6 minutes reading time

If you prefer to listen to Bass Bites, you can click the player below:

Global week in review

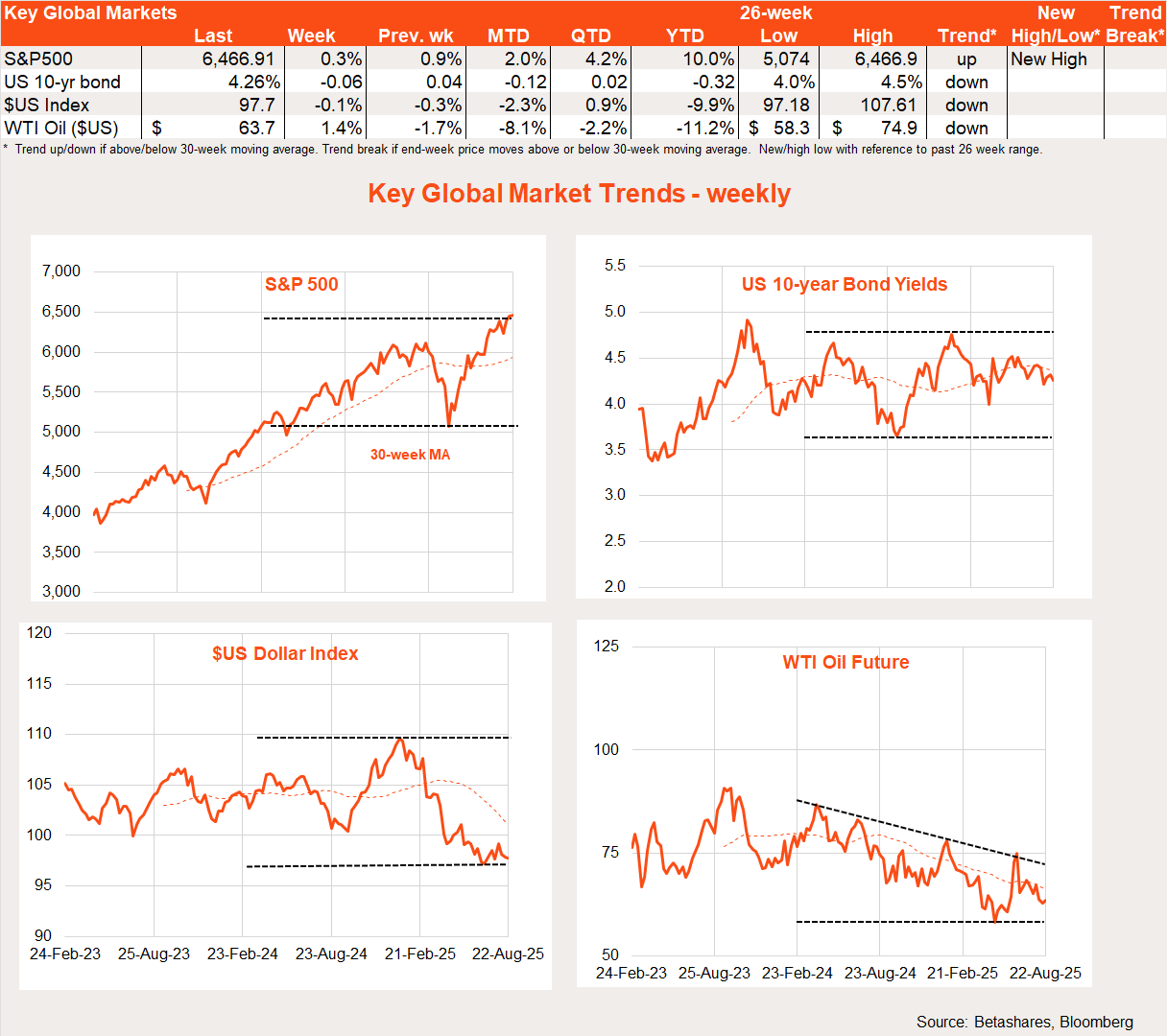

Global equities inched higher last week, with early concerns over US Fed and Trump policies washed away by a dovish Fed pivot on Friday.

Fed’s change of heart

It was a strange week for Fed watchers. Early in the week markets were dismayed by minutes from the recent US Fed meeting which suggested most around the table were still more concerned with upside risks to inflation than downside risks to growth. Some of the evident slowdown in employment growth, for example, was blamed on slowing immigration (labour supply) given the unemployment rate had held steady.

Adding to market concerns earlier in the week were new moves by the Trump administration to have tech companies pay 15% of revenues from chip sales to China. It sent a shudder through the tech sector as it opened up a whole new Pandora’s box of regulatory risk. Who’s next?

Other US data were robust, with a solid rebound in the S&P US Manufacturing Index and a still-solid services sector survey. This only dampened hopes for a September US rate cut.

By Friday, however, markets rebounded strongly following Fed Chair Jerome Powell’s Damascus conversion (dramatic transformation) to a policy dove. Powell noted the July payrolls report – which, notably, was not available at the time of the last Fed meeting – revealed large downward revisions to employment growth for May and June (so much so that the head of the Bureau of Labor Statistics was fired by Trump). Powell went on to suggest “downside risks to employment are rising” and later added “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

Crack open the champagne! Powell seems to have all but guaranteed a September rate cut, with markets now seeing it as a 90% chance. US stocks leapt 1.5% higher on Friday, resulting in an overall 0.3% gain for the week and yet another record high.

Of course, we get another payrolls report before the next Fed meeting over September 16-17 – and if employment surges big time, it might upset markets’ hopes for a rate cut. And if the Fed does not cut, it will certainly incur the wrath of Trump. Will the Fed bend to his will? We have a fascinating few weeks ahead.

NZ cuts rates – but it might not be enough!

Over in New Zealand, the RBNZ cut rates by 0.25% to 3% – as widely expected. With inflation back in the target band and the economy still soft, the Bank did canvass the possibility of a 0.5% cut but ultimately backed off.

In my view, the RBNZ could have cut by more and provided the still-moribund economy with some welcome shock therapy.

Global week ahead: PCED inflation report

In a data-light week, a key highlight will be Friday’s US private consumption expenditure deflator (PCED) inflation report. Price data from the CPI and PPI reports suggest another firm 0.3% gain will be seen in core PCED prices, which would lift annual inflation from 2.8% to 2.9%. This is still much higher than the Fed’s 2% target and underlying annual inflation on this measure has been going sideways for a year – hardly a recipe for rate cuts!

That said, a 0.3% core monthly price gain would still suggest tariff effects remain relatively muted. And with the Fed expressing newfound concern over the labour market, the market does not care about inflation that remains uncomfortably high – as long as it’s not surging higher.

Global share market trends

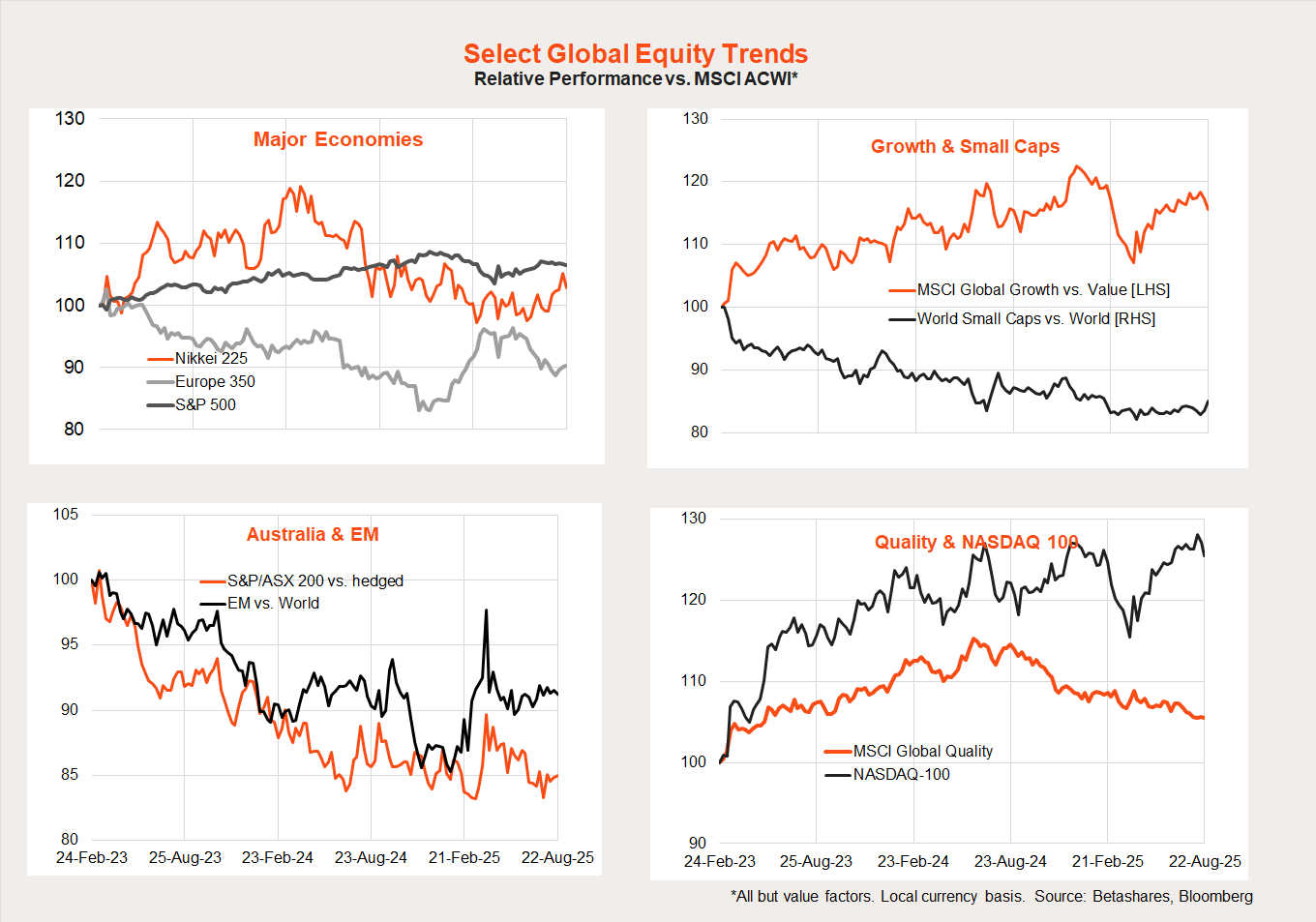

As has been noted here previously, the US/technology/growth/large cap outperformance trend appears to have largely resumed with the market rebounding since early April. But Trump’s new levy on chip sales hurt technology and growth stocks last week.

Japan’s relative performance has also picked up of late, with the Nikkei 225 reaching record highs. Although Japan’s market did correct a little last week, it should enjoy a catch-up rally today – along with Asia generally – given Wall Street’s bounce on Friday.

Australian week in review

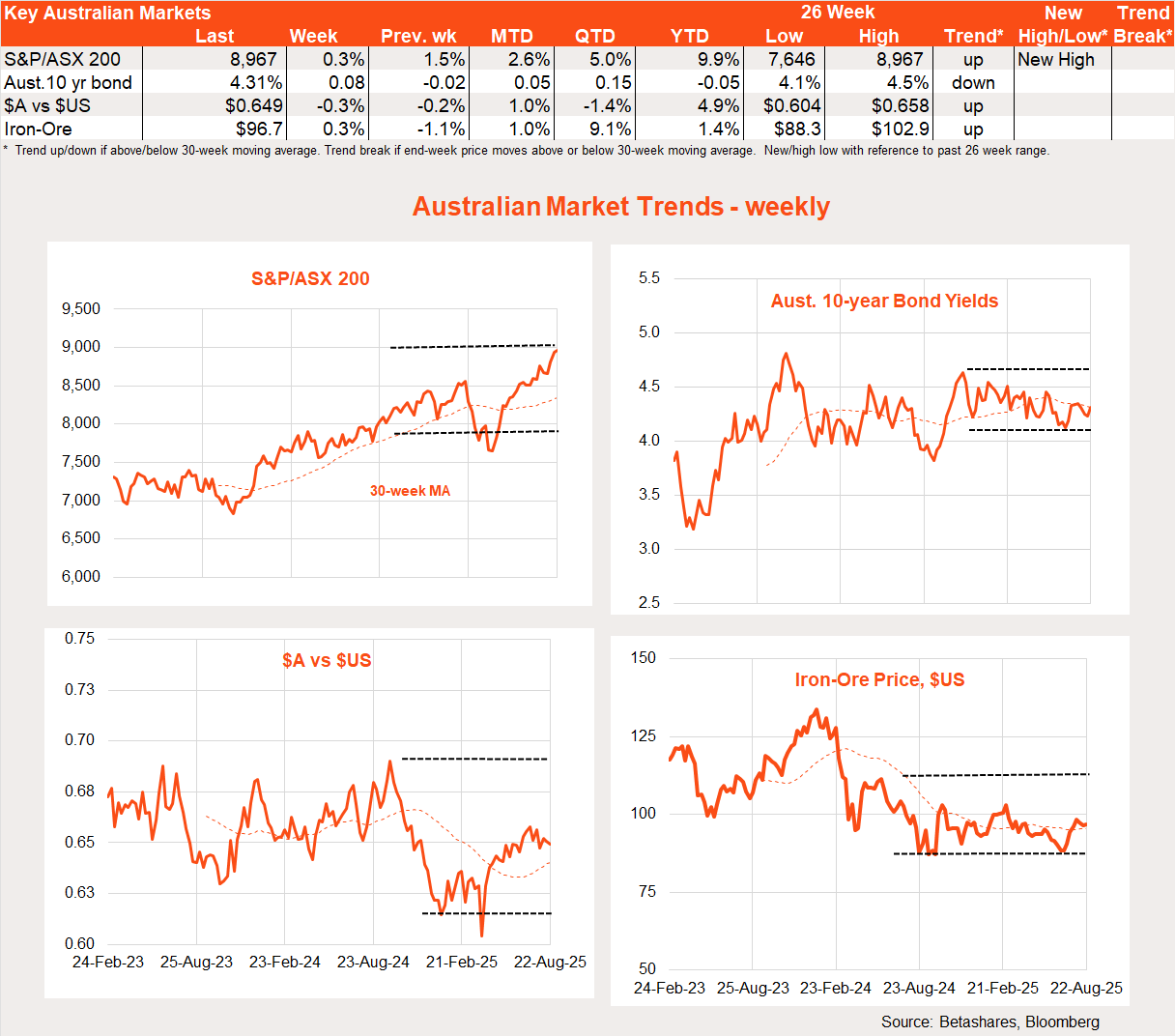

There was not much on the local data front last week, although we did get a nice 5.7% bounce in the Westpac/Melbourne Institute measure of consumer sentiment following the RBA’s August rate cut. Sentiment is now almost back at its long-run average, which should hopefully encourage a bit more consumer spending in the months ahead.

There was also the Productivity talkfest in Canberra. There were a range of modest deregulatory moves announced following the forum – with most low hanging fruit being overdue streamlining of regulations. While most participants agreed the young were taxed more heavily than the elderly/retired, there was little agreement on what should be done about it. I won’t hold my breath waiting for major tax reform – for the reasons I outlined last week.

Australian week ahead

There are a few interesting points of local interest this week. Tomorrow, the minutes from the most recent RBA meeting will be released, while on Wednesday we have the July monthly CPI report. After a large drop to 2.1% in June, some bounce back in annual trimmed mean monthly inflation seems likely – but not by enough to upset hopes for more rate cuts.

Building blocks to the Q2 GDP report will also trickle in with building construction on Wednesday and private capital spending on Thursday. Both building construction and private investment should bounce back a little in Q2 after flat Q1 outcomes which bodes well for a firmer Q2 GDP report. Most encouraging are signs of an ongoing lift in dwelling construction.

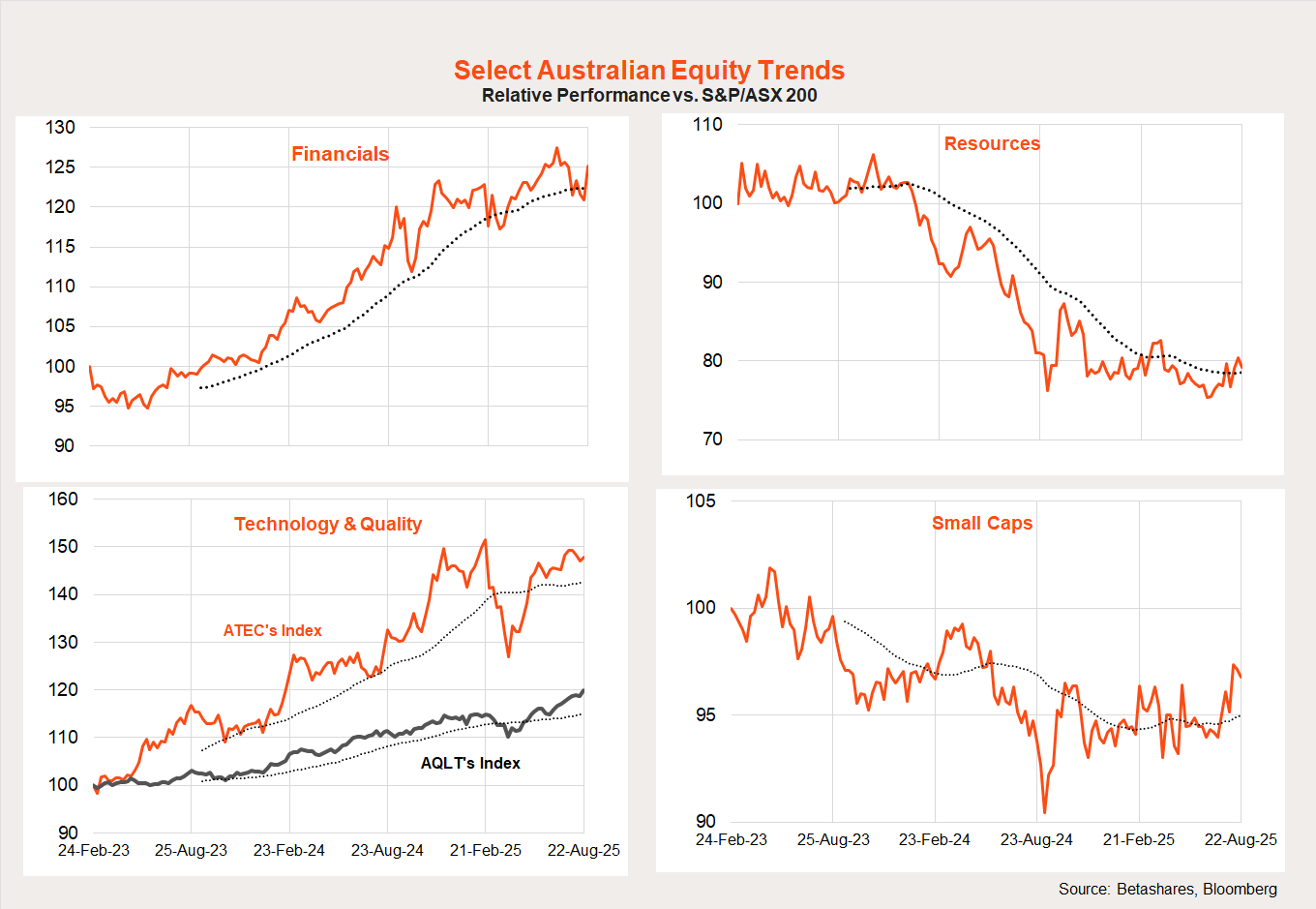

Australian share market trends

In terms of local equity trends, the recent rotation from financial to resource stocks was interrupted last week with the former performing more strongly. The relative performance of quality continues to trend higher, with some levelling out in the relative performance of technology of late.