6 minutes reading time

Investing in the share market can be a very daunting experience for many starting out on their investment journey. Deciding what stocks to buy with so many choices from blue chips, small caps, US shares, and what about Europe or Emerging markets? Then there is the never-ending list of exchange traded funds (ETFs) which bundle stocks together from broad market exposures to specific themes and different investment strategies.

With all the investment choices out there, it is no wonder many investors struggle to know where to start. Investing in the stock market does not have to be difficult, for most people the best course of action is time in the market, which refers to maintaining long-term investments throughout the market cycle, with regular contributions accelerating the compounding effect from market returns. As opposed to timing the market which refers to predicting stock market movements to buy low and sell high, which even the most experienced investors will admit is a difficult task to master.

The DHHF Diversified All Growth ETF has been designed as a complete all-in-one stock market solution for accumulators who recognise that time in the market is the key to achieving their long-term investment goals.

The only free lunch in investing

Harry Markowitz, the pioneer of Modern Portfolio Theory, famously coined the phrase “Diversification is the only free lunch in investing” explaining the result of diversification allowing investors to reduce risk without sacrificing potential returns.

DHHF combines 200 of the largest stocks in Australia with over 9,000 global stocks across developed and emerging markets inclusive of large, mid and small capitalisation companies, creating a truly diversified exposure.

When it comes to designing a complete solution for Australian investors, a key consideration is how much to allocate to Australian shares relative to Global shares. A home bias, describing investing a higher weight in domestic assets than their representation in global indices, is common across investors from different countries, a large part of this behaviour is familiarity and a greater knowledge of what you are investing in, as well as less risk in the form of currency movements.

In Australia in particular, franking credits are a unique feature of the tax system offering benefits to Australian shareholders of Australian companies. Franking credits serve to avoid double taxation of corporate profits and can significantly benefit after-tax returns for Australian investors, which largely explains why the home bias in Australia is generally higher relative to other parts of the world.

Seeking the right mix

A Strategic Asset Allocation (SAA) refers to a portfolio strategy whereby target allocations are set for various asset classes and the portfolio is rebalanced back to those weights periodically. In the case of DHHF, there are two asset classes being Australian shares and Global shares.

DHHF’s SAA is set by the Betashares Investment Committee, which seeks to maximise the portfolio’s Sharpe Ratio — a measure of efficiency that considers not just long-term returns, but also the volatility, or the investment journey, experienced by investors along the way.

Sharpe Ratio = (Portfolio Returns – Risk Free Rate) / Volatility of Returns

The first part of the equation above is portfolio returns:

The Betashares Investment Committee is tasked to estimate these returns which typically involve forecasting an income, growth and valuation (or mean revision) component for each asset class.

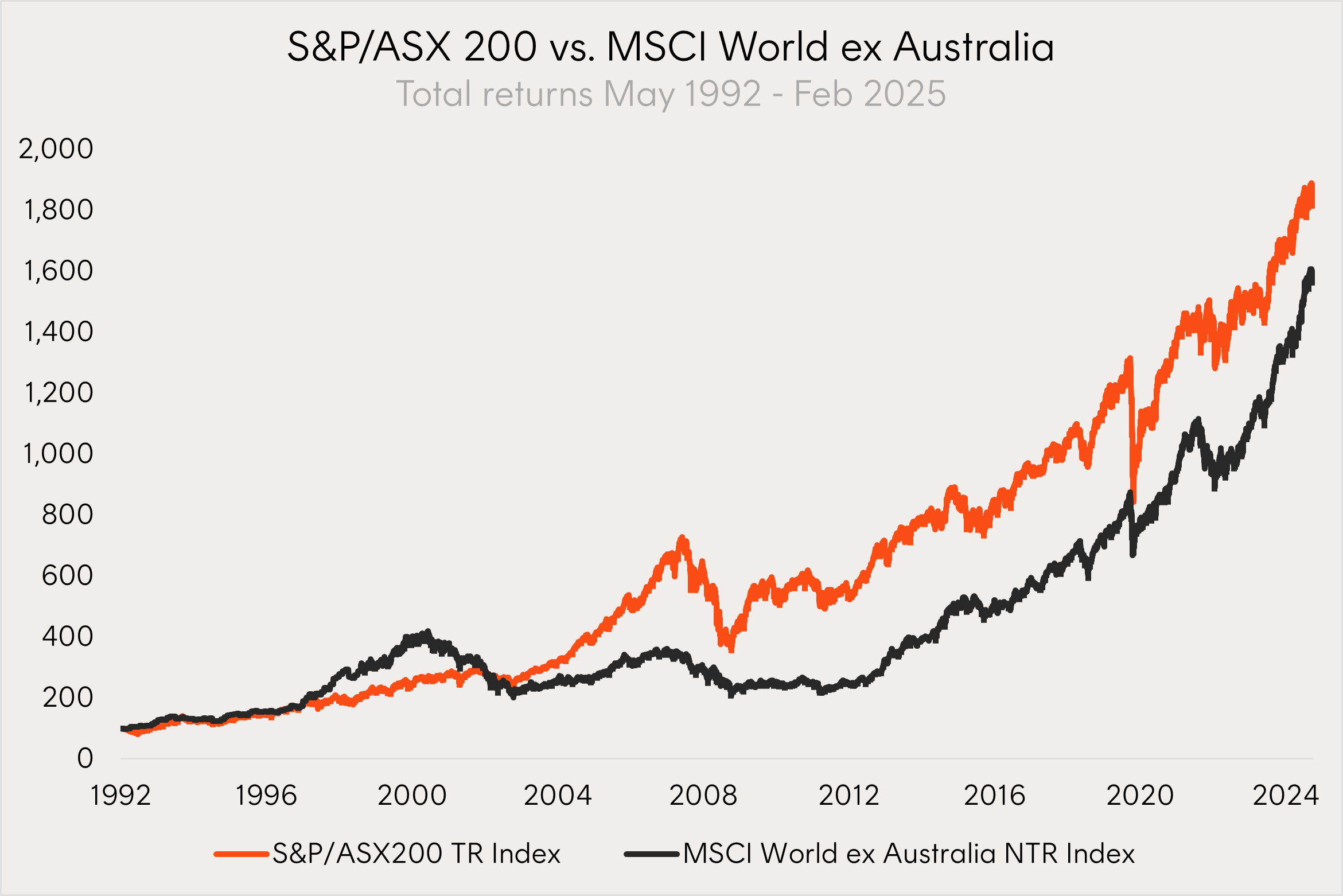

The S&P/ASX200 Index since inception in May 1992 has returned 9.24% p.a. (excluding franking credits) vs. the MSCI World ex Australia Index of 8.81% p.a.

Source: Bloomberg. May 1992 to Feb 2025. You cannot invest directly in an index. Past performance is not an indicator of future performance.

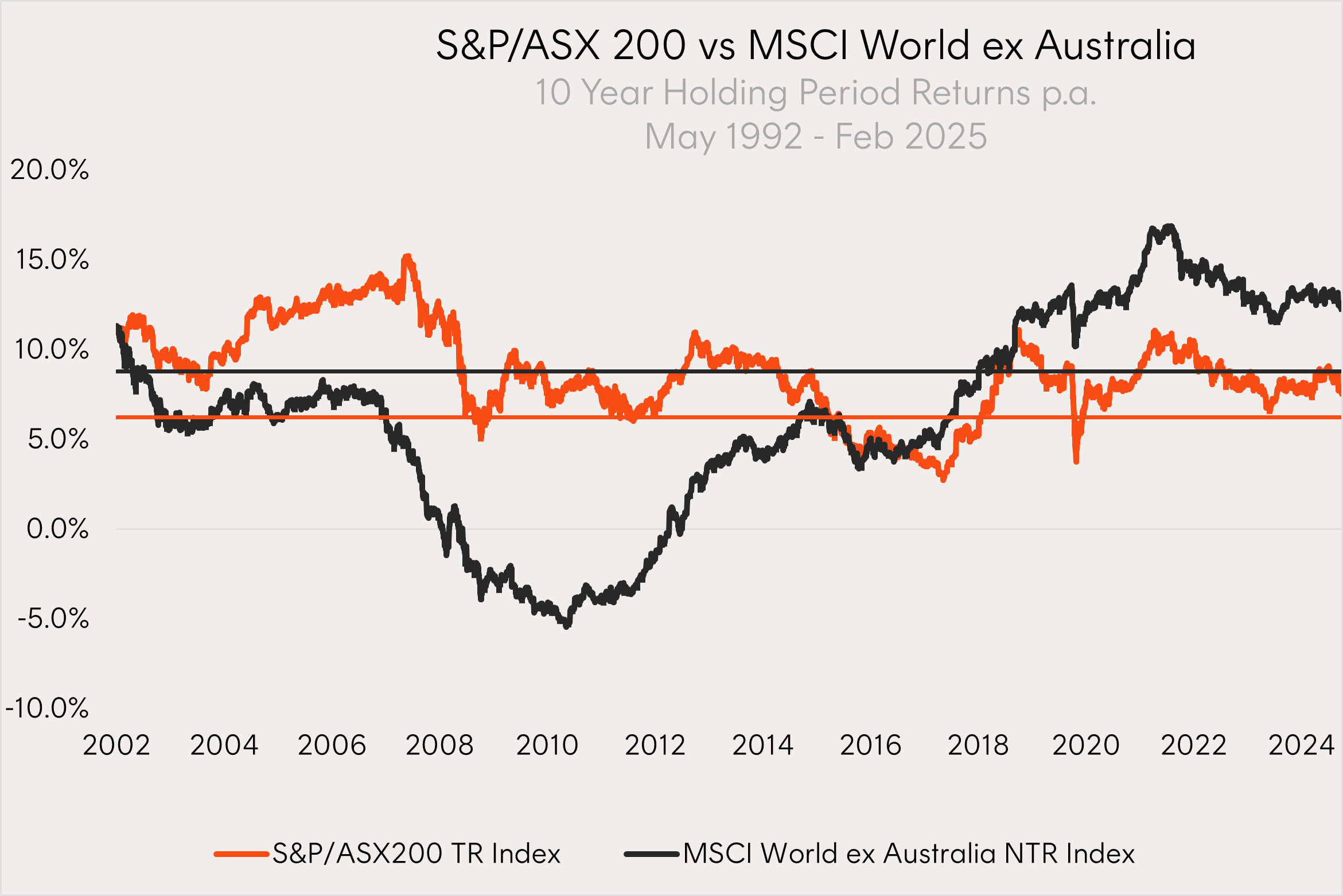

If we look at rolling 10 year holding period returns over this time frame, the average 10 year holding period return for the S&P/ASX200 Index was 8.80% p.a. (black horizontal line) exceeding the average 10 year holding period return for the MSCI World ex Australia Index of 6.23% p.a. (orange horizontal line).

Source: Bloomberg. May 1992 to Feb 2025. You cannot invest directly in an index. Past performance is not an indicator of future performance.

While Global shares have out-performed Australian shares over the last 10-year cycle, there can be a lot of variability in holding period returns, this variability does decline the longer your time horizon is. It is for this reason, that when determining the appropriate SAA for DHHF, the Betashares Investment Committee takes a longer term view and currently assigns an 8.0% p.a. return expectation for both asset classes.

The second part of the equation is portfolio volatility:

To maximise the fund objective (i.e. Sharpe Ratio) the focus turns to minimising the volatility between the 2 asset classes which has the impact of increasing the Sharpe Ratio.

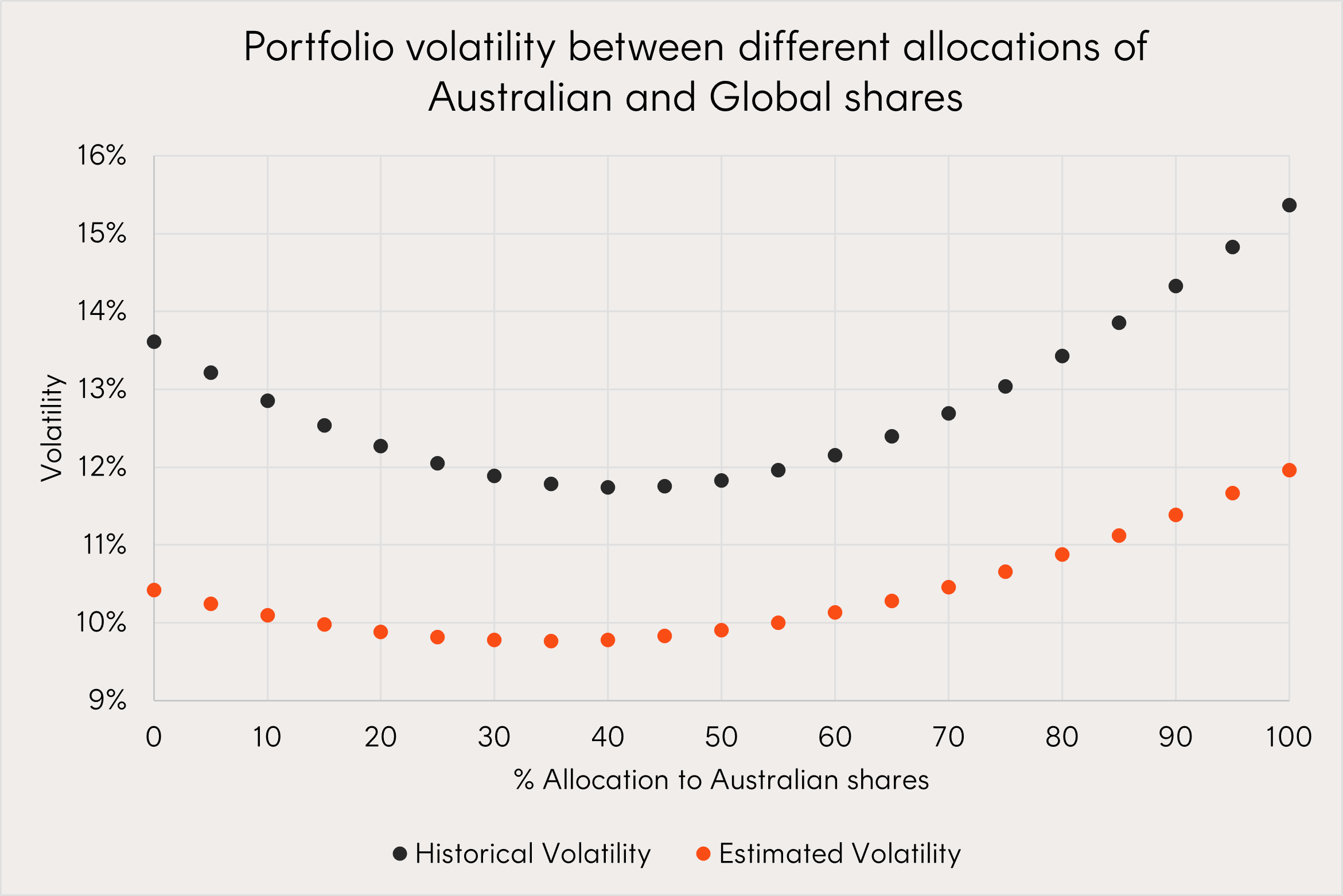

The below chart measures the volatility, on a historical and forecasted basis, of different portfolio allocations between Australian and Global shares. The left-hand dots represent a 0% allocation to Australian shares and incremental allocations of 5% are added until the portfolio is 100% Australian shares and 0% Global shares.

Source: Bloomberg and Barra, Australian shares measured by the S&P/ASX200 TR Index, Global Shares measured by the MSCI All Country NTR Index. Actual results may differ materially from assumptions.

Both measures suggest the allocation that minimises the portfolio volatility is between 35 to 40% Australian Shares when combined with Global Shares. The higher Global allocation is a function of the fact that Global shares have lower historical and estimated volatility, but the benefits of diversification mean a lower overall portfolio volatility can be achieved through a blend of both asset classes.

Australian and Global shares return and risk characteristics

|

Estimated Inputs |

Australian Shares |

Global Shares |

Australian (37%) |

|

Return |

8.0% |

8.0% |

8.0% |

|

Volatility |

11.96% |

10.42% |

9.76% |

|

Sharpe Ratio |

0.52 |

0.60 |

0.64 |

Source: Barra, Bloomberg, Betashares. Actual results may differ materially from assumptions.

Under these assumptions, diversification is effectively a ‘free lunch’ which allows investors to reduce risk without sacrificing potential returns.

Putting it all together

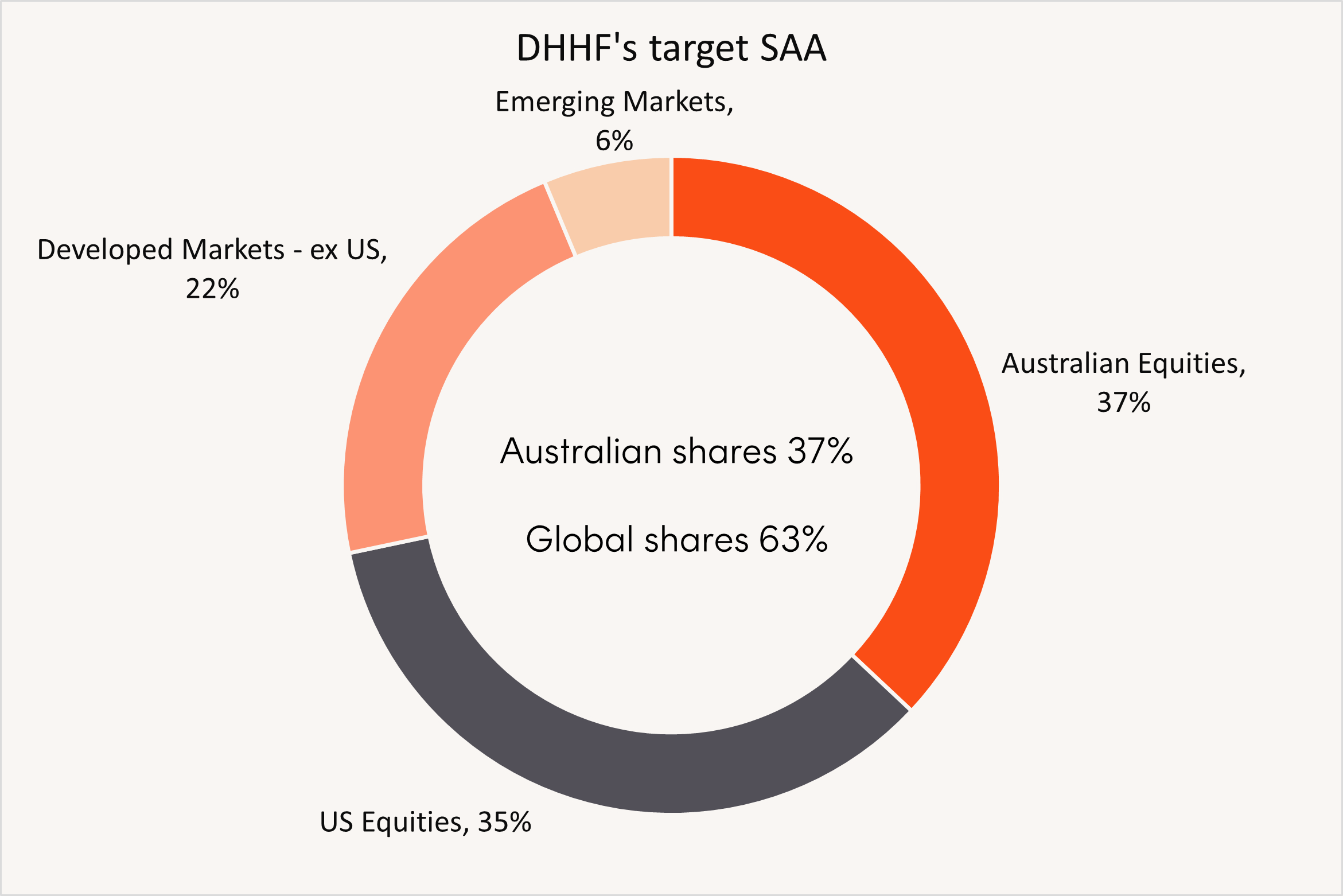

In seeking to maximise DHHF’s Sharpe Ratio, the Betashares Investment Committee must consider the expected returns and volatility of Australian and Global shares. Under the current assumptions outlined above this mix can be anywhere between 35 to 40% Australian and 55 to 60% Global shares. The assumptions used to determine these allocations are reviewed annually.

Source: Betashares.

There are risks associated with an investment in DHHF, including asset allocation risk, market risk, currency risk, underlying ETFs risk and index tracking risk. Investment value can go up and down. An investment in the Fund should only be made after considering your client’s particular circumstances, including their tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.