7 minutes reading time

This piece first ran in the Weekly Insights newsletter on 14 May 2025. It was last updated on 15 December 2025.

Few investors have shaped the modern market like Warren Buffett. In his 60+ year career, Berkshire Hathaway’s share price has risen by 5.5 million percent or an average of 19.9% per annum – far outpacing the S&P 5001.

His announcement this month that he will retire as CEO of Berkshire Hathaway was followed by silence, some shock then a long standing ovation.

Over many decades, Buffett has built one of the most remarkable investing track records in history, marked mostly by legendary successes and the occasional misstep. We look back on those big calls.

Insurance: The ultimate long-term investment?

Although Buffett’s first investment was in an oil company, he has acknowledged that his most important purchase was that of an insurance business in March 19672.

National Indemnity Company was bought for around US$8.6 million3. But unlike the traditional signposts of revenues and earnings, the value of insurance businesses are (at least in Buffett’s view) found in the size of their float.

Floats are the premiums that insurers collect before they pay out claims. Think of it as a pool of money that can be invested to generate returns for the issuer before a major event occurs (e.g. a natural disaster) and claims have to be paid out.

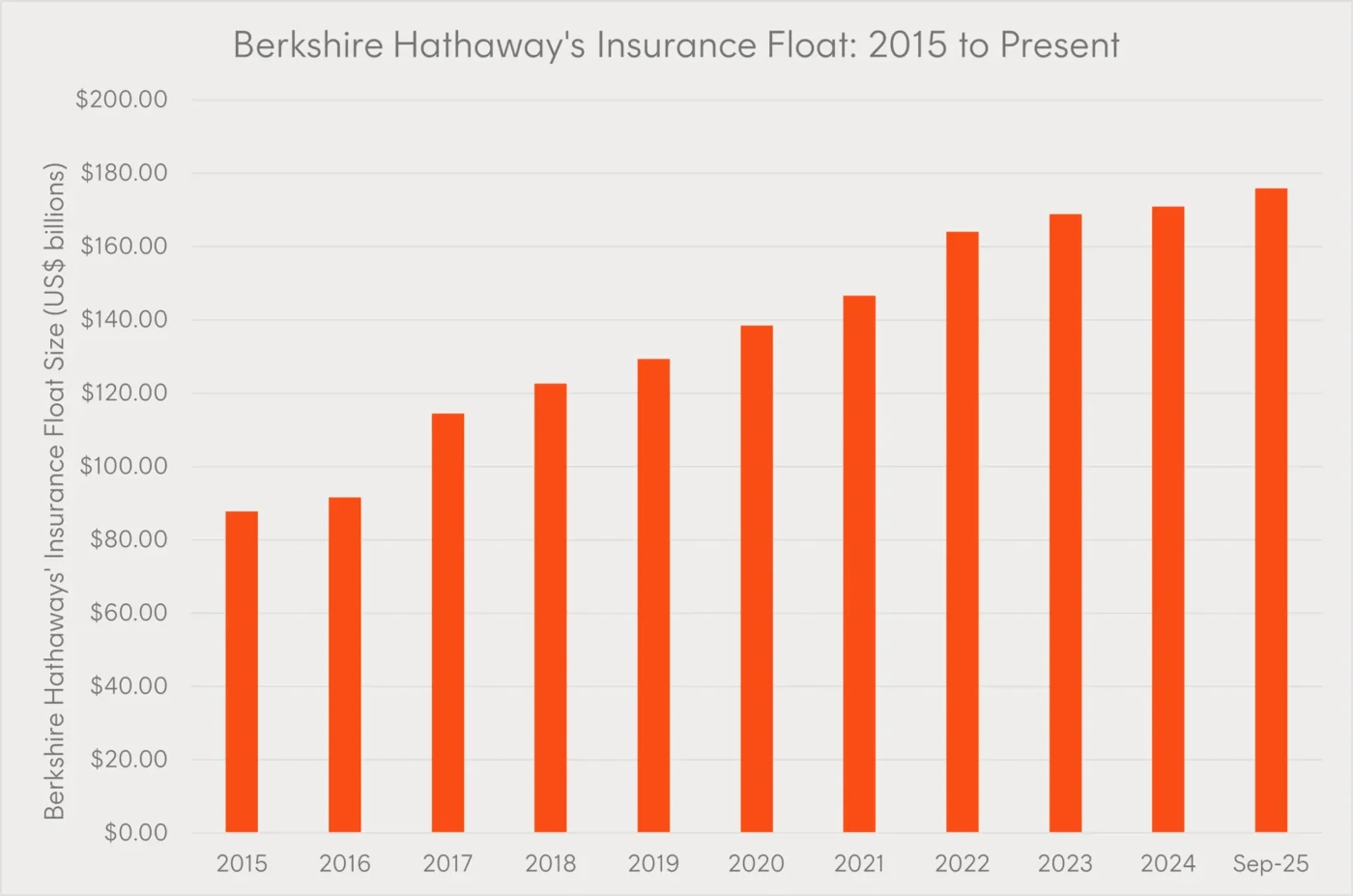

In 1970, the size of Berkshire Hathaway’s float was US$39 million. By the end of 2024, the value of the float had swelled to US$171 billion4.

Source: Berkshire Hathaway. As at 30 September 2025.

Buffett never understood tech businesses – unless you count Apple

One of the most fundamental investing principles from the Oracle of Omaha is to only invest in the businesses and industries you truly understand.

In a 2014 interview with CNBC, he argued that he would have invested in Google if he “could have figured out the company had a great advertising business” and that he would have bought Amazon if he hadn’t “really underestimated the brilliance of [Jeff Bezos’] execution”5.

One of the few tech businesses he did understand would go on to become one of the biggest wins of his career: Apple.

When Berkshire first invested in Apple in 2016, it was priced at US$28.35 per share. By 2024, Apple’s revenues had risen by 66% and its earnings per share had nearly tripled6. Although Berkshire Hathaway sold two-thirds of its holdings last year, it did so with an 850% total return7.

Source: Bloomberg. As at 20 November 2025. Berkshire Hathaway made its initial investment in Apple in Q1 2016.

Buffett has sold 74% of the firm’s stake in Apple in six of the last eight quarters. The firm’s latest filing with US regulators suggests some of that money has since been put to work in Google’s parent company Alphabet (NASDAQ: GOOGL).

Three of Buffett’s other long term wins

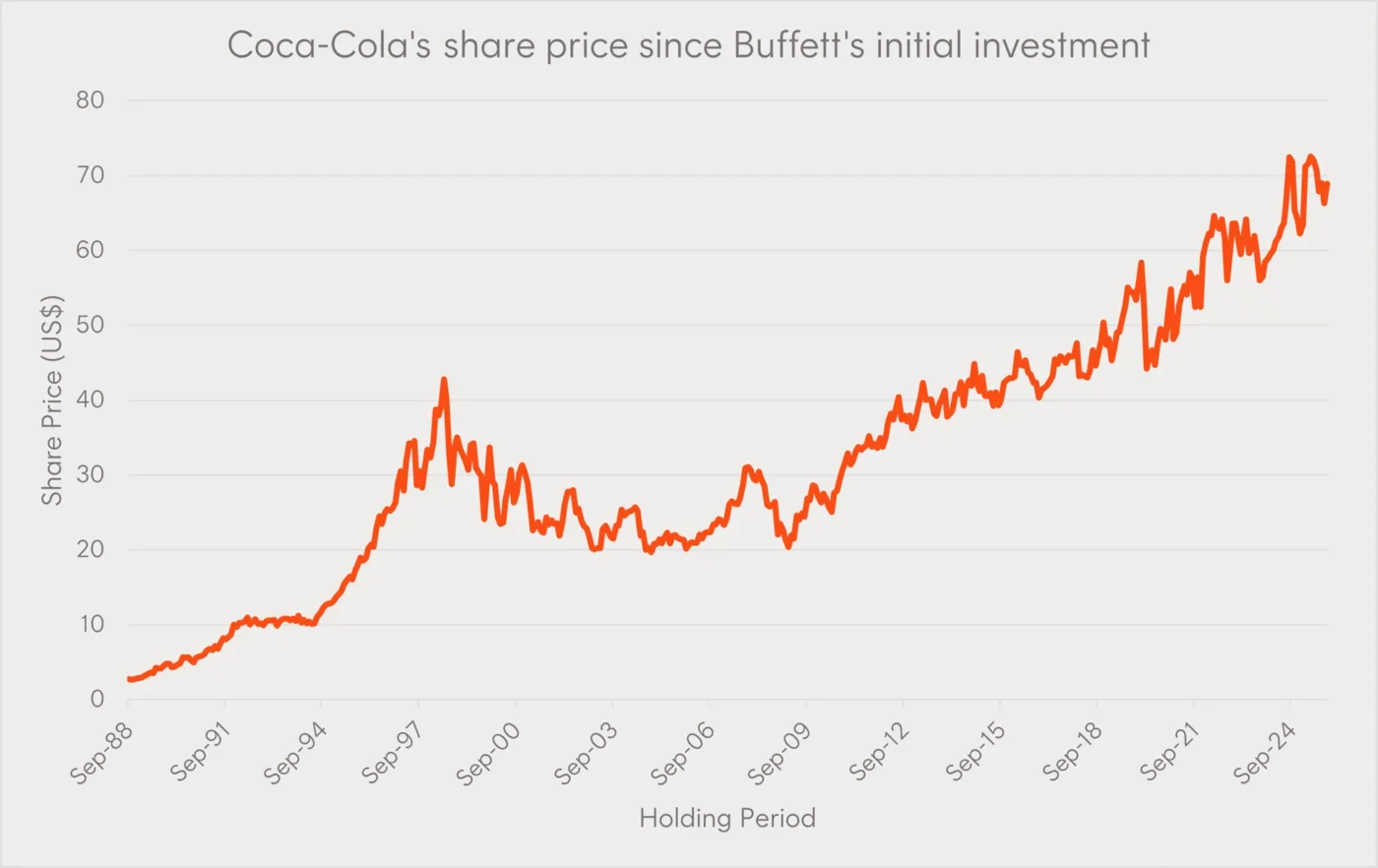

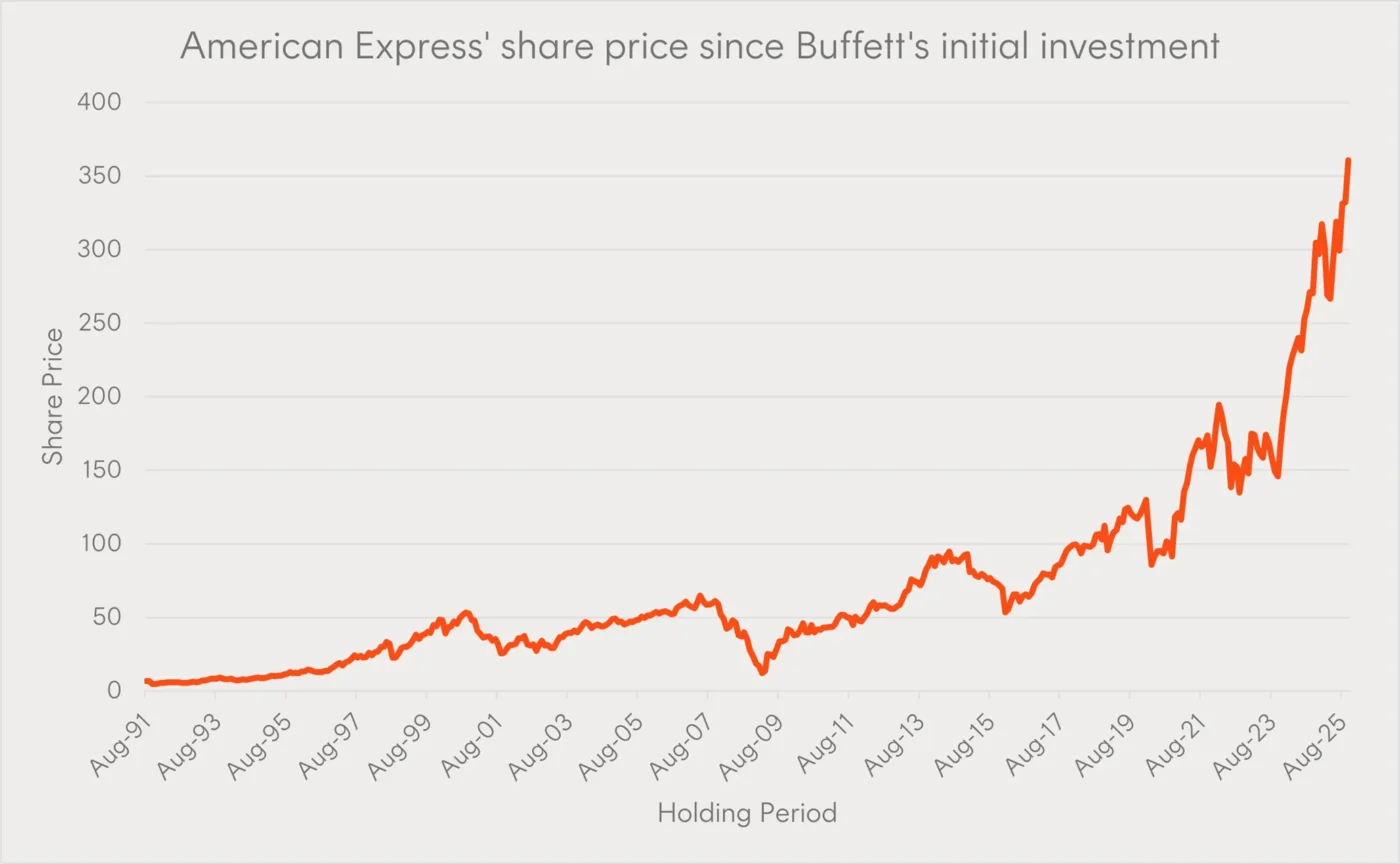

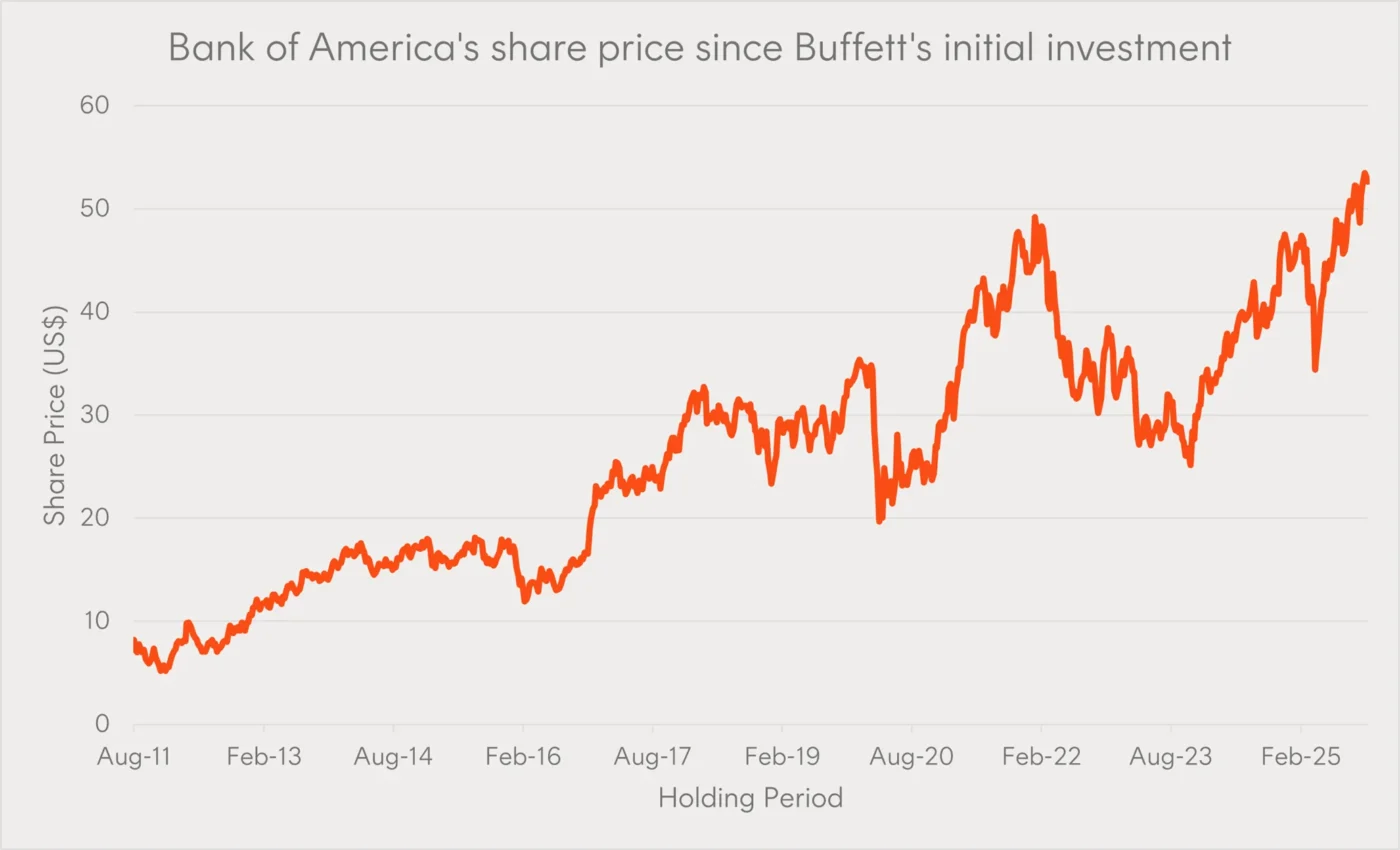

Buffett is well known for some other big single stock wins in his career. But what links all of them – Coca-Cola, American Express, and Bank of America – are two key principles. One is Buffett’s “never bet against America”8 mantra (a phrase that first appeared in his 2020 shareholder letter). The other principle is that all these stocks were bought years ago and were intended by him and his Berkshire colleagues to be held for the long term. To quote Buffett’s shareholder letter from 1988, “our favourite holding period is forever”9.

The following charts showcase how each stock has done since Berkshire Hathaway made its initial investment. Note however that although Berkshire still hold stakes in all three companies, these charts do not reflect any incremental selling that Buffett and his team may have executed along the way.

Source: Bloomberg. As at 20 November 2025. Berkshire Hathaway made its initial investment in Coca-Cola shortly after the 1987 market crash.

Source: Bloomberg. As at 20 November 2025. Although Berkshire Hathaway made its first American Express investment in the 1960s, the conglomerate did not make its first significant investment until August 1991.

Source: Bloomberg. As at 20 November 2025. Berkshire Hathaway first purchased US$5 billion worth of preferred shares in BAC in August 2011.

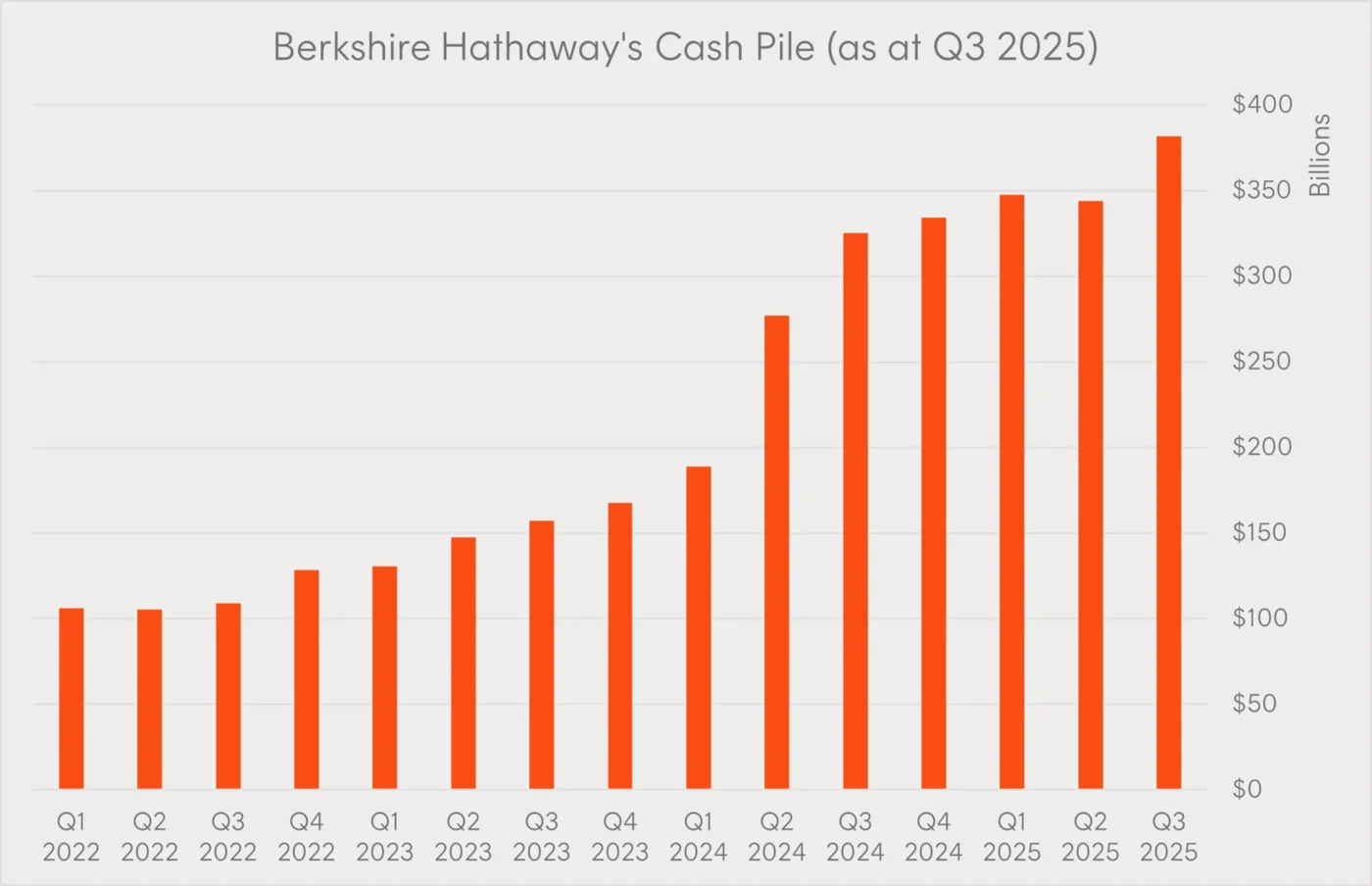

Greg Abel takes over a huge cash pile

Over the last few years, one of Buffett’s more conspicuous legacies is the size of the Berkshire Hathaway cash pile. As of the end of Q1 2025, cash and short-term securities (e.g. Treasury bills) made up 27% of the portfolio. That’s more than double the 25-year average10 and signals that Berkshire hasn’t found many great opportunities from a valuation standpoint in recent times.

Berkshire Hathaway’s cash balance over the last few years

Source: Bloomberg, Berkshire Hathaway. As at the end of Q3 2025.

Buffett isn’t perfect

Just because he’s the world’s most famous investor doesn’t mean he’s only made perfect calls. He is human after all!

A case in point is in the name of his business – Berkshire Hathaway. Not everyone knows that the name is derived from the textile company he acquired in 1965. This investment, Buffett says, was among the worst of his career.

“The truth is I had now committed a major amount of money to a terrible business,” Buffett recalled to CNBC’s Becky Quick in October 201011.

Buffett has also talked openly about his other big blunder – Dexter Shoe Company. The business was acquired in 1993 using US$433 million of Berkshire Hathaway stock. Eventually, it collapsed, and Buffett later wrote in a shareholder letter that he had given away 1.6% of “a wonderful business … to buy a worthless business”12.

Buffett’s “success” has little to do with money

Although he departs the day-to-day markets as one of the most successful investors of his time, Buffett does not equate financial returns with success. In many interviews he has given over the years, Buffett defines true success this way:

“If you get to be 65 or 70 (and later), and the people that you want to have love you actually do love you, you’re a success.”13

Now there’s an investor who never misses the big picture. Enjoy retirement, Warren.

Sources:

1. Source: Berkshire Hathaway’s 2024 Annual Letter (page 15). As at the end of 2024. ↑

2. https://finance.yahoo.com/news/warren-buffett-says-insurance-most-144516096.html ↑

3. https://www.berkshirehathaway.com/letters/1977.html#:~:text=It%20was%20early%20in%201967,achieve%20any%20of%20this%20growth. ↑

4. https://brk-b.com/the-indomitable-indemnity-berkshire-s-insurance-behemoth-through-the-ages_231219.html#fn:2 ↑

5. https://www.cnbc.com/2017/05/06/warren-buffett-admits-he-made-a-mistake-on-google.html ↑

6. https://www.ainvest.com/news/lesson-buffett-winning-apple-bet-2505-10/ ↑

7. https://www.businessinsider.com/warren-buffett-tim-cook-apple-steve-jobs-stake-berkshire-meeting-2025-5 ↑

8. https://berkshirehathaway.com/letters/2020ltr.pdf ↑

9. https://www.berkshirehathaway.com/letters/1988.html ↑

10. https://finance.yahoo.com/news/berkshire-hathaway-profits-drop-warren-203021138.html ↑

11. https://www.cnbc.com/2010/10/18/cnbc-transcript-warren-buffetts-200b-berkshire-blunder-and-the-valuable-lesson-he-learned.html ↑

12. https://markets.businessinsider.com/news/stocks/warren-buffett-most-gruesome-mistake-dexter-shoe-9-billion-error-2020-1-1028827359 ↑

13. https://www.youtube.com/watch?v=Tr6MMsoWAog ↑