9 minutes reading time

- Responsible investing

Howard Hughes was a visionary entrepreneur who built a business empire across industries that others thought too risky or unrelated to combine. Obsessed with innovation, he micromanaged teams and pushed engineers to their limits in pursuit of perfection. While his companies revolutionised transportation, communications, and defence, internal chaos often followed his brilliance.

Supporters viewed Hughes as a misunderstood genius, unafraid to challenge bureaucracy or groupthink. Yet his erratic behaviour – disappearing for weeks or overturning projects overnight – eventually damaged businesses and diminished shareholder confidence.

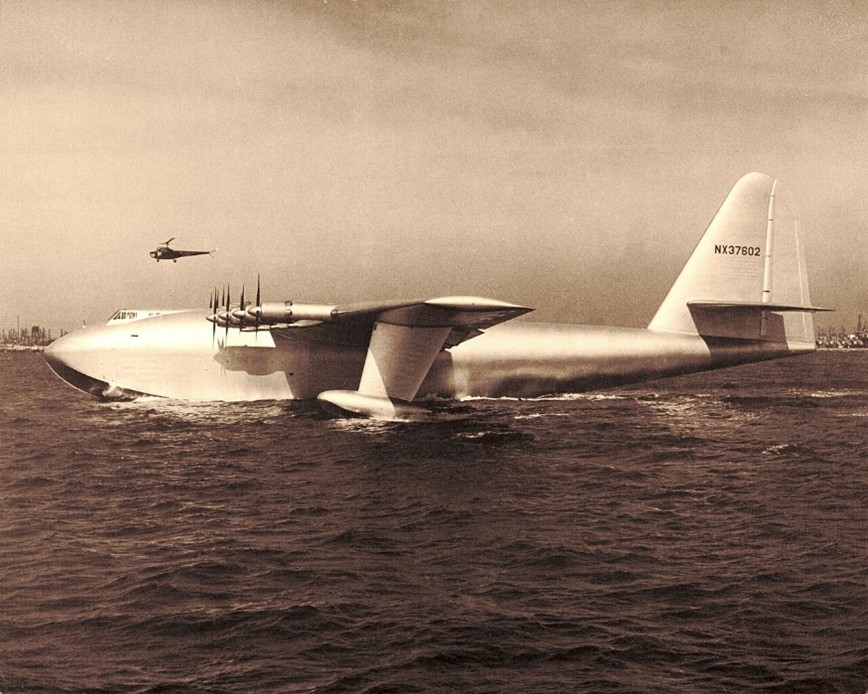

Troubled Genius – Industrialist and Aviator Howard Hughes and the H4 Hercules ‘Spruce Goose’

Source: Wikimedia Commons

Source: Wikimedia Commons

The similarities between Hughes and Tesla CEO Elon Musk have sparked comparisons in the media and pop culture.1 Both are brilliant visionaries. Hughes’ inability to delegate or maintain stable governance, which ultimately damaged businesses and diminished shareholder confidence across his empire,2 offers warnings for today’s investors.

What is Governance?

Governance encompasses the structure, rules, systems and processes by which a company is directed and controlled. It includes board oversight, accountability to stakeholders, and ethical conduct. Good governance balances risk, agility and accountability.

Why good governance matters

Effective corporate governance builds trust, improves access to capital, enhances reputation, aligns corporate strategy with stakeholders and helps prevent fraud and mismanagement.3

Historically most corporate failures can be traced back to governance failures. Examples include: Enron, Parmalat, Lehman Brothers, Wirecard, HIH and Crown Resorts.

Companies with good governance tend to be stable, low public profile, and controversy-free. However, there is no magic formula for good governance. A 1982 book entitled “In Search of Excellence” attempted to define good governance and identify companies which exhibited those characteristics. Most of the companies identified as ‘excellent’ underperformed in the years after publication. For instance, Texas Instruments was praised for its near perfect governance structure – yet the firm later faltered due to poor strategic decisions.4

Principles of good governance

While there is no magic bullet, the ASX Corporate Governance Council outlines eight principles for sound corporate governance:

- Lay solid foundations for management and oversight

- Structure the board to be effective and add value

- Instil a culture of acting lawfully, ethically and responsibly

- Safeguard the integrity of corporate reports

- Make timely and balanced disclosure

- Respect the rights of security holders

- Recognise and manage risk

- Remunerate fairly and responsibly5

What determines good governance?

Weak boards, toxic culture that fosters unethical behaviour, fear, blame or exclusion, ineffective risk management and flawed incentive structures are typical causes of corporate collapse. The Volkswagen ‘Dieselgate’ scandal is a textbook example. In 2015, Volkswagen was caught installing “defeat devices” in their diesel vehicles to artificially lower emissions during testing. The scandal ultimately cost the company over €30 billion in fines and settlements and saw €35 billion wiped off the company’s value.6

How the Volkswagen Dieselgate scandal was covered in the media

Source: The Economist

Good governance isn’t just more compliance. In 2011, the Federal Court of Australia in ASIC v Healy (Centro Case)7 established that directors are personally responsible for reviewing and understanding financial statements, even if complex. The decision led to a substantial increase in corporate compliance. Critics argue the Centro Case shifted board culture toward procedural defensiveness, contributing to a more bureaucratic governance environment and a reduction in strategic oversight and agile decision-making.8

Founder CEOs and governance challenges

Founder firms pose special challenges, particularly when that individual is a substantial shareholder. Founders often concentrate power, reduce board independence and resist scrutiny. Dual class share structures and supermajority vote provisions are common, undermining the ability of shareholders to engage or effect change. A charismatic founder has the potential to create a cult-like culture.9

Elon Musk is not technically a founder of Tesla – that honour belongs to Martin Eberhard and Marc Tarpenning. Musk became the majority shareholder of Tesla in 2004 and CEO in 2018, following a restructure that saw Eberhard ousted from the firm.10 Musk’s success at Tesla is the stuff of myth. Faced with ‘production hell’11 over the production ramp of the Model 3, Musk famously worked 24/7, sleeping on the floor of the Fremont factory, monitoring operations, personally rewriting code for the battery module assembly line, constructing a second assembly line in a giant tent in just three weeks, and engaging directly with suppliers for faster component deliveries.12

World’s Richest Man – Tesla CEO Elon Musk

Source: ABC News13

In less than two years, Musk helped grow Tesla’s market capitalisation to over US$1 trillion, more than the combined market capitalisation of its five biggest rivals: Toyota, Volkswagen, Daimler, Ford and General Motors.14

Despite this success, Musk’s behaviours have raised concerns. From launching a cherry red Tesla Roadster into Space (with the soundtrack of David Bowie’s Space Odyssey on continuous loop), to challenging Vladimir Putin to single combat,15 Musk has frequently in his career engaged in behaviours analysts and commentators describe as “odd”.16

‘Starman’, in 2018 Elon Musk launched his personal Tesla Roadster into space

Source: Popular Mechanics

Some of Musk’s actions have come at the expense of Tesla shareholders. Despite criticism from numerous experts, including Tesla’s own engineers, Musk has insisted that vision-only based AI, using cameras and neural networks, is the path to full autonomy, pouring billions into the pursuit.17 This contrarian approach has delayed Tesla’s rollout of reliable self-driving capabilities. In contrast, Google subsidiary Waymo’s LiDAR-based approach, has achieved regulatory approval for fully driverless operations in several US cities.18

More recently, Musk’s record on workers’ rights,19 his support for far-right political parties, including the Alternative for Germany,20 and his on-again, off-again involvement with the Trump administration has resulted in consumer boycotts that have impacted sales. Tesla’s Q1 2025 sales fell 13% year-on-year.21 In some markets, the fall has been more dramatic: Tesla’s sales in Europe fell 37% while, in Sweden, sales dropped 81%.22

Tesla vehicles set on fire in targeted attack in Las Vegas, March 2025

Source: ABC News

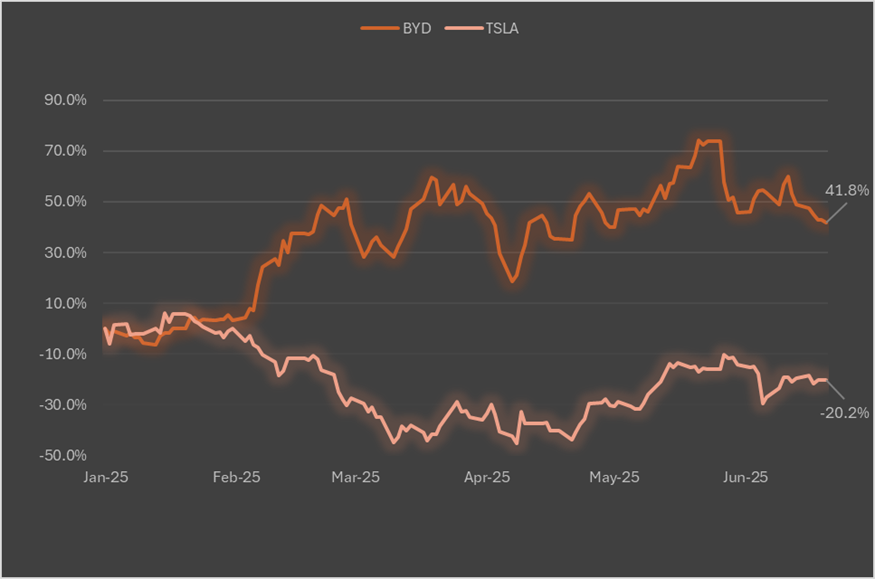

Tesla’s sizeable sales drop has ceded leadership of the EV market to Chinese rival BYD. BYD exceeded Tesla in global battery electric vehicle sales for the first time in 2024 and extended its lead in Q1 2025.23

Chinese automaker BYD has overtaken Tesla as the world’s largest EV manufacturer as of Q1 2025

Source: Chinese News

While BYD’s corporate governance is far from perfect, the company does have a stable board and governance framework that gives investors reassurance. BYD is not likely to relinquish its newly won global primacy soon. It leads Tesla in key technologies, including ultra-fast charging, autonomous driving, global expansion of its rapid-charging infrastructure, and next-generation electric motors.24

BYD has substantially outperformed Tesla 2025 YTD

Share price performance. Source: Bloomberg, Betashares

Like many companies with founder CEOs, shareholders at Tesla are more limited in their ability to influence governance arrangements. At the 2024 Tesla Annual General Meeting, shareholder proposals for governance reform were defeated,25 while a $50 billion bonus package for Musk that substantially diluted shareholders,26 and a proposal to move Tesla’s state of incorporation from Delaware to Texas, which has weaker corporate governance protections and risks weakening shareholder rights, both passed,27 (noting Musk’s bonus package was subsequently rejected by a Delaware court for a second time).

Changes under the Trump administration making US domiciled investment managers more reluctant to challenge companies on ESG issues, further reduce the probability of improvement in corporate governance arrangements.28

Conclusion

Good corporate governance is critical to company long-term success. While governance may lack the glamour of engineering breakthroughs or bold product launches, it is the foundation that supports sustained performance and investor confidence. The Howard Hughes story is both a lesson in visionary leadership, and a cautionary tale about what happens when governance is subordinated to personality.

Sources:

1. “Crazy Aviators: The Eerie Similarities Between Billionaire Howard Hughes and Elon Musk”Forbes April 5, 2019; and “The Musk Who Fell to Earth” – The Simpsons, Season 26, Episode 12.

2. https://en.wikipedia.org/wiki/Howard_Hughes

3. https://www.diligent.com/en-au/resources/blog/what-constitutes-good-governance

4. In Search of Excellence: The Investors Viewpoint, Michael Clayman, Financial Analysts Journal Vol 43, No 3 (May-June 1987).

7. ASIC v Healy & Ors [2011] FCA 717.

8. https://www.claytonutz.com/insights/2011/june/what-does-the-centro-case-mean-for-directors

10. Ashlee Vance, Elon Musk, Tesla, SpaceX, and the Quest for a Fantastic Future, HarperCollins, 2015.

11. https://www.wired.com/story/elon-musk-tesla-life-inside-gigafactory/

12. https://www.smh.com.au/business/companies/burning-the-midnight-oil-tesla-goes-24-7-as-it-ramps-up-its-model-3-production-20180418-p4za78.html; and Vance op cit.

13. Source for image: https://abcnews.go.com/Business/timeline-elon-musks-tumultuous-twitter-acquisition-attempt/story?id=86611191

15. https://www.reuters.com/world/us/musks-combat-challenge-putin-prompts-mockery-russia-2022-03-16/

16. https://www.thetimes.co.uk/article/gary-lineker-elon-musk-twitter-put-off-xw2vwkc6q

17. https://insideevs.com/news/658439/elon-musk-overruled-tesla-autopilot-engineers-radar-removal and https://www.teslarati.com/tesla-self-driving-program-investment-over-10b-2024-musk/

19. https://www.politico.eu/article/elon-musk-endorses-germanys-far-right

21. Ibid.

22. https://www.washingtonpost.com/business/2025/04/02/tesla-sales-musk/

24. https://cleantechnica.com/2025/02/12/byd-gods-eye-more-advanced-than-tesla-full-self-driving-fsd; and https://interestingengineering.com/energy/china-byd-unveils-5-minute-fast-charging-ev-battery-tech

25. Institutional Shareholder Services (ISS) and https://www.cnbc.com/2024/05/31/elon-musk-tesla-tsla-pay-package-shareholders.html

26. https://observer.com/2024/06/elon-musk-56-billion-pay-package-tesla-shareholder-vote/

27. https://www.wsj.com/business/tesla-texas-incorporation-delaware-edcbd0dd and https://www.bbc.com/news/articles/cyv3pzm4178o