Capturing growth and income from international equities

12 minutes reading time

- Fixed income, cash & hybrids

Global Macro and Rates

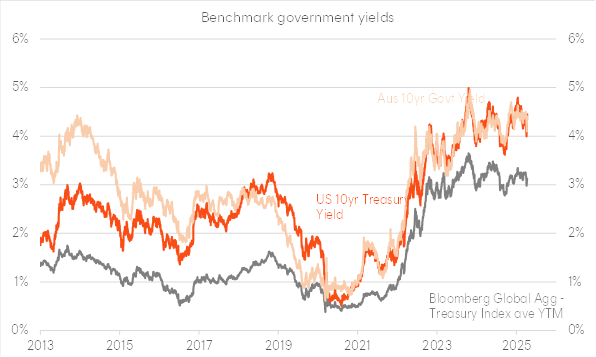

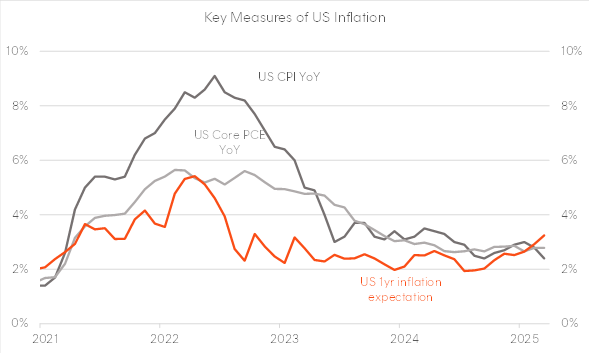

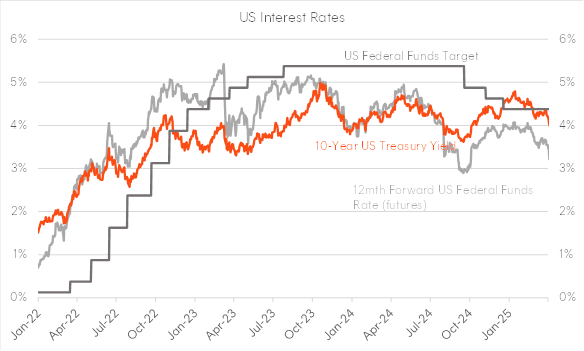

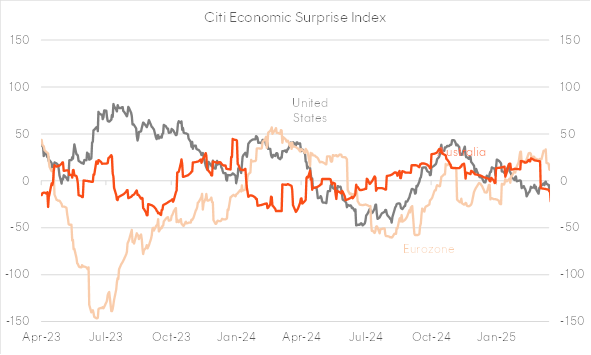

The start of 2025 witnessed choppiness and divergence in global bond yields, impacted by stronger-than-expected US economic data and renewed inflation concerns, which dampened the strong Fed rate cut expectations from the previous year. The initial market response to President Trump’s January inauguration was modest, with focus at first centred on potential deregulation and government spending cuts. However, discussions about tariffs targeting Mexico, China, and Canada soon became a defining theme, causing a downward trend in global bond yields due to policy uncertainty. By March, further tariff measures led to a brief rise in bond yields on inflation fears, but recession risks soon took precedence, leading to a decline in yields by quarter-end, and tariff concerns escalating in April.

The Bloomberg Global Treasury Index yield remained flat but volatile throughout the quarter, while the US 10-year Treasury yields ended the period 36 basis points lower. Elsewhere, German 10-year bund yields finished the quarter 37 basis points higher, including a historic one-day sell-off, triggered by Germany’s announcement of a sweeping fiscal overhaul. The newly formed government unveiled plans for a major infrastructure fund and proposed the exemption of defence spending from the constitutional debt break.

The Federal Reserve kept rates unchanged in January and March, adopting a slightly hawkish tone in January before shifting to a more neutral stance in March. The new median dot plot remained unchanged from December’s meeting, forecasting two rate cuts in 2025, but with greater dispersion among member projections. Inflation estimates were raised to 2.8%, while economic growth forecasts were lowered to 1.7% by the end of 2025. The Fed also announced plans to slow down Quantitative Easing starting in April.

Other central banks continued their rate-cutting cycles. Both the ECB and BOC implemented two rate cuts during the quarter, owing to growth concerns amid US tariffs uncertainty. The BOE cut rates once in February but adopted a cautious approach in March, holding rates steady due to global uncertainties and renewed inflation concerns. Notably, in the February BOE meeting, two of the nine voting members called for a 50bps rate cut due to growth concerns. The BOJ was the notable outlier, raising its policy interest rate by 25bps to 0.5% in January, continuing its path to interest rate normalisation as strong domestic consumption and investment supported reaching its 2% inflation target.

Domestic Macro and Rates

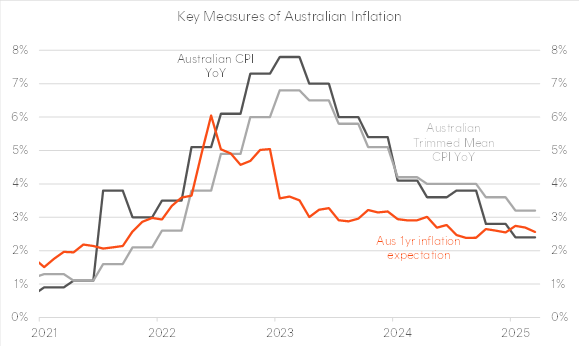

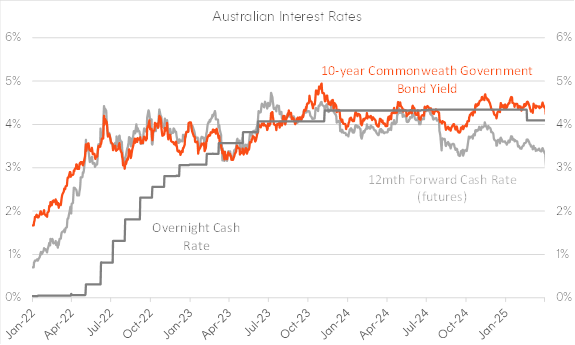

In Q1 2025, Australian government bond yields experienced a bull steepening, with 3-year yields falling by 12 basis points, while 10-year yields edged up by 2 basis points. This contrasted with the U.S., where government bond yields declined by approximately 36 basis points across the curve. The divergence was also evident in market pricing for central bank policy rates: expectations for the December 2025 Fed funds rate fell by 32 basis points over the quarter, compared to just a 13 basis point decrease in the expected RBA cash rate, reflecting a greater degree of recession risk being priced into US relative to Australia.

In February, the RBA delivered a hawkish 25 basis point rate cut. According to the minutes, the primary justification for the move was “the signal from recent trends in inflation and wages.” The Board assessed that monetary policy was restrictive and chose to ease slightly, though it was unwilling to commit to further cuts. Concerns remained that the labour market was still too tight to be consistent with inflation returning to target. However, given recent global developments, the RBA’s stance is likely to have changed. At quarter-end, markets were pricing in three rate cuts (75 basis points) by the end of 2025. Following the policy shock from President Trump’s reciprocal tariff announcement in early April, this has since increased to five cuts expected by year-end, at the time of writing.

Beyond interest rate policy, the RBA also announced changes to its Open Market Operations (OMO) repo auctions as part of its new “ample liquidity” framework. Key changes include the introduction of a 7-day repo tenor alongside the existing 28-day option, and an increase in the repo rate from Target Cash Rate (TCR) + 5 basis points to TCR + 10 basis points. The RBA aims to foster a more active role for the private market and reduce the risk of crowding out private sector participants in funding markets. This shift benefits investors in the short-term money market, leading to slightly higher margins for cash and money market funds.

Credit Markets

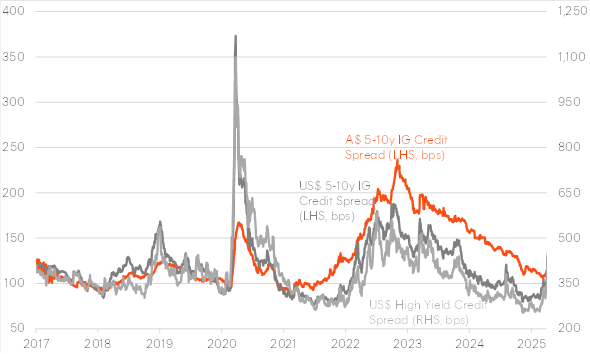

The first quarter of 2025 presented a volatile landscape for global corporate credit markets, shaped by macroeconomic uncertainty and diverging central bank policies. In the US, credit spreads widened from the tight levels seen at the end of 2024 amid concerns over trade policy and slowing growth. The Trump administration’s implementation of tariffs early in the quarter triggered a risk-off tone, with corporate earnings reflecting increased focus on tariff-related disruptions.

Despite supportive moves in government bond yields falling across the curve, risk aversion outweighed any benefit from lower base rates. US 5–10-year investment-grade spreads widened by 18 basis points to +102 basis points, while high-yield spreads saw a more pronounced move, widening 57 basis points to +345 basis points, reflecting growing caution towards lower-rated issuers.

In Europe, credit markets were shaped by Germany’s decision to increase infrastructure and defence spending, buoying growth expectations and pushing Bund yields higher. This fiscal shift, combined with the ECB’s rate cuts and ongoing geopolitical tensions (notably in Ukraine), sent mixed signals to the EUR credit market. Overall, EUR credit spreads finished the quarter broadly flat after some mid-quarter tightening.

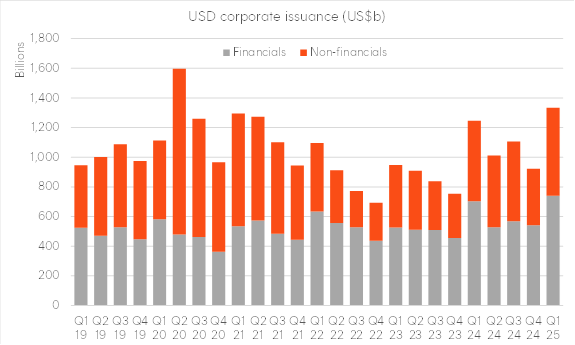

Issuance remained robust in the US with issuance hitting a record US$1.33 trillion issued in Q1, surpassing the Q1 2024 total of US$1.24 trillion. While supply remained strong, issuers may tread cautiously amid the uncertain macro backdrop.

In Australia, 5–10 year credit spreads finished the first quarter largely unchanged at +113, masking significant intra-quarter volatility. Spreads initially tightened by approximately 5 basis points through mid-February, nearing all-time tights set in late 2024. However, this move fully reversed in the latter half of the quarter as market volatility picked up.

The Australian securitisation market overcame a slow start with an active March, pricing over $11 billion across twelve deals. This robust activity put the market back on track to potentially match the record pace of 2024. Notable prime RMBS deals priced around the +100 basis points margin level, while non-conforming RMBS and various ABS transactions generally landed between +100 basis points and +115 basis points, highlighting solid investor demand despite heavy volume.

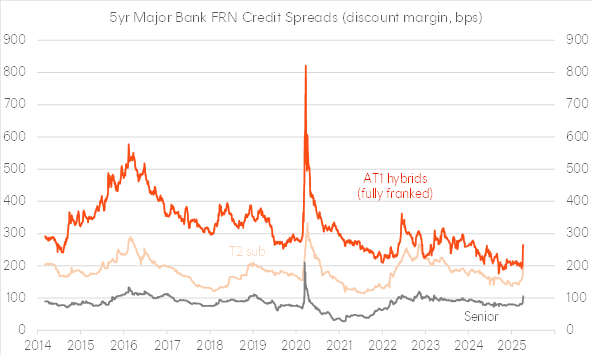

Spreads in this sector demonstrated notable resilience through Q1, contrasting sharply with the broad-based widening seen elsewhere from early March. For example, senior unsecured bank paper widened roughly 8 basis points, AT1s by a similar margin, and Tier 2 instruments by around 25 basis points over the quarter. However, this strength faced pressure as the quarter closed, with dealers beginning to mark securitisation spreads wider amid volatility spilling into April.

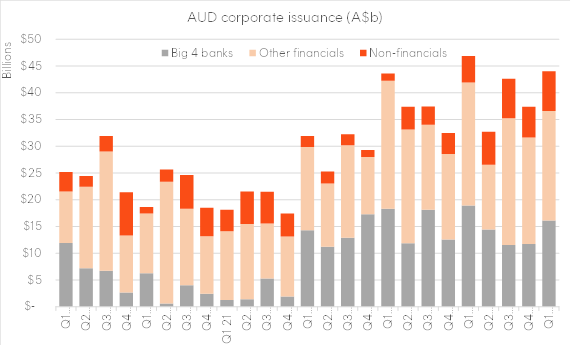

Debt capital market issuance started 2025 strongly, building on 2024’s record year, though initial expectations for a record first quarter were ultimately tempered. Financial issuance remained solid, led by $16 billion from the major banks and $20.4 billion from other financials. However, non-financial corporate issuance fell slightly short of expectations, printing only $7.4 billion. This lag was driven by deteriorating conditions in March, leading to lower coverage ratios and several issuers opting to reduce deal sizes or postpone transactions, suggesting a more cautious approach to issuance heading into Q2.

Outlook

President Trump’s early April announcement of reciprocal tariffs triggered significant upheaval across global markets, driving heightened risk premiums and a surge in volatility, including in fixed income. The tariffs, calculated using a simplistic formula based on each country’s goods trade deficit with the US, were framed as part of a broader attempt to rebalance global trade, rebuild the US manufacturing base, and pivot the economy toward private sector investment. The average US tariff rate has increased significantly – from around 3% to over 20% on affected goods, prompting some analysts to describe the move as the largest effective tax increase in nearly 60 years. The abrupt rollout also reignited tit-for-tat retaliation from key trading partners, particularly China, which responded with its own set of targeted tariffs and regulatory restrictions. This escalation has reinforced global policy uncertainty and introduced meaningful risks, both immediate and longer term.

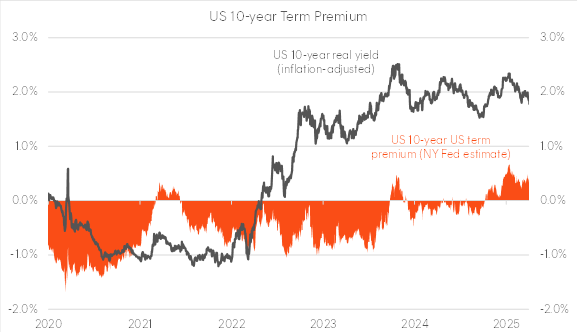

This shock sparked a surge in volatility that spilled over to US Treasuries, with long-end yields rising sharply despite mounting recession risks. The move was amplified by a mass deleveraging, as hedge funds were forced to unwind basis trades. Real yields surged, term premia expanded, and credit spreads widened. Combined, this has produced a material tightening in financial conditions, further compounding downside risks to growth. However, the speed and scale of the sell-off pressured the administration into walking back elements of the tariff schedule for key trading partners – a sign that bond market volatility may act as a constraint on further escalation.

Looking ahead, the Fed now finds itself in a difficult position. Despite rising recession indicators in survey data, resilient labour market prints and the potentially inflationary implications of tariffs give the Fed reason to remain cautious, allowing it to rebuild credibility after previously misjudging the prior inflation cycle. However, if labour market conditions deteriorate meaningfully, the Fed has room to cut aggressively. The global spillovers have been felt acutely in Australian fixed income markets. Domestic government yields have experienced a bear steepening sell-off and credit spreads have widened in sympathy, driven more by imported volatility than local conditions. This tightening unrelated to Australian inflation or labour market data supports the case for more aggressive RBA easing, with market pricing now reflecting five rate cuts.

Looking ahead, the investment case for long-term government bonds remains compelling, made even more so by the recent rise in long-end yields. These yields reflect both expected future policy rates and the term premium, both of which appear elevated. Importantly, the surge in nominal yields has occurred alongside a collapse in breakevens, pushing real yields sharply higher and tightening financial conditions. Should recession risks materialise and the unwind of leveraged positioning stabilise, forward rate expectations for both the RBA and the Fed and the respective term premiums on Australian and US bonds are likely to fall, offering attractive capital gain potential for investors willing to ride out near-term volatility.

In corporate credit, spreads may remain under pressure, particularly if the global economic outlook deteriorates or tariff escalation continues. However, investment grade spreads have now reached levels that are beginning to look attractive. For investors with a time horizon beyond 12 months, the additional yield of high-quality corporate bonds and government-related securities provides some cushion against further modest widening. High yield and private credit, however, presents a more asymmetric risk profile. Spreads in that segment are more likely to accelerate and liquidity risks likely to materialise in a US recession scenario, which would trigger the first significant default cycle since the GFC and mark the first major test of private credit as a mainstream asset class.

Ultimately risk assets, particularly US equities, remain vulnerable, coming from a starting point of elevated valuations before the tariff shock and still appearing expensive even after the recent sell-off. Forward earnings expectations have yet to be meaningfully revised lower, despite the likelihood that many firms will withdraw or downgrade guidance amid rising uncertainty around input costs, margins, and demand. At the same time, long-term nominal and real Treasury yields have risen sharply alongside wider credit spreads, keeping the equity risk premium uncomfortably thin. This combination increases the risk of further multiple compression, especially in a high-volatility environment where the outlook for returns remains challenged.

Chart 1: G7 + Australasia Policy Rates, as at 31-Mar-2025; Implied forward rates from futures or overnight indexed swaps; Source: Bloomberg

|

Country |

Dec-24 |

Mar-25 |

Dec-25 implied rate |

Expected rate change over 2025 |

| United States | 4.375% | 4.375% | 3.616% | -0.759% |

| Euro Zone | 3.000% | 2.500% | 1.918% | -0.582% |

| Japan | 0.250% | 0.500% | 0.805% | +0.305% |

| United Kingdom | 4.750% | 4.500% | 3.990% | -0.510% |

| Canada | 3.250% | 2.750% | 2.206% | -0.544% |

| Australia | 4.350% | 4.100% | 3.339% | -0.761% |

| New Zealand | 4.250% | 3.750% | 3.010% | -0.740% |

1 comment on this

My SMSF has had a flight to safety in the recent months. I have selected and invested in QPON Senior Bank Floating Bonds. When Beta Shares present investors with advice on Bond investing, QPON is noticeable by its absence. Why is this?