5 minutes reading time

If you prefer to listen to Bass Bites, you can click the player below:

Global week in review

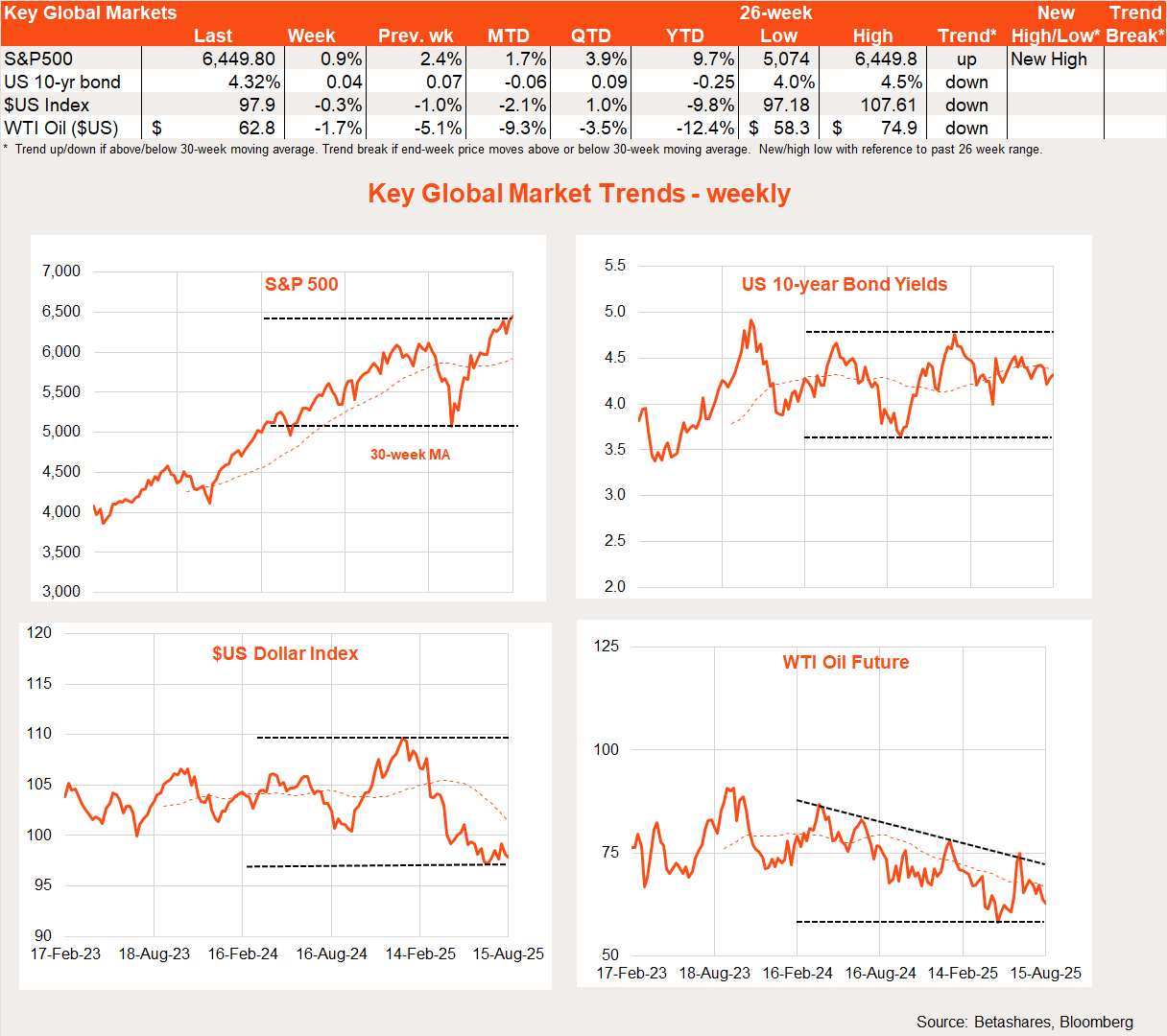

And so we wait. Global equities pushed higher last week, with a key US inflation report still failing to show much impact from higher tariffs.

Missing in action: inflationary tariff effects

Global equities continue to be buoyed by two factors: a modest softening in the US labour market and the ongoing absence of major tariff effects in US inflation, both of which have raised hopes for a September Fed rate cut.

Last week’s US July CPI report was as expected, with headline and core prices rising 0.2% and 0.3% respectively. At 3.1%, annual core CPI inflation is still higher than the Fed would like, and core services inflation remains especially sticky, lifting 0.4% in the month and 3.6% over the year. Markets, however, latched onto the fact that core goods prices rose only 0.2% and a modest 1.2% over the year. Dig deep enough and some tariff effects will surely be found in certain items. But overall, US goods inflation remains remarkably benign.

Of course, it could just be a question of lags. Later in the week, US stocks were briefly rocked by a higher-than-expected 0.9% gain in both headline and core producer (wholesale) prices. These are the prices that businesses charge each other for intermediate goods and services along the supply chain before the final products are on sold to consumers. Core goods wholesale prices rose 0.4% while services were again stronger, up 1.1%.

Also of note last week, US weekly jobless claims remained low – providing some reassurance that the labour market is not slowing too abruptly despite recent soft employment gains.

US Treasury Secretary Scott Bessent was so pleased with the inflation outlook he suggested last week that most “Fed models” would have the Fed fund rates 1.5-1.75% lower by now. Exactly which models he was referring to mystified most economists – with core inflation around 3% and the unemployment rate just over 4%, if anything the Fed funds rate should arguably be higher not lower.

Global week ahead: FOMC minutes

There’s little major global data of note this week, with most focus likely to be on the minutes of the recent Fed meeting. Markets will watch how inclined Fed members will be to cut rates at the upcoming September meeting.

In New Zealand, the Reserve Bank is widely expected to cut the cash rate further to 3% on Wednesday, in light of inflation being back at target and a still-weak labour market.

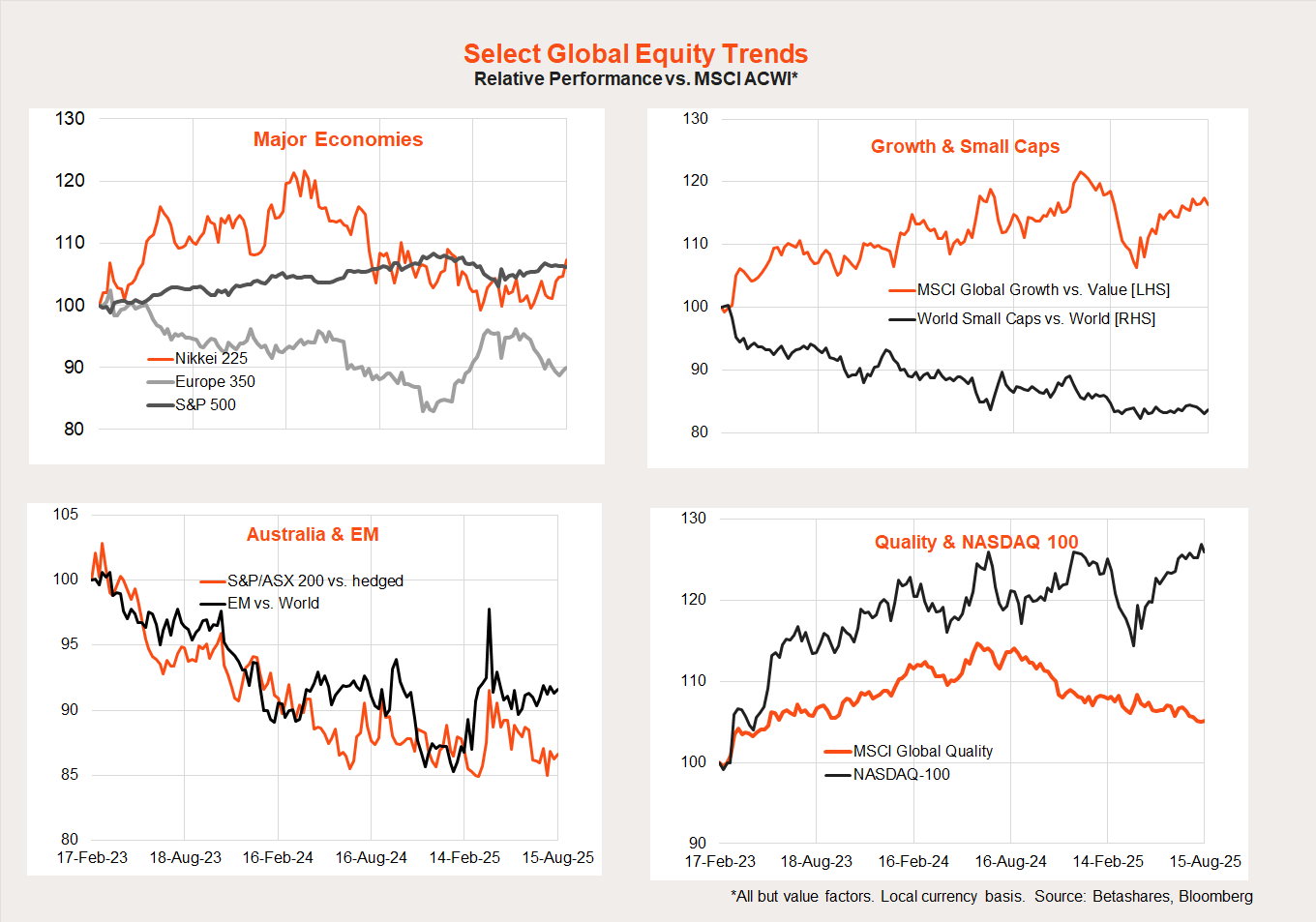

Global share market trends

As has been noted here previously, the US/technology/growth/large cap outperformance trend appears to have largely resumed with the market rebounding since early April.

That said, Japan’s relative performance has picked up of late, with the Nikkei 225 reaching record highs last week. The return of modest price and wage inflation, and improved corporate focus on shareholder returns, are helping to propel Japanese stocks higher.

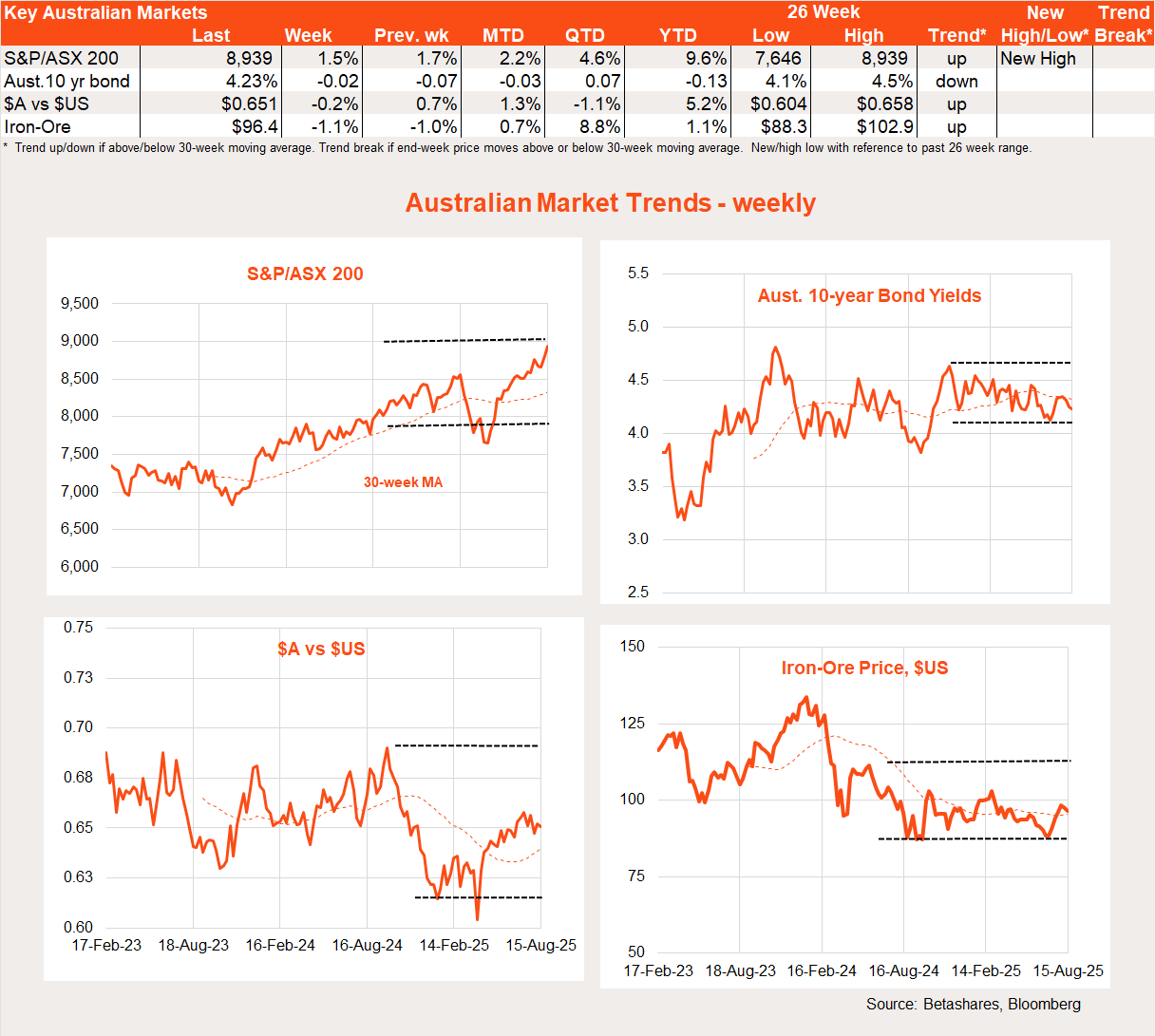

Australian week in review

The major highlight was the RBA’s widely expected decision to cut interest rates. However, one surprise was the relatively dovish commentary and forecasts, which left markets happily still predicting more rate cuts over coming months. That said, the market is only attaching a 30% chance to a September rate cut. Like myself, expectations are more focused on the possibility of a November rate cut, following the Q3 CPI report in late October.

Other local news last week was generally supportive of further rate cuts, albeit without the urgency to suggest a September cut.

The Q2 wage price index was as expected, lifting 0.8% and keeping annual growth steady at a relatively benign 3.4%.

Employment growth also bounced back by a largely expected 25k in July, with the unemployment rate easing back to 4.2% from 4.3%. Looking beyond the monthly volatility, employment growth has clearly eased of late, though the slow down remains relatively modest.

Australian week ahead

As is the case globally, there’s not much on the local data front this week, except the Westpac/Melbourne Institute measure of consumer sentiment. Sentiment should likely bounce given the RBA’s rate cut, which should hopefully encourage a bit more consumer spending in the months ahead.

Of course, there’s also the Productivity talkfest in Canberra this week. I won’t hold my breath expecting much to emerge – especially on tax. As it stands in Australia, no Federal Government feels it can launch major tax changes these days without an electoral mandate. Yet, no Government or Opposition wants to risk taking major tax changes into the heat of an election campaign following Bill Shorten’s ill-fated gamble at being a “big target” in 2019.

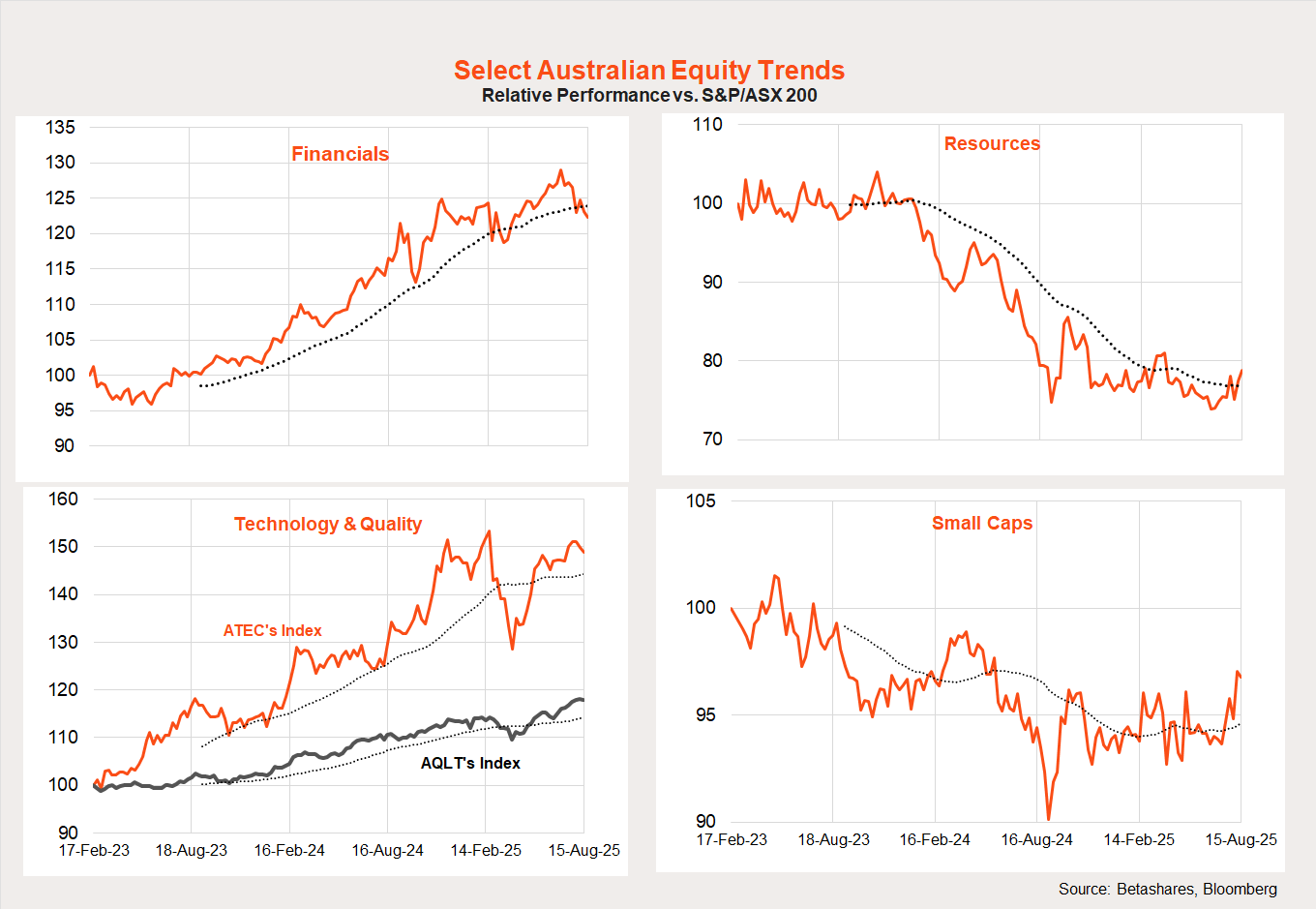

Australian share market trends

In terms of local equity trends, the rotation from financial to resource stocks in the large cap space continued last week – suggesting it could have legs! There’s also an ongoing bounce in (admittedly volatile) small cap performance. The relative performance of quality and technology continues to trend higher, although the latter had a pullback last week.