2 minutes reading time

We outline what you can expect in terms of tax during the coming months, which may be helpful for your tax preparation related to your Betashares Direct investments.

As a Betashares Direct investor, you’ll receive a single tax statement covering all the tax attributes received throughout the year for your ETF and/or share holdings. Your tax statement will also be sent to the ATO, which will be used to pre-fill your tax return.

In addition, if you’ve sold any investments during the financial year on the platform, you will receive a single CGT report. While the CGT statement data will also be sent to the ATO, this information will not be pre-filled.

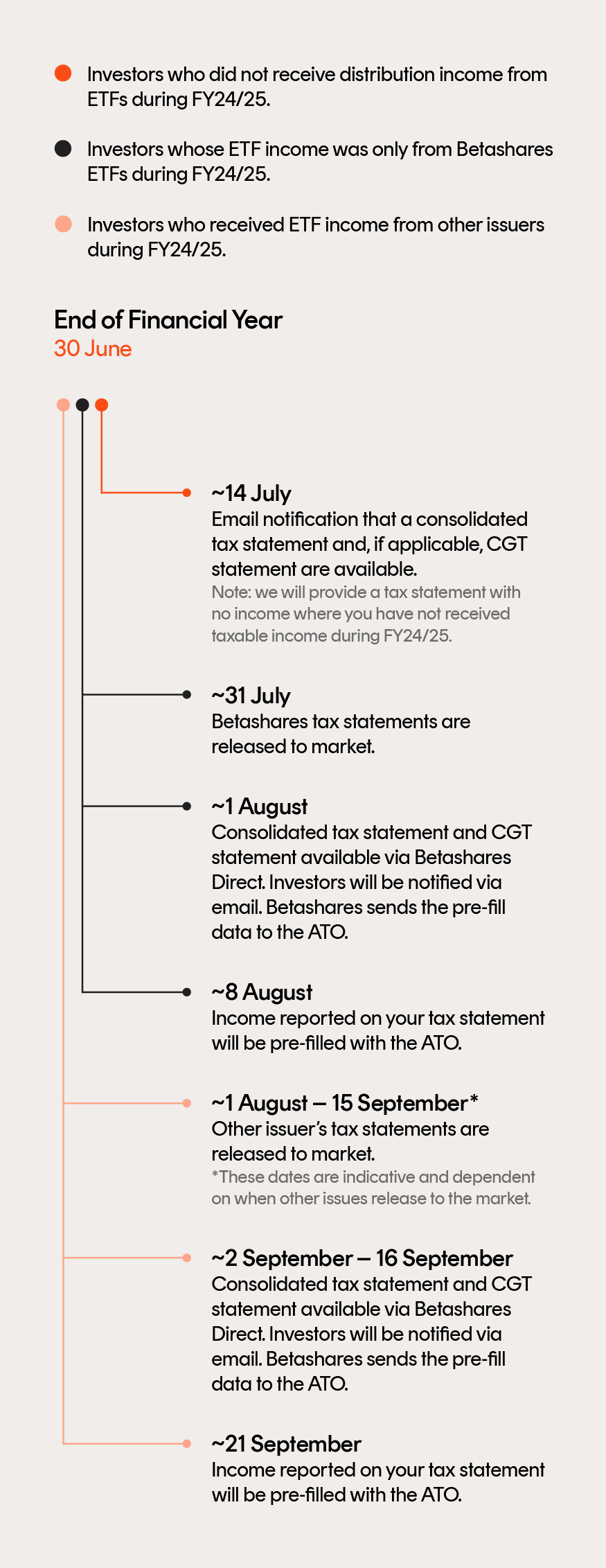

Estimated statement timeline.

The timing of your tax reporting is dependent on which type of securities you received income from during the tax year.

In order to provide you with accurate tax reporting, Betashares needs to obtain underlying tax data on each investment you held over the period:

• Income from ETFs – Betashares is required to wait for ETF issuers to deliver tax data for each fund, which varies by issuer.

• Income from shares – tax information is publicly available at the time of announcement and therefore does not impact the timing of our reporting.

The timeline below takes this data availability into account. Note that Betashares has to wait until all data is available before we can send you your personalised tax report.

If you have any questions in the meantime, refer to the FAQs or contact our Customer Support team for assistance via [email protected].

2 comments on this

Hi, any update as to when the NDQ ETF tax statement will be available?

ETF distributions and CGT statements often create confusion when it comes to matching with tax returns. Partnering with experts such as Clear Tax (https://cleartax.com.au/) ensures these details are handled correctly and efficiently.