7 minutes reading time

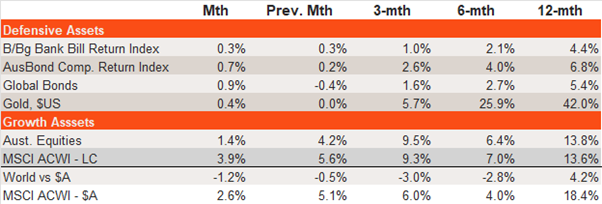

Major asset class performance

- Global equities continued to move higher in June, helped by a tentative US-China trade agreement and quick containment of US-Iran military tensions. Also helping has been still-resilient US economic growth and benign consumer price inflation – despite some lift in tariffs.

- Australian equities also rose (although again slightly less than global equities). A benign May CPI report has the market expecting a July RBA rate cut.

- Global and Australian fixed-rate bonds produced positive returns, helped by a decline in bond yields. Geopolitical tensions and still-subdued inflation helped lower bond yields, despite ongoing US budget deficit concerns.

- Gold prices were steady again in June, following solid gains in the ‘safe haven’ in earlier months.

Source: Bloomberg, Betashares. Cash: Bloomberg Australian Bank Bill Index; Australian Bonds: Bloomberg AusBond Composite Index; Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged); Gold: Spot Gold Price in $US; Australian Equities: S&P/ASX 200 Index; Global Equities: MSCI All-Country World Index in local currency and $A currency (unhedged) terms. Past performance is not indicative of future performance.

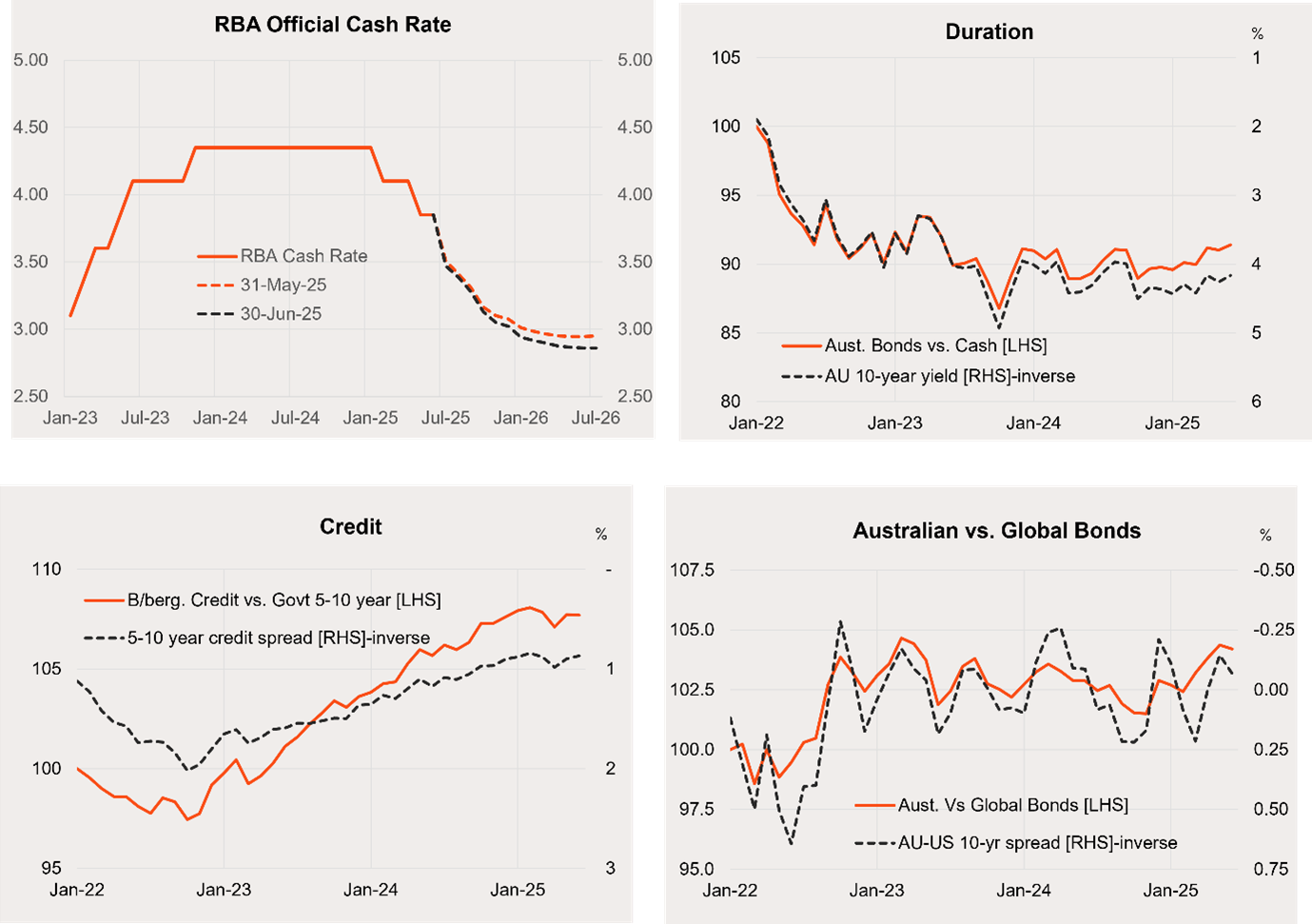

Fixed-rate bond trends

- A benign May CPI report lead to a modest increase in local rate cut expectations over 2026. Markets now expect the RBA cash rate to fall by 0.75% this year, with a high chance of one further rate cut by mid-2026.

- In the US, rate cut expectations also increased, with three rate cuts now priced by year-end, and two further rate cuts over 2026.

- Local bond yields have been in a choppy sideways range since early 2024, resulting in a choppy relative performance of bonds over cash. But yields are now at the lower end of their range and appear on the cusp of breaking lower. The prospect of further rate cuts should lower bond yields and boost bond returns relative to cash over the coming year.

- Local credit spreads – and the relative performance of corporate over government bonds – have flattened out so far this year, following a period of narrowing spreads (to historically low levels) and corporate bond outperformance over 2023 and 2024.

- The relative performance of local over global bonds remains in a choppy sideways range. The outlook for local versus global bonds remains relatively neutral.

Source: Bloomberg, Betashares. Australian bonds: Bloomberg AusBond Composite Bond Index; Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged).

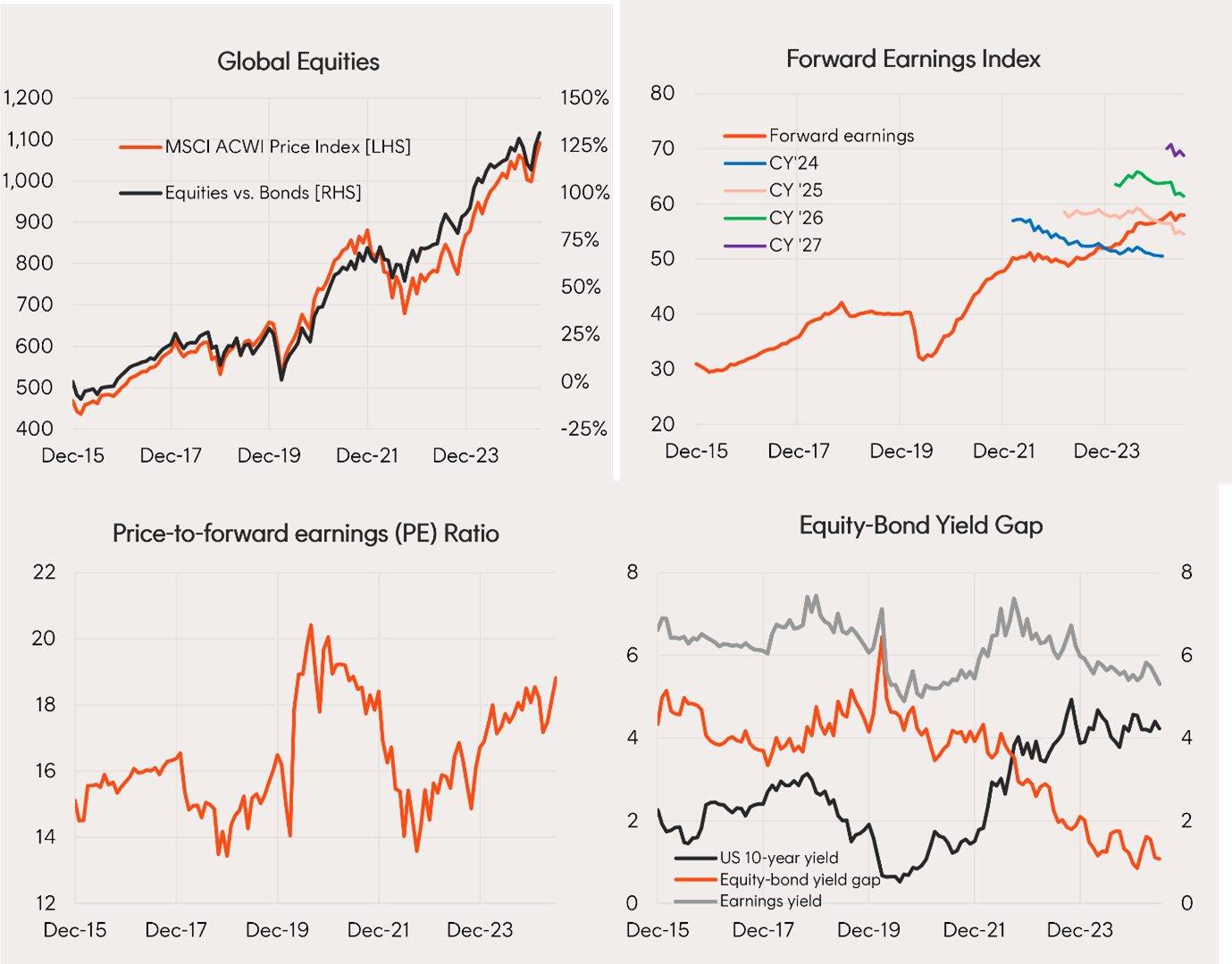

Global equity trends

- The MSCI All-World Price Index rose a further 3.8% in June – reaching a new end-month record high – after a solid 5.4% gain in May. This followed three consecutive monthly declines resulting in a cumulative 6% loss.

- The rebound has come despite a flattening in the growth of forward earnings and some downgrades to earnings outlook for this and following years. Current earnings expectations remain consistent with solid 12% growth in forward earnings over the next 12 months, although that’s only if earnings expectations are not revised down further. Some US tariff-related certainty may help in that regard.

- Much of the market’s recent gains reflected valuation expansion, with the price-to-forward-earnings (P/E) ratio rising to a relatively high 18.8 by end-June.

- With valuations still somewhat elevated, continued market gains will be reliant on falling bond yields and/or a stabilisation in the corporate earnings outlook.

Source: Bloomberg, LSEG, Betashares. Global Equities: MSCI All-Country World Index. Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged). You cannot invest directly in an index. Past performance is not an indicator of future performance.

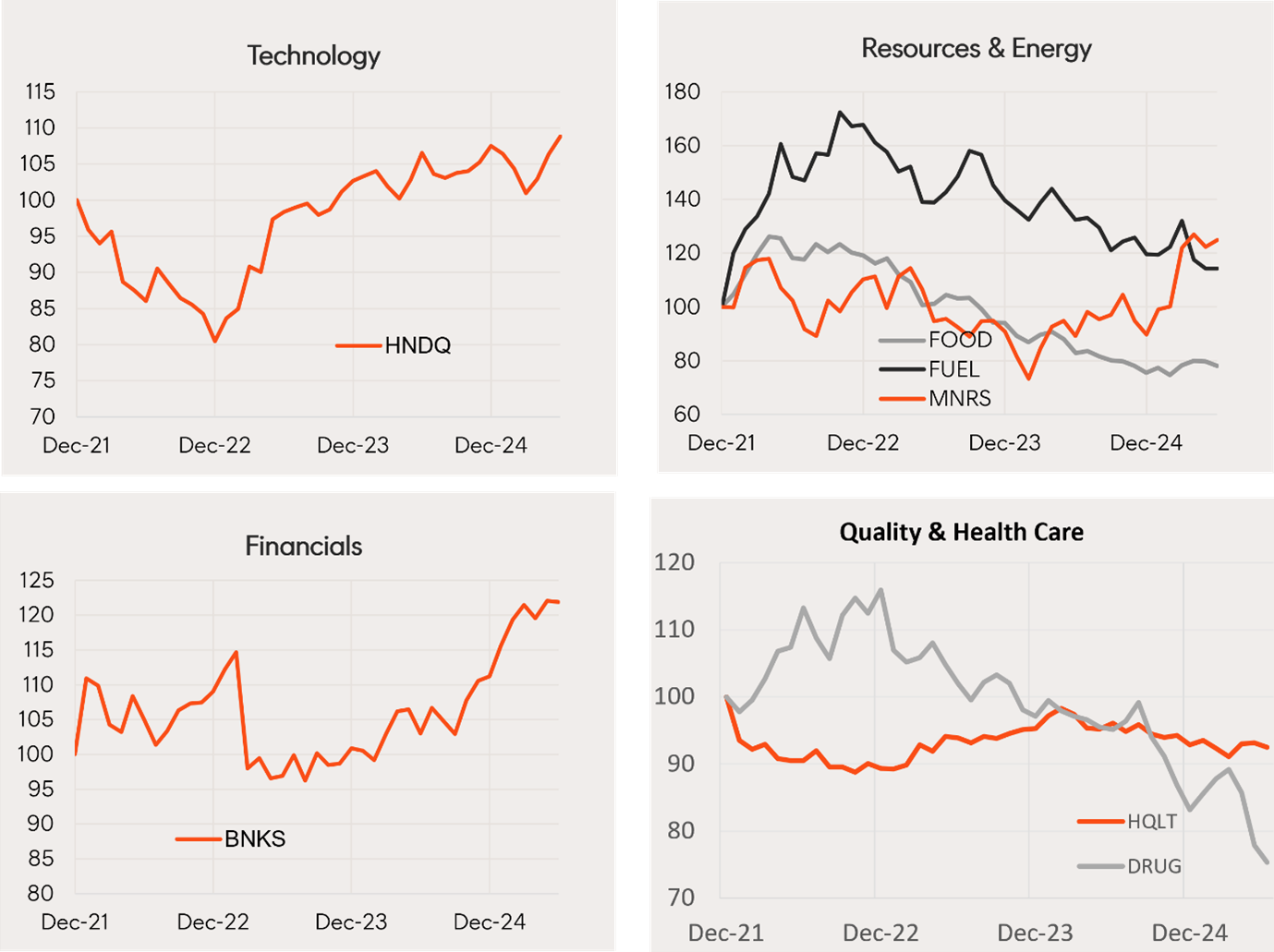

- Among select Betashares global equity ETFs, technology ( HNDQ Nasdaq 100 Currency Hedged ETF ) has enjoyed a relative performance bounce in line with the market rebound in the recent months.

- By contrast, the strong relative performance of financials and gold miners has since moderated somewhat.

- Healthcare ( DRUG Global Healthcare Currency Hedged ETF ) has underperformed in this period. The relative performance of Global Quality stocks has levelled out now, after modest underperformance in 2024.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the MSCI All-Country World Index (local currency terms) for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.

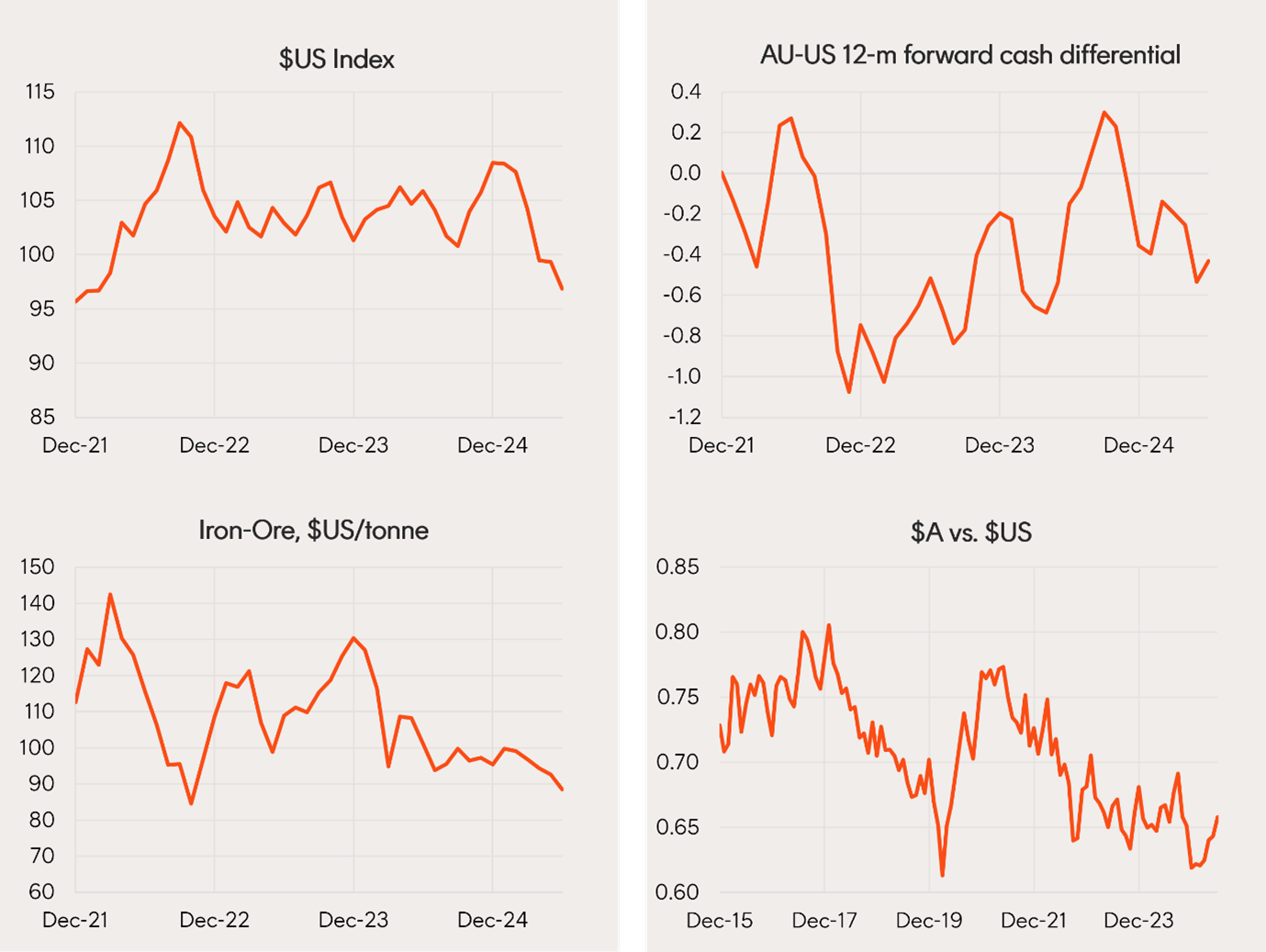

Australian dollar

- The Australian dollar continued to strengthen over June, reaching US65.8c.

- With iron ore prices softening so far this year and the year-ahead expected cash rate differential easing relative to the US, weakness in the US dollar has been the main support for the Australian dollar in recent months.

- Although normally considered a safe haven in times of global market stress, the US dollar has been undermined of late by US-centric concerns.

- Bigger picture, the US dollar remains expensive based on long-run valuation metrics. This should favour a firmer Australian dollar over time.

Source: Bloomberg, LSEG, Betashares. Australian Equities: S&P/ASX 200 Index. Australian Bonds: Bloomberg AusBond Composite Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

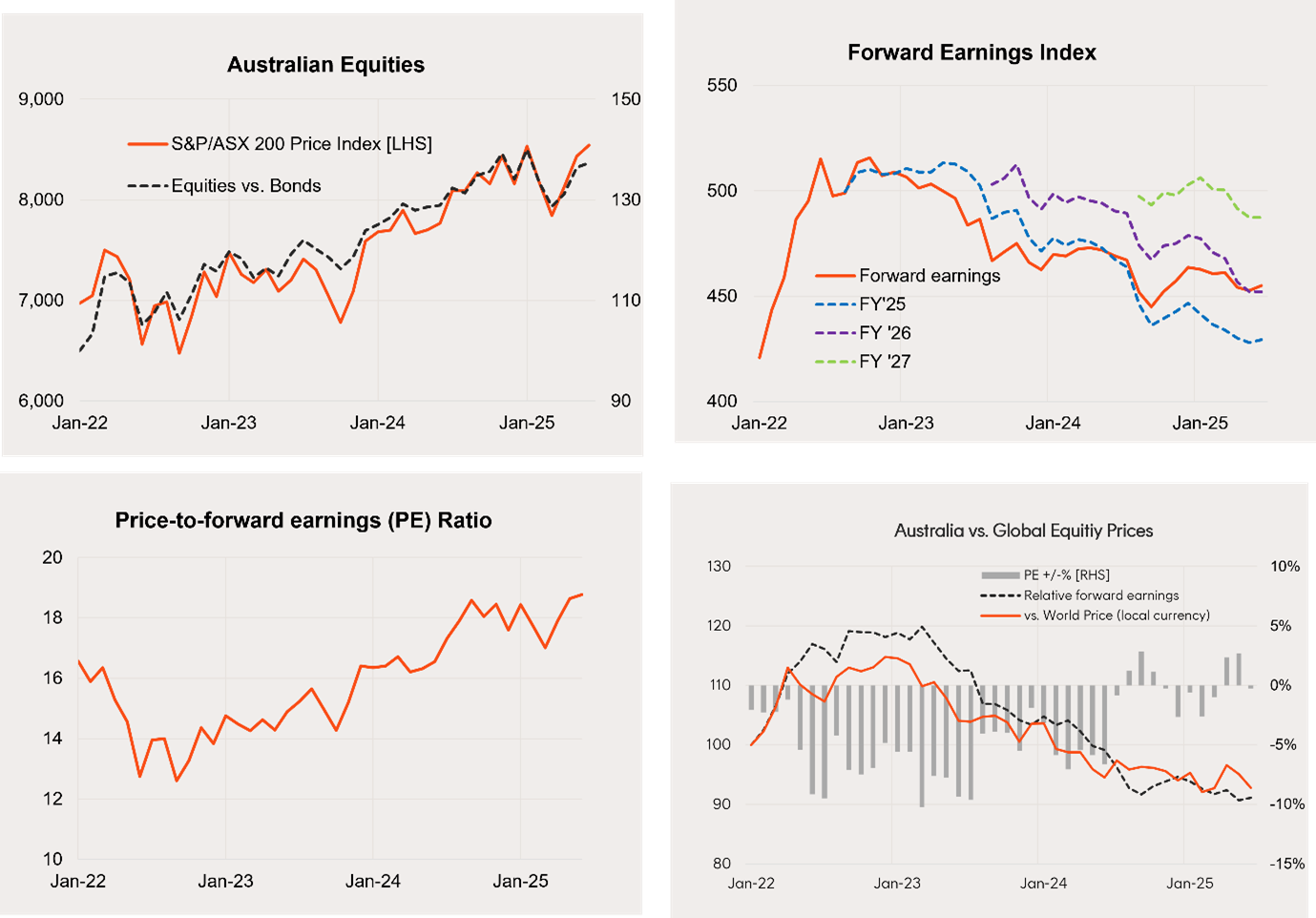

Australian shares

- The S&P/ASX 200 price index lifted a further 1.3% in June after a 3.8% gain in May.

- A small uptick in forward earnings (with some stabilisation in earnings expectations after recent downgrades) helped returns, as did a further lift in the price-to-forward earnings (P/E) ratio to 18.8.

- As with global equities, Australian valuations are now above average. That said, Australian valuations have tended to average close to global valuations over the past decade or so, so on a relative basis Australian equities could be considered neither overly cheap nor expensive.

- The forecast 12-month growth in Australian forward earnings of 8% is less than the 13% expected globally – which should hamper relative outperformance at the margin. Both local and global earnings, however, also remain under downward pressure.

Source: Bloomberg, LSEG, Betashares. Australian Equities: S&P/ASX 200 Index. Australian Bonds: Bloomberg AusBond Composite Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

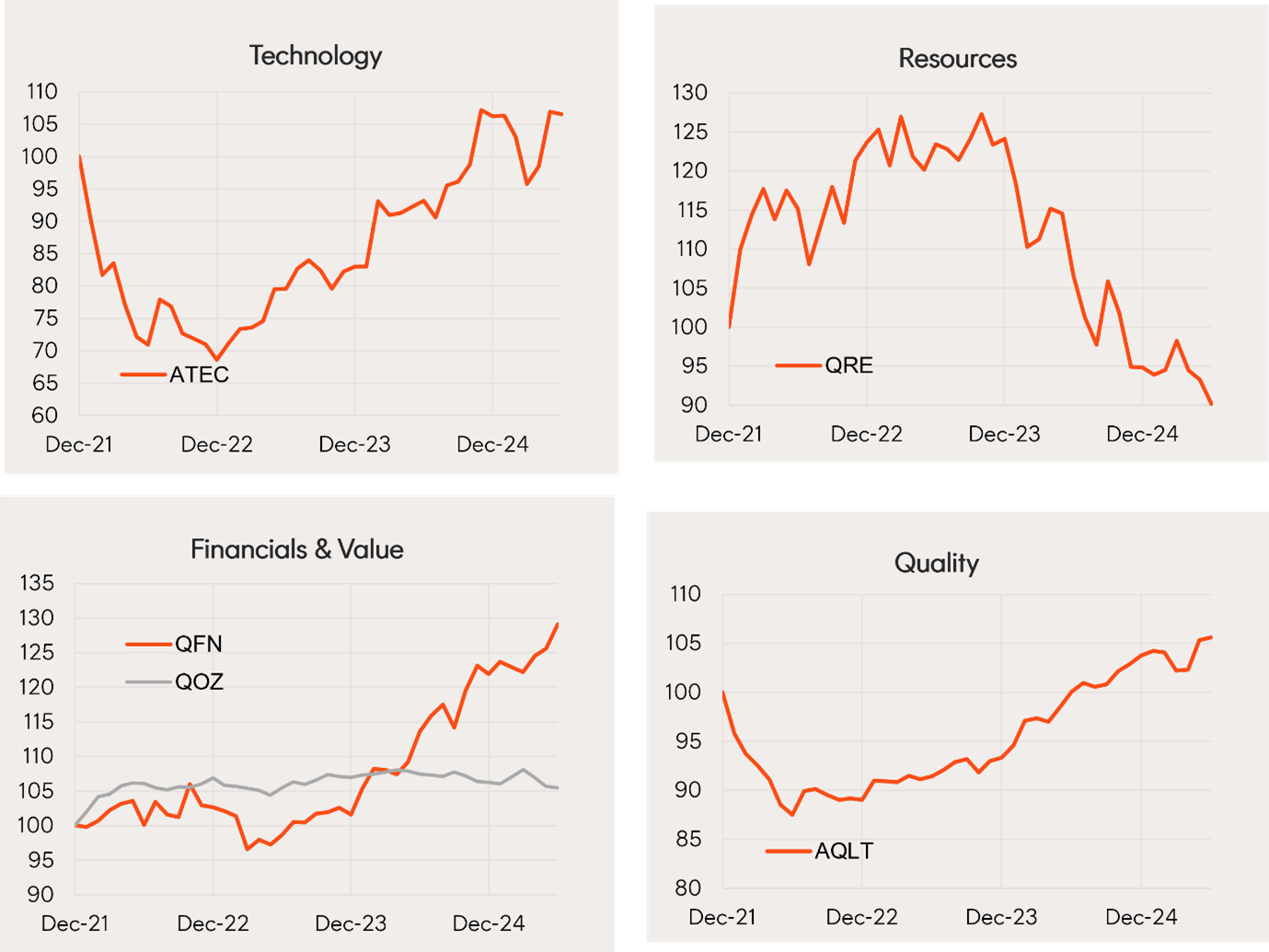

- Among select Betashares Australian equity ETFs, financials ( QFN Australian Financials Sector ETF ) and quality ( AQLT Australian Quality ETF ) have generally held up well so far this year

- Technology has bounced back relatively strongly in the past few months.

- Performance among other ETFs has been relatively steady, although resources are still tending to underperform.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the S&P/ASX 200 Index for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.