8 minutes reading time

This information is for the use of licensed financial advisers and other wholesale clients only.

3 things we learned

US market resilient despite uncertainty

US equity markets ended the quarter at all-time highs with the S&P 500 delivering a 24.5% intra-quarter gain between the Liberation Day market correction and 30 June.

Government policy remained centre stage throughout the period, with initial fears over higher than expected ‘reciprocal’ tariffs from the US fading as pauses were put in place. But we are not out of the woods yet! The final level of US tariffs and their ultimate impact on global economies remains uncertain and will continue to pose a risk for markets in the quarters ahead.

Trump’s Big Beautiful Bill passed with little immediate impact on markets. However, the bigger narrative to watch is how markets respond to the administration’s pivot away from deficit reduction toward significantly larger fiscal spending. US debt is a growing tail risk, well recognised by markets but so far without a clear resolution.

While uncertainty looms at the macro level, better than expected and broadened out corporate earnings growth, with the S&P 500 reporting annual growth in earnings of 12.9% in Q1, allowed investors to look through economic challenges and place their trust in the resilient private sector. This saw the S&P 500 and Nasdaq 100 return 10.9% and 17.9% respectively over the quarter – making the US the strongest major developed market globally.

While the US retook its status as global equity leader, looming economic risks, high valuations and concentration at the traditional index level could favour equal-weighted strategies to help diversify portfolios.

Divergence across themes driving regional equities

Outside of the US, other major global markets are riding waves of enthusiasm for localised themes.

European markets were again driven by strong returns in the financial and industrial sectors – these two sectors contributed to over 50% of the market’s performance. European banks, having suffered through years of negative yields, fiscal austerity, and low investment are now facing a much more promising outlook with structurally higher yields and governments increasing fiscal expenditure which could help revive private sector activity. NATO’s commitment to 5% spending on defence sent related companies higher with EU defence poster child Rheinmetall returning 48.8% over the quarter.

Chinese markets recovered from the Liberation Day sell off whilst experiencing heightened dispersion of returns. A mixed earnings season for Chinese tech saw heightened market sensitivity to any weakness in earnings or guidance. Year-to-date Chinese tech is still outperforming however long-term sustainability of the rally will likely rely on actual results, be it compelling policy, technology breakthroughs, and/or growing corporate earnings. In the meantime, Chinese equities will likely continue to experience high levels of volatility at the index and stock level.

The Australian share market enjoyed another strong quarter and is one of the best performing markets year-to-date. The elephant in the room remains CBA. The financial sector, the big 4, and CBA contributed to 55%, 39%, and 25% of the ASX 200’s returns respectively over the quarter. Any slowing or reversal in the big banks’ fortunes could have a significant impact on the broader market index and we have been encouraging investors to seek out ways to diversify their Australian equity exposure. Betashares has several Australian equity ETFs that have outperformed the ASX 200 over the past 12 months despite being underweight or excluding CBA altogether.

Like other global markets Japan recovered from the Liberation Day slump but remains a laggard year to date with tariffs and currency appreciation, driven by the BoJ’s policy shift and foreign inflows, weighing on exporter profits. India has remained notably resilient to global market volatility this year benefitting from geopolitical resilience and structural growth drivers like the growing uptake of Systematic Investment Plans (SIP) injecting US$3bn into markets each month.

US dollar weakness continues

The US Dollar Index fell another 7.0% in Q2 taking its cycle drawdown to 11.9% – reaching the lowest levels in three years. This marks the worst first half of a calendar year since the 1970s for the greenback.

Further weakness came despite the resurgence in US stocks singling out the dollar’s decline from a broader “sell-US trade”. A weaker US dollar is an explicit goal of the Trump administration. And while no policy has directly targeted this outcome a combination of policy aiming to close trade deficits and expectations of a US growth slowdown are doing the job.

There are several implications for investors to consider as the USD weakens.

Firstly, it may be a positive for US large caps with high levels of foreign earnings, like the big technology companies, as a weaker dollar translates into more USD from foreign revenues. A weaker dollar typically also supports emerging market assets as cost to service debt, which is often denominated in USD, drops.

A declining dollar will also likely support gold’s recent highs as investors look to it as an alternative reserve asset.

Finally, investors should consider the impacts on their international equity returns if US dollar weakness continues and the potential benefits or currency hedging US asset and gold positions – something that is possible through our range of currency hedged ETFs.

2 charts we’re watching

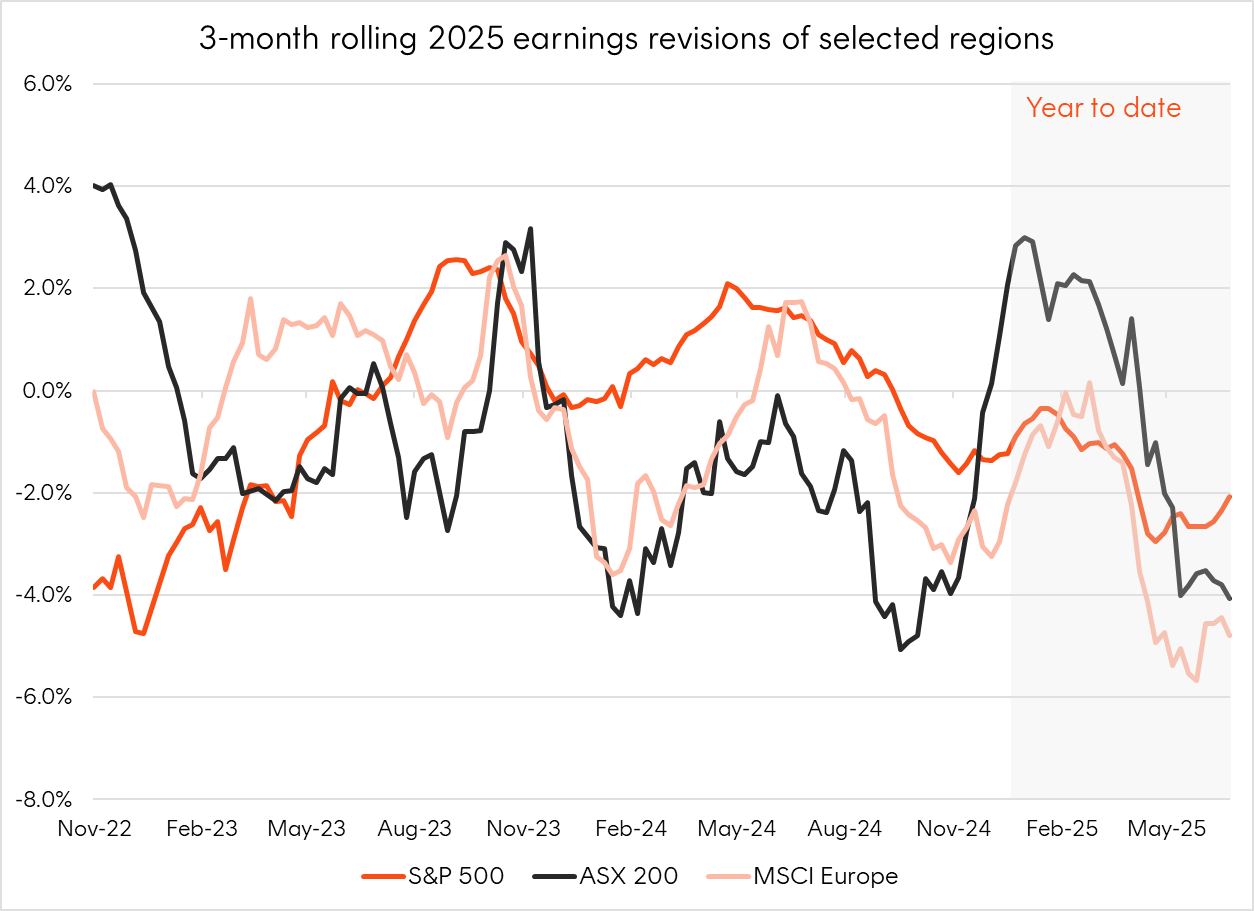

Direction of travel in corporate earnings expectations

Source: Bloomberg. As at 30 April 2025. Bloomberg consensus EPS estimates. Actual results may differ materially from estimates.

Whilst corporate earnings have remained robust so far this year analyst expectations for future earnings have been highly volatile.

Most recently, following the Liberation Day tariff announcements, expectations for global corporate earnings took a hit as analysts factored in lower economic growth from trade disruptions.

Interestingly, US earnings have been more resilient than those for Australian or European equity markets.

As we head into reporting in the US, Europe, and Australia over the next few months the direction of corporate earnings will be critical in sustaining equity market rallies. If corporate earnings or guidance begin to weaken alongside slowing macro data, it could raise concerns — especially given how much optimism is already priced into current valuations.

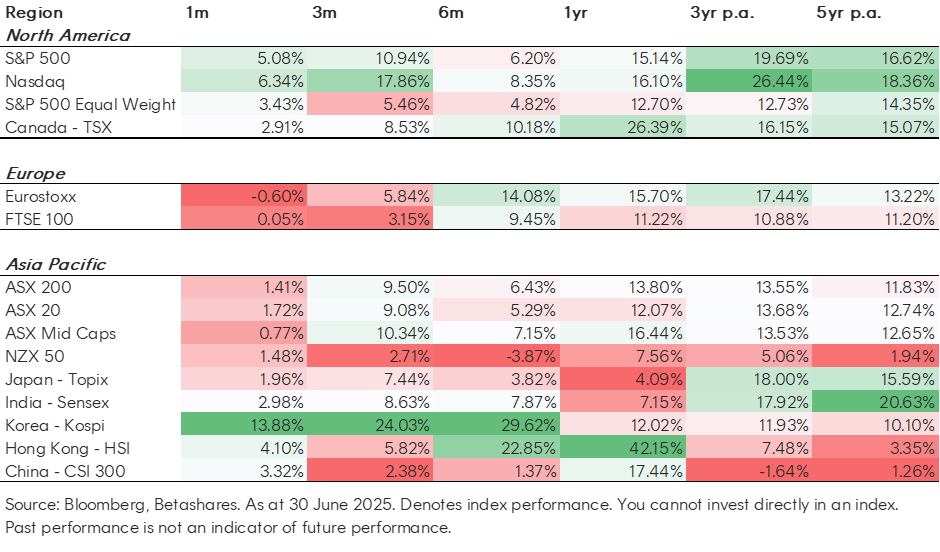

Regional equity market valuations

Source: Bloomberg. As at 30 June 2025. Forward price to earnings ratios and 10-year averages for select global indices. Bloomberg consensus EPS estimates. Actual results may differ materially from estimates.

Much of the concern in equity markets coming into 2025 was around concentration and valuations. With the US, and in particular big tech, underperforming in Q1 and global markets selling off dramatically on Liberation Day valuations in major markets reverted to 10-year averages and concentration subsided.

However, the reprieve was short lived. The rebound in equity markets since Liberation Day marked a return to the trend of recent history with large caps outperforming small, growth outperforming value, big tech outperforming the rest, and the US outperforming the world.

The rebound saw valuations and concentration whipsaw back above recent averages in most major markets.

The S&P 500 is once again trading close to 25x forward earnings while the S&P 500 Equal Weight remains at 10-year averages, a divergence that could close if earnings continue to broaden out.

1 question remaining

What can drive markets higher from here?

With valuations and concentration back at elevated levels, and policy uncertainty still in focus, the next leg higher for markets will likely require a new catalyst.

In the US greater policy certainty could provide a short-term benefit until the impacts of any policy changes, higher tariffs and/or government debt, are digested by markets. Comprehensive US trade deals with Europe and China would help, although the notation 1 August deadline is fast approaching. Within Europe and China talks of spending commitments turning into specific legislation and coordinated stimulus could see their markets continue to run.

Better than expected corporate earnings globally defying falling expectations. For example, the upcoming quarterly reporting season in the US is expected to show the lowest level of year-on-year growth, beats at the company and index level could drive markets higher.

A Fed cut driven by the soft landing finally delivering – and not because of a sustained deterioration in unemployment would be a boost for markets. The same applies to the continued global rate cutting cycle continuing under soft landing conditions.

Sustained structural growth initiatives and results in key regional themes: US AI, European defence and infrastructure, Chinese tech, Indian middle-class growth.

The path forward looks less dependent sentiment and more on fundamentals catching up to price and hard economic data remaining resilient as soft data weakens.

Equity market dashboards

Betashares Capital Limited (ACN 139 566 868 / AFS Licence 341181) (“Betashares”) is the issuer of this information. It is general in nature, does not take into account the particular circumstances of any investor, and is not a recommendation or offer to make any investment or to adopt any particular investment strategy. Future results are impossible to predict. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in any opinions, projections, assumptions or other forward-looking statements. Opinions and other forward-looking statements are subject to change without notice. Investing involves risk.

To the extent permitted by law Betashares accepts no liability for any errors or omissions or loss from reliance on the information herein.