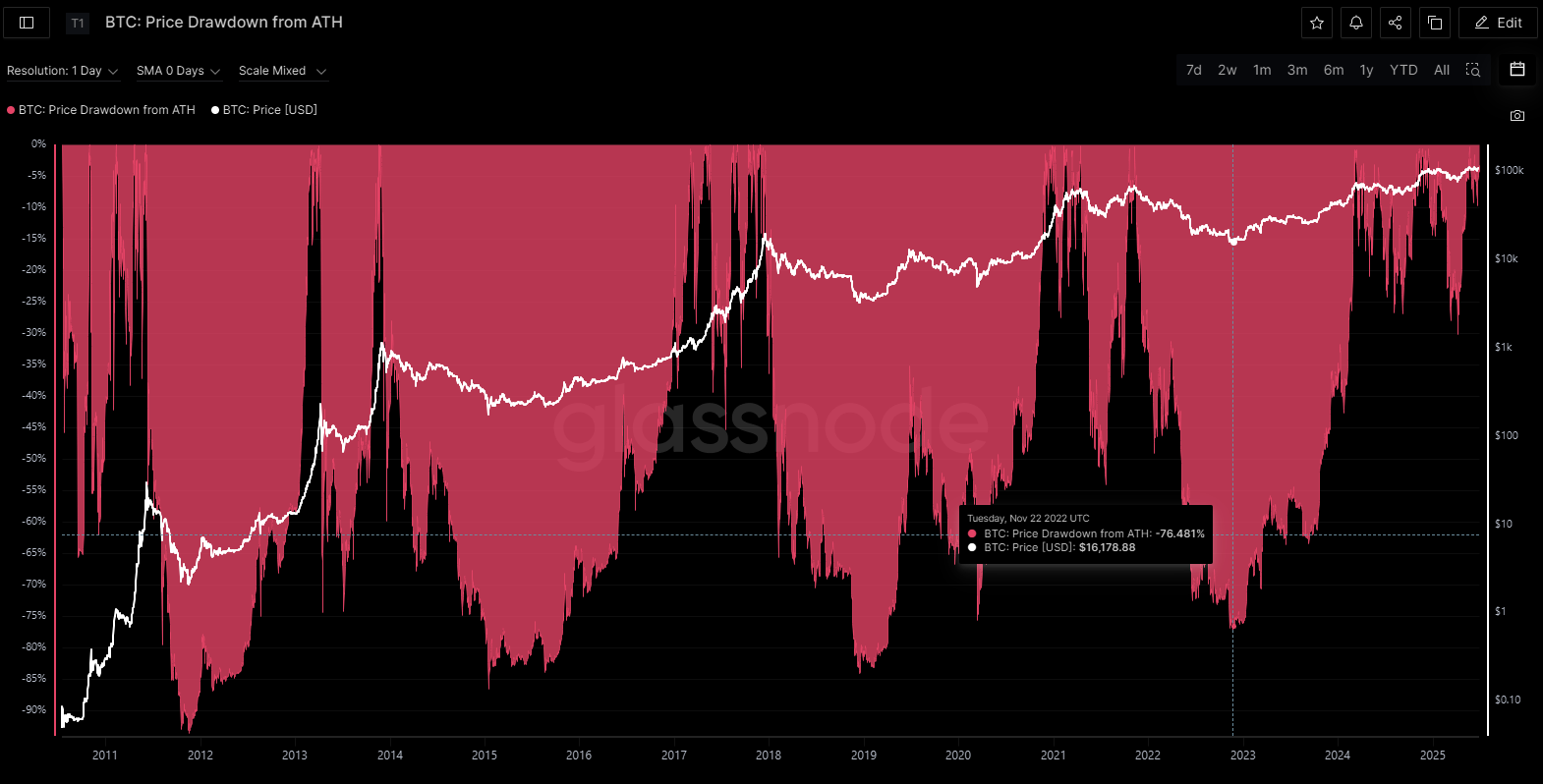

The last crypto bear market left many investors bruised and cautious. While some no longer believe crypto is here to stay; others fear another major drawdown. And fair enough – Bitcoin plunged 75% after peaking in 2021, as the chart below shows.

Source: Glassnode. Past performance is not indicative of future performance.

So is the current bull market different and who has been driving it? According to data, the current Bitcoin bull market hasn’t been driven by retail investors. Rather, it has been driven by those who ‘missed out’ on the previous bull cycles – the institutions.

And now that institutional investors are involved, Bitcoin could be looking like it’s here to stay.

Why are institutions finally getting involved?

Regulations are changing

In the 100 days that followed the second Trump inauguration, US lawmakers rolled out sweeping crypto reforms. Today, there is no longer a war on crypto and the US is racing to lead the emerging digital economy.

Last week, the director of the US Federal Housing Administration (FHA) posted on X that he had ordered Fannie Mae and Freddie Mac to “prepare their business to count cryptocurrency as an asset for a mortgage.” He went on to thank Trump “for making the USA the crypto capital of the world!”1

While this did not create much chatter beyond crypto circles, it is the latest in a slew of good news on Bitcoin and crypto over the last year. Indeed, this could be a historic milestone and Bitcoin may no longer just a speculative asset.

If this momentum continues, Bitcoin could become involved in everyday credit markets in the US, with investors not needing to sell their Bitcoin to buy a home.

This is also significant given that the US mortgage market has over $13 trillion in outstanding mortgage debt outstanding. Fannie Mae and Freddie Mac supporting over 70% of this figure2.

The rise of Bitcoin Treasury Companies

Following the success of Strategy (formerly known as MicroStrategy), holding Bitcoin in public corporate treasuries is becoming more mainstream. So far in 2025, publicly traded companies and private investors have scooped up more than 157,000 BTC. Put another way, that’s over US$16.6 billion at current prices3.

Companies such as Metaplanet, Twenty-One and the newly announced ProCap Financial have all been purchasing Bitcoin to hold on their balance sheets.

Metaplanet had purchased 10,000 BTC in total as of June 2025. It has a goal to reach 210,000 BTC by the end of 20274. Twenty-One holds over 37,000 BTC5 (as at 26 June 2025) and its vision is to not just offer an exposure to Bitcoin, but build the infrastructure that will enable a world restructured around it. ProCap plans to hold up to $1 billion in Bitcoin and offer services like lending, trading and capital markets6.

If these companies are anything to go by, it may soon no longer be a question as to whether Bitcoin belongs on the balance sheet. Rather, the question may become how to do it responsibly and advantageously.

Are governments taking advantage of Bitcoin’s benefits as well?

According to TradingView, governments collectively hold over 463,741 BTC (which is approximately 2.3% of Bitcoin’s total supply) (as at the end of Q1 2025)7. The largest holder is the UAE, which is rumoured to have around 420,000 BTC. This is followed by the US, with over 98,000 BTC, and China, which holds an estimated 194,000 BTC8.

Now that the US has declared Bitcoin a strategic reserve asset9, it may potentially continue to accumulate the cryptocurrency in a budget-neutral manner. And if you believe game theory, the US’ actions could mean other countries will follow.

In fact, some countries may already be following suit. For example, the Czech Republic has become the first central bank in Europe to openly discuss Bitcoin in the context of reserve management. Meanwhile, in Switzerland, a people’s initiative launched on 31 December 2024 proposes amending the national constitution to require the Swiss National Bank (SNB) to hold Bitcoin alongside gold10.

Bitcoin ETFs keep buying

Since spot Bitcoin ETFs were approved in the US in January 2024, the purchasing has been relentless.

In a little over 17 months, there have been net inflows of over $133 billion11 (as at 30 June 2025). The largest bitcoin ETF is now also the 23rd largest ETF in the US, despite being the youngest by over a decade.

ETFs have also been paramount in the accumulation of Bitcoin for institutions and investors who are seeking to purchase BTC through a regulated vehicle.

Crypto equities are also having their time to shine

Bitcoin isn’t the only asset benefitting from this bull market.

Companies involved in Bitcoin and cryptocurrency more broadly have also been having a ‘resurgence’. The most recent crypto company to go public in early June was Circle (NASDAQ: CRCL). Since its debut, the stablecoin company has soared over 621% against its IPO price (as at 1 July 2025)12.

There are many more highly anticipated crypto IPOs scheduled for 2025, with investor appetite currently looking healthy. Other companies exploring IPOs are the crypto exchange OKX, crypto exchange and custodian bank Gemini and the blockchain-based platform, Tron13.

Then there’s Coinbase

It may have taken four years but Coinbase has finally completed a full circle moment.

After going public in November 2021 and hitting all-time highs of US$357 per share, the share price tumbled during the crypto bear market. During that time, it sunk as low as US$47 per share. On 24 June 2025, Coinbase managed to eclipse its old all-time high. It was the best performing S&P 500 stock in June and could have room to appreciate further, according to financial tech research at Citizens14.

Source: Bloomberg. As at 1 July 2025. Past performance is not indicative of future performance.

Will the bull market continue?

Since the halving in April 2024, approximately 450 Bitcoins have been mined each day given the current block reward of 3.125 BTC. Institutions are just beginning to get involved and slowly integrating into Bitcoin. Corporates, governments and ETFs alike have been buying at a pace unseen in Bitcoin’s history.

Both the amount of Bitcoin being mined as well as the remaining amount to be mined may not be enough to satiate demand.

For now, sellers are willing to accommodate and we haven’t seen much price movement since November. However, once the sellers dry up, the price of Bitcoin could easily surge higher in its typical but dramatic fashion.

References

4. https://cointelegraph.com/news/metaplanet-bitcoin-holdings-hits-10000-btc-beating-coinbase

5. https://bitbo.io/treasuries/twenty-one-capital/

6. https://www.cnbc.com/2025/06/23/pompliano-procap-spac-bitcoin.html

8. https://www.ccn.com/news/crypto/bhutan-top-crypto-nations-full-list-of-countries/

10. https://www.chainalysis.com/blog/bitcoin-strategic-reserves/

11. Source: Bloomberg

12. Circle listed its IPO price at US$31/share. As of 1 July 2025, it sits at over US$192/share. https://www.reuters.com/business/wall-street-analysts-bullish-circle-after-blockbuster-ipo-warn-sky-high-2025-06-30/