Contributing to your super

If you want to grow your wealth, you’re likely asking yourself a question many investors face at some point: is it smarter to put your money in stocks or exchange-traded funds (ETFs)?

Stocks represent ownership of a portion of a company. When you invest in an ETF you are effectively buying an interest in the fund diversified portfolio of. Most ETFs can track an index. . Both stocks and ETFs can be effective investments but they each come with unique features that are important to understand.

We discuss the differences between investing in shares directly and investing in ETFs so you can make the best choice for your portfolio in this piece. At the end, you’ll find a comparison table you can use to gain clarity on which kind of investment best aligns with your circumstances and goals.

What are ETFs?

An ETF is an open-ended investment fund, similar to a traditional managed fund, but which can be bought or sold like any share on the ASX. Most ETFs aim to closely track the performance of an index or underlying asset and seek to provide the returns of that index or asset – less any fees and costs. ETFs can be either passively managed – that is, it tracks a pre-determined index – or actively managed – that is, their holdings are managed by a group of hands-on professional investors.

Advantages of investing in ETFs

Since ETFs provide exposure to a range of companies or assets, they can be an efficient way to gain investment exposure without purchasing individual shares.

Another benefit of ETFs is their ability to provide diversification inorder to help reduce (or spread) the risk of fluctuations in their investments. ETFs are also regularly rebalanced to reflect changing market conditions.

ETFs also collect distributions such as dividends and bond coupons from their underlying assets, periodically distributing them to investors as regular payments.

This is notably advantageous in Australia, where individual companies often pay dividends semi-annually. In contrast, many share ETFs offer quarterly distributions, providing investors with a more frequent and consistent income flow. That is because they are collecting payments throughout the year rather than at only a couple of specific times per year.

Drawbacks of investing in ETFs

Volatility goes in two directions, and there is a tradeoff for protection from major dips in key share prices. ETF returns are also generally lower than those from the top-performing shares included in the fund.

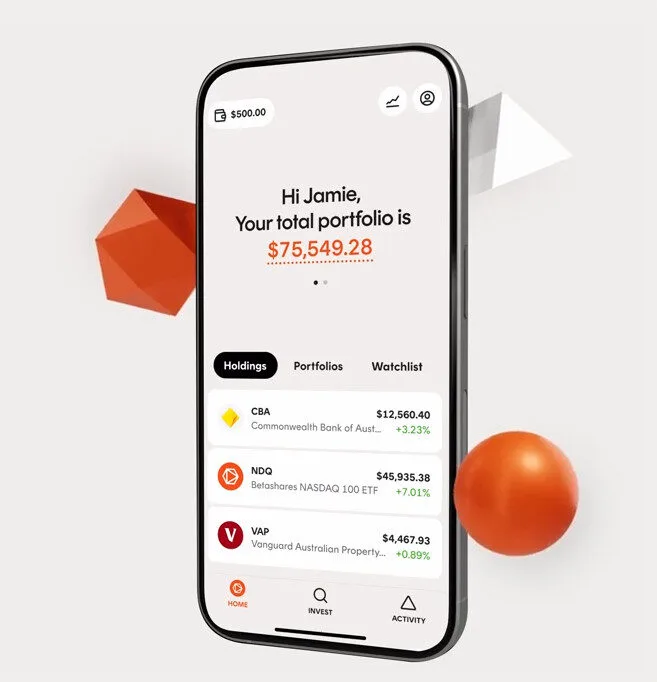

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.

What are stocks?

A share represents partial, or fractional, ownership in a company.

Advantages of investing in individual stocks

Investors who prefer a hands-on active investing approach may lean towards trading shares in specific companies. If investors find the right stocks their value can increase more significantly over a shorter period compared to ETFs.

Investing in individual stocks also gives you more control over what is in your portfolio as you can directly see what you own and how much you own in a particular company.

Many companies also pay periodic dividends out of their profits to shareholders and offer voting rights in company meetings.

Disadvantages of investing in stocks

Stocks of individual companies are considered riskier than ETFs since they can be more exposed to price fluctuations.

Choosing which stocks to invest in also requires considerably more research than choosing an ETF. The potential downside of picking a loser may be greater than investing in a diversified ETF.

Finally, investing in individual stocks can produce more paperwork for investors, since documents are typically sent out every time a corporate actions takes place, an AGM occurs and/or a dividend is paid out.

Differences between ETFs and stocks

While both ETFs and stocks give investors a way to grow their wealth, there are important factors differentiating the two.

Structure

ETFs pool money from all investors in the ETF to buy a portfolio of assets, while stocks represent ownership in specific companies, with each share representing a fractional ownership stake.

Ownership

When you invest in an ETF, you gain an ownership interest in the assets as a whole that are managed in the fund. Buying stocks provides direct ownership, which confers voting rights and potential dividend payments.

Risk and Diversification

While all investments come with some risk, individual stocks may expose investors to more risk since the performance of a single company can make or break their investment. On the other hand, ETFs provide diversified exposure to many underlying assets which can reduce this single stock risk. Diversification means spreading your investments across a range of asset classes such as shares or bonds, geographic regions and industry sectors – and within an asset class, spreading your money across multiple individual investments. ETFs have simplified the process as they offer ‘pre-packaged’ assortments of investments or assets, making diversification more accessible, efficient and cost-effective. Meanwhile, stocks provide exposure to the performance of a single company, so investors would need to purchase many individual stocks to build a more diverse portfolio.

ETFs vs stocks: how to choose?

There’s no one-size-fits-all answer to investment. But knowing which factors to consider can help you make an informed decision.

Risk tolerance

Consider how you would feel, and how you could manage financially, if your investment portfolio underwent a major drawdown.

Investment goals

Investment goals can vary from capital appreciation to income generation. Some stocks may provide better returns and more income than the index that an ETF aims to track, but many will not. In contrast, ETFs aim to replicate the same growth and yield as the benchmark.

ETFs vs stocks comparison

By now, you should have a better idea of how ETFs and stocks differ, and which may be better suited to your investment goals.

ETFs provide exposure to a variety of companies or other assets, while individual stocks provide ownership to single companies. Both investments have their benefits and drawbacks, with ETFs being beneficial for a diversified, passive portfolio approach, and stocks providing potential performance benefits.

To help you identify the right choice for you, we’ve created a checklist of key considerations. While this isn’t a replacement for financial advice, it can help you gain clarity on your investment preferences.

| Feature, benefit, or risk | ETFs | Stocks |

| Liquidity | Market makers provide liquidity, making ETFs easy to sell when markets are open | Usually easy to buy and sell whenever markets are open, but some may have lower trading volume |

| Risk tolerance | Suited for many risk tolerances | Suited for moderate-to-high risk tolerance |

| Price volatility | Generally less volatile than individual shares | Can be highly volatile, depending on the stock |

| Investment minimums | Like shares, the minimum initial investment in an ETF begins at $500 for most brokers (however, platforms like Betashares Direct allow you to invest from as little as $10). | Depends on the price of the individual stock(s) but a portfolio can start for as little as $500 on the ASX |

| Management fees and brokerage | Management fees apply, but are typically lower fees than active funds.

Brokerage applies, but can be traded brokerage free on platforms such as Betashares Direct. |

No management fee.

Brokerage applies, but can be traded brokerage free on platforms such as Betashares Direct. |

| Voting rights | Generally ETF investors do not have voting rights in underlying companies | Provides voting rights |

| Dividends | Pays periodic distributions subject to income being generated by the underlying portfolio | May pay dividends based on company profits |

| Diversification | Provides exposure to a range of stocks or assets across a variety of regions | Provides exposure to a single asset or company |

Conclusion

Deciding between ETFs and stocks will depend on your investment goals and risk tolerance.

ETFs offer a diversified, lower-risk approach with less individual company research. They’re ideal for passive, long-term investors seeking to build wealth. Stocks, on the other hand, cater to investors with a higher risk tolerance who directly manage their portfolios and have the time and resources to research individual companies. They are ideal for investors who are after higher returns but also have a higher risk tolerance.

With Betashares Direct you can invest brokerage-free in all ETFs and 300+ shares traded on the ASX.

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.

Betashares Capital Limited (ABN 78 139 566 868 AFSL 341181) (Betashares) is the issuer of this information. This is general information only and does not take into account any person’s objectives financial situation or needs. Investors should consider the appropriateness of the information taking into account such factors and seek financial advice. This information is not a recommendation or offer to make any investment or to adopt any particular investment strategy. You should make your own professional assessment of the suitability of this information, relying on your own inquiries. Betashares is the issuer of the Betashares Funds. Before making an investment decision, investors should read the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD), available at www.Betashares.com.au, before making any investment decision. Investments in the Betashares Funds are subject to investment risk and the value of units may go up and down.