6 minutes reading time

- Defined income bonds

- Fixed income, cash & hybrids

Once the domain of institutions, the introduction of fixed income ETFs has afforded every investor the chance to invest in these products easily and cost-effectively.

However, traditional bond ETFs don’t always replicate the certainty of outcomes and income profile of holding an individual bond to maturity. This has led some investors to fall back on term deposits. This comes with certain limitations:

- Limited access: Term deposits lock up your money, making it difficult to access without penalties.

- Lower yields: Term deposits typically offer lower interest rates than corporate bonds (which carry higher risk) and require you to reinvest frequently, exposing you to the risk of lower interest rates in the future.

- Lack of flexibility: Term deposits restrict your ability to quickly move your money to better opportunities as they arise.

Introducing Betashares Defined Income Bond ETFs

To cater to these challenges, Betashares has introduced a solution that combines the predictability of direct bonds with the flexibility of ETFs. The new Betashares Defined Income Bond ETF range is the first of its kind in Australia and offers a smarter way to invest in fixed income.

Why consider Betashares Defined Income Bond ETFs?

- Attractive, predictable income: Betashares Defined Income Bond ETFs target fixed monthly income payments, providing predictability of cash flow*.

The Funds are currently offering the following yields (as at 1 May 2025)**- 28BB – 4.13%

- 29BB – 4.21%

- 30BB – 4.43%

All three Funds have a target monthly distribution (which can be found on any of the relevant Fund page) and currently yield well above the benchmark term interest rate (see the chart at the bottom).

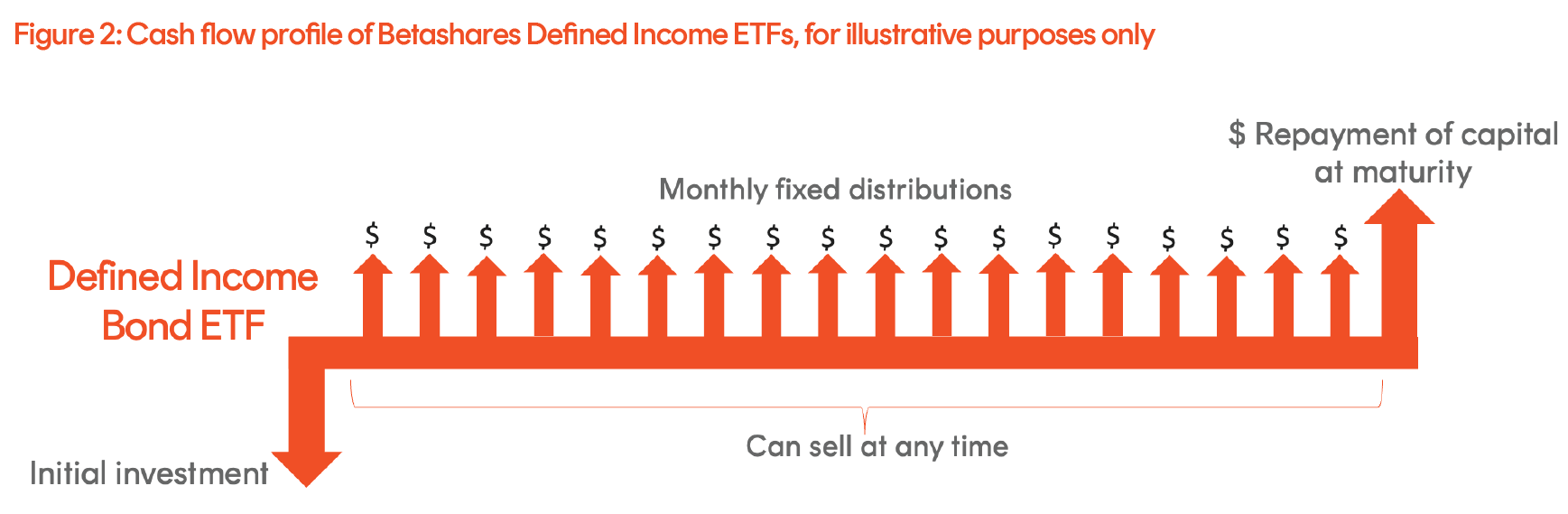

- A clear investment timeline: Like a traditional bond, these ETFs have a set maturity date. Like any ETF, you also have the flexibility to buy or sell any time prior to maturity on the ASX.

- A portfolio of bonds in one trade: Betashares Defined Income Bond ETFs invest in a portfolio of corporate bonds, giving you diversified exposure across a range of corporate issuers.

*The target monthly distribution may vary in certain circumstances. Please refer to the PDS. ** Each Defined Income Bond ETF yield is Yield to Worst (net of fees) and represents the annualised total expected return of a Fund’s portfolio if underlying bonds are held to maturity or called and do not default, and the coupons are reinvested at the YTW. The YTW is the lower of the Yield to Maturity (YTM) or Yield to Call (YTC). Assumes no change in interest rates. Yields are subject to change over time.

How Betashares Defined Income Bond ETFs work

These ETFs offer access to a carefully curated portfolio of high-quality corporate bonds, set to mature in a specific future year. When you invest in a Betashares Defined Income Bond ETF, you are essentially buying an interest in the Fund’s diversified portfolio of bonds.

Investors in the Fund will receive a fixed monthly income, reflecting the prevailing market yield (after fees and costs) of the initial portfolio of securities. At the end of the ETF’s term, the Fund will be wound up and investors will receive the NAV of their units. This structure allows you to experience the predictability of individual bonds while enjoying the liquidity and ease of trading that ETFs provide.

Note that unlike term deposits, an investment in the Funds does not receive the benefit of any government guarantee. While corporate bonds do have their benefits, it is important to be aware of the risks (see below for further information).

How do investment grade corporate bonds perform over time?

Investment grade corporate bond returns have tended to exhibit low correlation with shares, which may help mitigate the effects of sharemarket downturns.

In 2002, 2008 and 2011, corporate bonds recorded material gains at the same time as stocks were struggling. However, the relationship hasn’t always held up, and in 2022, both asset classes sold off in unison as markets reacted to surging inflation and rising interest rate expectations.

Returns are not everything – volatility matters too

Between 1999 and 2024 (i.e. the last 25 complete calendar years), Australian fixed rate corporate bonds returned 5.22% p.a. compared to an 8.69% p.a. return for the ASX 200.

However, it is important to note that corporate bonds achieved these returns with significantly less volatility. Corporate bond volatility has been 2.48% p.a. over the last 25 years. In contrast, share market volatility has been 15.67% p.a. over that same time.

The maximum and average drawdowns seen in corporate bonds have also tended to be significantly smaller than for shares.

Level up your fixed income investing

The Betashares Defined Income Bond ETF range has three products, each with different yields and maturity dates to suit different investment horizons:

- 28BB 2028 Fixed Term Corporate Bond Active ETF – Betashares 2028 Fixed Term Corporate Bond Active ETF (maturing in May 2028)

- 29BB 2029 Fixed Term Corporate Bond Active ETF – Betashares 2029 Fixed Term Corporate Bond Active ETF (maturing in May 2029)

- 30BB 2030 Fixed Term Corporate Bond Active ETF – Betashares 2030 Fixed Term Corporate Bond Active ETF (maturing in May 2030)

Source: Bloomberg. Overnight Indexed Swap (OIS) represent the market’s expectation of the total return on cash invested at the prevailing daily cash rate over different time periods. Each Defined Income Bond ETF’s YTW is net of fees and represents the annualised total expected return of a Fund’s portfolio if underlying bonds are held to maturity or called and do not default, and the coupons are reinvested at the YTW. The YTW is the lower of the Yield to Maturity (YTM) or Yield to Call (YTC). Assumes no change in interest rates. Yields are subject to change over time.

Investing in fixed income does not have to be complicated or restricted to large institutions. With Betashares Defined Income Bond ETFs, you can enjoy predictable income based on a yield that exceeds the RBA cash rate. You also benefit from clear investment timelines and the flexibility to access your money when you need it. In summary, these ETFs truly offer a smarter way to invest in fixed income.

There are risks associated with an investment in the Funds, including interest rate risk, credit risk and market risk. Investment value can go up and down. An investment in the Funds should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.