Like most things in life, achieving your goals requires planning. Whether it’s organising your summer holidays, building your family home or even baking a cake, your groundwork sets you up for success. Attaining your financial goals is no different – building a robust investment portfolio requires thought and planning.

Let’s start with a basic question. What exactly is ‘portfolio construction’?

Portfolio construction

Portfolio construction is the process of combining different asset classes and individual investments in a way that appropriately balances risk and return, with the objective of achieving your financial goals over a defined time horizon.

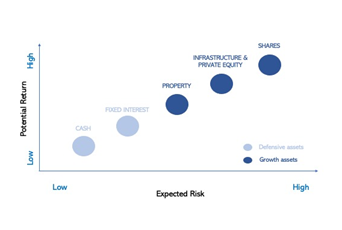

Part of the process is determining your allocation to growth vs defensive assets. As shown in the graph below, this is likely to include stable investments like cash, more volatile investments like shares, and other asset classes in between.

Diversification – also known as not putting all your eggs in one basket! – is probably a term you have heard before. Given the volatility we’ve seen in asset markets throughout the past 12 months, diversification is as important as ever. Fortunately, there are free lunches in finance and diversification is one of them.

The key questions to ask yourself when building a portfolio

1. Where should I allocate my funds?

Your asset allocation is probably the most important decision you will make. According to Roger G. Ibbotson and Paul D. Kaplan, asset allocation explains about 90% of the variability of investment returns over time.1

This can be achieved through completing a risk profile which evaluates your risk tolerance on the different asset classes with your investment time horizon in mind. Once completed, this will give you an indication on how to balance your investments between Australian vs International shares, property, cash, bonds etc.

2. How much will these investments cost?

Your investment’s management fee (MER) and implementation costs (brokerage) are both important considerations. Given that investment costs will differ across active and passive investments, it is worth considering how much you should allocate in each bucket.

3. How much risk do you want to take?

Another consideration when deciding active vs passive is how much to allocate within a specific asset class. For example, Australian equities is a very broad asset class. You can get access to Australian equities via active managed funds or index-based ETFs and they will inherently carry different risks. An actively managed fund in Australian Small Caps is likely to have higher volatility compared to a passive ETF that tracks the largest Australian companies. With that in mind, having a portfolio 100% in small cap investments compared to a portfolio that uses market cap ETFs will have significantly different risk and volatility.

4. What “ingredients” will you use to implement your portfolio?

The benefits and risks associated with each investment choice differ, so it is important to choose wisely.

- Direct shares – give you direct ownership of a part of a company, which involves stock specific risk for example.

- Managed funds – money is pooled together from multiple investors and then invested into a portfolio of assets such as stocks or bonds. Traditionally investors buy units in a managed fund by making an application to the fund manager.

- ETFs – a special type of managed fund that can be traded on an exchange like the ASX, like investing in shares. Because you don’t have to apply for units, there is less administration involved in buying an ETF when compared to a managed fund. ETFs generally offer better liquidity, access to capital, and greater holdings transparency compared to managed funds.

Index funds aim to track the performance of an index, such as the NASDAQ. This is a different type of approach to an “active” fund, where a fund manager picks the assets that the fund will invest in, with the goal of outperforming an index. Index funds are commonly called “passive”, and because they don’t involve actively picking assets, they’re usually much cheaper than active funds.

Most ETFs offered today are passively managed, but there is a growing number of ETFs that are actively managed by a fund manager who selects stocks and seeks to outperform the market. Most unlisted managed funds are actively managed, however you will also find many unlisted managed funds that track an index.

5. How often should I review my investments?

As you would when building your home (or baking your cake), you will want to check-in every so often to make sure your portfolio is moving in the right direction. It is important to have rules in place on how often you review or rebalance your portfolio. For example, you might decide to rebalance annually, or quarterly. Rebalancing generally involves looking at your asset allocation to see if it remains in line with the goals you set for yourself at your previous rebalance, and taking steps to adjust your investments if required.

Why use ETFs to construct your portfolio?

The global ETF market has experienced astounding growth over the last five years and has more than doubled from US$4.69 trillion in 2017 to over US$9.55 trillion in 20222.Due to ETFs being low cost, transparent and easily accessible, we are seeing ETFs making up a growing share of portfolios for both individual to sophisticated investors.

Some of the ETFs investors can use to access to a diversified basket of stocks across different asset classes include:

- A200 Australia 200 ETF . With management fees of 0.04% p.a*., it aims to track the performance of an index of 200 of the largest companies on the ASX.

- QLTY Global Quality Leaders ETF With management fees of 0.35% p.a.*, it aims to select 150 high quality companies from a range of geographies and global sectors, many of which are underrepresented in the Australian market.

- OZBD Australian Composite Bond ETF A potential core portfolio allocation for fixed income. For a management fee of 0.19% p.a*., this offers exposure to 328 fixed income securities[3] including Australian Government bonds, State Government bonds, and corporate credit.

While we cannot control what happens in the market, we can control the process we take when constructing our investment portfolio. Having a strong foundation and framework is essential to building a solid portfolio that can weather the different seasons of market volatility.

*Additional costs, such as transaction costs, may apply. Refer to the Product Disclosure Statement for more information.

Investing involves risk. The value of an investment and income distributions can go down as well as up. Before making an investment decision you should consider the relevant PDS and Target Market Determination (available at www.betashares.com.au) and your particular circumstances, including your tolerance for risk, and obtain financial advice.

Risks may include (fund specific): interest rate and credit risk with bond and cash investments, sector and market risk with share investments.

References:

1. Ibbotson, Roger G. and Kaplan, Paul D., Does Asset Allocation Policy Explain 40, 90, 100 Percent Of Performance?.

2. https://www.statista.com/statistics/224579/worldwide-etf-assets-under-management-since-1997/

3. As at 3 February 2023.

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.

1 comment on this

loved it