DEI: Impacts of changes to US law for companies and responsible investors

11 minutes reading time

Lithium was there at the start of time, created in the Big Bang. Along with hydrogen and helium, it is one of the original elements. Despite this, lithium is rare in the universe.

Lithium was discovered in 1817 by Swedish chemist Johan August Arfvedson. The name lithium is Greek for ‘stone’. It is a soft white metal that is highly reactive and flammable. It catches fire on contact with water. It has the lowest density of all metals, corrodes quickly and does not occur freely in nature. It is most commonly present as an ionic compound in the form of the mineral spodumene or as lithium carbonate, a found in sea water and brines.

Lithium is vital to the fight against climate change and the transition to a zero-emissions economy. It is the most electropositive of all elements, which means it sheds electrons easily to produce positive ions, the basic building blocks of all batteries.

However, lithium mining is not without controversy. Operations have been guilty of environmental damage and negatively impacting indigenous communities. However, new technologies are emerging that make lithium production far more sustainable.

Why is lithium so important?

In 1980, Koichi Mizushima and John B Goodenough discovered that using Lithium Cobalt Oxide as a cathode more than doubled the energy density of a rechargeable battery. In 1987 Akira Yoshino patented what would become the first commercial lithium-ion battery, and in 1991, Sony began manufacturing the first rechargeable lithium-ion batteries.

While lithium-ion batteries were a great success with users of mobile phones, digital cameras and hand-held gaming consoles, the great leap forward came on 22 June 2012, when the first Tesla Model S rolled off the production line.

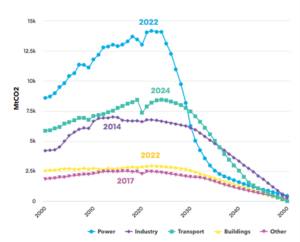

Global CO2 emissions in 2021 totalled 36.3 gigatonnes, a 6% increase on the previous year. To avoid the worst impacts of climate change, emissions need to peak by 2024 and then fall rapidly.

Source: Bloomberg New Energy Finance 2022 New Energy Outlook

To achieve net-zero it is crucial we decarbonise transport and move rapidly from internal combustion engine (ICE) vehicles to low/zero emission vehicles. Electric vehicles (EVs) have emerged as the clear technological winner. Initial interest in hydrogen fuel cell powered vehicles has waned in the last decade as EVs have proven superior in terms of cost, performance, reliability, and safety1.

EVs need batteries. More specifically, they need batteries with high energy per unit of mass, high energy efficiency, superior high-temperature performance, low self-discharging, and high cycle life (the number of times a battery can be charged and discharged). Due to its unique properties, only lithium-ion batteries currently meet all the requirements for EV production. While it is possible solid-state battery technologies will emerge that surpass the performance of lithium-ion batteries, that research is in its infancy and is decades away from scale production. There is no credible alternative to lithium for EV manufacturers.

The future use of lithium-ion batteries in stationary applications is less clear. As the electricity grid transitions from fossil fuels to renewables it will be necessary to install storage to ‘firm’ supply. While lithium-ion technology has been used for large-scale storage applications, such as South Australia’s Hornsdale Power Reserve and Neoen’s Victorian Big Battery, emerging reduction and oxidation (redox) flow technologies such as Vanadium Redox Flow Batteries (VFB) have advantages over lithium-ion for large-scale stationary applications, particularly in terms of cost.

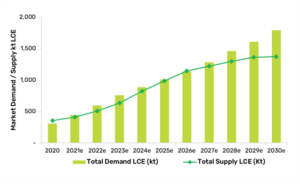

Global Demand and Supply

Global demand for lithium is expected to grow rapidly, driven primarily by the growth of electric vehicles (EVs) – the battery of a Tesla Model S uses around 12kg of lithium – but also by residential and commercial energy storage for renewable energy systems.

Under the International Energy Agencies (IEA) Sustainable Development Scenario (SDS), lithium demand in 2040 is expected to grow to 43 times current levels but may be as much as 51 times higher if solid-state battery technologies are successfully commercialised[1]. However, even that projection could be conservative. According to research firm Benchmark Mineral Intelligence, there are 200 battery mega-factories in the pipeline to 2030. If all 200 factories were operating at capacity, they would require annually3.

Figure 2: Global Supply and Demand for Lithium

Source: https://globallithium.com.au/our-business/lithium-market/

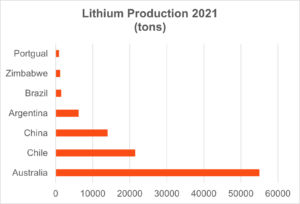

World production of lithium compounds is estimated at 100,000 metric tonnes in 2021, a significant increase in production from 2010, when production was estimated at just 28,100 metric tonnes.

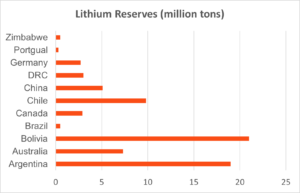

The supply of lithium has been growing but lags demand. Chile and Australia are currently the largest producers with Argentina and China also producing material quantities.

Bolivia has the largest reserves of lithium with 21 million tons, followed by Argentina with 19 million tons5, most of it in the ‘lithium triangle’, an area that exists along the Atacama Desert and neighbouring arid areas, including the Salar de Uyuni in Bolivia, Salar de Atacama in Chile, and Salar del Hombre Muerto in Argentina.

Figure 3: Salar de Uyuni, Bolivia

Source REUTERS/Claudia Morales

The lagging supply response to lithium demand has seen the price of lithium (lithium carbonate) rise sharply.

Figure 4: Price of Lithium (lithium carbonate)

Source: Bloomberg

Governments around the world have recognised the importance of lithium by adopting policies to support lithium production. In Australia the Federal Government has provided a 10-year debt facility to Pilbara Minerals of up to A$250 million to support the expansion of its Pilgangoora operations in Western Australia.

Environmental concerns: is lithium toxic?

Lithium mining has a poor track record. In 2016 a leak of toxic chemicals from the Ganzishou Rongda Lithium mine poisoned the local Lichu river, killing fish and livestock and sparking protests. It was the third spill of toxic chemicals in a five-year period7.

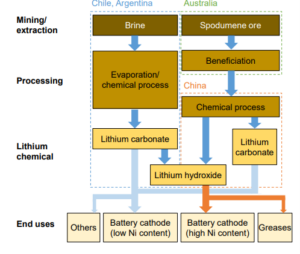

Most of the world’s lithium is produced by either mining and acid leaching spodumene ores to produce a lithium sulphate solution, which is converted to battery-grade lithium carbonate or hydroxide via an electrochemical process, or through the evaporation of lithium carbonate rich brines via evaporation ponds. Processing spodumene dominates Australian and Chinese lithium production, while concentration and precipitation of brines is the predominant method of lithium production in Chile and Argentina.

Figure 5: Lithium Production and Applications

Source: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf

Lithium production in Chile involves drilling holes into the salt flats of the Atacama Desert and pumping the incredibly salty groundwater or brine from an underground aquifer into shallow ponds, where it evaporates over a period of typically 18 months. A chemical process is then used to separate the concentrated lithium carbonate from other salts present.

Figure 6: Brine Extraction Atacama Desert Chile

Source https://www.npr.org/2022/09/24/1123564599/chile-lithium-mining-atacama-desert

Only two lithium mining companies are currently operating in Chile: Abermarle, a speciality chemicals company based in Charlotte, North Carolina that is the world’s largest producer of EV battery grade lithium, and Sociedad Química y Minera (SQM), a Chilean chemical company listed on the New York Stock Exchange.

Figure 7: Lithium evaporation ponds, Atacama Desert, Chile

Source: Euronews.com

According to a report produced by Friends of the Earth, the extraction of lithium has significant environmental and social impacts, especially due to water pollution and depletion. Toxic chemicals are needed to process lithium, and the release of such chemicals through leaching, spills or air emissions can harm communities, ecosystems and food production. In Chile’s Atacama salt flats, mining consumes, contaminates, and diverts scarce water resources away from local communities8.

The Salar de Atacama is one of the driest areas in the world. The 18 indigenous communities that live there are called the Lickanantay nation. Their single largest community is the township of Toconao, an agricultural community reliant on groundwater from the aquifer. They accuse Abermarle and SQM of overextraction and contamination of groundwater, and diverting the limited available freshwater for mine use, impacting their crops.

Due to the hydrology of the Salar, freshwater that has travelled underground from distant mountains reaches the aquifers where it floats on top of the salty brine. At the edge of the desert, this freshwater forms lagoons which support numerous animal and bird species including large flocks of flamingos. Since the commencement of lithium mining in the Atacama, the size of these lagoons has decreased by 40%, impacting the flamingo population. A recent study found that combined with climate change, the expansion of lithium production in the Atacama could have a devastating impact on the flamingo population.9

Figure 8: Flamingos, Salar de Tare, Atacama Desert

Source: Carlos Urzua – https://commons.wikimedia.org/w/index.php?curid=18447306

Advances in mining technology

A number of companies are developing direct lithium extraction (DLE) technologies which substantially reduce the water usage and environmental risks associated with lithium production. Rather than pumping brine from the aquifer and concentrating it in evaporation ponds, DLE uses a combination of mechanical filters and chemical treatment processes to pull the lithium directly out of the brine, and then the spent brine is returned to the aquifer.

Houston-based EnergyX, is one of the first to complete a large scale DLE pilot project using technologies developed by researchers at Monash University, the CSIRO’s Australian National Laboratory, and the University of Texas at Austin. The process involves mechanically extracting lithium from brines using nanomaterials called Metal Organic Frameworks (MOFs). MOFs replicate the precise filtering capabilities of a living cell by mimicking the filtering function, or ‘ion selectivity’, of a biological cell membrane. In December 2021, EnergyX successfully deployed a large scale pilot project in Bolivia’s Salar de Uyuni, which produced battery grade lithium using 90% less water and virtually no toxic chemicals. EnergyX has signed a letter of intent with Australian lithium miner Allkem (formerly Orocobre) to deploy its technology at the company’s operation in the Salar de Olaroz in northern Argentina.

International Battery Metals (IBAT), based in Vancouver Canada, uses an advanced sorbent-based DLE process that can recycle nearly all the water it uses. IBAT has constructed a pilot plant at Lake Charles, Louisiana with 35 skid-mounted modules expected to produce 5,740 tonnes of lithium chloride a year. The plant is currently undergoing evaluation trials and initial results indicate a water recovery rate of 94%.

EV Battery Recycling

Commercial interest in recycling lithium-ion batteries is growing rapidly. In 2019 the US Department of Energy announced a US$5.5 million prize to incentivise new solutions for EV battery recycling. In June 2022 four winners were announced for the third and final stage of that prize, each demonstrating innovation in processes and technologies10.

In Europe, the European Parliament in December 2022 reached a provisional agreement on regulations covering whole-of-life battery usage including compulsory collection and standards for recycling11.

Also in December 2022, Belgium-based Umicore, a global leader in circular materials technology, entered into a long-term agreement with Volkswagen to supply its proposed North American EV battery gigafactory with recycled materials.12

Conclusion

Lithium is a unique metal with properties that make it ideally suited to battery production. Lithium demand is expected to increase rapidly as electric vehicle production ramps up. It is likely the supply response will lag demand. The production of lithium historically has caused environmental damage, water stress and negatively impacted indigenous communities. New technologies offer hope that future lithium production will be substantially more sustainable.

XMET Energy Transition Metals ETF has substantial exposure to lithium producers as well as companies supplying and processing metals crucial to the transition to net-zero. Companies included in this article; Allkem, Pilbara Minerals and Umicore are held by XMET.

Betashares Capital Ltd (ABN 78 139 566 868 AFS Licence 341181) is the issuer of the Betashares funds. Read the Target Market Determination and PDS at www. betashares.com.au and consider with your financial adviser whether the product is appropriate for your circumstances. The value of the units may go down as well as up. The Fund should only be considered as a component of a diversified portfolio.

1. https://www.slashgear.com/833231/heres-why-hydrogen-cars-were-doomed-to-fail/#:~:text=The%20answer%20is%20fairly%20simple,powered%20cars%20rapidly%20outgunned%20them.

2. https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf

3. https://www.visualcapitalist.com/sp/mapped-ev-battery-manufacturing-capacity-by-region/

4. ktLCE = kilotons lithium carbonate equivalent

5. https://pubs.usgs.gov/periodicals/mcs2022/mcs2022-lithium.pdf

6. https://www.slashgear.com/833231/heres-why-hydrogen-cars-were-doomed-to-fail/#:~:text=The%20answer%20is%20fairly%20simple,powered%20cars%20rapidly%20outgunned%20them.

7. https://tibetnature.net/en/lichu-river-poisoned-case-minyak-lhagang-lithium-mine-protest/

8. https://www.sciencedirect.com/science/article/abs/pii/S0959652620308854?via%3Dihub

9. https://royalsocietypublishing.org/doi/10.1098/rspb.2021.2388

10. https://www.herox.com/BatteryRecyclingPrize/updates

11. https://www.europarl.europa.eu/news/en/press-room/20221205IPR60614/batteries-deal-on-ne-eu-rules-for-design-production-and-waste-treatment

12. https://www.umicore.com/en/newsroom/news/umicore-and-powerco-explore-long-term-strategic-supply-agreement-for-ev-battery-materials-in-north-america/